Month: January 2024

Canadian Dollar weakens as Fed decision overshadows domestic GDP data

Post Content

Dollar rebounds as Fed’s Powell sees March rate cut as unlikely

Post Content

Tether’s Audit Report Reveals Over $2.8 Billion in Bitcoin Holdings

Announced today, Tether, the leading stablecoin issuer, has emerged with a robust balance sheet showcasing ownership of over $2.8 billion in Bitcoin. The information comes to light following an audit conducted by BDO, a renowned auditing firm, as detailed in the official auditor’s report.

The audited report provides a comprehensive analysis of Tether’s financial standing, including more information on its Bitcoin holdings. Tether, known for its stablecoin USDT, has consistently played a massive role in the cryptocurrency market, facilitating transactions and maintaining a peg to the US Dollar.

“At Tether, we look forward to great 2024, with many new projects and products ready to come alive,” said Tether CEO Paolo Ardoino. “I’m really excited by Tether’s expansion. While Tether is mostly known for one product (USDT), the company is becoming an investor and infrastructure builder in many strategical sectors, spacing from AI to P2P telecommunications, from Bitcoin mining to renewable energy production.”

The company also had a $2.85 billion profit for last quarter, of which about $1.85 billion came from gold and bitcoin holdings. For all of 2023, Tether achieved a profit of $6.2 billion.

Bitcoin’s 2023 Chronicles: Massive Gains And Exchange Anomalies

So, 2023 has been pretty epic for Bitcoin. It’s like Bitcoin woke up and decided to flex its muscles big time. We’re talking a massive leap, over 140% in value – that’s huge! It’s not just about topping traditional rivals like gold; it’s also about leaving other cryptocurrencies in the rearview mirror. Let’s dive into the on-chain action and the exchange buzz, trying to piece together clues to see what Bitcoin might be up to in the coming year.

Bitcoin’s Blast from the Past

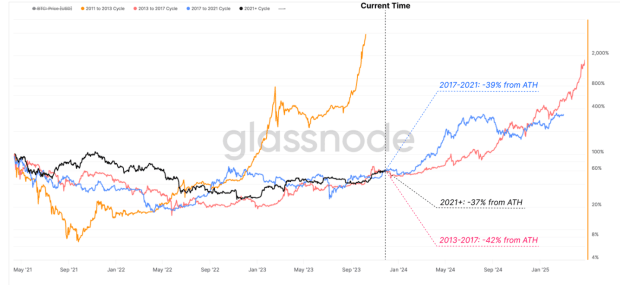

According to Glassnode’s report, we’re seeing a déjà vu with Bitcoin cycles in 2015-2017 and 2018-2022 in terms of how long it’s taking to bounce back and the drawdown since the all-time high (ATH).

Source: Glassnode

In the current cycle, Bitcoin has seen a drawdown of about -37% from its ATH, which is pretty close to the -42% in 2013-2017 and -39% in 2017-2021. Plus, since the FTX lows in November 2022, Bitcoin prices are up a solid +140%, making it the strongest one-year return compared to the +119% in 2015-2018 and +128% in 2018-2022.

Exchange Activity: Bitcoin’s Trading Paradox

Despite 2023 being a banner year for Bitcoin, the number of transactions depositing funds to exchanges has surprisingly hit multi-year lows. But here’s the kicker: Glassnode data shows that the on-chain volume flowing in and out of exchanges has skyrocketed, jumping from $930 million to a staggering $3 billion – that’s a massive 220% increase.

This discrepancy between fewer deposits yet skyrocketing volume makes us wonder: what’s driving the intensified exchange activity if not retail investors? On one hand, the decrease in deposit transactions might suggest that investors are becoming more cautious about leaving their assets on exchanges, possibly due to security concerns or a desire for greater control over their funds. This is where the potential shift towards non-custodial exchanges like StealthEX comes into play. Given the FTX drama that’s still on everyone’s mind, it’s no surprise that these platforms where you can keep your private keys are becoming more popular.

There’s a serious uptick in on-chain volume showing that trading and speculation are buzzing more than ever. It seems that while investors might be shying away from depositing their funds, they are actively trading and moving large sums of money. This could be a sign of growing institutional interest, especially as we see the average size of deposits to exchanges nearing the previous all-time high of $30k per deposit, according to Glassnode.

Moreover, the fact that exchange deposits as a percentage of all transactions have dropped from around 26% in May to just 10% today, yet the decline is more modest (around 20%) when adjusted for Inscriptions, adds another layer to this narrative. Undeniably, we’re witnessing a dynamic shift in the blockchain sphere as novel transaction types emerge and new players grab their share of the limelight.

Short-Term Holders Cashing In

Short-Term Holders (STHs) have been making some smart moves lately, cashing in on their Bitcoin investments at just the right time. Glassnode’s got the stats to prove it – the STH-Supply Profit/Loss Ratio has been hovering above ~1 since January. This means these savvy traders have been playing the ‘buy-the-dip’ game pretty well, a classic move in uptrends. However, these STHs are moving hefty amounts of coins to exchanges, and the gap between what they paid and what they’re selling for is pretty sizable.

Source: Glassnode

The first week of December, when Bitcoin hit $44.2k, STHs jumped into action, seizing the moment to take profits. It’s like they saw the wave coming and rode it all the way to the shore, capitalizing on the demand liquidity. This activity has put a bit of a pause on Bitcoin’s upward climb, demonstrating STHs’ sway over crypto prices.

Wrapping It Up: Bitcoin and Beyond

So, there you have it – Bitcoin’s 2023 story is a mix of triumphs, challenges, and a whole lot of excitement. Bitcoin, in its digital universe, never fails to keep us intrigued with its roller-coaster ride of strong recoveries and declines that resonate with historical patterns, even bouncing back recently despite a few bumps on the road. The play of STHs and the unpredictable ebbs and flows of exchange activities knit together a complex, yet intriguing narrative. Regardless of whether you’re in it for the highs or the lows, or simply out of sheer curiosity, observing Bitcoin’s ride is undoubtedly one to watch.

This is a guest post by Maria Carola. Opinions expressed are entirely their own and do not necessarily reflect those of BTC Inc or Bitcoin Magazine.

Bitcoin: Digital Mineral Rights For The Future

In Texas, the legacy of mineral rights ownership is a narrative etched into the very bedrock of state history. Passed down through generations like a cherished heirloom, the ownership of mineral rights is more than a legal claim; it is a cultural emblem, a symbol of resilience, and a precious legacy. The wealth and prosperity created for mineral rights owners in Texas over time through the extraction and production of hydrocarbon minerals is tremendous but also comes with a heavy responsibility. That responsibility demands a farsighted financial perspective and a commitment to ethical and environmental stewardship to ensure the well-being of future generations who will inherit the mineral estate. It is common knowledge among native Texans that nothing should ever be done to jeopardize their ownership rights. “Never sell your mineral rights” is a commonly heard expression for Texas natives.

The reason generations of Texans have kept their mineral rights intact within their families is that the modern global economy rests almost entirely upon the benefits of the extraction, refining, and processing of these subsurface minerals. When you own mineral rights, you own the fundamental primary material that allows the production and distribution of nearly all of the goods and services our civilization enjoys. In the future, the world’s economic production will similarly rely on Bitcoin to coordinate large transactions between manufacturers and industrial firms.

Texas Mineral Rights

Mineral rights represent ownership of subsurface materials and the right to sell, develop, and produce those materials. Texans have been fortunate to have the right to access the valuable mineral and hydrocarbon reserves located beneath their properties for more than 150 years. Mineral owners can track ownership through legal records dating back to the 1866 state constitution of Texas, which was formed to meet the requirements to reenter the United States after seceding five years earlier and which firmly established privately held mineral rights.

It is essential to understand that mineral rights in Texas can, and predominantly are at this point, severed from the rights of ownership of the land surface. These two distinct property rights are often referred to as the mineral estate and the surface estate. In addition to the ability to separate the mineral estate from the surface estate, the mineral estate can be subdivided into fractional shares of ownership. In Texas, it is commonplace for mineral estates to be divided into tiny fractional ownership shares. Whether the same owner holds the mineral ownership and surface ownership or they have been separated sometime in the past, according to Texas law, the mineral estate holds a position of supremacy over the surface estate. This authority allows the mineral rights owner to use the land’s surface to explore, develop, and produce oil and gas under the property. The mineral rights holder usually accomplishes this by entering into a contract (mineral lease agreement) with a specialized company to explore and extract resources from the property in exchange for a lump sum payment followed by ongoing royalty payments that result from selling the resources to the market.

4 Pillars Of Modern Society

The standard of living in our modern society would not be possible without the massive widespread use of fossil fuels extracted from below the earth’s surface. In his book “How the World Really Works,” author Vaclav Smil masterfully explores our total dependence on fossil fuels to provide four indispensable materials our civilization relies upon. These fundamentally essential materials are cement, steel, plastics, and ammonia.

Approximately 17% of the world’s energy supply is needed to produce these four critical materials. Your ability to use the internet and every connected device ultimately depends on fossil fuel hydrocarbons. The infrastructure and technologies of the modern world are only possible through their use, and they are the sole means to provide food for 4 billion people. In his book, Smil explains the crucial role each of these materials plays in the function of our global economy. Their production heavily relies on fossil fuels with no other viable energy substitutes. Smil reports that the global annual production of cement is 4.5 billion tons, steel is 1.8 billion tons, plastics are nearly 400 million tons, and ammonia is 180 million tons.

Currently, there are no feasible alternatives to using steel or cement to construct the world’s infrastructure. Their combination of strength, durability, and adaptability is unmatched by any other materials. The production of cement and steel requires intense heat, which is currently only possible by way of the combustion of fossil fuels. Replacing the aging infrastructure of developed countries and building new infrastructure in underdeveloped nations will require continual vast amounts of new cement and steel production.

Not only do ammonia and plastics require a large amount of energy in production, but they also are formed using hydrocarbon-derived inputs. 50% of worldwide food production relies on ammonia fertilizer, produced using hydrogen that is sourced from natural gas. Natural gas is also the energy source that provides the high pressure and temperatures required for the process.

Over 99% of plastics are derived from the refining of fossil fuel hydrocarbons. No alternative material offers the same extensive benefits of plastic’s light weight, flexibility, durability, and usefulness. The world enjoys countless products that contain plastics, such as automobile and appliance parts, consumer electronics, food packaging, furniture, and life-saving medical equipment found in hospitals. Petroleum refining also provides critical elements such as adhesives, engine lubricants, detergents, coolants, inks, pharmaceuticals, coatings, and textiles.

Eliminating fossil fuels from the global energy supply in the next few decades is an unrealistic goal when we honestly consider the available data. Due to our physical and real-world constraints, the transition to a decarbonized, renewable energy-driven economy poses a nearly insurmountable challenge.

Hydrocarbon minerals play a prominent role in the beginning stages of mass-scale modern production, and the transport of final goods depends almost entirely on hydrocarbon fuels. Tracing the stages of production processes backward from the final stage of consumer goods and services to the original input of fossil fuel hydrocarbons, we find that the ownership of mineral rights at the first stage of production signifies a pivotal position of influence over the economic landscape. This position grants mineral rights owners the immense power to shape and dictate economic destiny for every individual, business, and nation. Our global economy rests upon mineral rights owners’ discretion to allow their property to be utilized.

Just as owning mineral rights is owning the base material that underpins the functioning of the entire global economy, owning bitcoin today is owning the mineral rights to the future economy. The worldwide economy will one day function through the exchange of bitcoin between productive entities. Those who own bitcoin will own the financial collateral that allows the economy to function and transact.

Bitcoin And Mineral Rights

Bitcoin and mineral rights may seem like disparate concepts, but share some similarities. Both are subject to the concept of limited supply. In the case of Bitcoin, there will only ever be 21 million coins in existence due to its programmed scarcity. Similarly, mineral rights pertain to owning scarce mineral resources found underground. Both Bitcoin and mineral rights have forms of ownership, meaning both can be bought, sold, or transferred to others. The value of each asset is determined by market demand and supply dynamics, and each has experienced significant price fluctuations over time. Both mineral rights and Bitcoin share the feature of being decentralized. Bitcoin operates on a decentralized network, with no single entity controlling its issuance or transactions. Likewise, mineral rights represent ownership of an asset found across the globe without a centralized issuer. Each asset also has a substantial cost to its extraction and release into the arena of human economic activity. Oil and gas extraction from underground requires significant investments of financial capital, labor, and energy. Generating new supply in the Bitcoin network also requires considerable energy expenditures and capital investments in physical hardware and infrastructure.

The scarcity of bitcoin derives from its programmed 21 million supply cap, but bitcoin scarcity also develops because of its relative relationship with the entirety of the world’s goods and services. As the nominal amount of goods and services grows at a rate higher than the rate of supply of new bitcoin, bitcoin becomes more scarce relative to these goods and services because it grows more slowly. This relative aspect of Bitcoin to our economy creates a second layer of scarcity beyond the programmed supply limit of 21 million. As this second layer of scarcity grows over time due to the network effects of an expanding economy, other forms of storing value become perpetually inferior to this better store of value.

The price of everything in terms of bitcoin is always trending downward, making it a better way to preserve capital than other forms. For example, new industrial building construction costs have increased by 46% in the past five years, meaning an industrial capital project that cost $100 million five years ago might cost $146 million today. However, when priced in Bitcoin terms, the cost for this project has reduced by nearly 90%, from 26,253 BTC five years ago to 3,395 BTC today. As the world continues to become more productive, the value of those productivity gains is stored in the most dominant store of value. That store of value is Bitcoin, and as global market participants increasingly understand this, the value of Bitcoin will trend upward forever.

Within the domain of current Bitcoin commentary, it is common to hear or read about a future where merchants will sell their goods in exchange for payment by Bitcoin or other related applications functioning on top of the Bitcoin network. Retail merchant adoption will undoubtedly help build Bitcoin demand and incrementally enlarge the network’s value. However, the most considerable impact on the growth of bitcoin demand will arrive when the owners of the world’s factors of production begin to demand bitcoin as payment for their goods.

Bitcoin And Production

Firms participating in the various stages of productive processes will start to understand the economic phenomenon of holding cash balances that increase in value while simply holding them, and therefore, will begin to demand bitcoin. Cash balances that accrete value instead of declining in value over time simplify financial planning for large capital expenditures. Significant capital investments in new projects become more manageable to facilitate. Businesses can finance capital projects more efficiently using their cash reserves held in Bitcoin rather than relying on debt or equity financing that dilutes shareholder value. Financial officers managing a company’s capital structure will break into a new era of corporate finance when they begin calculating the net present value of an investment made with money that appreciates in value over time instead of depreciating.

When a firm chooses to invest in productive endeavors, the firm does so in anticipation of earning a resulting return of greater value. When a company uses accumulated Bitcoin to fund a capital project, it will consequently only accept Bitcoin as a return on investment. Accepting an inferior form of money in return will be unacceptable. As manufacturing and production businesses increasingly adopt Bitcoin as a medium for coordinating exchanges of value in manufacturing processes, the Bitcoin network will absorb significant amounts of value from the existing monetary system. This process will create a circular exchange, strengthening Bitcoin’s store of value characteristic and increasing demand among companies supplying production factors throughout supply chains.

When the use of Bitcoin to facilitate large value exchanges between businesses becomes widespread, the availability of Bitcoin in the market will become limited. At that point, the only way to acquire Bitcoin will be by providing something of value in return. Purchasing Bitcoin with other forms of currency from a money exchange will become rare, and those who wish to obtain Bitcoin will instead have to earn it. Bitcoin will become all but unavailable for purchase through traditional means.

There will be a day when the producers of capital-intensive goods and scarce natural resources stop accepting continually and purposefully diluted money for their products. In the future, when large payments of value between manufacturers and industrial firms are made through Bitcoin, the worldwide economy will become dependent on it to function. Those who have accumulated bitcoin in advance of this will find themselves in a position of dominance. Just as the owners of subsurface mineral rights today profit by allowing their property to be utilized to power the global economy, bitcoin owners will one day profit by administering the money that coordinates worldwide economic production.

Owning Bitcoin today is owning the mineral rights to the future.

This is a guest post by Aaron Roberts. Opinions expressed are entirely their own and do not necessarily reflect those of BTC Inc or Bitcoin Magazine.

130-Year-Old German Bank Partners With Bitcoin Consulting Firm for Innovative Offerings

Today, Volksbank Raiffeisenbank Bayern Mitte eG, a Bavarian cooperative bank with an ~130-year history, has entered into a long-term partnership with terahash.energy GmbH, according to a press release sent to Bitcoin Magazine. The Ingolstadt-based cooperative bank and the young startup, terahash, will collaborate on promoting topics related to Bitcoin and develop new offerings.

“We are expanding our options as part of our Bitcoin strategy with terahash’s broad expertise in Bitcoin and mining,” said Andreas Streb, Deputy Chairman of the Board of VR Bank Bayern Mitte eG. “Together we can educate and develop solutions for our customers.”

Since April 2022, VR Bank Bayern Mitte eG has been a pioneer among regional banks in Germany, exclusively offering Bitcoin only related services to its customers. The bank has embraced Bitcoin as a key focus, marking a commitment to providing more Bitcoin related services.

“Terahash and VR Bank Bayern Mitte complement each other perfectly,” stated Kristian Klager, CEO of terahash.energy GmbH. “The strategic partnership is an important step for us, we can use the synergies and combine our strengths even better.”

Terahash.energy GmbH, established only a year ago as a spin-off from a 70-year-old family business in the Augsburg area, operates the terahash.space platform. This platform aims to serve as a “comprehensive digital space” to foster connections within and beyond the Bitcoin market environment. Terahash’s primary focus lies in consulting and planning within Bitcoin, energy, and data centers, emphasizing the use of renewable energies and innovative technologies.

The strategic partnership aims to synergize VR Bank’s reliability and innovation with terahash’s expertise, according to the release, fostering joint efforts in service and educational development over the coming years. The collaboration also extends to the planning of the 2nd Bitcoin Forum in Ingolstadt, scheduled for April 12, 2024, which will feature a Bitcoin Business & Energy Area catering to B2B enthusiasts and companies.

Dollar set for hefty monthly gain ahead of Fed decision

Post Content

IMF sees Japan committed to flexible exchange rate

Post Content

China’s major state banks defend yuan as stock markets slide – sources

Post Content

China Emerging As Surprising Source Of Bitcoin Demand

The below is an excerpt from a recent edition of Bitcoin Magazine Pro, Bitcoin Magazine’s premium markets newsletter. To be among the first to receive these insights and other on-chain bitcoin market analysis straight to your inbox, subscribe now.

Last week, I put the massive buying pressure coming to bitcoin in context, but there is another — perhaps the largest — source of potential demand entering the scene.

We already know the Bitcoin ETFs, MicroStrategy issuing more shares to buy more bitcoin, Tether’s constant buying, and the halving will all be major sources of demand this cycle. For example, in the first two weeks of trading alone, the “newborn 9” accumulated 125,000 BTC. That has, so far, been offset by GBTC outflows, but it is unlikely that all GBTC holders are captive sellers who will get out ASAP. This outflow should start to wane in the coming weeks.

A somewhat unexpected development is emerging in China of all places. Readers of my content here and on bitcoinandmarkets.com won’t be strangers to what’s happening in China over the past couple of years. They are experiencing the end-of-an-economic-model transition. The China we have grown to know was built on debt, producing goods for over-indebted foreign customers. They are heavily dependent on globalization and a highly elastic monetary environment. That era is coming to an end, and the crash of the Chinese real estate market, and now their stock market, are visible signs of the end of that paradigm.

Source: @Schuldensuehner

On January 24, China Asset Management Company (China AMC), a gigantic fund manager and ETF provider in China, halted trading on their Nasdaq 100 and S&P 500 ETFs to stop the flood of money out of other funds and into these US-connected funds. On Tuesday, other US-connected ETFs on Chinese markets opened limit up, and had a 21% premium over NAV. The flight to safety is also affecting Chinese-based Japanese ETFs. Tuesday saw the China AMC’s Nomura Nikkei 225 ETF rise over 6% to a 22% premium.

Source: @Sino_Market

Chinese investors are in full-on panic mode, and the authorities are barring the door. It is only a matter of time until more Chinese investors start tapping bitcoin for its store-of-value and portability. Many Chinese are already familiar with bitcoin. China used to be a dominant source of demand for bitcoin until the CCP banned it in 2021.

While bitcoin is still officially banned in Mainland China, investors can still use exchanges like Binance and OKX. They can also buy OTC, person-to-person, or via off-shore bank accounts. Last year, Hong Kong very publicly opened back up to bitcoin. They have been following in lockstep behind US regulators giving Bitcoin the official blessing in Hong Kong. It is unlikely that Hong Kong authorities would make such a public push for legalizing bitcoin only to turn around the next year to ban it.

This morning, a piece from Reuters quotes a senior executive of a Hong Kong-based bitcoin exchange, who confirms this capital flight story. “Investment on the mainland [is] risky, uncertain and disappointing, so people are looking to allocate assets offshore. […] Almost everyday, we see mainland investors coming into this market.”

The source added, “If you are a Chinese brokerage, facing a sluggish stock market, weak demand for IPOs, and shrinkage in other businesses, you need a growth story to tell your shareholders and the board.”

Source: Reuters

We have been talking about Bitcoin providing a parallel world of green shoots, and now it is being recognized everywhere.

The flows from China will be a big source of demand in this cycle, and the approval of bitcoin spot ETFs in the US will create a perfect synergy via allowing sophisticated foreign investors to buy bitcoin and US-based assets at the same time.

We cannot forget about the faltering European markets either. Europe is likely already in recession. By December, EU factory activity had contracted for 18 straight months. Germany barely avoided a technical recession despite 2023 GDP being negative at -0.2%. The relative attractiveness of bitcoin is very high in a world of capital flight and negative growth. Many bitcoiners are worried about a recession bringing a stock market crash, which would force selling of bitcoin like it did in March 2020, but it might be the opposite this time around. As investors realize that the old system is stagnant and decaying, Bitcoin’s unique convergence of properties as revolutionary tech, a fixed supply asset, and economic growth potential will be where capital flees into.

Bitcoin Price Update

Bitcoin’s price performance has been disappointing since the ETF launch. However, in the context of FTX receivership selling $1 billion worth of GBTC and other large entities selling GBTC to rotate into lower capital fees of the new ETFs, price has held up extremely well.

RSI is one of the most widely used indicators and, as such, has a Schelling point effect. People and bots are watching for the daily RSI to hit oversold. Therefore, it is likely we won’t see any significant upside in price until 30 on the RSI is broken. That can be achieved by one more sell-off into support, since we are so close to 30 already. A more unlikely possibility is we could form a hidden bullish divergence, where the price makes slightly higher lows, but the RSI makes lower lows. I do not expect any significant downside either with the confluence of demand described above:we are at a temporary stalemate.

Staying on the daily chart below but zooming in, we see the 100 DMA is providing support currently. I also am watching the $37,877 level; an important price from back in November. Any dip that pushes RSI to oversold might not close below that.

The 100-day typically does not provide much support in bitcoin, with the 50- and 200-day moving averages being the most influential. However, below I show September 2020, right before the monster bull rally to end that year. The 100-day was the star back then. It is possible to hold along the 100-day and then rally with a pause in GBTC selling. Another interesting note from that period in 2020: the RSI stopped shy of oversold, catching many off guard as it shot to the moon. That is not my base case, but it does have precedence.

Bottom line, we are seeing massive and new sources of demand for bitcoin from the ETFs and now China capital flight. The ETF launch dynamics have been complicated but price has been relatively steady all things considered. It is only a matter of time until demand becomes apparent in price.