Month: May 2024

Asia FX creeps lower, yen fragile with more rate cues on tap

Post Content

Bitcoin rises to $70,206

Post Content

Case Study: Enabling Bitcoin as a Medium of Exchange at the Bitcoin Asia Conference in Hong Kong

The Bitcoin Asia conference held on May 9 and 10, 2024 in Hong Kong demonstrated a significant milestone in the adoption of bitcoin as a legitimate medium of exchange.

This article outlines the strategies and technologies implemented to facilitate seamless bitcoin transactions for goods and services over the two days, leveraging the capabilities of self-custodial payment processing through BTCPay Server.

Executive Summary

Throughout the event, 212 Bitcoin transactions were processed, involving four vendors and totaling 7,714,253 sats, equivalent to 36,974.63 HKD.

The average transaction was approximately 36,560 sats (about 175 HKD). Notably, the system maintained full operational uptime with zero failures in bitcoin base chain or lightning network transactions.

What is BTCPay Server?

With banks, you have no option between self-custody or custodial payment processing.

For example, if you wanted to run a self-custody business with fiat, you would have to run a cash payments-only business, which comes with huge risk of theft when centralizing capital in one place. This would also limit your customer base.

BTCPay server helps businesses accept bitcoin payments.

To expand our economic outreach beyond our local economies, we created payment networks and payment processors that allow for digital transactions.

But what have been the consequences of implementing custodial payment systems over time? Why can’t we have a digital self-custodial payment processor? What innovations, freedoms, and data do customers & businesses have to sacrifice due to custodial payment processing? What if my digital form of payment (e.g., credit card, Apple Pay, Venmo) declines even though I have the funds in my account? What valuable data — both financial and personal — am I now giving away for free because of these services?

With BTCPay Server, we can facilitate the experience of cash-like transactions digitally, meaning we can make digital payments peer-to-peer. Transactions do not require personal information from the payer, nor do they require an intermediary. This eliminates the risks that come from both transacting with cash and depending on an intermediary.

BTCPay Server is free to use and completely open source, meaning BTCPay Server is not a company — it’s simply code.

BTCPay Server is a bitcoin payment processor that allows businesses and individuals to receive payments directly, without relying on third-party services.

The benefits of using BTCPay server.

Unlike traditional payment processors, BTCPay Server does custody funds and does not charge any transaction fees.

BTCPay Server is a highly adaptable payment processor. It can be integrated into existing systems with APIs, and both individuals and businesses can tailor their payment processing experience to meet specific needs, ensuring a seamless integration into their operational frameworks.

In addition to the features listed above, BTCPay Server supports what are known as Prism Payments.

This functionality allows for the trustless distribution of funds across multiple accounts at the point of sale. This innovative approach fundamentally rethinks the flow of money, enabling real-time compensation for stakeholders and employees.

BTCPay Server’s Prism Payments

How to Use BTCPay Server

Step 1: Setup a BTCPay Server

For a comprehensive guide on setting up a BTCPay Server, see this full step-by-step tutorial on YouTube.

Step 2: Ensuring Liquidity and Price Stability

At the time of writing, the Lightning Network is the only Bitcoin scaling solution that maintains bitcoin’s cash-like properties in making payments with BTC.

The Lightning Network facilitates instant settlement, doesn’t require any KYC and offers near non-existent fees, much like the experience of using cash.

For the Lightning Network to function, it needs liquidity. Providing liquidity often means running and managing a node yourself, but BTCPay Server does this for you.

At the conference, BTCPay Servers nodes, in conjunction with Blink, which served as a liquidity provider for the conference, operated flawlessly, ensuring no payment failures.

Blink Wallet was a liquidity provider for the Bitcoin Asia conference.

In addition to utilizing an extra liquidity provider, we also employed a price hedging solution in case we experienced bitcoin price volatility during the conference.

This risk needed to be addressed because vendors who accepted bitcoin at the conference wanted to be paid out in their local currency once the conference ended.

A bearish scenario for a vendor would be receiving a $10 payment bitcoin at the time of sale while the price of bitcoin was high, and then, during the course of the conference, bitcoin’s price could have dropped 50%.

In this type of situation, when it was time to perform a settlement in the local currency for the vendor, they would only receive $5 in their local currency, which is unacceptable.

To mitigate this risk, we used “stablesats“, a Blink feature that allows for instant conversion into a synthetic version of a stable currency (such as the Hong Kong dollar) at the point of sale.

More information on Blink features and services here.

Step 3: Deploying Physical POS Machines

Despite the digital nature of bitcoin transactions, physical point-of-sale (POS) machines were deployed to give a familiar checkout experience to attendees and vendors.

We used POS machines from Bitcoinize. These devices also facilitated the issuance of physical receipts upon request.

BTCPay Server Point of Service (POS) machines

Step 4: Simplifying Bitcoin Access with Bolt Cards

To facilitate seamless bitcoin transactions at the conference, we also utilized Bolt Cards.

These custom “Bitcoin Asia” edition cards, enabled attendees to convert fiat currency into bitcoin for use within the event. The cards allowed for straightforward NFC tapping at POS devices.

BitcoinAsia Bolt cards

Step 5: Training for Merchants and Employees

A training session was conducted before the conference to familiarize vendors with how to use BTCPay Server.

The 10-minute session was effective, with minimal questions from participants.

A group chat was set up for support, which remained largely inactive due to the smooth operation of the payment system.

BTCPay server machines in use at Bitcoin Asia

A full video of the training session is available here.

Conclusion

Thanks to free and open source software like BTCPay Server and innovative solutions from companies like Blink, transacting with bitcoin transactions at the Bitcoin Asia conference was incredibly easy.

The success of using BTCPay server at the Bitcoin Asia conference demonstrated the potential for wider adoption of bitcoin in everyday commerce.

Consider using such solutions for your next event or within your local economy.

BTCPay server logo

Institutional Bitcoin Adoption: Insights from Nathan McCauley, CEO of Anchorage Digital

At the MicroStrategy World: Bitcoin for Corporations conference, Nathan McCauley, co-founder and CEO of Anchorage Digital, shared his thoughts on the growing rate of institutional Bitcoin adoption.

Anchorage Digital, the only federally-chartered bitcoin bank and a leading institutional custodian, plays a crucial role in facilitating this transition to bitcoin becoming an asset in which institutions invest by providing secure storage and trading solutions for the asset.

In an interview with Bitcoin Magazine, McCauley discussed the company’s mission, the evolving interest from institutions, and how Anchorage’s clients are dealing with bitcoin’s volatility among other topics.

The Rise of Institutional Interest in Bitcoin

Reflecting on his career in technology and the founding of Anchorage Digital in 2017, McCauley highlighted the company’s goal to serve a diverse array of institutional clients, including large corporations, sovereign wealth funds, and governments.

“We provide a secure place for institutions to store their Bitcoin and enable them to trade and manage their holdings,” McCauley told Bitcoin Magazine.

Over the four years that MicroStrategy has hosted its Bitcoin for Corporations conference, bitcoin has experienced a notable shift from being a taboo topic to a legitimate asset class attracting significant institutional interest.

McCauley noted that this growing interest is not a sudden phenomenon but the result of consistent demand over time.

“The demand for Bitcoin was always there,” he said. “In fact, one kind of counterintuitive thing that I’d like to tell people is that the Bitcoin ETFs did not create this demand. The demand already existed. There were already folks that were interested in participating in the space.”

Client Satisfaction and Long-Term Commitment

When asked about how clients are feeling coming out of the bitcoin bear market, McCauley emphasized that those institutions that develop a long-term perspective on Bitcoin tend to be more satisfied.

“Most of our clients are committed to holding Bitcoin for an extended period, and they’ve been satisfied with both their investments and their relationship with Anchorage,” he said.

He added that Anchorage’s dedicated client experience team plays a crucial role in helping clients navigate the volatility and manage their investments effectively.

Infrastructure for Financial Advisors

Anchorage not only focuses on helping clients custody bitcoin but also on on building the infrastructure necessary for financial advisors to facilitate bitcoin investments for their clients.

“We are developing comprehensive custody and trading integration systems to support financial advisors nationwide,” he explained.

Global Talent

A significant aspect of Anchorage’s strategy is its global approach to talent recruitment.

“Bitcoin is a global movement, and we recruit talent from various regions, including the United States, Portugal, and Singapore,” McCauley stated.

“The whole point is to democratize access to this financial asset the world over. Anything less than doing that when we think of where we recruit and where we bring in talent for the company would almost be a kind of a betrayal of the ecosystem,” he added.

Anchorage’s Federal Trust Bank Charter

Anchorage’s credibility is further reinforced by its Federal Trust Bank Charter, making it one of the few cryptocurrency companies overseen by the Office of the Comptroller of the Currency (OCC).

“This level of oversight and compliance rigor places us on par with the largest banks in the country,” McCauley said.

Achieving this charter involved building a secure and flexible custody system and demonstrating compliance capabilities to the OCC.

The Era of Institutional Adoption

In a keynote talk at the conference, Michael Saylor, Executive Chairman of MicroStrategy, walked the audience through a timeline of Bitcoin adoption. In it, he pointed out that we’ve moved on from the asset’s Wild West days and shared that the days of “crypto chaos” — the 2020-2023 era in the broader crypto space — are behind us.

McCauley agrees with this assessment and sees Anchorage as a key player in this transition.

He cited early predictions from figures like Hal Finney, who anticipated that much of Bitcoin would eventually be held by banks.

“Anchorage is a manifestation of this vision, and we are committed to driving further institutional growth in the Bitcoin space,” McCauley concluded.

As Bitcoin continues to gain acceptance among institutions, companies like Anchorage Digital are at the forefront, providing the necessary infrastructure and regulatory compliance to support this growth.

The insights shared by Nathan McCauley underscore the importance of long-term commitment, education, and global collaboration in advancing the institutional adoption of Bitcoin.

Everything Old Is New Again

This article is featured in Bitcoin Magazine’s “The Inscription Issue”. Click here to get your Annual Bitcoin Magazine Subscription.

Let me start off by acknowledging that Ordinals are amazing! Ordinal Theory is a very clever method of tokenizing individual satoshis and Casey Rodarmor deserves high praise and recognition for gamifying the blockchain and Making Bitcoin Fun Again. For the first time in the history of Bitcoin, we have NFTs on the heaviest proof-of-work chain, preserved indelibly forever!

Okay, now that we got that out of the way, let’s dive into some “inconvenient” history. Ordinals was not the first — far from it. Tokens have existed on meta layers on top of the Bitcoin blockchain for at least a decade. Most have been flashes in the pan like Colored Coins; never quite launched, like RGB; or under-the-radar this whole time, like Counterparty.

You may not have heard of Counterparty — a shockingly high number of Bitcoiners haven’t — which launched in 2014 with a fair “proof-of-burn” that sent 2,130 bitcoin to an irrecoverable burn address, but you may have heard of Rare Pepe, an early, pioneering “tokenized art” collection on Bitcoin consisting of 1,774 hilarious and dank works revolving around Pepe the Frog. RAREPEPE (Series 1, Card 1) commonly referred to as the “Nakamoto Card” sold for upwards of half a million dollars during peak NFT mania. Another card, HOMERPEPE (Series 2, Card 32) was probably the first significant NFT sale ever at $38,000 in 2018 and then again for $320,000 in early 2021.

Oh, did I mention I am an original Rare Pepe artist? I submitted a piece entitled CHAMPAGNETNT (Series 25, Card 38) that poked fun at the then-current ICO boom, and eventual bust. The great thing about the Rare Pepe collection is that it acts as an illustrative time capsule of what was happening in Bitcoin (and crypto) during the 2016-2018 era, warts and all. But this was all before 2021, before NFTs went bananas, so there really wasn’t much speculation or expectation of profit. It was just a bunch of dudes (mostly dudes) hanging out on Telegram and making dank art to share with friends. I gave away half the supply of my card without even stopping to consider if it could be worth something “someday”.

Click the image above to subscribe!

Let’s skip forward a few years. It’s early 2023 and Ordinals is making waves as the shiny new thing. What makes Ordinals novel? A clever method of FIFO (first in; first out) accounting, which reimagines waves of satoshis as individual, trackable particles. It’s an abstraction, because satoshis don’t really exist as individual, non-fungible units. But if everyone agrees on the FIFO accounting method, we can all collectively believe that they exist and therefore they do! The wave-function collapses thanks to the observer effect of Ordinal Theory. And once they exist, we can also pretend that owning a certain one corresponds with ownership of a particular inscription on the blockchain, much like a star registry gives you a claim on some distant sun. Ordinal Theory is a lens through which to view the blockchain in interesting new ways. It’s like magic!

So when I first found out about Ordinal Theory I was completely blown away. I always thought, “Well you can’t just manifest something new into existence simply by claiming it to exist using an arbitrary counting method completely extrinsic to the system itself”. But apparently you can! The artificial walls in my mind that had been built up around “crazy ideas that could never work” suddenly vanished and I could see a clear path in front of me: I can make up stuff too! And that’s how Bitcoin Stamps was born. Well, not exactly. Ideas are a dime a dozen, but the implementation of an idea is really what brings it to life. I’ve had the privilege of working with some great coders and engineers that have been indispensable in launching and evolving the Bitcoin Stamps protocol: Kevin, Arwyn, Regan, B0B Smith, and many others. We were also fortunate enough to leverage the decade-old Counterparty protocol, maintained through many lean years by stalwarts like JDog and Joe Looney, to quickly bootstrap Bitcoin Stamps.

So what exactly is a Bitcoin Stamp? Well, it’s Secure Tradable Art Maintained Permanently.

Essentially, an image file, like a JPEG or GIF, is converted into a long Base64 string — Base64 is a method to encode binary data as printable text — that’s appended to the URI (Uniform Resource Identifier) “stamp”: and placed in the description field of a Counterparty transaction. Explorers and wallets convert these long Base64 strings back into viewable images.

Here is the Base64-encoded string of the very first Bitcoin Stamp (#0):

stamp:iVBORw0KGgoAAAANSUhEUgAAAAUAAAAFCAYAAACNbyblAAAAHElEQVQI12P4//8/w38GIAXDIBKE0DHxgljNBAAO9TXL0Y4OHwAAAABJRU5ErkJggg==

A big selling point for Bitcoin Stamps is the preservation of data once minted on the blockchain. How is this persistence of data achieved? The way Counterparty typically operates is to encode data into a transaction’s OP_RETURN. OP_RETURN’s are limited to 80 bytes which is quite restrictive from a “storage” perspective. However, OP_RETURN works well for traditional NFTs that employ an HTTPS pointer to a resource on a third-party server like AWS. Commonly, when you tell people the art isn’t actually “on chain” it’s like telling them Santa Claus does not exist. Alas, it’s true: The vast majority of NFTs throughout the years are mere pointers to off-chain art which makes them very susceptible to bit-rot. When the AWS bill stops getting paid, the art is gone forever.

There is another way, however, to encode larger amounts of data using a standard Counterparty transaction: bare multisig encoding. Essentially, when a transaction’s data exceeds 80 bytes, Counterparty instead chunks and encodes that data into a bare multisig’s key-strings, using a 1-of-3 quorum where two of the three keys are utilized to store data in a sneaky fashion. The one actual redemption key in the multisig that can spend the outputs is a burner: The artist does not actually have control of a corresponding private key. We call this technique KeyBurn as it ensures that the data stored within the UTXO set cannot be removed through spending.

Bitcoin Stamps happen to be extremely SIGOPS (Signature Operations) heavy as a result of how the data is stored. Typical transactions do not contain so many SIGOPS, which has led some mining pools to cut corners over the years, and not count them when including transactions in a candidate block. Everyone is aware of the block size limit, but did you know there is an 80,000-SIGOPS limit per block as well? I didn’t! I found this out when news first broke that F2Pool had created an invalid block that got rejected by the network for exceeding the SIGOPS limit due to all the Stamp transactions in it, which were tied to very juicy mining fees. Expensive mistake! Then they did it again shortly after. That’s 6.25 BTC lost twice, not including transaction fees.

Source: https://twitter.com/0xB10C/status/1643871608401014785

How does this differ from Ordinal inscriptions? Well, I like to say that Rodarmor came up with the most responsible solution for inscribing data on-chain by placing it in the SegWit witness data structure. This is a data structure that’s been designed with optionality in mind: Don’t want it? That’s fine, once your node validates the signatures, the data can be easily discarded. In fact, anything before an “Assume Valid”-marked block doesn’t need to be downloaded at all! Inscriptions are designed to respect the wishes of node runners, and what did Rodarmor get for being so gracious?

OUTRAGE! HOW DARE YOU STORE YOUR JPEGS ON MY NODE!

Bitcoin Stamps takes a different, much less polite, approach. The data encoded in the bare-multisig is not only held in blocks, but also in the UTXO set as unspent outputs. This data is much more difficult to “prune” as every node, by default, maintains a full copy of the UTXO set. So while inscriptions are stored in a blockchain-adjacent data structure called “the witness” which, by design, makes pruning easy, Bitcoin Stamps are stored in actual blocks in the canonical Blockchain data structure as well as the UTXO set held in memory by every node.

Here’s how it breaks down:

Ordinal Inscriptions: stored by post-SegWit, full archival nodes only. Pre-SegWit nodes will never know that your beautiful JPEGs even exist. Sad.

Bitcoin Stamps: stored by every node. Period. Pre-SegWit nodes. Post-SegWit nodes. Full Archival Nodes. Pruned SPV nodes. They all get the Bitcoin Stamps. ALL NODES MATTER.

I like to make this analogy: Ordinal inscriptions are like drawing with chalk on a sidewalk on a sunny day. Bitcoin Stamps is like spraying graffiti on the sidewalk. It’s very rude and antisocial. It’s also very hard to remove.

Now you might be wondering: This sounds too good to be true, Mike, what’s the catch?

Well, there is a catch: Permanent storage on the blockchain is not cheap. Bitcoin Stamps do not utilize witness data so they don’t benefit from the witness discount. As a rule of thumb, Bitcoin Stamps cost at least four times what Ordinals cost to inscribe. But hey, you get what you pay for, amirite? And before you accuse me of fear-mongering, there have been very real discussions by various core contributors about changing the IBD (initial block download) default in Bitcoin Core so that newly spun-up nodes never see your JPEGs in the first place.

As I write this, Luke Dashjr’s OCEAN mining pool has just launched to much fanfare, and it appears that they are purposely not relaying data after OP_FALSE as a means of censoring Ordinal inscriptions.

Source: https://twitter.com/oomahq/status/1729689197974319549

And while there are some theoretical methods of pruning Bitcoin Stamps out of the UTXO set, like UTreeXO, they are far more invasive than discarding witness data and come with their own trade-offs for full-node operators. Ordinals, magnanimously, make pruning easy while Bitcoin Stamps make it very hard.

Bitcoin Stamps are a lot more expensive to mint than Ordinals but we’ve found that constraints can make for good art. In the words of Leonardo da Vinci: “Art lives from constraints and dies from freedom.” The artist community that’s sprung-up around Bitcoin Stamps tend to gravitate towards pixel and SVG art because they compress much more efficiently than raster art, for lack of a better term.

The size/cost constraint has also led to more recent innovation through recursion where a JSON file is minted that points to a number of previously minted stamp “traits”. By repurposing these “traits”, the cost of a large collection is brought down several orders of magnitude by stripping away the redundant data across a collection. Audio Stamps that mint only a song’s notes (similar to old-school MIDI format) and AI Stamps that mint only a generative seed prompt are additional innovative methods that work around the constraints and deliver novel results.

You want fungible degen tokens? Yeah, we got those too in the form of SRC-20.

Want to get involved in Bitcoin Stamps either as an artist, developer, or collector?

There’s a thriving Telegram community full of people happy to answer any questions you may have, found here: t.me/BitcoinStamps

Here are some links to the ever-growing Bitcoin Stamps ecosystem:

STAMPCHAIN.IOSTAMPED.NINJARARESTAMP.XYZSTAMPVERSE.IOOPENSTAMP.IOTHESTAMPWALLET.COM

This article is featured in Bitcoin Magazine’s “The Inscription Issue”. Click here to get your Annual Bitcoin Magazine Subscription.

Dollar edges higher as investors await Fed guidance

Post Content

The New Wave Of Bitcoin L2s Are Sidechains

I heard a lot of people say no one could define an L2 at Bitcoin Asia. The problem is that we have a definition, and most people just want to ignore it. Marketing, eh.

“Bitcoin L2s” are the hottest thing on the street. People are using a bunch of jargon to distract users from trust assumptions and shill Bitcoin Season 2.

Why all the sudden energy? See, about a year ago, some teams figured out how to use Bitcoin as a data availability layer for rollups. Others have been working on improving trust assumptions related to bridges (aka two-way peg). The research has been making great progress, and a lot of projects think we’ll have rollup-like blockchains in production by 2025.

2025? Some projects claim to be on mainnet now?

Teams have taken this energy and are prematurely promoting the modular thesis for Bitcoin scaling. Projects are launching with bridge contracts on blockchains that aren’t Bitcoin, and are marketing themselves as Bitcoin L2s. Infrastructure providers amplify their message and boast that Bitcoin is back.

But these solutions don’t scale Bitcoin. They’re completely independent, centralized sidechains.

Layers they say? More like layers of trust assumptions.

Definitions

A lot of these projects are trying to adopt the modular thesis for Bitcoin scaling. This basically means that each aspect of the transaction lifecycle can be its own specialized system. Execution, transaction ordering, and data availability can all be operated by independent actors. Bitcoin will be the settlement layer at the base of it all.

It’s not a terrible thesis when you dive into it. But its current implementation on Bitcoin is a bit worse for wear.

A lot of the new projects claim to be “rollups”. Rollups would use Bitcoin for data availability, and post their latest state root, and enough transactions to recompute the state of the blockchain from genesis, to Bitcoin. If they want to scale Bitcoin’s transaction throughput, they’ll also have a trust-minimized, bridge contract where users can deposit funds to mint on the rollup.

Dive into a few documentation sites and you’ll see that none of these new projects (in production) are using Bitcoin for data availability. They want to use an alternative DA solution for performance’s sake. Meaning they want to be “validiums” or “optimiums”.

These constructions are similar to rollups. They’re blockchains that similarly have a bridge contract with the parent chain, but use a different system for DA. This improves performance, decreases costs, but comes with some security tradeoffs.

In the validium design, the L1 contract would be responsible for verifying the validity proof associated with a specific state transition for settlement. After finalizing a specific state transition, the validium bridge contract is able to process withdrawals for users who want to exit the chain, including unilateral exits that users can submit themselves if the state data is available. Optimiums are similar, but they rely on a fraud proof mechanism instead of validity proofs.

But none of the production implementations use a mechanism, on Bitcoin, that supports verifying SNARKs or fraud proofs…

Everything is being verified on a completely different Layer 1 or their own permissioned sidechain network!

Most of these chains are forking an Ethereum L2 SDK. They’re either settling on Ethereum or some completely centralized fork of geth they scraped together.

So there’s no relationship to Bitcoin. Maybe it settles on Ethereum, uses the hottest DA layer, and has a kick-ass execution layer.

But it’s not Bitcoin.

So sidechains?

All the new Bitcoin L2s are just modular sidechains. And when I say “modular sidechain”, I mean they run an alternative blockchain off of their parent blockchain for performance purposes. They also make security tradeoffs by using an alternative DA layer for improved performance.

Their bridge with Bitcoin? Run by multi-sigs.

So the general trust assumptions users take on are:

Hope multi-sig operating the Bitcoin bridge doesn’t rug themHope the centralized sequencer will include and execute their transactionsTrust the alternative DA layer to ensure data is readily made availableHope the centralized prover will post state transitions to the L1 contract OR hope centralized challengers will challenge malicious state transitionsTrust the sidechain’s parent chain to validate state transitions (finality)Trust an admin key to not upgrade the chain and steal user funds

Using a modular Bitcoin sidechain is fine if users know they’re trusting a completely centralized chain, and bridge program, to use their BTC. A couple projects are completely honest about this approach, and I’ve said publicly that I’m not completely against it from a go-to-market perspective.

The problem is that the majority of teams abstract away security details and attempt to make it seem like their designs are remotely similar to modular constructions in Ethereum or other ecosystems.

Not all hope is gone

You might read this post and think the entire situation has gone to hell and is not worth exploring. Some days it might feel like that, but there’s a lot of cool R&D work happening around improved sidechain designs.

Teams like Citrea and Alpen Labs are looking to develop rollups on top of Bitcoin. A lot of great work is being driven from the BitVM community and the ZeroSync team on improving two-way peg designs and developing a SNARK verifier that works today. This work is also inspiring a number of bridging proposals from various rollup and sidechain projects.

You can’t throw the good out with the bad in these situations. It’s not completely hopeless. But, all of the nonsense that we see in other ecosystems around convoluted scaling proposals, token incentives and the “progressive decentralization” roadmaps?

That’s coming to Bitcoin times a hundredfold.

So, yeah. These new chains aren’t L2s.

Don’t lie to users.

Bitcoin Policy Institute Launches Fund to Defend Non-Custodial Tools from Regulatory Threats

The Bitcoin Policy Institute (BPI) has announced the launch of its Peer-to-Peer Rights Fund, a strategic initiative aimed at safeguarding the decentralized, peer-to-peer integrity of the Bitcoin ecosystem. The fund’s mission is to defend non-custodial tools and their developers from regulatory overreach, ensuring that innovation, privacy, and user autonomy remain protected.

🚀Announcing the Peer-to-Peer Rights Fund

The mission? Safeguard the decentralized, peer-to-peer integrity of the Bitcoin ecosystem by defending non-custodial tools and their developers from regulatory overreach.

Learn more & make a tax-deductible donation here:…

— David Zell (@DavidZell_) May 20, 2024

The Peer-to-Peer Rights Fund is dedicated to protecting the decentralized nature of Bitcoin through strategic litigation and advocacy. By supporting pivotal legal cases and providing essential regulatory guidance, the fund aims to establish a fair legal framework that promotes the growth and resilience of Bitcoin’s open-source community.

BPI made the case that Bitcoin’s success lies in its peer-to-peer foundation, which distinguishes it from other electronic cash attempts, since this decentralized, open-source tool is powered by its users and operates free from the influences of greed, corruption, politics, or overregulation. Developers worldwide have built non-custodial tools that preserve Bitcoin’s essence, including multi-signature wallets, Lightning Service Providers, and Coinjoin coordinators, which enhance security, facilitate low-cost transactions, and ensure privacy.

Recently, U.S. regulators have shifted their stance, threatening the non-custodial ecosystem by going after the developers of open-source tools and companies such as Tornado Cash, Samurai Wallet, Uniswap, and MetaMask. These cases could lead to unfavorable legal precedents, endangering the non-custodial Bitcoin ecosystem in the United States, since the government’s broad interpretation suggests that anyone facilitating fund transmission should be regulated under the Bank Secrecy Act, regardless of fund control. This could extend regulation to various non-custodial Bitcoin tools, affecting developers of hardware wallets, transaction-broadcasting nodes, miners, and collaborative custody services.

The fund’s first project is defending Keonne Rodriguez and William Lonergan Hill, founders of Samurai Wallet. Rodriguez and Hill face charges of conspiracy to commit money laundering and operating an unlicensed money services business.

“The prosecution’s attempt to classify Samourai’s non-custodial coinjoin tool as a money service business risks setting a damaging precedent that could impact the entire Bitcoin ecosystem,” stated BPI co-founder David Zell. “By defending this case, the fund aims to ensure the court understands the technology and legal principles at stake, and seek a favorable result establishing that non-custodial privacy tools cannot be regulated under the Bank Secrecy Act.”

The outcome of Rodriguez and Hill’s case may significantly influence the future of non-custodial Bitcoin tools and the broader decentralized finance landscape. Through this fund, BPI aims to ensure that innovation within the Bitcoin ecosystem can thrive under a fair and just legal framework, by providing critical resources for defense counsel, sponsoring amicus briefs, and supporting impact litigation.

For more information or to donate, visit their website here.

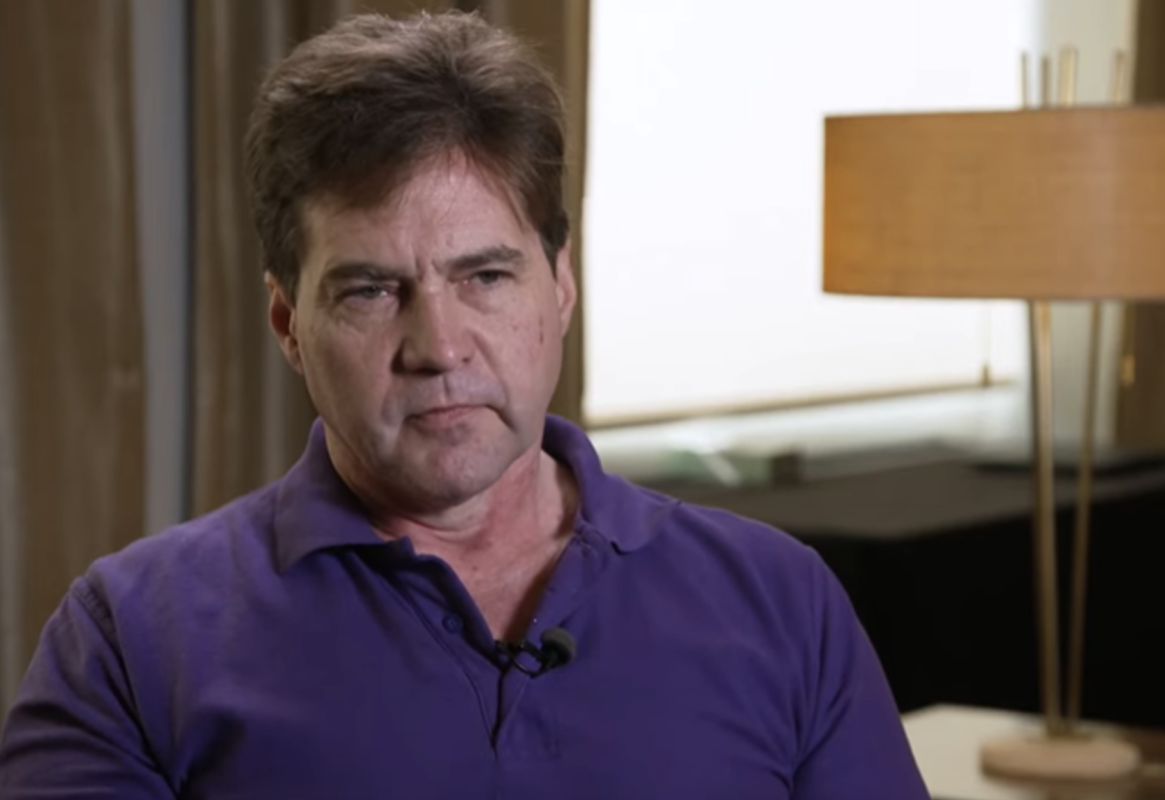

Craig Wright Lied and Forged Documents: Judge Rules

A UK judge has ruled that Craig Wright, who claimed to be Satoshi Nakamoto, the creator of Bitcoin, lied extensively and forged documents during a high-profile trial.

In a scathing 231-page judgment, Justice James Mellor stated that Wright “lied to the court repeatedly” and committed forgery “on a grand scale” in a failed attempt to prove he was Nakamoto.

A group of crypto firms brought the civil trial, the Crypto Open Patent Alliance (COPA), that sought to prevent Wright from claiming he invented Bitcoin.

BREAKING: 🇬🇧 Judge has just published his ruling in the COPA vs Craig Wright lawsuit that Craig is not Satoshi Nakamoto.

Massive victory for #Bitcoin 👏 pic.twitter.com/rCSewIhsA9

— Bitcoin Magazine (@BitcoinMagazine) May 20, 2024

Mellor wrote that Wright presented fake documents and gave false testimony in support of “his biggest lie – his claim to be Satoshi Nakamoto.”

The judge determined Wright is neither the author of the Bitcoin white paper nor the person behind the Satoshi pseudonym from 2008-2011.

Furthermore, Mellor ruled Wright does not have copyright ownership that would enable him to sue Bitcoin developers, as he has done in the past.

The judge slammed Wright’s narrative as “riddled with inconsistencies and absurd explanations” and said Wright was “not nearly as clever as he thinks he is.”

COPA lawyers accused Wright of extensive deception and forgery throughout the trial. They also presented technical evidence exposing fake documents Wright justified with “fluent but ultimately unpersuasive answers.”

Following the damning judgment, Wright has already dropped several lawsuits premised on his being Nakamoto. However, Mellor’s ruling only prevents him from bringing new claims in the UK, not other jurisdictions.

The case has raised questions about Wright’s litigation funding source. Online gambling tycoon Calvin Ayre is rumored to be backing Wright financially, but both men deny this.

Overall, the judge’s unequivocal findings represent a major blow to Wright’s reputation and credibility. COPA hopes the judgment will discourage further legal action from Wright despite potential appeals.

For the Bitcoin community, it provides a major relief from his past claims and litigation threats.

BofA sees potential for further USD selling by CTAs

Post Content