Category: Crypto

Women Building Bitcoin: Leaders in Adoption and Innovation

Women Building Bitcoin: Leaders in Adoption and Innovation

As bitcoin moves into the mainstream of American life, people from every background and corner of the planet are contributing to its historic rise. In the spirit of the age, the bitcoin industry is largely a meritocracy. It is the quality of contributions—rather than any singular identity—that drives bitcoin forward.

March is recognized as International Women’s Month, a tradition rooted in early-20th century labor and suffrage movements. It provides an occasion to reflect on the role of women in bitcoin. Rather than focusing on the experience of being a woman in a technical field, this article spotlights the real contributions and leadership from individuals who happen to be women but who have each, in their own right, helped shape the bitcoin ecosystem.

Adapting Expertise to Bitcoin

Whether they come from legal, financial, or technical backgrounds, individuals with strong foundational skills often transition naturally into the bitcoin industry. Much of bitcoin’s growth can be credited to those able to distill complex technical concepts into accessible language. Women are excelling in this role, using skills in marketing, community organizing, and storytelling to broaden understanding and trust in bitcoin. It’s one thing to code or invest in bitcoin, but quite another to convey its principles effectively to the uninitiated. As more people demonstrate real skill in bridging that knowledge gap—through podcasts, workshops, or online content—bitcoin’s base of educated users expands exponentially.

“Women can be powerful communicators and community builders, finding ways to distill complex topics into easily understandable and relatable bites,” says Kelley Weaver, CEO of Melrose PR & Founder of Bitwire. “Since bitcoin fundamentally grows through network effects, this is essential! I’ve seen firsthand how women’s approaches to explaining bitcoin can reach people who might otherwise be intimidated. Approachability is essential for bitcoin’s long-term success.”

In recent years, bitcoin ownership among women has risen significantly. One survey showed that women’s share of digital asset ownership jumped from 29% to 34% in a single quarter. While these numbers vary depending on the source, there’s a clear upward trend. If finance was once perceived as a male-dominated space, that narrative is shifting—particularly for a technology-driven asset like bitcoin, which democratizes participation by removing traditional gatekeepers.

“Across ‘Main Street’ America and the world… decentralized networks of female leaders can be a catalyst for financial education and increasing understanding about the transformative nature of bitcoin,” says Cleve Mesidor, Executive Director of Blockchain Foundation. “Particularly because of scarcity, most individuals will never own even a fraction of bitcoin, which is why women cannot afford to be late adopters.”

Mesidor points to a key dynamic: informal, community-driven networks excel at spreading education. Because bitcoin can be learned and shared peer-to-peer, it finds fertile ground in the natural social structures that women have historically led, such as book clubs, parent associations, and charitable groups. Such networks become informal “nodes” of adoption, where knowledge flows more freely than it might in a top-down environment.

Household CFOs

In the past, popular culture often portrayed men as the family financiers while women managed daily household tasks. Yet a recent study revealed that about 84% of women say they are responsible for their family’s finances, from paying bills to setting budgets to overseeing savings and debt obligations. Perhaps more remarkable is that almost all women in couples (94%) report being actively involved in shaping household financial decisions. Many women effectively act as Chief Financial Officers for their families, handling budgeting, strategic planning, and long-term goal setting.

As bitcoin continues to gain traction worldwide, it is increasingly one of the tools under consideration, especially for those who like to plan with a low-time-preference mindset. Bitcoin’s design fits neatly with the mindset that prudent financial planners rely upon. Its limited supply and disinflationary monetary policy reward disciplined saving. As families look for ways to preserve purchasing power, it is natural to add bitcoin in the mix. Whether it’s a small allocation every month or a larger diversification strategy, bitcoin attracts those seeking reliability over the long run.

“For long-term investments, bitcoin is a top choice. While short-term fluctuations are inevitable, its overall trajectory shows a clear path toward growth and stability.” says Frieda Bobay, co-founder of Bitcoin Sports Network. “I never plan to sell my bitcoin; instead, I view it like real estate—an asset I can borrow against while it continues to grow in value.”

While it’s easy to over-generalize, data does suggest that women, on average, tend to adopt disciplined approaches to money management. They trade less frequently in stock markets, are more likely to stick to a plan, and often do deeper research before making an investment. One of bitcoin’s most emblematic qualities is its alignment with low-time-preference thinking: favoring long-term wealth building over short-term speculation. Studies have shown that women are often methodical, patient, and focus on fundamentals rather than jumping in and out of markets. This mindset leads to outperformance in traditional investment contexts.

“A common misconception is that bitcoin is ‘too expensive’—in reality, this is a matter of unit bias,” says Hailey Lennon, General Counsel at Fold. “Many people don’t realize you can own fractions of a bitcoin, and by that measure, it’s still incredibly early and relatively cheap when you compare it to traditional assets. If women empower themselves with the basic knowledge of how bitcoin works, they’ll see that we’re just at the beginning of its potential, making it a compelling opportunity rather than an exclusive, high-priced investment.”

Lennon’s perspective highlights a key barrier for new entrants: bitcoin’s per-coin price might intimidate some, but the option to purchase fractions (satoshis) lowers that barrier significantly. That’s often an eye-opener for people new to bitcoin—especially those who excel in careful, long-term budget allocation. By embracing the possibility of stacking small amounts, methodically and regularly, one can build a meaningful position over time.

Weaver agrees: “Slow and steady wins the race! My personal strategy is to DCA, or “dollar cost average” meaning that I purchase small amounts daily. This spreads out risk. I ultimately think it’s more risky to NOT own bitcoin in the long term, but I also recognize that it’s incredibly volatile. I always say in the short term it may never be a good time to buy bitcoin but in the long term it’s ALWAYS a good idea to buy bitcoin.”

Bitcoin and Financial Sovereignty

Another reason for the surge in interest among women is that bitcoin, as a universal asset, offers financial independence and sovereignty. This resonates strongly with individuals who value autonomy. “Bitcoin is the pathway to financial sovereignty. It removes traditional gatekeepers and allows for independent wealth management without intermediaries,” says Evie Phillips, Founder of Creeds Collective & Founding Board Member of Crypto Connect, now Eve Wealth. “The blockchain’s immutability means assets can’t be frozen or seized—this is specifically valuable in relational situations and regions where women face financial restrictions. Bitcoin doesn’t have geographic limitations, making global transactions seamless, and that opens up a flood of opportunities that aren’t available through centralized financial systems.” Phillips’s point highlights bitcoin’s advantages in personal control over assets. The economy is fundamentally transforming, and many are drawn to the reliability of an asset that exists beyond the reach of institutions.

The novelty of bitcoin can be intimidating, especially because the mainstream media frequently associates it with scams and hype-driven speculative bubbles. Thought leaders in bitcoin address this by pointing to the facts of the technology. “The more I learn about bitcoin, the more I trust this trustless financial system,” says Weaver. “The network has had zero downtime since it launched in 2009 and has never been hacked. Over the course of bitcoin’s history, the price has risen and fallen, but consistently trends upward in the long term.”

Bitcoin is a protocol, and using it does not require trust in any central authority. Yet it thrives on trust, education, and consensus among people. This is why communicators matter so much. “I often see women’s entire perspective shift when they recognize bitcoin’s potential—not just as an investment, but as a vehicle for financial empowerment,” says Megan Nilsson, host of the Crypto Megan Podcast. “By leveraging their ability to build networks, drive education, and advocate for broader adoption, women can play a leading role in shaping the future of bitcoin and decentralized finance… Bitcoin has fundamentally redefined the concept of financial independence. It has leveled the playing field, offering financial tools that were once only available to accredited investors. It eliminates reliance on centralized systems, providing individuals with true ownership and control over their wealth.”

In the coming years, the world economy, and society itself, will be reshaped by the convergence of transformative technologies including AI, robotics, and space travel, all underwritten and financed with bitcoin. It’s no wonder that as families, institutions, and communities discover bitcoin’s utility, so many of those leading the charge are women. They do so not because they want to check a box, but because the technology itself demands the best talent available. In celebrating the achievements of women this month, we also celebrate bitcoin’s potential to reshape our collective future. It is a global experiment buoyed by those who see beyond the hype and dedicate themselves to building, teaching, and expanding the Bitcoin Network for future generations.

This is a guest post by Dave Birnbaum. Opinions expressed are entirely their own and do not necessarily reflect those of BTC Inc or Bitcoin Magazine.

This post Women Building Bitcoin: Leaders in Adoption and Innovation first appeared on Bitcoin Magazine and is written by Dave Birnbaum.

Pakistan Plans To Legalise Bitcoin And Crypto

Pakistan Plans To Legalise Bitcoin And Crypto

Bilal Bin Saqib, CEO of the Pakistan Crypto Council, told Bloomberg on Thursday that Pakistan has plans to legalise bitcoin and crypto and implement a regulatory framework to attract foreign investment and boost adoption.

The government aims to devise clear regulations and align with international best practices. Pakistan’s Finance Minister formed the PCC last week to steer the country’s crypto strategy.

“Pakistan is done sitting on the sidelines” regarding bitcoin and crypto, Saqib told Bloomberg. “We want to attract international investment because Pakistan is a low-cost, high-growth market with 60% of the population under 30.”

“Trump is making crypto a national priority, and every country, including Pakistan, will have to follow suit,” he said.

This move comes amid a global shift in attitudes towards bitcoin and crypto after the United States pushed for greater mainstream acceptance. The new stance is a stark change for Pakistan, which had previously banned crypto. By embracing bitcoin and crypto early, Pakistan is looking to position itself as a regional leader and attract investors.

Pakistan’s central bank had expressed concerns earlier. However, the government now seeks to mitigate risks through prudent legislation. Clear rules could boost innovation and prevent potential abuse of decentralised networks.

This post Pakistan Plans To Legalise Bitcoin And Crypto first appeared on Bitcoin Magazine and is written by Vivek Sen Bitcoin.

President Trump To Speak At Digital Assets Summit Tomorrow

President Trump To Speak At Digital Assets Summit Tomorrow

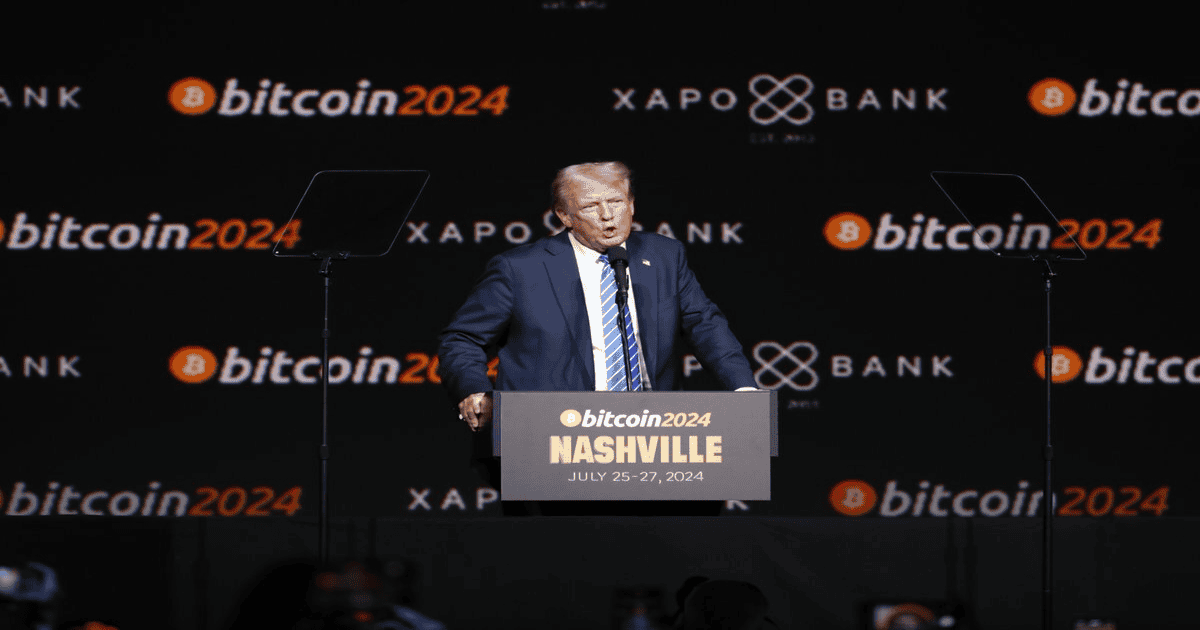

President Donald Trump is expected to deliver a speech at Blockworks’ Digital Asset Summit (DAS) in New York City on March 20. This will be the first time a sitting U.S. president has addressed a Bitcoin and crypto conference, highlighting the growing influence of digital assets in mainstream financial policy.

Although this marks his first speech as a sitting president at a crypto event, Trump has previously engaged with the Bitcoin community, having spoken at the world’s largest Bitcoin conference in Nashville last summer while on the campaign trail. His return to the stage now as president further highlights the continued support from the U.S. government on Bitcoin.

Trump’s speech at DAS comes only a couple weeks after moving forward with officially integrating Bitcoin into his national strategy, when he signed an executive order establishing the U.S. Strategic Bitcoin Reserve, positioning BTC as a key asset for the country’s financial future.

Joining the lineup tomorrow at DAS is Strategy’s Michael Saylor, who will deliver a keynote speech and engage in a fireside chat with Bitcoin historian Pete Rizzo. Additionally, Bloomberg ETF analyst James Seyffart will host a panel discussion with BlackRock’s Head of Digital Assets Robbie Mitchnick and Nasdaq’s Head of U.S. Equities & Exchange-Traded Products Giang Bui, where they will delve into the evolving landscape of Bitcoin ETFs and institutional adoption.

The announcement of Trump’s participation follows remarks from Bo Hines, Executive Director on Digital Assets for President Trump, who spoke earlier this week at DAS. Hines reaffirmed the administration’s commitment to accumulating Bitcoin for the Strategic Bitcoin Reserve, stating:

“I think it’s high time that our President started accumulating assets for the American people, which is what President Trump is doing rather than taking it away.”

He also emphasized the administration’s approach to acquiring Bitcoin in budget-neutral ways, likening BTC accumulation to gold reserves:

“You know, I’ve been asked all the time, it’s like how much do you want? Well, that’s like asking a country how much gold do you want – as much as we can get.”

Trump’s executive order has already sparked legislative action aiming to build on this momentum. Senator Cynthia Lummis and Congressman Nick Begich have each proposed plans for the U.S. to acquire 1 million BTC over the next five years, ensuring a long-term reserve of the scarce asset. Earlier today at DAS, House Majority Whip and Congressman Tom Emmer stated that he believes this legislation will be enacted “before this congress is done.”

This post President Trump To Speak At Digital Assets Summit Tomorrow first appeared on Bitcoin Magazine and is written by Nik.

BIGGER THAN ORDINALS. MORE THAN ART

BIGGER THAN ORDINALS. MORE THAN ART

Bitcoin’s cultural footprint has evolved significantly, from peer-to-peer currency to a canvas for artistic and community expression through Ordinals. Now, Blockware, a pioneer known for introducing mining-as-a-service to North America, is bridging two foundational aspects of the Bitcoin ecosystem—mining infrastructure and digital collectibles—through a unique model of community-driven participation and reward distribution.

Blockware, having mined over 15,000 BTC, deployed more than 500 MW of energy, and distributed over 400,000 mining servers, is leveraging its scale and expertise to introduce an innovative concept: integrating Bitcoin mining rewards with Ordinals to foster community engagement. This approach transcends typical digital art collections, positioning itself as a significant advancement in the utility and purpose behind Ordinals.

The initiative, named Hashrate Hackers, introduces a mechanism where participants don’t merely collect digital art but actively contribute to and benefit from the strength of Bitcoin’s network. Rather than passive ownership, Hashrate Hackers transforms collectors into active community members who compete in regular, skill-based events called “Hacks.” These Hacks reward participants with Bitcoin sourced directly from mining proceeds, effectively redistributing the value generated by Blockware’s professionally scaled mining operations.

Beyond the aesthetic appeal and cultural resonance of the artwork—meticulously crafted in homage to early digital pioneers with an imaginative steampunk aesthetic—the real innovation lies in the project’s underlying economic model. Funds raised through Hashrate Hackers collections directly support and expand mining operations, with competitive advantages like optimized energy rates, premium hardware, and strategic mining pool allocations ensuring maximized returns.

This circular economy enriches the Bitcoin community ecosystem: collectors participate in activities that reinforce their stake in the network, while the rewards they earn from mining efforts continuously incentivize deeper engagement. The narrative, poetically framed as to “steal from the thieves,” aligns philosophically with Bitcoin’s foundational principles of decentralization, redistribution of power, and financial sovereignty.

The platform also opens opportunities for participants interested in deploying their own individualized mining operations, reflecting the project’s commitment to flexibility and deeper integration with Bitcoin’s core infrastructure.

Hashrate Hackers exemplifies a novel integration between mining—a traditionally industrial and capital-intensive sector—and the creative, culturally vibrant sphere of Ordinals. By harnessing community strength, strategic mining capabilities, and the transformative potential of digital art, this model not only enhances community participation but also serves as a blueprint for future innovation in blockchain-based ecosystems.

In essence, Hashrate Hackers is pioneering a practical yet creative path forward, redefining how cultural participation and economic utility intersect within the Bitcoin network.

This is a project that is serious about art, Ordinals, and about contributing to Bitcoin.

Join the @HashrateHackers on X and click here to learn more and get involved.

Disclaimer: This article is sponsored content and does not necessarily reflect the views or opinions of Bitcoin Magazine. The information provided is for promotional purposes and should not be considered financial advice. Readers are encouraged to conduct their own research before making any investment decisions related to Bitcoin or other financial products mentioned herein.

This post BIGGER THAN ORDINALS. MORE THAN ART first appeared on Bitcoin Magazine and is written by Blockware.

If Congress Wants To Be Pro Bitcoin, Then Act Like It

If Congress Wants To Be Pro Bitcoin, Then Act Like It

It has recently come to my attention that multiple U.S. Congressmen who have taken very public pro-Bitcoin stances are not even aware of the currently unfolding prosecution of Samourai Wallet developers Keonne Rodriguez and William Hill.

This is simply mind-boggling to me as a Bitcoiner. The current legal prosecution of the Samourai team, as well as the relevant prosecutions against Roman Sterlingov, accused of operating the mixer Bitcoin Fog, and Roman Storm and Roman Semenov, two developers behind Tornado Cash, are the most important legal cases impacting the sovereign and private use of Bitcoin on the docket today..

Roman Storm is sitting in jail right now after a conviction attained with zero hard evidence whatsoever. His conviction was based on nothing more than unproven assertions by blockchain analysis company Chainalysis. The Samourai and Tornado Cash developers are being prosecuted under money laundering legislation for developing purely self custodial software that, in no circumstances in which their software could be used, gave them any control over user funds.

The fact that this is not only not on the radar of any Congressman or Congresswoman who claims to be pro-Bitcoin, but not being loudly talked about, is absurd.

So, let’s do something to change that. I’m calling on every United States citizen reading this to take the form letter below, fill it in appropriately, and send it to your congressman or congresswoman — especially if you are in a district with a representative claiming publicly to be pro-Bitcoin.

This article is a Take. Opinions expressed are entirely the author’s and do not necessarily reflect those of BTC Inc or Bitcoin Magazine.

[Your Name]

[Your Address]

[City, State, Zipcode]

[Email]

[Phone Number]

[Date]

The Representative [or] Senator [Congressman or Congresswoman’s Name]

[Congressman/Congresswoman’s Address]

[City, State, Zipcode]

I am writing as a concerned citizen of [your State]. I wish to bring to your attention a very important matter regarding the criminal prosecution of open source developers writing software for the Bitcoin and cryptocurrency ecosystem.

Keonne Rodriguez and William Hill of Samourai Wallet, Roman Semenov and Roman Storm of Tornado Cash, are being prosecuted for various acts of or assertions of conspiracy to commit money laundering. All four of these men have done nothing but produce and publish open source software that was/is freely available to the public.

A foundational reality of decentralized networks like Bitcoin is the ability their architecture gives to their users to interact and transact with their money using nothing but open-source and freely available software that communicates with a decentralized computer network. When using cryptocurrencies in this way, no one except the end user of the software has any ability to influence, control, or restrict the transfer of a person’s assets on these decentralized networks.

All four of these men have done nothing beyond produce and operate freely available open-source software with the aim of helping end users of these networks protect their personal privacy. Americans have a right to privacy, especially financial privacy, which is why the Bank Secrecy Act mandates that financial institutions take measures to protect the security and confidentiality of American’s financial information.

Blockchains by their very nature, however, are public stores of information. For everyone to guarantee that the rules of the decentralized network are being followed properly, everyone must be able to download and verify the entirety of a blockchain’s transactional history. Everyone’s transactional history. This allows anyone who you transact with to see potentially how much wealth you have, even to follow and learn of future transactions you make.

This is not only very sensitive information to have in the public domain in general, but it can present a very serious risk to people’s physical safety. Incidents of kidnapping, physical assault, and home invasion in order to steal bitcoin from private individuals have increased in frequency as its value has increased.

Software that enables users to maintain their privacy while using networks like Bitcoin is critical, not only to their privacy in general, but also to their physical safety. Both Samourai Wallet and Tornado Cash do so in a purely self-custodial manner, meaning no entity other than the end users themselves ever has control, or ability to influence, the transactions that are made. This also means that there is no legal entity that the current charges actually apply to (i.e. a custodial financial institution subject to financial regulations).

Separately, Roman Sterlingov has been convicted in criminal court of operating a custodial mixing service used to achieve privacy on the Bitcoin network. While this service was custodial, and as such would have financial regulatory obligations, the evidence presented at trial of Roman’s involvement in operating this service is purely circumstantial. Many details of the nature of this evidence, and its questionability, exist on the public record from Sterlingov’s attorney Tor Ekeland.

I strongly urge you to investigate these matters, and take action to correct these severe miscarriages of justice resulting from the application of nonapplicable financial regulations to open-source software developers, and the complete flouting of the requirements to show evidence behind a reasonable doubt to achieve conviction in a criminal proceeding.

[Only include the bold if your congressman/congresswoman is publicly pro-Bitcoin]

This is incredibly important when it comes to the freedom to use Bitcoin and cryptocurrencies in a self-custodial and freedom-preserving way. I hope to see your actions in Congress live up to your stance on public record when it comes to Bitcoin as a policy issue.

Sincerely,

[Your Name]

This post If Congress Wants To Be Pro Bitcoin, Then Act Like It first appeared on Bitcoin Magazine and is written by Shinobi.

How Bitcoin ETFs and Mining Innovations Are Reshaping BTC Price Cycles

How Bitcoin ETFs and Mining Innovations Are Reshaping BTC Price Cycles

Bitcoin’s market structure is evolving, and its once-predictable four-year cycles may no longer hold the same relevance. In a recent conversation with Matt Crosby, lead analyst at Bitcoin Magazine Pro, Mitchell Askew, Head Analyst at Blockware Solutions, shared his perspective on how Bitcoin ETFs, mining advancements, and institutional adoption are reshaping the asset’s price behavior.

Watch the Full Interview:

According to Askew, Bitcoin’s historical pattern of parabolic price increases followed by steep drawdowns is changing as institutional investors enter the market. At the same time, the mining industry is becoming more efficient and stable, creating new dynamics that affect Bitcoin’s supply and price trends.

Table of Contents

Bitcoin’s Market Cycles Are FadingThe Role of Bitcoin Mining in Price StabilityWhy Mining Profitability Is StabilizingCould the U.S. Government Start Accumulating Bitcoin?Bitcoin Price Predictions & Long-Term OutlookConclusion: A More Mature Bitcoin Market

Bitcoin’s Market Cycles Are Fading

Askew suggests that Bitcoin may no longer experience the extreme cycles of past bull and bear markets. Historically, halving events reduced miner rewards, triggered supply shocks, and fueled rapid price increases, often followed by corrections of 70% or more. However, the increasing presence of institutional investors is leading to a more structured, macro-driven market.

He explains that Spot Bitcoin ETFs and corporate treasury allocations are bringing consistent demand into Bitcoin, reducing the likelihood of extreme boom-and-bust price movements. Unlike retail traders, who tend to buy in euphoria and panic-sell during downturns, institutions are more likely to sell into strength and accumulate Bitcoin on dips.

Askew also notes that since Bitcoin ETFs launched in January 2024, price movements have become more measured, with longer consolidation periods before continued growth. This suggests Bitcoin is beginning to behave more like a traditional financial asset, rather than a speculative high-volatility market.

The Role of Bitcoin Mining in Price Stability

As a mining analyst at Blockware Solutions, Askew provides insight into how Bitcoin mining dynamics influence price trends. He notes that while many assume a rising hash rate is always bullish, the reality is more complex.

In the short term, increasing hash rate can be bearish, as it leads to higher competition among miners and more Bitcoin being sold to cover electricity costs. However, over the long term, a rising hash rate reflects greater investment in Bitcoin infrastructure and network security.

Another key observation from Askew is that Bitcoin’s hash rate growth lags behind price growth by 3-12 months. When Bitcoin’s price rises sharply, mining profitability increases, prompting more capital to flow into mining infrastructure. However, deploying new mining rigs and setting up facilities takes time, leading to a delayed impact on hash rate expansion.

Why Mining Profitability Is Stabilizing

Askew also highlights that mining hardware efficiency is reaching a plateau, which has significant implications for miners and Bitcoin’s supply structure.

In Bitcoin’s early years, new mining machines offered dramatic efficiency improvements, forcing miners to upgrade hardware every 1-2 years to remain competitive. Today, however, new models are only about 10% more efficient than the previous generation. As a result, mining rigs can now remain profitable for 4-8 years, reducing the pressure on miners to continuously reinvest in new equipment.

Electricity costs remain the biggest factor in mining profitability, and Askew explains that miners are increasingly seeking low-cost power sources to maintain long-term sustainability. Many companies, including Blockware Solutions, operate in rural U.S. locations with stable energy prices, ensuring better profitability even during market downturns.

Could the U.S. Government Start Accumulating Bitcoin?

Another important discussion point raised by Askew is the potential for a U.S. Strategic Bitcoin Reserve (SBR). Some policymakers have proposed that the U.S. government accumulate Bitcoin in the same way it holds gold reserves, recognizing its potential as a global store of value.

Askew explains that if such a reserve were implemented, it could create a massive supply shock, pushing Bitcoin’s price significantly higher. However, he cautions that government action is slow and would likely involve gradual accumulation rather than sudden large-scale purchases.

Even if implemented over several years, such a program could further reinforce Bitcoin’s long-term bullish trajectory by removing available supply from the market.

Bitcoin Price Predictions & Long-Term Outlook

Based on current trends, Askew remains bullish on Bitcoin’s long-term price trajectory, though he believes the market’s behavior is shifting toward more gradual, sustained growth rather than extreme speculative cycles.

Bitcoin Price Targets for 2025:

Base Case: $150K – $200K

Bull Case: $250K+

Long-Term (10-Year) Forecast:

Base Case: $500K – $1M

Bull Case: Bitcoin flips gold’s $20T market cap → $1M+ per BTC

Askew sees several key factors driving Bitcoin’s price over the next decade, including:

Steady institutional demand from ETFs and corporate treasuries.

Reduced mining hardware upgrades, leading to a more stable industry.

Potential government involvement in Bitcoin reserves.

Macroeconomic conditions such as interest rates, inflation, and global liquidity cycles.

He emphasizes that as Bitcoin’s market structure matures, it may become less susceptible to sharp price swings, making it a more attractive long-term asset for institutions.

Conclusion: A More Mature Bitcoin Market

According to Askew, Bitcoin is undergoing a structural shift that will shape its price trends for years to come. With institutional investors reducing market volatility, mining innovations improving efficiency, and potential government adoption, Bitcoin’s market behavior is beginning to resemble that of gold or other long-term financial assets.

While dramatic parabolic runs may become less frequent, Bitcoin’s long-term trajectory appears stronger and more sustainable than ever. Askew’s perspective reinforces the idea that Bitcoin is no longer just a speculative asset—it is evolving into a key financial instrument with increasing global adoption.

If you’re interested in more in-depth analysis and real-time data, consider checking out Bitcoin Magazine Pro for valuable insights into the Bitcoin market.

Disclaimer: This article is for informational purposes only and should not be considered financial advice. Always do your own research before making any investment decisions.

This post How Bitcoin ETFs and Mining Innovations Are Reshaping BTC Price Cycles first appeared on Bitcoin Magazine and is written by Mark Mason.

Samourai Wallet Developers Appear Together In Court At Fourth Pre-Trial Hearing

Samourai Wallet Developers Appear Together In Court At Fourth Pre-Trial Hearing

Today, the fourth pre-trial hearing for the United States’ case against the Samourai Wallet developers took place in the Southern District of New York.

This is the second time that the two developers, Keonne Rodriguez and William Lonergan Hill, have appeared together in public since the previous status conference, which occurred on September 17, 2024.

Today’s hearing was the shortest and least substantive of the four pre-trial hearings that have occurred thus far.

Pre-Trial Motion Schedule

At the hearing, the prosecution and the defense established and agreed upon the pre-trial motion schedule schedule, which is as follows:

May 9, 2025 — Opening motion

June 6, 2025 — The prosecution’s response to the opening motion

June 20, 2025 — Replies to the prosecution’s response

Expert Disclosure

The prosecution is scheduled to provide its expert disclosure on July 15, 2025, while the defense is expected to provide it by August 8, 2025.

Further expert disclosure may also be permitted on July 16, 2025 at 10:00 AM EST, which is the date for the next in-person pre-trial hearing.

Hill To Remain In Lisbon

Hill’s attorney asked Judge Richard Berman, who is presiding over the case, if the court would be amenable to the court not requiring Hill’s appearance at future pre-trial hearings given that Hill is currently living with his wife in Lisbon, Portugal and traveling back and forth to New York City is expensive.

His attorney also stated that pre-trial services were “supportive” of this request.

The judge stated that he didn’t see a problem with this.

Rodriguez Expresses Gratitude

After the hearing, Rodriguez told Bitcoin Magazine that he‘s grateful to all those who’ve donated to the Peer-to-Peer Rights Fund, which helps to fund the developers’ legal defense.

Those interested can still donate to the fund.

Trial Start Date

The trial is slated to begin on November 3, 2025.

This post Samourai Wallet Developers Appear Together In Court At Fourth Pre-Trial Hearing first appeared on Bitcoin Magazine and is written by Frank Corva.

Trump Administration Eyes Massive Bitcoin Accumulation, Says Executive Director

Trump Administration Eyes Massive Bitcoin Accumulation, Says Executive Director

The Trump administration is doubling down on its Bitcoin strategy, with top officials emphasizing their commitment to growing the U.S. government’s BTC holdings. Speaking at the Digital Assets Summit today in New York, Bo Hines, Executive Director on Digital Assets for President Trump, made it clear that the United States is determined to accumulate Bitcoin at an unprecedented scale.

“I think it’s high time that our President started accumulating assets for the American people, which is what President Trump is doing rather than taking it away,” Hines stated. He went on to reveal that at President Trump’s first-ever digital assets summit at the White House, discussions centered around “ways of acquiring more Bitcoin in budget-neutral ways.”

Hines drew a direct comparison between Bitcoin and gold when asked how much BTC the government intends to hold. “You know, I’ve been asked all the time, it’s like how much do you want? Well, that’s like asking a country how much gold do you want – as much as we can get.”

His comments align with the administration’s broader strategy following President Trump’s March 6 executive order, which formally established the U.S. Strategic Bitcoin Reserve. The initiative repurposes BTC obtained through forfeitures and seizures, ensuring that the bitcoin remains under government control as a long-term reserve. The very next day, President Trump’s crypto advisor David Sacks underscored the move’s significance, telling Bloomberg: “We’ve decided that Bitcoin is scarce, it’s valuable, and that is strategic for the United States to hold on to this as a long-term reserve asset.”

Beyond retention, the administration is exploring ways to expand its holdings without it costing tax payers anything. At the White House Digital Asset Summit, President Trump himself stated, “The Treasury and Commerce Departments will also explore new pathways to accumulate additional Bitcoin holdings for the reserve.”

The establishment of the Strategic Bitcoin Reserve has already spurred more legislative action. U.S. Rep. Byron Donalds introduced a bill to solidify Trump’s initiative into law, ensuring it remains intact for future administrations. Meanwhile, U.S. Senator Cynthia Lummis and Congressman Nick Begich have proposed a separate measure calling for the United States to purchase 200,000 BTC per year over the next five years, totaling 1 million BTC, which would be held for a minimum of 20 years.

With a limited Bitcoin supply and increasing institutional adoption, the administration sees BTC as an essential asset for the nation’s financial future. As Hines put it, “We look at Bitcoin, it’s not a security, it’s a commodity. It has intrinsic stored value, it’s traditionally accepted… and that’s why you saw in the executive order that we compared this to digital gold.”

This post Trump Administration Eyes Massive Bitcoin Accumulation, Says Executive Director first appeared on Bitcoin Magazine and is written by Nik.

ECB Prepping the Ground for Digital Euro Launch

ECB Prepping the Ground for Digital Euro Launch

The European Central Bank (ECB) is laying the groundwork for the probable launch of its wholesale and retail central bank digital currency (CBDC), the Digital Euro. Christine Lagarde, President of the ECB, shared this update at their latest press conference. “President Lagarde stressed that the digital euro is ‘more relevant than ever,’” the ECB tweeted.

Lagarde emphasized that the Digital Euro, the EU’s CBDC solution, is set to launch in October 2025—provided it passes the legislative phase involving key stakeholders, including the European Commission, Parliament, and Council. Notably absent from this process is the European public, despite the significant impact this initiative will have on their daily lives.

Why Is the Digital Euro More Relevant Than Ever?

Could it be linked to Ursula von der Leyen’s recent “ReArm Europe” announcement, which proposes the creation of an EU army? This initiative requires an estimated €800 billion in funding—money the EU does not have. The options? Extracting it from EU member states and their citizens or printing fresh funds via the ECB. Either way, it’s time to warm up the ECB’s money printers!

Furthermore, The EU has introduced the “Savings and Investments Union”, aiming to redirect €10 trillion in “unused savings” from citizens to finance military growth and bolster Europe’s defense industry. “We’ll turn private savings into much-needed investment,” tweeted von der Leyen. If this hasn’t shocked you already, I’ll try to clarify: This is a clear violation of private property rights, and an implicit confiscation of Europeans’ wealth, while bluntly using their funds as the EU sees fit, including funding of a military industrial complex, without even asking them.

If the EU is accelerating toward totalitarian collectivism, as this statement suggests, then a CBDC would be a powerful tool—enabling tighter control over Europeans’ money with features like an “on/off” switch and programming abilities.

Christine Lagarde recently campaigned at the European Parliament, arguing that the Digital Euro is necessary to reduce the EU’s dependence on foreign payment solutions. European banks must innovate payment methods, but the EU’s primary concern isn’t just reliance on tech giants like Google Pay or Apple Pay—it’s the potential for widespread adoption of decentralized global protocols like Bitcoin.

The ECB is observing geopolitical trends, noting that the U.S. is embracing crypto, Bitcoin, and stablecoins—technologies that pose a risk to centralized control. Unsurprisingly, they are choosing a different path. According to Reuters, “Eurozone banks need a digital euro to respond to U.S. President Donald Trump’s push to promote stablecoins” as part of a broader crypto strategy. ECB board member Piero Cipollone reinforced this stance, stating, “This solution further disintermediates banks as they lose fees, they lose clients… That’s why we need a digital euro.”

Bottom line, Lagarde’s and Von der Leyen’s recent agendas are aimed to drive more centralised control while strengthening the EU hierarchy, governance and incentive structure – that has always been their role.

New Digital Euro CBDC Survey

The ECB recently published findings from a survey on consumer attitudes toward retail CBDC, conducted among 19,000 Europeans across 11 Eurozone countries. Key takeaways include:

1) Lack of Interest – Most Europeans are not interested in the Digital Euro, as existing payment methods already serve their needs well.

Why would you not adopt the digital euro? source: European Central Bank

2) Europeans are Open to Propaganda – While public interest is low, the survey found that Europeans are receptive to video-based education and training. The ECB’s study suggests that CBDC-related videos could drive widespread adoption by reshaping consumer beliefs. The report states: “Consumers who are shown a short video providing concise and clear communication about the key features of the digital euro are substantially more likely to update their beliefs… which increases their immediate likelihood of adopting it.” No wonder the ECB has ramped up its digital euro video content since late 2024. For example:

3) Preference for Existing Payment Methods – “Europeans have a strong preference for existing payment methods and see no real benefit in a new type of payment system”. While this finding sounds like a positive pushback, it can serve as a precursor to a tactic of technological integrations. “If you can’t beat them, join them” tactic – similarly to the Chinese e-CNY retail CBDC.

A recent Euromoney article highlighted e-CNY’s integration with China’s most popular apps (DiDi, Meituan, Ctrip, WeChat Pay, and Alipay), a move that facilitated its widespread adoption. Despite early struggles, e-CNY now boasts 180 million personal wallet users and a cumulative transaction value of $1 trillion. I recently explored this topic in depth with Roger Huang recently on my podcast.

Not Just Retail—Wholesale Too

On the wholesale CBDC front, the EU is experimenting with distributed ledger technology (DLT) to interconnect financial institutions across Europe and beyond. This follows exploratory work conducted by the Eurosystem between May and November 2024. Their trials involved 64 participants—including central banks, financial market players, and DLT platform operators—conducting over 50 experiments.

Lagarde insists that the Digital Euro is a form of cash, gaslighting and misleading uninformed Europeans about the risks of CBDCs. Permission-based CBDCs such as the Digital Euro are prone to micro levels of control through expiry dates, geofencing and programmability. If Europeans don’t recognize these dangers, they won’t resist the Digital Euro. By framing it as “digital cash,” the ECB ensures smoother public acceptance with little to no public fuss.

To be clear, cash itself is fiat currency—centrally controlled, easily debased, and prone to inflation. Every time the issuer expands the money supply, citizens suffer from declining purchasing power, essentially being robbed by the state.

“Rules for Thee, But Not for Me”

While ordinary citizens are bound by the rule of law, elites often evade consequences. A prime example is Christine Lagarde, who was found guilty of negligence for approving a massive taxpayer-funded payout to controversial French businessman Bernard Tapie. However, she avoided a jail sentence. The Guardian reported in 2016: “A French court convicted the head of the International Monetary Fund and former government minister, who had faced a €15,000 fine and up to a year in prison. But it decided she should not be punished, and that the conviction would not constitute a criminal record. … The IMF gave her its full support.”

My Prediction for the EU’s CBDC

Despite public disinterest, the ECB (and other central banks) will push forward with their CBDCs. To maintain the illusion of public involvement, they will conduct surveys and create engagement tools. But ultimately, the Digital Euro will be integrated into existing payment methods and consumer apps—just as China did with e-CNY. This strategy will drive adoption even without direct public enthusiasm.

We are, after all, playing the game of “democracy,” right?

Geopolitical analyst Alex Krainer recently tweeted in response to Lagarde and von der Leyen’s acceleration of CBDC efforts: “This is excellent news; Christine Lagarde and Ursula von der Leyen never took on something they didn’t completely mess up. I hope they’ll continue with their excellent performance. Godspeed.”

Stay tuned as I continue to track central banks’ moves toward CBDC implementation.

This is a guest post by Efrat Fenigson. Opinions expressed are entirely their own and do not necessarily reflect those of BTC Inc or Bitcoin Magazine.

This post ECB Prepping the Ground for Digital Euro Launch first appeared on Bitcoin Magazine and is written by Efrat Fenigson.

Introducing Congressman Nicholas Begich, An OG Bitcoiner

Introducing Congressman Nicholas Begich, An OG Bitcoiner

Last Tuesday, Congressman Nick Begich (R-AK) introduced The BITCOIN Act of 2025 to the U.S. House of Representatives. He made the announcement that he’d be doing so at the Bitcoin For America summit.

The bill, a revised version of a bill that Senator Cynthia Lummis (R-WY) introduced to the Senate last year, stipulates that the United States government acquire 1 million bitcoin for its Strategic Bitcoin Reserve and protects the right of U.S. citizens to self custody their bitcoin.

As Rep. Begich spoke about the importance of the bill at the summit, I got the impression that he was acting as more than just an opportunist, a politician simply striking while Bitcoin is a hot topic in the U.S. government, but as someone who actually has a deep understanding of Bitcoin.

Turns out, I was right. The Congressman has held his own bitcoin in self custody for over 12 years now and very much understands the importance of U.S. citizens being legally permitted to do the same. Furthermore, he believes that in an age of “undisciplined bureaucracy” and reckless spending, it’s important for the U.S. government to hold bitcoin, as it will serve as a backstop to our financial system.

On a personal level, when did you first begin to see the value in Bitcoin?

In late 2012. I was reading an article on Slashdot.org regarding Bitcoin and the forthcoming halvening, and it piqued my interest. I started digging in a little further and decided that I wanted to learn more about how this digital asset worked. So, I wired the $100 over to Mt. Gox, and I bought seven bitcoin. Afterward, I transferred them over to a private wallet. I wanted to understand how Bitcoin worked, because I owned a software development company and spent 20 years in technology as a career before coming to Congress. This was just interesting to me.

So, you were just fulfilling your curiosity?

Yes, but also, a couple of days later, I called my business partners and told them that I thought bitcoin could become something really big. They had never heard of it. I said “I’m going to take $5,000, and I’m going to buy bitcoin.” I took that money from our software business and bought more bitcoin on Mt. Gox. We ended up with 440 bitcoin. So, when the exchange went under, of course it was a huge disaster, because all of that bitcoin was still on the exchange. A number of us who were creditors found each other and we put a group together to hire an attorney in Japan. We were one of the creditors that petitioned the courts successfully. Japan changed the bankruptcy type from an obliteration to a civil rehabilitation, which allowed creditors to receive a portion of their bitcoin back.

Did you get some of it back then?

Ultimately, I sold our company’s claim to Fortress. But I still hold my own original seven bitcoin.

What was your impetus in introducing The BITCOIN Act to the House last week?

For years, I’ve thought that the United States government should have a Strategic Bitcoin Reserve. The reason I believe it’s important is because when you look at the universe of available reserve assets, the lion’s share of them can be printed at will by a centralized authority. As a corollary to gold, bitcoin reminds us that there is value in scarcity, and scarce assets are the sorts of assets that belong in a reserve because they’re the defense against an undisciplined bureaucracy. What we’ve seen not just in the last several years but in the last several decades, is a federal government that will print dollars to solve problems. And, in doing so, it’s created bigger problems. That’s why holding the gold that we’ve held all these years is so important, and that’s why holding bitcoin going forward will also be important. Both provide us with a financial backstop of a scarce resource that can’t be created by an executive action or Congressional action, which imposes discipline on the financial system. Congress has not demonstrated a sustained ability to impose financial discipline and keep the government in its Constitutional lane. As a result, ultimately the math will not add up. The United States cannot sustain a 125% debt-to-GDP ratio. The United States will be unable to continue to deficit spend at the levels that we have over the last several decades. Our gold reserves and a future bitcoin reserve provide the United States and its people with a fallback mechanism should the debt-based fiat system collapse.

In your mind, what is the likelihood that The BITCOIN Act becomes law?

The likelihood is growing, and the reason I believe that is because a) there are more people in Congress today who understand what Bitcoin is than ever before, b) there are more people in Congress today who understand just how precarious our current debt and deficit is, and c) there’s a growing awareness among the public that holding a scarce asset in addition to gold is a wise diversification of our national strategic reserve. For those three reasons, the time is right. Seeing the number of cosponsors that have already come in from the Senate and the House is encouraging. And I will tell you that there’s significant interest among others in Congress who haven’t yet decided to cosponsor in learning more about the legislation and how it can be a backstop for the United States.

The bill states that the government should acquire 1 million bitcoin — 5% of the supply — over the next five years, which was also the math in the initial version of the bill. Why five years and why 1 million bitcoin?

If you look at the total amount of gold held in reserve by central banks relative to the total supply of gold, it’s estimated to be about 5% to 15%. So, as a reserve asset, that 5% to 15% zone for a global centralized bank aggregated total makes sense. The reason why five years makes sense is because what you don’t want to do is introduce a demand shock to the system that causes short- to mid-term volatility. It’s also important to remember the United States government is not a day trader. It recognizes that it needs to be methodical, thoughtful, and predictable in the way in which it acquires that asset. That’s why I think a five-year period versus say a one-year or 18-month period is more appropriate.

The bill also stipulates that the U.S. establish a proof of reserves system. Will this look something like El Salvador’s proof of reserves system, one in which the government’s Bitcoin address is made public?

100%. Yes. One of the challenges that we’ve had with Fort Knox is that there’s no way for the public to audit the reserves, and so you’ll often hear people say that they don’t believe we have the gold we say we do or perhaps we even have more than we say we do. There’s no way for a citizen of the United States to know with confidence that the United States has the gold that it says it has. Bitcoin provides us with mechanisms for continuous proof of reserves so that every citizen of the United States can know for a fact that we have the bitcoin we say we have.

What do you imagine to be the design of the United States’ cold storage setup?

The bill outlines that those regulations and technical practices will be developed in consultation with industry experts, which I think is appropriate. However, based on my own experience with Bitcoin, I believe it’s very important that a) we’re talking about cold storage, and b) that we’re talking about thousands of separate cold storage wallets. It’s also important that the keys for those wallets be held in different physical locations, and that we use the Shamir backup system, which is a mechanism where, as long as you have two of the three pieces of a key, you can reassemble the key. What you don’t want is to have a complete key in one physical location, because, if it’s compromised, someone would be able to access that wallet. You want a diversified key strategy so that you would need to reassemble the keys from multiple physical locations for each individual wallet. That is the most secure deep cold storage solution that I’m aware of.

The bill also protects U.S. citizens’ right to self custody their bitcoin. In your mind, why is self custody so important?

It’s important because if you look back at what the United States government did with gold in the early 20th century with Executive Order 6102, they nationalized the asset. You were not permitted to own gold outside of jewelry. They essentially confiscated the wealth of the people. We do not want to see a repeat of that ever in the United States, whether it’s with gold or anything else. I think continuing to assure the public in law that we have a fundamental right to self custody our own wealth is an important restatement of our Constitutional rights.

Are you familiar with the Samourai Wallet and Tornado Cash cases, which are cases in which developers may be put on trial for creating and maintaining Bitcoin and crypto mixers?

I’m not familiar with them. I know what mixers are, but I don’t know about Samourai Wallet. Mixers have been around for a long time.

Yes, they have. What are your thoughts on them?

Well, I think the question is: “Where do you draw the line on the base layer and subsequent layers?” If you think about Bitcoin versus other cryptocurrencies, Bitcoin has unique characteristics as a store of value. Whereas other cryptocurrencies like Ethereum have multiple layers in which logic for transaction restriction can be applied. In my view, you don’t wanna have transaction restrictions baked into the base layer of a store of value cryptocurrency like Bitcoin because it allows centralized control from an authority, which fundamentally defeats the fungibility aspect of it.

Do you have any final thoughts you’d like to share?

I’m excited for this legislation. I think it’s important for the nation. And I look forward to the Bitcoin community being an advocate with their members of Congress and their senators. I’m one person. Senator Lummis is one person. We have cosponsors. That’s fantastic. But we need the Bitcoin community to continue to educate and inform the rest of Congress so that we can move this legislation to President Trump’s desk where he can sign it into law.

This post Introducing Congressman Nicholas Begich, An OG Bitcoiner first appeared on Bitcoin Magazine and is written by Frank Corva.