Month: June 2024

Australia’s First Spot Bitcoin ETF With Direct Holdings Officially Begins Trading

Australia now officially has its first spot Bitcoin ETF that directly holds BTC. The Monochrome Asset Management’s Bitcoin ETF (IBTC) just began trading as the Cboe Australia exchange opened. Trading under the ticker IBTC, the ETF carries a management fee of 0.98%.

BREAKING: 🇦🇺 Australia’s first spot #Bitcoin ETF to hold #BTC directly officially begins trading. pic.twitter.com/k4OPyPDm5O

— Bitcoin Magazine (@BitcoinMagazine) June 4, 2024

This milestone makes IBTC the first fund in the country to offer direct Bitcoin holdings, providing investors with straightforward access to BTC. This new product stands apart from the two existing spot Bitcoin ETFs in Australia, which provide exposure to spot Bitcoin without holding Bitcoin directly. Monochrome’s ETF fills this gap, by providing an ETF that actually holds Bitcoin.

“Before IBTC, Australian investors were only able to invest in ETFs that indirectly hold bitcoin or through offshore bitcoin products, both of which don’t benefit from the investor protection rules under the directly held crypto asset Australian Financial Services Licensing (AFSL) licensing regime,” the company stated.

This development in Australia follows the successful launch of spot Bitcoin ETFs in the United States earlier this year. These ETFs have seen considerable success, reflecting strong investor interest and confidence in Bitcoin. Additionally, Bitcoin ETPs have gone live on the London Stock Exchange, and Bitcoin Exchange-Traded Commodities (ETCs) have gone live in Germany as well, further highlighting the global trend towards accessible Bitcoin investment products.

Central banks turn cautious on China’s yuan, keen on dollars and gold

Post Content

Mexican peso, stocks tumble on fears of ruling coalition super-majority in Congress

Post Content

US dollar sinks to three-week low on signs of slowing economy

Post Content

Bitcoin’s 5th Epoch: Prophecies Of What To Come

Death and taxes and 21 million Bitcoin. That is what we know to be certain. The rest is conjecture. Today I wanted to share my big bets on the next halving. I am sure I will cringe in 4 years at some of these “prophecies” but some of them will come true. I don’t have a ton of data to back up these predictions, some are gut feelings, others are random. All I know is that the future is weird.

3 Zeta Hash Mining

Based on my experience mining during the previous cycle, I learned a valuable lesson in trying to estimate hashrate, think log not linear. The current hashrate exceeded my expectations by a very long shot, so I I am going extra long on the next cycle. We are going to see more nation-states adopt and it is going to rip up. This is the way we conquer the stars.

5 Countries in Western Hemisphere Declare USDT Legal Tender

Nations with high inflation and unstable currencies are exploring cryptocurrencies as legal tender, following El Salvador’s example. Political movements in countries like Argentina and Venezuela show increasing public and legislative interest in digital currencies. Economic reports suggest that adopting digital currencies can reduce transaction costs and increase financial inclusivity.

Apple integrates Stablecoins into wallet

Apple has historically adopted new financial technologies (slowly), however there’s significant user interest in accessing stables alongside traditional banking in mobile wallet apps. Recent hires and patents by Apple in cryptocurrency and blockchain suggest future product offerings including digital currencies.

Liquid’s Growth Fueled by USDt

Liquid Network’s total daily transaction volume is laughable today at the halving but as stablecoin regulation is put in place we will se an insane increase in demand for tether which will fuel Liquids growth. As of today, USDt on liquid is ~ $36,500,000 or 3.17% of total USDt supply. ($111,897,000,000). I expect > $1b to be issued on Liquid by next halving or > 2,600% increase. This is a wild guess which I am making based on the assumption that USDt dominoes falling into place on the other prophecies.

Ordinals Still Thriving

The degenerate NFT market has shown consistent interest in “blockchain-based ownership verification”, indicating a strong future for projects like Ordinals. Initial uptake by digital artists and collectors at Ordinals’ launch hints at long-term viability. Technological enhancements in blockchain scalability are making it feasible to manage extensive data like that used in Ordinals.

Fees Carry Mining Revenue at 2:1 Subsidy

As block rewards halve, transaction fees are becoming a more significant part of miners’ income, visible in the last two halvings. Economic models predict accumulated fees will become the dominant incentive for miners as transactions increase. Historical data shows increasing fee proportions relative to block rewards with each halving event. I am a fee maxi.

LN Will Be 90% Centralized and Compliant

The Lightning Network’s growth is supported by major financial institutions seeking scalable solutions, leading to potential centralization. Regulatory pressures are shaping crypto technologies to favor centralization for easier oversight. Studies on network nodes show a trend towards centralization as major players establish dominant positions.

E-Cash Finds Market Fit with Miner Payouts

The need for efficient miner payment methods is driving the adoption of e-cash solutions that offer immediate, low-fee payouts. Pilot projects show promising results for integrating e-cash into mining operations. Economic analyses suggest that e-cash can reduce volatility and improve liquidity for miners.

Challenges in Seed Phrase Security Due to Neuralink

Neuralink and similar projects explore direct brain-computer interfaces, complicating traditional cryptographic practices. All your seeds are belong to machines. New methods to create seeds without revealing to machines becomes critical.

Oil Contracts Settled on Chain

Bitcoin use in commodity trading is expanding with successful pilots for crude oil trading on-chain. Countries critical of the US dollar’s dominance are exploring Bitcoin solutions to circumvent traditional financial systems. Bitcoin technology improvements have enhanced its capacity to handle large-scale, complex contract settlements.

Bitcoin ETF Surpasses Gold ETF Market Cap

Rapid expansion in the Bitcoin investment market and the launch of Bitcoin ETFs in multiple countries indicate a growing market. Bitcoin’s market cap occasionally surpassing major companies (FAANG) and traditional assets. Bitcoin is increasingly viewed as a “safe haven” asset, driving ETF investments. RIP Gold.

Assassination Markets Settled by Decentralized Oracles

Over $100 billion is locked in “DeFi platforms”, engaging with “decentralized applications”. Decentralized oracles’ viability in settling bets on real-world events. We will see assassination markets on chain irl. Probably carried out by drone swarms.

Reorg for Epic Sat

We wanted fireworks last halving and we didn’t get them. Next halving we get them The value of the Epic Sat will be massive next halving and mining pools who don’t participate will be ridiculed.

SV2 Only Captures 20% of Hashrate

No one care’s sadly. The big pools are not incentivized to adopt SV2. Big pools will continue to find innovative ways to monetize blocks, and that doesn’t include SV2.

A US State Invests in Bitcoin

States like Wyoming and Texas have enacted blockchain-friendly laws, laying legislative groundwork for such investments. Diversifying state treasuries with Bitcoin could hedge against inflation, particularly with fluctuating USD strength. Several state treasurers have shown interest in exploring digital assets as part of financial strategies.

AI Becomes Sentient and Demands Bitcoin

The machine(s) want Bitcoin, not shitcoin.

China Unbans Bitcoin Mining

China’s previous Bitcoin mining ban significantly impacted the global hash rate and mining landscape. Reinstating Bitcoin mining will bolster China’s industrial and technological sectors economically. They will no longer ignore the importance of hashing.

Great Replacement Becomes Reality, Leading to Mass Deportations

Nationalist movements in Europe have used the Great Replacement theory to influence immigration policy. Demographic studies forecast significant population shifts, potentially underpinning radical policy changes. Political gains for parties endorsing these theories indicate possible moves towards more radical demographic policies.

Bukele Continues as President

Bukele’s popularity in El Salvador is buoyed by his bullish bitcoin economic policies, indicating potential for prolonged leadership. Surveys in El Salvador show high approval ratings for Bukele, especially among tech-savvy demographics. Constitutional or legislative changes will facilitate extended terms or repeated re-elections.

The Bitcoin-Dollar is a Documentary

Financial analysts’ models project Bitcoin’s value could exceed $1 million per coin within the decade, considering supply and demand dynamics. Bitcoin’s price has historically surged post-halving, supporting future price increase predictions. Institutional investment is increasing, with major firms allocating portfolios to cryptocurrency, boosting its legitimacy and demand.

Scaling BIP Activated

CTV, LNhance. OPCAT, some BIP is activated.

Fold Adds New Feature And Team Member To Better Bank Bitcoiners

Fold recently released its Direct to Bitcoin feature as part of a set of features that the team at Fold calls its Bitcoin Checking Account. Fold Users can now auto-convert anywhere from 1% to 100% of their fiat deposits to bitcoin from a checking account through which they can also make payments.

This new feature is the first of many that the company plans to release in the coming months that will help its users more easily live on a bitcoin standard.

You can now transition to a bitcoin standard in two taps using @fold_app.

Earn in bitcoin and maintain access to all the day to day financial tools you need. pic.twitter.com/V8BQgwTs7S

— WILL REEVES (@wlrvs) May 31, 2024

“Direct to Bitcoin is an automated way to balance between dollars and bitcoin for any funds coming in, and it’s essentially the base on top of which the Fold product works,” Fold CEO Will Reeves told Bitcoin Magazine.

“It really brings a fully functional banking experience to Bitcoiners, which really hasn’t existed in a great way until now,” he added.

In this new phase for Fold, Reeves and his team want to make it easier for Bitcoiners to use bitcoin as their base money, something that they not only accumulate through the app but can also easily convert to US dollars when they want to make a payment, as well.

To help usher in this new era, Fold has hired Ecosystem Lead Brian Harrington, whose first major task has been bringing features for the Bitcoin Checking Account to market.

The banking features you need

The currency you prefer

Bitcoin is better than dollars https://t.co/eKxJplD11i

— Brian Harrington (@BrainHarrington) May 31, 2024

Harrington is well known for his work at Choice App, where he directed the marketing efforts for the first Bitcoin IRA account in 2020, an offering that changed the public’s perception about holding bitcoin in an IRA. Now, many companies offer bitcoin IRAs.

Harrington seems extremely excited as he prepares to bring attention to Fold’s Bitcoin Checking Account. He wants people to be able to convert their bitcoin to US dollars and then spend those dollars all in one app, an idea that was born from his own frustration.

“I was tired of switching back and forth between a bank and a bitcoin exchange,” Harrington told Bitcoin Magazine.

“The checking account product solves what I call having an ACH portal. What is a bank? It’s access to the ACH network. I didn’t want to use the ACH portal at a USD maximalist institution anymore,” he added.

“After searching for these solutions for myself, I’m excited to work with Will and the team on making this a cohesive thing.”

With that said, both Harrington and Reeves stressed that what Fold is looking to accomplish is bigger than just these two features as they stand on their own.

“What Fold is doing is bigger than a single feature,” Harrington said.

“It’s not about features. It’s about this thing that’s happening with Fold,” he added.

Reeves chimed in to elaborate.

“Bitcoin is coming more and more to the center of our lives and to millions of lives,” he explained.

“The world is getting much more expensive for people that hold dollars, it’s getting cheaper for Bitcoiners, but there’s no bank for Bitcoiners,” he added.

“We’re focusing on how we can be the bank for Bitcoiners that doesn’t exist today.”

To learn more about Fold and its future plans, check out our recent Founders profile on Reeves.

Download the Fold app here.

Australia’s First Spot Bitcoin ETF To Begin Trading Tomorrow

Australia is set to join the growing list of countries offering a spot Bitcoin exchange-traded fund (ETF), with the launch of the country’s first such product expected tomorrow.

JUST IN: 🇦🇺 Australia’s first spot #Bitcoin ETF to go live tomorrow.

Are you prepared? 🚀 pic.twitter.com/EfKqdMU48P

— Bitcoin Magazine (@BitcoinMagazine) June 3, 2024

Monochrome Asset Management announced that Bitcoin ETF (IBTC) will begin trading on June 4th, pending any last-minute delays. The ETF will trade under the ticker IBTC and carry a management fee of 0.98%.

Monochrome Asset Management, the issuer, offers the fund as a means for investors to gain exposure to Bitcoin in a regulated framework. The ETF tracks the CME CF Bitcoin Reference Rate index, providing exposure tied directly to the spot price of bitcoin.

Cboe will become the first Australian exchange to list a bitcoin ETF, beating the larger Australian Securities Exchange (ASX) to the market. However, according to reports, the ASX is also planning to approve spot Bitcoin ETFs before the year’s end.

The launches tap into surging interest following the breakthrough regulatory approval of Bitcoin ETFs in the US market this January. Those products ignited massive inflows from both institutional and retail investors.

Australia is now poised to follow suit in offering investors easy and secure exposure to bitcoin without direct ownership. As a strictly passive ETF, IBTC removes the technical challenges of buying real Bitcoin while providing the return profile tied to bitcoin’s price.

Regulated Bitcoin ETFs have launched this year across North America, UK, Europe and Asia-Pacific. Australia’s entrance reflects the broader embrace of Bitcoin as an institutional asset class.

Other countries are likely to follow, with major markets now offering spot Bitcoin ETFs. The regulated wrapper provides legitimacy and gives investors a straightforward way to gain exposure.

Asia FX steady as dollar drops amid rate cut speculation; Indian rupee surges

Post Content

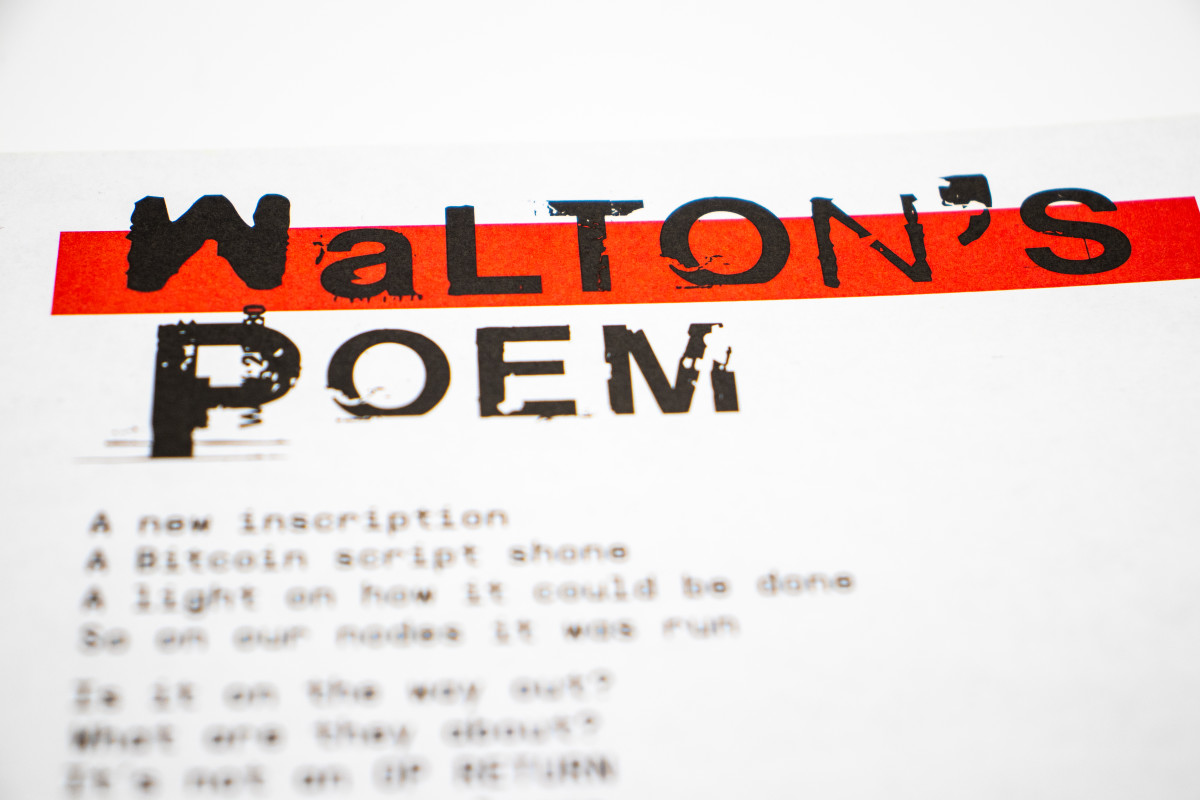

Walton’s Poem

This article is featured in Bitcoin Magazine’s “The Inscription Issue”. Click here to get your Annual Bitcoin Magazine Subscription.

A new inscription

A Bitcoin script shone

A light on how it could be done

So on our nodes it was run

Is it on the way out?

What are they about?

It’s not an OP RETURN

Perhaps we can learn.

So it’s a message that you’re making

Like my girl, non-fungible & taken

What is the beast that did awaken

Decentralization can’t be forsaken

Censorship resistant, code is lawless

Immutable bits, they stay flawless

I like physical art so I tango

Some want it on-chain, as if it’s django

See for me, BTC is plenty

Don’t have a need for BRC20

Always current, need more amps

Really, what’s the use for stamps?

Click the image above to subscribe!

Ordinal enjoyoors, rare sat hunters

Crypto kitties, rare cat punters

BRC-20 is why the mempool is clogged

Sophon’s off so no longer leap-frogged

An open network, Bitcoin’s the name

For each individual, it dgaf about fame

It doesn’t discriminate, the rules are the same

Human behavior is harder to tame

Verifiable history – it’s a facts machine

Bitcoin’s got a stronger future than the fax machine

So pop a bottle of Krug, man

Noble, full throttle, accrue, plan.

How you transact, you got your reasons

Do it on bitcoin, it’s there for seasons

It’s there to stay, comfy, four seasons

If the fee you pay, don’t need more reasons.

Many came to take profits

No heroes, fake prophets

Only I can decide my future

Only one cut, no need to suture

Offer me shitcoins, I’ll tell you: No I’m fine

Head down on chest day, easy, press decline

Always off on a tangent, multisig and co-sign

When time for a child, that’s Obs and Gyn.

Always flowing, trip the motion sensor

New pool growing, slip to Ocean, censor

Spam that’s showing, that’s devotion, tense lore

Pump new liquidity like a lotion dispenser

Inspired by logic, only God can judge

Everything is clear, except her lipstick smudge.

I’m not a whale, so I can’t blow it

Call me WALTON, I’m the bitcoin poet.

This article is featured in Bitcoin Magazine’s “The Inscription Issue”. Click here to get your Annual Bitcoin Magazine Subscription.

Pound nears 2016 levels as election nods to new Brexit tack: Mike Dolan

Post Content