Month: May 2024

UBS maintains key G10 currency views, sees USD strength

Post Content

Dollar steady ahead of Fed minutes, sterling gains on CPI release

Post Content

Asia FX subdued as Fed minutes approach; NZD surges on hawkish RBNZ

Post Content

America’s First Bitcoin President: Trump Now Accepts Crypto Donations

President Trump, in a press release published on his website this afternoon, announced that his campaign to take back the White House will begin accepting donations using Bitcoin.

BREAKING:

— Bitcoin Magazine (@BitcoinMagazine) May 21, 2024

This announcement by his campaign is sure to stoke the fires between the incumbent President Joseph Biden, who alongside fellow Democrat Senator Elizabeth Warren (D-MA), has spent the majority of his term in Washington waging an all-out regulatory attack against the digital asset space, and Bitcoin in particular.

“As our President, Donald J. Trump has reduced regulations and championed innovation in financial technology, while Democrats, like Biden and his official surrogate Elizabeth Warren, continue to believe only government has the answers to how our nation leads the world,” the announcement stated. “The effort to reduce the control of government on an American’s financial decision-making is part of a seismic shift toward freedom. Today’s announcement reflects President Trump’s commitment to an agenda that values freedom over socialistic government control.”

As Bitcoin Magazine made note in its Orange Party Issue, Trump’s appointment of former Coinbase VP Brian Brook as the Comptroller of the Currency was “the single most important Bitcoin-forward move in the history of the United States,” as it allowed banks and financial firms to hold cryptocurrencies. This ruling went into effect midway through the last year of Trump’s first term, and bitcoin’s price multiplied around twenty times in just the next calendar year.

The Trump administration has been no stranger to Bitcoin over the years, with the appointment of long-time Bitcoin and crypto proponent Mick Mulvaney as his White House Chief of Staff, as well as PayPal’s Peter Thiel making an appearance on his transition team.

Trump also made history by being the first US President to embrace non-fungible tokens with his incredibly successful Trump Cards that sold out at the end of 2022. In yet another historic first not to be forgotten, Melania Trump was the first First Lady to tweet about Bitcoin creator Satoshi Nakamoto’s contribution to the financial system at the start of 2022, referencing the January 3 anniversary of the Genesis Block that kick started the Bitcoin blockchain.

In January at a campaign stop in New Hampshire, Trump promised that when he is elected, he will not allow the Federal Reserve to create a central bank digital currency. “Tonight, I am also making another promise to protect Americans from government tyranny,” Trump said. “As your president, I will never allow the creation of a central bank digital currency.”

As for the campaign donations themselves, the announcement specified that donors would be able to send Bitcoin and other cryptocurrencies to the Trump 2024 campaign via Coinbase, the only publicly-listed Bitcoin exchange in the United States.

“Biden surrogate Elizabeth Warren said in an attack on cryptocurrency that she was building an “anti-crypto army” to restrict Americans’ right to make their own financial choices,” the announcement continued. “MAGA supporters, now with a new cryptocurrency option, will build a crypto army moving the campaign to victory on November 5th!”

For details on how to donate to the Trump 2024 campaign, visit their website here.

Dollar firm as Fed officials urge patience on rate cuts

Post Content

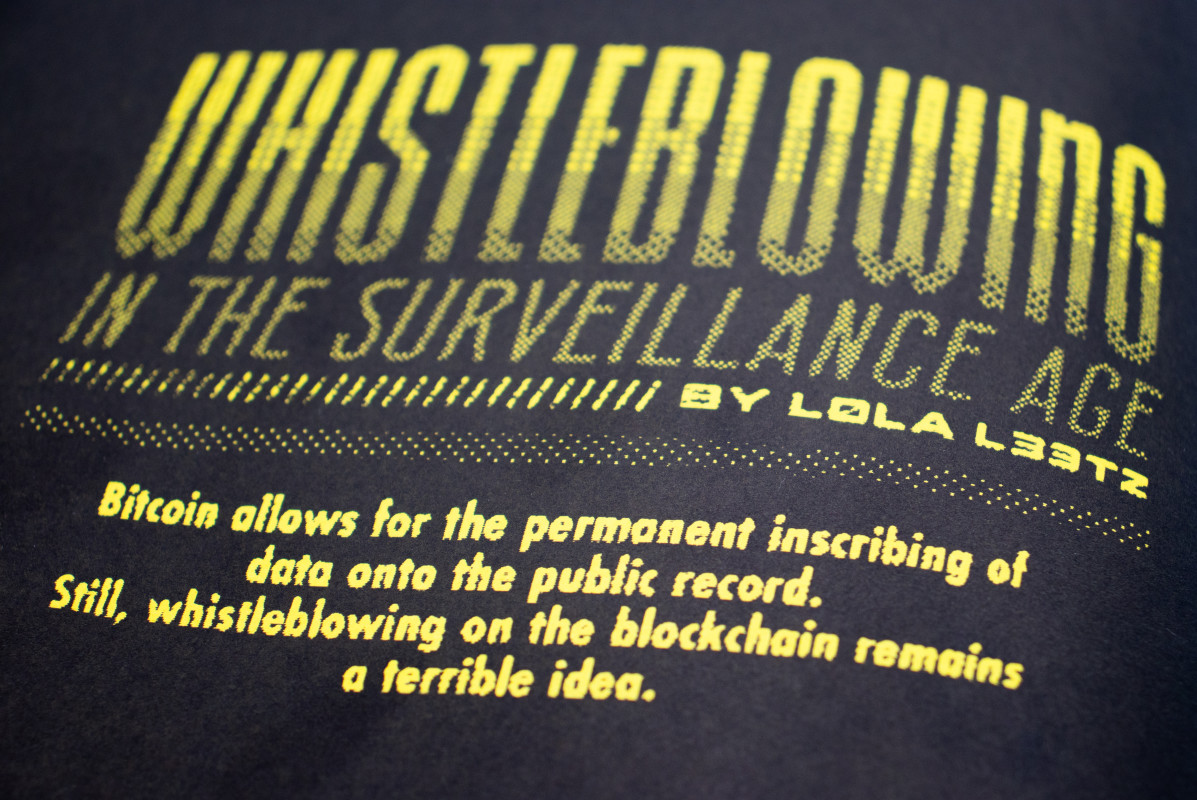

Whistleblowing In The Surveillance Age

This article is featured in Bitcoin Magazine’s “The Inscription Issue”. Click here to get your Annual Bitcoin Magazine Subscription.

Bitcoin allows for the permanent inscribing of data onto the public record. Still, whistleblowing on the blockchain remains a terrible idea.

Leaking information is risky business. If you’ve obtained sensitive information — particularly if you’re not supposed to be in possession of said information in the first place — you can’t just send out an email or post it to your Twitter feed. If you did, before you knew it, you’d be tracked, identified, and thrown in jail, while the data you obtained would quickly be deleted.

By inscribing information on the Bitcoin blockchain, the data you’ve obtained cannot be deleted. Just as a Bitcoin transaction is final, so is any information published to the blockchain. Forever there, for anyone in the world to see. But, what sounds like a great plan for leaking information — call it WikiLeaks 2.0 — is actually not a very smart idea.

Protecting whistleblowers is of the highest importance to any sophisticated publisher. And it for sure isn’t easy. By publishing data yourself directly to the Bitcoin blockchain, you may miss important data points that could identify you as the source. Readers would further be unable to verify the chain of custody, potentially discrediting your leak. In addition, neither Bitcoin nor the internet are privacy technologies, potentially leading to your identity leaking via various mechanisms to the public.

Watermarking and Digital Fingerprints

Many large corporations employ methods to identify sources of leaks, such as analyzing watermarks and digital fingerprints. Watermarking is the act of altering a piece of data to make it uniquely identifiable, while digital fingerprints are derived from information inherent to most forms of digital communication. Both are largely invisible to the human eye.

A popular way of watermarking is the modification of text spacing on documents accessible to employees. Using text spacing to watermark documents was famously employed by Elon Musk at Tesla to identify the individual behind a 2008 email leak, which disclosed that the company only had $9 million in cash on hand. Every email sent out at Tesla has a slightly different text spacing, forming a binary signature to identify the source of a leak.

Another way to watermark documents is via printers. Again, mostly invisible to the naked eye, most printers — particularly laser printers — form unique dotted patterns on printed documents in order to identify the printer a document was printed on.

Click the image above to subscribe!

This was the case for Reality Winner, who leaked classified information on the Russian interference of the 2016 U.S. elections to the U.S. newspaper The Intercept. The Intercept, financed by eBay founder and friend of U.S. intelligence Pierre Omidyar (dubbed “one of the scariest tech billionaires out there” by journalist Yasha Levine), published Winner’s documents without removing the document’s watermarks, allegedly leading to Winner’s arrest. While watermarking adds identifiable patterns to data, fingerprinting deducts identifiable patterns from data. For example, JPEG image headers usually contain unique metadata giving indications as to what device an image was taken on, as well as time and location of the image. Fingerprinting may also suggest what platform was used to communicate, as most platforms use differentiating compressor mechanisms to send data. Unless you are aware of all the ways a document can be watermarked and fingerprinted, leaking information yourself is not a good idea.

Chain Of Custody

Establishing a chain of custody is important to protect the credibility of leaked information. Simply adding documents to the blockchain will not help journalists verify the integrity of the information you uploaded, leading to your leak likely being discredited.

Chain of custody is important to maintain ethical reporting standards. Just as law enforcement is required to protect chain of custody to ensure evidence has not been altered, journalists are expected to verify any and all information they receive. This is done by establishing where a specific document originated and through how many (and whose) hands it went in the aftermath. Without documentation of how and by whom a document has been handled, journalists can hardly determine whether a leak is genuine or has been tampered with. Generally, chain of custody attempts to answer the questions of who, when, why, where, and how a document has been discovered.

Discreditation has become somewhat of a profession. Generally, there are two ways to discredit a leak: discrediting the leaker and discrediting the leak itself. Discrediting the leaker can involve uncovering undesirable information about a target, such as sexual relations or health issues, or the outright framing of a leaker to invoke the perception of bias, focussing on who and why.

The discreditation of documents is largely carried out by sowing further uncertainty around a leak’s chain of custody. Chain of custody herein causes a dilemma, as the removal of metadata to protect us from identification makes the establishment of who, when, why, where, and how much harder. In digital forensics, it is therefore often focused on whether documents appear authentic, accurate, and complete, as well as whether documents are believable and explainable. Without an established chain of custody, the establishment of authenticity, accuracy, completeness, believability, and explainability becomes much harder to determine, making discreditation much easier.

While we can make sure that a leaked document has not been tampered with after adding it to the blockchain, we cannot answer the questions of who, when, why, where, and how, pertaining to the much misunderstood dilemma that a blockchain can only verify data it has produced itself — perfectly illustrated by Todd Eden in 2018, who added a picture of the Mona Lisa to the blockchain-based art platform VerisArt, turning himself into the verified Leonardo da Vinci. This makes leaking information on the Bitcoin blockchain pointless unless journalistic due diligence is applied.

Private Information On The Internet

Contrary to public opinion, Bitcoin is not privacy technology. Even if you have established no fingerprinting in documents and followed chain-of-custody procedures, publishing information on the public blockchain can still lead to your identification.

The easiest way to determine where a leak originated is through so-called supernodes. A supernode is a node in Bitcoin’s peer-to-peer network which establishes connections to as many nodes as possible, allowing it to tell from which node a transaction originated.

We may now think that using the Tor network may be enough to hide our private information from being obtained. But because blockchain surveillance works closely with government intelligence — Chainalysis has received over $3 million in the past two years by CIA’s venture capital fund In-Q-Tel, while its competitor Elliptic was founded out of a GCHQ accelerator — we must assume that blockchain surveillance firms have access to the resources of global passive adversaries.

A global passive adversary is an entity with the capabilities to watch the entire traffic on a given network. By doing so, it is able to determine the timing of when a packet has been sent and when it was received, correlating its sender and recipient. For example, if you used the Tor network from within the United States to access a website in the United States, the United States knows which websites you visited by correlating the timing of network requests sent and received. Because the United States is a global passive adversary, it possesses the abilities to link the timing of network requests globally.

To leak information securely, it is therefore advised to do so via the Tor network from an internet café while refraining from performing any other web request. If you leak a document from an internet café and have recently signed into your email from the same computer, your identity can be assumed even when using Tor. You should therefore never use your own computers to leak information, as computers, too, are fingerprinted throughout the world wide web, from browser window sizes used to the applications installed. Additionally, it is advised to visit locations from which information is to be leaked while leaving your phone at home, as intelligence is able to obtain your location records. Nation-states herein have the capability of tracking your location even when your GPS is disabled by tracking the network requests your phone sends to WiFi networks you pass by.

Unfortunately, it is improbable to find an internet café which allows you to install a Bitcoin node. The only other way to leak information securely therefore becomes purchasing a single-use throwaway computer, as using someone else’s node leaks further identifiable information to untrusted third parties. But, as soon as your personal devices and secret computer touch the same networks, you can again be identified.

Conclusion

Leaking information is incredibly important, especially when it pertains to abuses of power. But it’s also incredibly dangerous. Using Bitcoin as a platform for whistleblowing, as proposed numerous times throughout the ecosystem, is a terrible idea given the risks at hand.

The Tor network is insufficient to protect one’s privacy in the face of global passive adversaries, making direct publication to the Blockchain incredibly difficult while ensuring the protection of one’s identity, as the Bitcoin network is insufficient to protect one’s personally identifiable information in general. Documents can contain invisible fingerprints leading to one’s identification, and a lack of chain of custody will likely result in the discreditation of your leak.

It is dangerous to believe that you are safe from both government and corporate surveillance, as it results in less caution and more reckless action. It is always better to be safe than sorry. Unfortunately, this mantra does not seem to resonate with many Bitcoiners these days.

This article is featured in Bitcoin Magazine’s “The Inscription Issue”. Click here to get your Annual Bitcoin Magazine Subscription.

OP_CAT & Bitcoin Ossification With Blockstream’s Andrew Poelstra

In a recent interview with Bitcoin Magazine, Shinobi sat down with Andrew Poelstra from Blockstream to discuss his colleague Rusty Russell’s ambitious proposal. Rusty plans to restore several abandoned features from Bitcoin’s code, a bold move that could significantly enhance the functionality and expressivity of Bitcoin scripts.

Understanding the New Costing Model

One of the central aspects of the “Great Script Restoration” proposal is the introduction of a new costing model for opcodes. Currently, in Bitcoin, every operation costs the same, regardless of its computational complexity. This model, however, does not accurately reflect the true cost of script execution, leading to potential inefficiencies and limitations. Rusty’s new costing model seeks to address this by assigning different costs to opcodes based on their computational requirements. This approach is a significant departure from the existing model and aligns more closely with how computational costs are handled in other blockchain platforms like Ethereum.

Andrew Poelstra highlighted the potential benefits and challenges of this new model. “The new costing model is very interesting and it’s kind of a departure from the way that Bitcoin works today,” he noted. The new model would ensure that scripts are priced more fairly based on the resources they consume, potentially preventing spam attacks and other issues.

Challenges and Consensus-Building

Implementing this plan is not without its challenges. One major concern is the complexity of determining the execution time of scripts. In Ethereum, for example, transactions have a gas limit to prevent excessive computation. Poelstra acknowledged the similarities, stating, “I’m gonna say something kind of mean here and say this looks like gas, right?” However, he emphasized that unlike Ethereum, where running out of gas still costs the user, in Bitcoin, a failed transaction does not result in lost funds.

To move forward, the Bitcoin developer community needs to build consensus around this plan. Poelstra mentioned a noticeable shift in the community’s attitude toward script expressivity over the past few months. This change is partly due to the emergence of new use cases and the realization that restrictive approaches may hinder innovation. “There’s been a really interesting kind of mood shift in the Bitcoin developer community over the last, really like the last six months,” he observed.

Addressing Bitcoin Ossification

The path forward involves several key steps. Firstly, developers need to write up a proper proposal, including reference implementations and test vectors. This proposal will then be reviewed and discussed within the community to gather feedback and build consensus. Poelstra stressed the importance of this process, stating, “Initially the steps are pretty straightforward, right? You write up a proper proposal, you have a reference notation, you write test vectors, you get benchmarks.”

A significant part of the consensus-building process will involve addressing the debate around ossification—the idea that Bitcoin’s protocol should remain unchanged to preserve stability and security. Some community members, known as ossificationists, believe that Bitcoin should resist changes to avoid introducing potential vulnerabilities and maintain its current robustness. Poelstra recognizes this concern but argues that certain changes, like Rusty’s proposal, are necessary for Bitcoin’s continued growth and functionality.

The debate centers on whether the risks associated with changes outweigh the benefits. Poelstra pointed out that Bitcoin is already evolving, citing the emergence of ordinals and inscriptions as examples of how the network is being used in new, unanticipated ways. He emphasized that refusing to adapt could limit Bitcoin’s potential and that the economic incentives within the network will naturally sort out usage priorities.

“We need to talk to people who identify as ossificationists or who we might call ossificationists, right? People who don’t want Bitcoin to change. And I think we just got to argue passionately and correctly that this is something that would be good for Bitcoin,” Poelstra said. He believes that by clearly articulating the benefits of enhanced script expressivity and addressing the concerns of the ossificationists, a balanced and informed consensus can be reached.

Furthermore, Poelstra highlighted that while change comes with risks, it also opens up opportunities for essential improvements, such as better scalability, enhanced security through vaults, and more efficient use of blockchain space with mechanisms like coin pools. These enhancements can make Bitcoin more robust and adaptable to future needs.

The next steps involve not only the technical process of formalizing the proposal and conducting thorough testing but also engaging in a broader dialogue within the community. This dialogue will need to balance the preservation of Bitcoin’s core principles with the need for innovation and adaptation, ensuring that the network can continue to thrive and meet the evolving demands of its users.

Conclusion

Rusty’s plan to make Bitcoin script great again represents a significant step towards enhancing the expressivity of the Bitcoin network. While there are challenges to overcome, the potential benefits in terms of functionality and innovation are substantial. As the Bitcoin developer community continues to evolve and embrace new ideas, proposals like this will be crucial in shaping the future of the network.

Running The Self-Sovereign Bitcoin Business

As we take the concluding tenth and final step in “10 Steps to Self-Sovereignty”, we’ve articulated nine ways that Bitcoin can enable the sovereign individual. But what about building the sovereign Bitcoin business? From longer timeframe accounting practices to managing a bi-weekly payroll, to using a volatile asset that operates on a 24/7 market, there is no shortage of needed techniques and technologies that enable entrepreneurs to leverage bitcoin for their companies.

As companies delve into the state-change of money that is Bitcoin, they are confronted with a myriad of novel questions and considerations that demand careful attention and strategic planning. From security concerns to regulatory compliance and operational efficiency, managing Bitcoin on a company’s balance sheet requires a security-focused approach.

A Sat Stacked Is A Sat Earned

The most effective and efficient way for an entrepreneur to grow their bitcoin stack is to increase their revenue and denominate their long-term treasury with bitcoin. It sounds simple, and in many ways it can be, and yet business owners are constantly baited by speculative schemes outside of their core business functions – you know, the things they are actually good at – in order to catch some promised yield in an attempt to outperform bitcoin the asset. Sure, you could drop your fancy new business cards into one of those fishbowls at the host stand of your favorite new restaurant, but outside of that, there are no free lunches in business. And the Bitcoin business is much the same.

Bitcoin is a means to an end, not some get rich quick scheme, and treating it as something different can be ultimately detrimental to the sustainability of your bottom line, and thus, your business as a whole. Not every Bitcoin business should pull a MicroStrategy. In fact, probably no business should attempt to take on that much debt to gobble up bitcoin at a rate beyond their expected cash flows. One should hold the same principles to their business as they would to a pleb fresh out of their first orange-pilling – stay humble, stack sats.

Securing Assets and Mitigating Risks

Business use of bitcoin, in comparison to that done by individuals, often requires governance built in to the signing of transactions. While simple singlesig self-custody can be a solution for single-person businesses, larger organizations require more complex and robust solutions. For example, your business might need quorums or customizable permissions for subsets of individuals to manage a treasury or comply with local laws and regulations.

Secure Non-Custodial Storage

One of the foremost concerns for businesses venturing into Bitcoin is ensuring the security of their assets against external threats and even internal collusion. With cyberattacks on the rise and sophisticated hacking techniques constantly evolving, security is one of the most important aspects of running a Bitcoin business.

Bitcoin signing devices and encrypted hardware can provide a secure means for companies to mitigate risks related to cyber threats, man in the middle attacks, asset mismanagement and unauthorized treasury access. For larger Bitcoin businesses such as exchanges, you need a device built for that purpose. Most solutions use Hardware Security Modules (HSMs) for storage, built for long-term, high level cold storage.

Insurance if something goes wrong

Of course, risk management requires a backup plan. In any business context, insurance is a near-necessity, and the Bitcoin ecosystem is no different. By integrating vault governance best practices alongside reporting, businesses can insure their bitcoin treasuries.

Ensuring Compliance and Auditability

Navigating the regulatory landscape is a complex challenge for businesses involved in Bitcoin. Compliance requirements vary across jurisdictions, and for many entrepreneurs, adherence to regulatory standards is non-negotiable.

Scalability

In the fast-paced, 24/7 world of Bitcoin, automation and scalability are key drivers of success. While decentralization is paramount in Bitcoin, businesses must also grapple with their ability to scale.

From treasury management to decentralized lending operations and trading, managing diverse Bitcoin functions efficiently requires a unified approach. Maintaining control and visibility over Bitcoin addresses and their operations can be challenging, but it is crucial for businesses seeking to mitigate risks and optimize performance.

Today, businesses can leverage APIs and user interfaces to streamline their operations and inter-organization communication. Programmability of a company’s bitcoin management practices – can streamline decision making and resource allocation without sacrificing security.

Ledger Enterprise

Ledger Enterprise is an enterprise grade platform that provides businesses with a secure infrastructure for storing, moving and using Bitcoin at scale.

Ledger’s Enterprise is designed to be the most secure institutional platform and relies on Ledger unique Hardware expertise and technology to empower exchanges, custodians, banks, trading desks, and hedge funds to scale their Bitcoin operations securely. But that’s not the only service Ledger Enterprise offers: it also provides business owners all the tools they need to succeed.

Built for enterprise scalability, Ledger Enterprise comes with a fully customizable policy engine to match all business scenarios, allowing to eliminate the risk of internal collusion and providing unmatched control over your assets. Designed for business efficiency, it comes with powerful automation capabilities so you can streamline workflows, reduce manual errors, and enable seamless scaling of operations across teams, regions, and projects. By automating routine tasks and processes, businesses can focus on strategic initiatives and capitalize on emerging opportunities in the Bitcoin landscape.

It also offers a unique insurance program, protecting both small businesses, as well as large institutions, for up to $150 million USD worth of bitcoin from theft or loss.

Since regulatory compliance is important for all businesses, especially Bitcoin businesses, Ledger Enterprise provides advanced reporting tools and integrations with compliance partners to ensure that businesses can operate lawfully worldwide and in any jurisdiction.

Because Ledger Enterprise’s mission is to enhance the security of the entire institutional ecosystem, it continuously innovates to introduce new solutions. As with Ledger Enterprise TRADELINK, which enables asset managers and institutions to trade off-exchange. This allows to prevent FTX-like events by allowing secure trading without exposing assets to exchange vulnerabilities. By leveraging Ledger Enterprise TRADELINK, institutions can maintain robust security over their trading cycle for maximum peace of mind and best in class risk management.

Setting Up a Bitcoin Business For Success

As the Bitcoin network integrates itself into the legacy financial system, the need for a comprehensive suite of solutions emerges for the many new and unique challenges of running a business with bitcoin as a unit of account. Bitcoin businesses are growing, and so too are the challenges of keeping up with regulatory hurdles. It’s time for businesses to consider how to manage risk, reporting and operational efficiency in the digital era kicked off by Satoshi’s protocol.

Entrepreneurs should spend their time growing their business, working on their products, and delivering to their customers, not worrying about the responsibilities associated with being a self-sovereign Bitcoin business.

Ledger Enterprise stands out as a solution that addresses key challenges and unlocks opportunities in the digital asset landscape. From security and compliance to operational efficiency and scalability, this platform offers the tools and capabilities businesses need to succeed in the evolving world of Bitcoin. By leveraging Ledger’s technology and expertise, businesses can confidently navigate the Bitcoin landscape, seize opportunities, and drive growth in their bleeding-edge financial operations.

For more information about Ledger Enterprise and how it can empower your business in managing bitcoin securely and efficiently, visit Ledger Enterprise.

Ecash Makes Bitcoin (And Fiat) Private With Calle’s Cashu

Editor’s note: Cashu is a protocol, not a company.

Founders: Calle

Date Founded: October 2022

Location of Headquarters: Remote

Amount of Bitcoin Held in Treasury: N/A

Number of Employees: 20-30 open-source developers

Website: https://cashu.space/

Public or Private? N/A

Of Bitcoin’s many notable properties, privacy isn’t one of them.

In fact, the transparency of the Bitcoin blockchain contrasts starkly with the privacy that Chaumian ecash, a form of digital cash created by legendary cryptographer Dr. David Chaum in 1982, offers.

So, what do these two technologies have to do with one another?

Well, 40 years after the invention of ecash and after a failed attempt to integrate it into the traditional financial infrastructure in the 1990s, a developer who goes by the pseudonym “Calle” found a place for the technology within the Bitcoin ecosystem.

“Ecash was waiting for Bitcoin as a foundational layer,” Calle told Bitcoin Magazine. “Bitcoin represents a permissionless system on which anyone can build financial innovation without having to consult the big banks. It’s just a way better environment to experiment with this technology.”

Calle has been innovating with this technology via Cashu, a free and open-source ecash protocol he released into the world in October 2022. With Cashu, users get the best of both the Bitcoin and Chaumian ecash worlds.

And while readers of this publication are likely already familiar with how Bitcoin works, ecash may be a new concept.

What Is Ecash?

Ecash is a bearer asset that can be transferred peer-to-peer, much like bitcoin.

However, a key difference between ecash and bitcoin is that bitcoin exists on a ledger, whereas ecash lives on its holder’s device.

“Ecash is for us Bitcoiners a very alien concept because it flips the concept of a ledger on its head,” explained Calle.

“In an ecash system, the state of who owns what is determined by who has ecash in their pockets, not ‘What does this database say about who has what?’” he added.

On a more technical level, ecash tokens are essentially IOUs that are minted using a technology called “blind signatures.”

With Cashu, ordinary users can operate a mint via the Lightning Network using this guide, written by Calle.

Calle’s Motivation In Creating Cashu

You might think that someone who hides their face behind a bright orange face wrap when making media appearances would be motivated by quite radical ideology, but this isn’t the case with Calle.

Instead, he’s surprisingly down-to-earth, practical and highly logical. His goal in building Cashu is simply to preserve the type of privacy we’ve had in financial transactions for centuries.

“We used financially-private instruments for hundreds of years without realizing that we use one of the best technologies in financial privacy — physical cash,” said Calle.

“So, it’s not really like we’re trying to bend towards something that we haven’t experienced. We’re just preserving the things that we already enjoy,” he added.

Calle wants to see Chaumian ecash succeed despite the challenges it faced when Dr. Chaum tried to implement it into the traditional financial system via his company DigiCash in the ‘90s.

“Chaumian ecash had a very big mission,” said Calle.

“It should have revolutionized the entire financial world. But, unfortunately, PayPal and Visa took over,” he added.

“I’m also being pragmatic in that I’m choosing to build this on Bitcoin because first. Bitcoin is the only world where you can start building something like this open source.”

Ecash On Bitcoin

Part of Calle’s objective in building Cashu on Bitcoin is to get more people using bitcoin for everyday transactions.

“Bitcoin needs to be carried by diverse groups of people, so we can get the normies to see the enormous potential that this technology gives,” he said.

He also believes that in onboarding more people to Bitcoin, we should be more measured in our approach and let the technology itself do the talking.

“You don’t have to be against the state to love Bitcoin. You don’t even have to believe in separating money from state,” he said.

“Ideology spreads way more slowly than technology. Technology can explode overnight,” he added.

“Just explain to people that we have found the money of the internet. This happens once only in the history of the internet, and we have crossed that line. Let’s spread that message.”

When I asked Calle if he thought the recent crackdown on the Samourai Wallet developers might put a privacy-focused protocol built on Bitcoin like Cashu in the crosshairs of regulators, he didn’t respond directly, but he also didn’t seem particularly worried, as he pointed out that the traditional financial system is on the verge of employing ecash, as well.

Ecash Beyond Bitcoin

“In Europe, we have very active discussions about what CBDC will look like here,” explained Calle.

“The ECB is willing to also look into ecash systems that provide cash-like privacy for transactions under 300 euros. The Bank of International Settlements is piloting an ecash system right now. The National Bank of Switzerland and the Swiss Parliament itself are considering ecash deployments for their national digital currencies,” he added.

“We see that there is a window of perfectly legal and compliant use of ecash.”

According to Calle, any levels of enhanced privacy that come with using ecash — whether on Bitcoin or within traditional financial structures — is a net positive for whoever uses the technology.

Who Will Use Ecash?

Much like Bitcoin, ecash is for everyone. More specifically, it’s for those who are looking to make digital payments privately.

“The Achilles heel of digital payments is that all payments are tied to identities,” explained Calle. “There is no reason why you need to have KYC to read an article on NYTimes.com. These online activities should not connect to our bank account, especially if you’re reading political articles.”

Nostr users are already using ecash minted on Cashu in several privacy-based chat applications, according to Calle.

It’s also being used as a payment to prevent denial of service (DoS) attacks in some cases, while other users are using it to pay for VPNs without disclosing their identity.

Calle seemed most enthused, though, when he discussed how the unbanked or those who have been debanked because of their political affiliations can use ecash.

“I think a lot about how this can become local banking infrastructure in parts of the world where there are no banking systems and or banking systems are so prohibitive that dissidents and political activists basically cannot use any digital money,” he said.

For such cases, Calle also described how he can create a system that issues fiat-denominated ecash backed by bitcoin.

“We can build fiat payment experiences without touching the fiat banking system at all in the most private and fast and efficient way that is very close to physical cash, but it is all still built on Bitcoin. That makes me very excited because stablecoins are extremely popular and they have also taken over the popularity of bitcoin in most parts of the world,” he added.

“There is just a clear demand for it and fiat on ecash is the best form of fiat that I can think of.”

Proceed With Caution

While there are a number of benefits to using ecash, it’s also important to be careful when using the technology.

Given that ecash is minted through a custodian, there is counterparty risk associated with using it.

“I would urge anyone to be very cautious about the custodian that they choose,” warned Calle, who provided a caveat to his statement, explaining how the team behind Cashu is trying to offset some of the risk associated with trusting a mint by creating a star rating system based on reputation for them.

“We recommend to anyone using Cashu: Use it for very small amounts. Use it like a wallet in your pocket so that if you lose it at the bar, it won’t hurt you too much,” he added.

He went on to state very clearly that “when a mint goes down, your sats are gone.”

There is also some risk in losing your funds if you lose the device on which they’re stored, but Cashu has created a way to restore lost ecash.

“In Cashu itself, there is a mechanism to restore your tokens if you lose them, similar to Bitcoin UX where you store a seed phrase,” Calle explained.

However, he also pointed out that users restore their funds through the mint and that, again, if the mint goes down, users lose their tokens permanently.

Call To Action

Calle doesn’t profit from his work with Cashu. He started the project as an “academic interest” and has pushed forward because he finds great purpose in developing it.

“Working on Bitcoin is a big honor and opportunity that gives life meaning, because it’s a project for humanity,” he explained.

“It’s beautiful to be a little part of this process, knowing that you work on something day-to-day that improves the world and doesn’t feed big mega tech companies while they’re sucking the life out of your body.”

So, not only does he encourage you to use Cashu if you’re looking for greater privacy in your everyday bitcoin transactions, but he invites developers — or anyone with any skills pertinent to driving Bitcoin adoption — to join him in helping to further Bitcoin adoption.

“I know so many people with this desire to work on something that makes the world a better place, and Bitcoin is an open system that invites anyone with any skill level to participate,” said Calle.

“For those in the big tech industry whose work has lost meaning, this is an opportunity to work on something meaningful, global and inclusive,” he added.

“Join us as we go to the moon.”

Dismantling The Cash-flow Narrative: Real Estate vs. Bitcoin

Bitcoin sceptics frequently argue that bitcoin lacks intrinsic value, claiming that investments like real estate, with their tangible cash flows, are superior.

In this article, I will debunk the myth of ‘intrinsic value’ and illustrate why cash flow has no direct impact on an asset’s ability to serve as a reliable store of value, even in the context of real estate.

The myth of intrinsic value

The idea that value is inherently embedded in objects is a misconception. This common belief, influenced by the labor theory of value (LTV) – a flawed concept used in classical economics, Marxism and modern economic theories, which posits that value is inherently tied to labor, energy invested or output, misinterprets how value is perceived in the economy. This belief extends to real estate, with the notion that its ability to generate cash flow through rentals or its utility as a living and production space imbues it with intrinsic value. But, the concept of intrinsic value is fundamentally flawed.

Subjectivity of value

In a free market, characterized by voluntary exchanges, it’s evident that value is subjective. Both parties involved in a transaction believe that what they receive is of greater value than what they give up, indicating that value is determined by individual perception rather than inherent qualities.

Take the Rolex watch as an example: its value is not merely a reflection of the extensive labor involved in its craftsmanship but is significantly influenced by its scarcity and the aspiration among individuals to own it. This principle of subjective valuation extends across the board; the worth of assets, including bitcoin and real estate, is not predetermined but fluctuates based on personal perceptions.

Understanding the subjectivity of value is crucial for grasping the true essence of bitcoin’s value, illustrating that its significance, much like that of luxury watches or real estate, is deeply rooted in the collective demand and limited availability, rather than inherent properties. Carl Menger, a pioneer of the Austrian School of Economics and arguably an inspiration behind the Cypherpunks creation of Bitcoin, demonstrated already in the 19th century that prices are a reflection of subjective valuation.

Recognizing the importance of subjective valuation is key to appreciating the advantages bitcoin holds over real estate as a store of value. Menger pointed out that value can only come into existence once human beings realize that economic goods exist and that the reach of them has a personal (subjective) importance. The Subjective Theory of Value parallels the perception of beauty, which is also in the eye of the beholder. Just as beauty standards vary, so does the value of objects like bitcoin or real estate, which are coveted not for their inherent value but for people’s collective desire or need to possess them.

Bitcoin’s value proposition

The value of bitcoin does not come from the difficulty of its production, but from the unparalleled protection the Bitcoin network gives to the value (productivity) stored in it and the network’s final settlement capabilities. This creates demand for bitcoin, which is, besides time, the first absolute scarce commodity that we discovered in this universe. This scarcity, highlighted by a limited supply and a disinflationary issuance schedule, as well as the indestructible nature of the network, is driving demand for bitcoin.

Real Estate’s value proposition

In numerous real estate transactions, I experienced that investors typically assume the majority of profits originate from price appreciation rather than direct cash flow. This observation underscores a critical insight: real estate’s high valuation is less about the immediate income it can generate and more about its scarcity and ability to hedge against inflation. This observation can be confirmed when one looks at the data on the increase in the price of houses and the money supply, M2, in the U.S.

The following chart, depicting the average sales price of houses sold in the U.S., illustrates a sharp increase in housing prices since 1971. The average sales price of a house in the U.S. rose from ≈$27,000 in 1971 to ≈$492,000 in the third quarter of 2023, indicating a substantial appreciation in property values over this period (≈1,700%).

This period follows the Federal Reserve’s transition to a fiat currency system initiated on August 15, 1971, when U.S. President Richard Nixon announced the United States would end the convertibility of the dollar into gold. Subsequently, central banks globally adopted a fiat-based monetary system characterized by floating exchange rates and the absence of any currency standards. As shown in the chart below, the money supply M2, which as defined by the Federal Reserve, includes cash, checking deposits, and easily convertible liquid assets such as certificates of deposit (CDs), which reflects the comprehensive scope of funds readily accessible for spending and investment, has exhibited a consistent increase since the detachment of the U.S. dollar from gold. This vividly illustrates the striking correlation between the escalation of housing prices and the concurrent expansion of the U.S. money supply.

Analyzing the compound annual growth rates (CAGR) of these two metrics shows a clear connection between them. Since 1971, the money supply, M2, has experienced a CAGR of 6.9%, closely paralleled by housing prices, which have risen at a CAGR of 5.7% (for the detailed calculation breakdown, please see the appendix). Why did this happen ?

The increase in the money supply forced market participants to look for ways to invest their money to protect against this monetary inflation and one of the most popular investments has been real estate.

The correlation between the expansion of the money supply and rising housing prices is influenced by several factors, including interest rates, economic growth, and housing supply dynamics. However, since 1971, phases of rapid monetary expansion have usually been accompanied by low interest rates and increased borrowing. As illustrated in the following chart, showing the Federal Funds Effective Rate.

The availability of affordable financing increases buyers’ purchasing power and, consequently, demand for real estate, particularly because it is predominantly acquired through loans. This surge in demand, in turn, drives up real estate prices. The phenomenon of an increasing supply of currency units coupled with low interest rates has been a global trend in recent decades. Influenced by the historical role of the United States as the leading world power, setting a precedent with the dollar as the world reserve currency.

Although there are exceptions to how real estate markets have responded in the long term, such as Japan, where an aging population combined with decades of low-interest rate policy have led to malinvestment, an oversupply of housing and declining prices. Only in some metropolitan regions such as Tokyo is real estate still used to store value. Despite these regional differences, a global trend emerges, real estate is used as a store of value in response to diminishing purchasing power caused by monetary expansion. It follows that the primary appeal of real estate, especially in high-demand locations, lies in its perceived ability to maintain value over time, a characteristic now challenged by bitcoin’s emergence.

The primary role of a property’s cash flow is in the repayment of loans, a topic I will explore in detail later.

Real Estate vs. Bitcoin

As the data shows, the excessive demand for real estate is due to monetary inflation, which has led people to invest in scarce assets such as real estate to protect their wealth. The development of real estate prices reflects the financialization of the asset class, a development that was significantly influenced by the departure of central banks globally from a gold standard, marked by the “Nixon shock” in 1971. In its function as a store of value, real estate is facing direct competition from bitcoin. A near perfect digital store of value. Real estate cannot compete with bitcoin as a store of value. The latter is rarer (fixed in supply), cheaper to maintain, more liquid, easier to move and harder to confiscate, tax or destroy.

A comparative analysis between bitcoin and real estate as stores of value reveals bitcoin’s unique advantages. The following table highlights these distinctions, showcasing why bitcoin is increasingly recognized as a powerful contender in the arena of wealth preservation:

The table further highlights that the popularity of real estate as an investment choice is largely due to affordable financing options and its ability to generate cash flows that make debt repayment easier, rather than its exceptional qualities as a store of value. Given that real estate acquisitions are largely financed through credit, this appears to have been a major factor in widespread purchasing since 1971, along with scarcity. From this perspective, cash flow neither gives real estate any intrinsic value (which does not exist) nor does it act as a phenomenal store of value. This observation can be proven statistically.

Bitcoin analyst Rapha Zagury (aka Alpha Zeta) has found that the Composite 20 Case-Shiller Home Price Index, which tracks home prices in 20 metropolitan areas across the U.S., rose just 2.3% in value when prices are adjusted for inflation. This does not account for the deduction of taxes, transaction costs, and maintenance fees. Zagury discovered that only in some metropolitan areas, such as the South Florida metropolitan area and Greater Los Angeles, real estate prices have significantly outpaced inflation, exhibiting growth rates that surpass inflation by approximately 3.6%. In contrast, regions like Greater Cleveland and metropolitan Detroit experienced negative inflation-adjusted real returns.

Zagury, 2023. From Bricks to Bits Unmasking Real Estate Investment in the Bitcoin Era. Available at: nakamotoportfolio.com

Bitcoin vs Fiat

It cannot be denied that real estate as an asset class offers certain advantages in the existing fiat system, since it has become increasingly important for the global financial system.

After all, it is the world’s number one store of value (≈67% of global wealth is stored in real estate) and collateral accepted by banks when granting loans. Therefore, many jurisdictions offer more robust financial infrastructures and tax advantages for purchasing real estate and utilizing it as collateral.

However, as bitcoin’s role as an indestructible, absolutely scarce store of value in the global financial system will become increasingly important, this is also expected to have a positive impact on its use as collateral. Both functions, store of value and collateral for lending, are closely linked.

Why would a bank (or anyone else) accept collateral that loses value over the long term?

The infrastructure around access to financial services related to bitcoin and its use as collateral is still in its infancy. But the possibilities are extremely promising.

The recalibration of the cash flow investment thesis on a Fiat standard

During MicroStrategy’s Q4 2023 earnings call, Chairman Michael Saylor highlighted the growing difficulty of generating cash flow that exceeds the rate of monetary inflation.

He argued that in the context of the fiat system’s widespread monetary inflation, relying on cash flow as an investment metric appears increasingly untenable. He further underscored bitcoin’s distinct role as a digital scarce asset, combining the value preservation qualities of real estate without its inherent drawbacks, thereby establishing it as an unparalleled store of value for the digital era.

One of bitcoin’s greatest strengths lies in its valuation not being tethered to cash flow, rendering it immune to the adverse effects of inflation and quarterly financial reporting. On the contrary, bitcoin thrives in an environment of escalating fiat inflation, as it becomes a more attractive repository for capital.

Bitcoin’s valuation mirrors the influx of capital flows, benefitting from the increased desire to safeguard wealth against the diminishing purchasing power of traditional fiat currencies.

The revaluation of real estate on a Bitcoin standard

Real estate, while tangible and potentially yielding regular cash flow, is subject to regulatory changes, and physical degradation, factors that bitcoin inherently resists. If real estate is not properly cared for, its value will literally degrade over time. Bitcoin on the other hand provides the ultimate form of transferable value because it preserves the encapsulated wealth. If stored properly, its value will increase over time without high maintenance costs. In fact, bitcoin’s qualities reflect many of real estate’s value offers on top of fundamentally more secure and easier custody, cheaper maintenance, absolute scarcity, resilience against inflation and most importantly the ability to protect, liquidate or move your wealth in times of crisis.

As a real estate developer, I have grappled with the question of how bitcoin as a digital store of value challenges real estate’s dominant position as a store of value. This realization initially unsettled me. However, I’ve come to see that bitcoin and real estate can coexist and even thrive together.

In my opinion, bitcoin enhances the real estate industry by offering a reliable store of value, safeguarding cash flows against monetary inflation. This advantage extends beyond real estate to encompass all sectors. As Michael Saylor puts it, bitcoin represents the digital transformation of capital, marking a pivotal shift in how value is preserved across all industries. As a result, bitcoin is likely to attract the monetary premium currently held by real estate, potentially recalibrating real estate values more closely to their utility value. Yet, the realm of real estate development and the business of real estate will continue to hold appeal. People will always require spaces to live and work in. From this perspective, real estate is not just an asset but a service—one that provides housing and production spaces in exchange for rental income.

The cash flow generated from this service represents the return on investment, similar to what the renowned Austrian economist Ludwig von Mises called “originary interest”, which is the difference between the cost of production and the expected revenue from the sale of the finished product. But, it is obvious that real estate cannot compete with bitcoin in its capacity to store value. However, even if the value proposition of real estate as a store of value has changed due to the discovery of Bitcoin, the development of real estate will continue to be economically feasible going forward, if the digital paradigm shift that Bitcoin brings to the financial world is properly maneuvered.

Conclusion

In conclusion, the narrative of cash flow and intrinsic value in investment strategies is being reevaluated in the face of Bitcoin’s emergence. This digital asset, free from the constraints of traditional monetary systems, offers a glimpse into the future of finance, where value is preserved not in bricks but in bits.

As we navigate this paradigm shift, the lessons learned from the comparison between real estate and bitcoin will undoubtedly shape our approach to investment, wealth preservation, and the very fabric of the global financial system. While real estate brings the opportunity to borrow money for the foreseeable future, it’s importance as a store of value should decline over time, while bitcoin, with its fixed supply and decentralized nature, is poised to become an increasingly preferred method for preserving wealth, offering unparalleled security and global accessibility without the constraints of traditional financial systems.

0A79 E94F A590 C7C3 3769 3689 ACC0 14EF 663C C80B

Appendix—To calculate the Compound Annual Growth Rate (CAGR) for both the Money Supply (M2) and housing prices, we used the formula:

CAGR = (Ending Value/Beginning Value)^(1/Number of Years)

For Money Supply (M2) from January 1971 to December 2023:

Beginning Value (Jan. 1971): $632.9 billionEnding Value (Dec. 2023): $20,865 billionNumber of Years: 52

Substituting these values into the CAGR formula gives: CAGR= 6.9532%. Reflecting the annualized average growth rate of the total dollar money supply over this period.

Source: Growth Money Supply (M2) St. Louis FED

For housing prices from January 1971 to December 2023:

Beginning Value (Jan. 1971): $ 27,300

Ending Value (Dec. 2023): $ 492,300 Number of Years: 52

Substituting these values into the CAGR formula gives: CAGR= 5.7195%. Reflecting the annualized average growth rate of housing prices in the U.S. over this period.

This is a guest post by Leon Wankum. Opinions expressed are entirely their own and do not necessarily reflect those of BTC Inc or Bitcoin Magazine.