Month: April 2024

Human Rights Foundation Announces Finney Freedom Prize On Fourth Bitcoin Halving

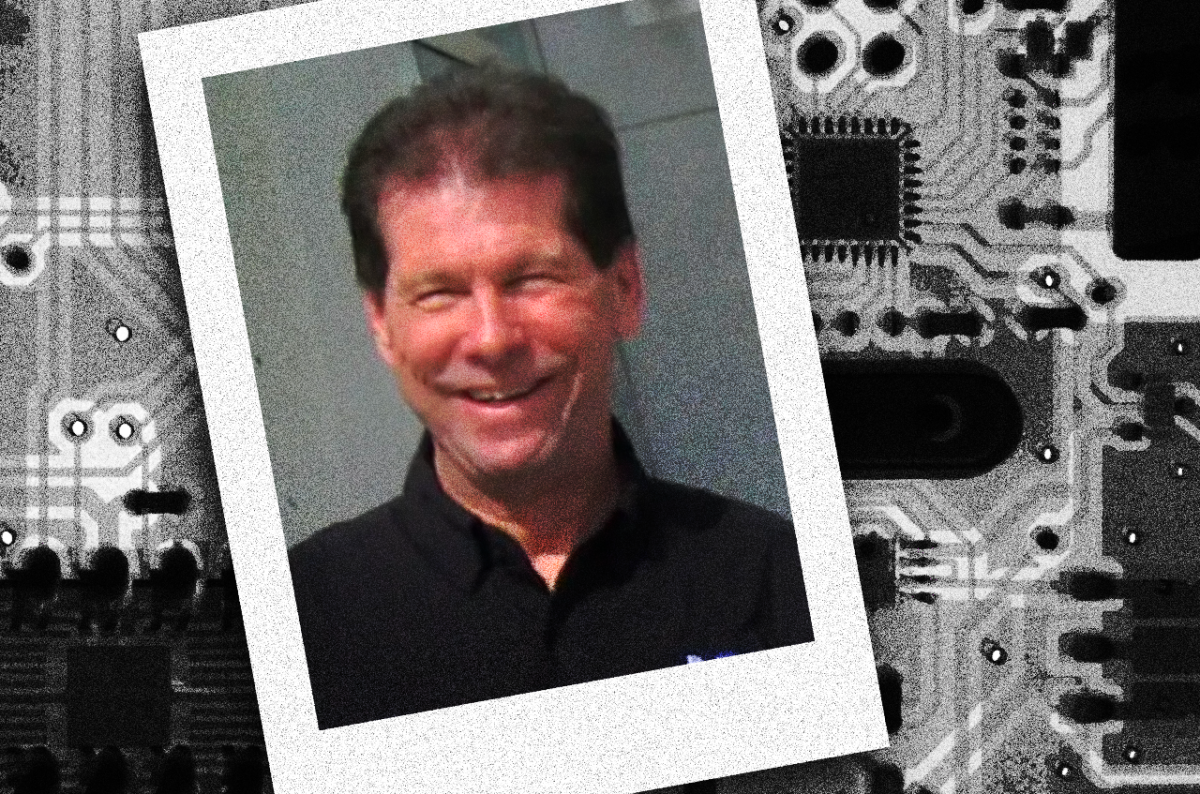

Today, on the day of the fourth Bitcoin halving, the Human Rights Foundation (HRF) announced the Finney Freedom Prize, commemorating the work of Hal Finney, one of the earliest public champions of Bitcoin.

Today HRF launches the Finney Freedom Prize to honor Hal Finney, a champion of privacy, open-source software, and electronic cash

The 1 BTC award celebrates those who do the most for Bitcoin and freedom each halving era

Let it inspire many more Hals✌️https://t.co/Zv6MagooUW pic.twitter.com/X4EqMEeIoM

— Alex Gladstein 🌋 ⚡ (@gladstein) April 19, 2024

The prize will be awarded to the individual or institution that does the most for Bitcoin and human rights in each halving era, and the recipient will receive a monetary award of 1 BTC.

“We wanted to help inspire people to use Bitcoin to advance human rights — to help more people achieve economic liberation around the world — and we thought that creating a prize that could be persistent throughout the early lifecycle of Bitcoin would be one way to do it,” Alex Gladstein, Chief Strategy Officer of the Human Rights Foundation, told Bitcoin Magazine.

“The halving is a very important day. It’s something that anyone can celebrate, regardless of what country or situation they’re in or who they are, and it’s a great time to announce a Bitcoin-related prize,” he added.

The prize winner, or Laureate, for the 2009-2012 era is Hal Finney himself, and his 1 BTC prize will go to “causes that matter to Hal’s family,” according to Gladstein.

The HRF will work with the Finney family to appoint a seven-person “Genesis Committee” that will select Laureates for the 2012-2016, 2016-2020 and 2020-2024 eras. Starting with the 2024-2028 era, a new committee will be composed to select the winner of the award.

A maximum of two Laureates can be selected for each era. In the event of two Laureates being chosen, each Laureate will receive 50 million satoshis (half of a bitcoin).

To be considered for the prize, individuals or institutions must excel in the following areas:

Educating large numbers of people about BitcoinDemonstrating how people can exercise financial freedom by being their own bank using BitcoinMaking notable contributions to Bitcoin’s codebaseHelping to make Bitcoin more accessible to the average person, especially those living under authoritarian regimesFollowing in Hal’s footsteps of advocating for digital privacy

A total of 33 Finney Freedom Prizes will be awarded, one for each Bitcoin halving era. The prize will be awarded through the 2130s, when the last Bitcoin block is expected to be mined. The treasury for the award is publicly verifiable here.

So, can we think of the Finney Freedom Prize as the Nobel Prize of Bitcoin?

“In as much as the Nobel Peace Prize or the Nobel Prize in Economics inspires people, yes,” Gladstein told Bitcoin Magazine. “We want people to be inspired to be like Hal — to think about more than themselves and about expanding this tool so that it can be accessible to more people.”

WATCH: The 2024 Bitcoin Halving Livestream

The Final Countdown to the Bitcoin Halving Has Begun

Join Bitcoin Magazine and top voices in the industry as we countdown to block 840,000 and ring in a new era in Bitcoin. The Bitcoin Halving Livestream powered by Kraken will reveal the Top 21 Moments over the past 4 years as voted on by Bitcoin Magazine readers, setting the stage for Bitcoin’s next epoch.

Visit www.bitcoinhalving.com to watch the Bitcoin Halving Livestream and countdown to block 840,000

Speaker Lineup:

Barstool CEO Dave PortnoyStrike CEO Jack MallersBitcoin Magazine Institutional Lead Dylan LeClairTen31 Managing Partner Matt OdellBitcoin Magazine Chief Content Officer Pete RizzoKraken CEO Dave RipleyUnchained Founder and CEO Joseph KellySimply Bitcoin Founder Nico MoranBitcoin Magazine Correspondent Isabella SantosHuman Rights Foundation Director of Financial Freedom Christian KerolesPomp Investments Founder Anthony PomplianoAND MORE

Visit www.bitcoinhalving.com to watch the livestream and countdown to block 840,000

Bitcoin Magazine and Nitrobetting will also be awarding a 1 BTC prize pool to the winners of The Bitcoin Halving Challenge for those who most closely guess the price of bitcoin at the halving.

WATCH

The Bitcoin Halving livestream can be viewed at www.bitcoinhalving.com and across Bitcoin Magazine social media channels:

MicroStrategy to Host Bitcoin For Corporations Conference – Pioneering Bitcoin Adoption

MicroStrategy, the leading business intelligence and Bitcoin development company, is set to convene its MicroStrategy World conference, taking place April 29 – May 2, 2024 in Las Vegas, NV. The event features two core components: i) Artificial Intelligence + Business Intelligence, and ii) Bitcoin for Corporations. Bitcoin Magazine will serve as the exclusive livestream partner of the Bitcoin for Corporations segment on May 1 – May 2, 2024, highlighting the case for Bitcoin as a critical part of corporate strategy.

MicroStrategy Executive Chairman Michael Saylor is scheduled to deliver keynote remarks addressing how Bitcoin’s role as a store-of-value has been cemented post-approval of Spot Bitcoin ETFs in the United States. David Marcus, LightSpark CEO and former Meta Executive, will appear alongside Saylor to explore the innovation taking place on the Bitcoin network. The pair will discuss how Bitcoin as “money over IP” and Bitcoin Layer 2 technologies are primed to transform how businesses facilitate transactions.

MicroStrategy Vice President, Treasury and Investor Relations, Shirish Jajodia noted the groundswell of momentum in the Bitcoin industry: “MicroStrategy has uniquely executed its Bitcoin strategy, benefitting from bitcoin’s properties as a superior long-term store-of-value. Our objective is to open-source our playbook and support bitcoin adoption at the enterprise level. We are excited to spread this message in partnership with Bitcoin Magazine and believe we are at a critical juncture in terms of Bitcoin taking its place in boardrooms around the world.”

The event comes on the heels of MicroStrategy’s continued doubling down on bitcoin – the firm recently conducted two convertible bond offerings raising proceeds of $1.4 billion, with much of the net proceeds used to purchase more bitcoin. MicroStrategy’s bitcoin holdings total more than 1% of the total supply, now worth $13.5 billion. MicroStrategy CEO Phong Le and CFO Andrew Kang will present the MicroStrategy Playbook for Corporates along with Michael Saylor to discuss opportunities to emulate the firm’s success and identify catalysts for other corporations to follow suit.

Get 30% off tickets to MicroStrategy World: Bitcoin for Corporations with code “BMAG30”. Click here to claim offer.

Bitcoin Magazine Institutional Lead Dylan LeClair previously noted that “MicroStrategy is the biggest story in corporate finance. Every Fortune 500 CEO has been put on notice.” LeClair also commented on Bitcoin’s rise as a new monetary paradigm: “Bitcoin is both a step-change in monetary technology and pristine collateral available to anyone with an internet connection. We are in the very beginning stages of adoption, and first movers in the space will have a distinct advantage. MicroStrategy’s Bitcoin for Corporations event will likely be a bellwether for institutional and corporate adoption throughout this decade.”

The Bitcoin for Corporations segment of MicroStrategy World will take place in the two days following the artificial intelligence and business intelligence event programming. The overall event is projected to exceed 1,000 executives in attendance, including representatives from Microsoft, Amazon Web Services, Google Cloud, Bayer, Bank of America and Hilton.

The Bitcoin Magazine livestream of Bitcoin for Corporations will be broadcast on Twitter, YouTube, Facebook and LinkedIn beginning May 1, 2024.

Fun Facts About The Halving

The halving is a pivotal moment in Bitcoin’s monetary policy every four years, having massive implications for the economic viability of individual mining operations, the overall market dynamics of the asset, and generally the block alcohol content present in Bitcoiners’ bloodstreams.

Everyone celebrates the halving each cycle as a moment where Bitcoin becomes a more scarce asset, an event where historically the price has skyrocketed in reaction to the change in the issuance schedule and everyone waits with bated breath for history to repeat itself.

I’m sure everyone is all too familiar with these dynamics, so today as we all sit around waiting for block 840,000 to hit, let’s look at a few lesser known facts about Bitcoin’s supply schedule and halvings:

The total supply of Bitcoin is actually not present anywhere in the codebase. The code simply specifies a starting reward of 50 BTC per block and modifies that value each halving by cutting it in half.The total supply of Bitcoin is actually not 21 million coins. Because of how the code in Bitcoin actually works, simply cutting the supply in half every halving, there will only ever be 20999999.97690 BTC in circulation by the time the coinbase subsidy drops to 0 satoshis. The supply, due to a quirk in how the programming language (C++) that Bitcoin is written in, was not capped at all originally. In 2214 the entire supply would have started issuing again, resetting the block reward back to 50 BTC per block and going through the issuance of another 21 million coins again. The BIP is written up in a joking manner, but this was corrected by BIP 42 in 2014. The halving supply curve in combination with the total supply has an interesting property. During the first subsidy period of 50 BTC coinbase rewards, 50% of the supply entered circulation. In the next halving period of 25 BTC rewards, 25% of the supply entered circulation. Each halving the value of the coinbase reward is the percentage of the total supply that enters circulation. During the first halving when the block reward decreased from 50 BTC per block to 25 BTC, a group of miners altered their Bitcoin clients and attempted to continue mining on a chain where the block subsidy remained 50 BTC after the halving.

A lot of less technical people, or newer people, in this space probably weren’t aware of most of these little factoids. Interesting little tidbits about things tend to fade off into the historical memory and disappear. If we do wind up seeing a reorg this halving over the Epic sat in block 840,000, maybe in 15-20 years most people using Bitcoin then similarly won’t remember or know such an event occurred back in 2024.

If you are lucky enough to be around now to see these little moments in history, cherish the experience. They’re once in a lifetime things you can look back on, and probably use to annoy people around you despite their lack of caring.

Happy Halving everyone.

The Halving Holiday

This article is featured in Bitcoin Magazine’s “The Halving Issue”. Click here to get your Annual Bitcoin Magazine Subscription.

Setting aside certain days for celebration, commemoration or remembrance is a nearly universal practice among humans. While different cultures and religions have their own unique customs and traditions, the entire human race seems to share an underlying propensity to recognize certain occasions as distinct from otherwise ordinary days.

Finally, something we can all agree on! While the word “holiday” or Holy Day, literally means a day that is set apart, there are also examples of special occasions which extend beyond a 24 hour period such as Hanukkah, Ramadan or even the 12 days of Christmas. After only 13 years since its inception, the nascent Bitcoin community has also begun observing its own special occasions: Jan 3rd, October 31st and Bitcoin Pizza Day, to name a few.

Then, about every 4 years, there’s the big one.

Click the image above to subscribe!

Unlike Birthdays, Kwanza or Presidents’ Day, I would argue there are aspects of Bitcoin’s Halving which make it somewhat extraordinary compared to our standard understanding of holidays and their accompanying traditions. Perhaps in ways that even Bitcoin’s most ardent fanatics have yet to fully appreciate. It’s not that the halving is more important than Christmas or more memorable than a bar mitzvah. But the implications and distinct properties which take place every 240,000 blocks, are simply unlike any other “holiday” that humans are accustomed to observing.

We are approaching Bitcoin’s 4th ever Halving at block height 840,000 which marks the beginning of a new epoch and a reduction of the block reward from 6.25 BTC to 3.125 BTC. But we don’t know exactly what day or time it will take place. You can’t exactly mark the occasion on your calendar because it is dependent on block time not clock time. It is a quadrennial occasion, occurring every 4 years, but it also has a clearly demarcated finale: there will only ever be 32 halvings. Overall, its predictability is somewhat of a paradox. We know for sure the block height, reward change and total number of halvings while having no idea the time it will occur, the impact on bitcoin’s valuation or the critical metric of subsequent network hashrate. Inevitable arguments and assertions about whether or not “the halving is priced in” are as futile as other classic bitcoin debates such as stainless steel vs cast iron, bitcoin vs Bitcoin or my personal favorite: sats vs bits.

New Year’s Eve might be the closest example we have in terms of sharing similar holiday type dynamics with the Halving. The anticipation of a brand new year or a brand new epoch. The tendency to pause and reflect on the previous year or the previous epoch. The mystery of what a fresh 12 months will bring or the mystery of what the next epoch has in store. But New Year’s Eve happens every December 31st at midnight. Nothing is fundamentally different about the world on January 1st and as far as we can tell, humans will continue to repeat this routine indefinitely into the future. Again, making these distinctions isn’t meant to suggest one is “better than the other” but more to highlight the ways in which The Halving is particularly unique as an emergent cultural phenomenon.

We can acknowledge that the implications of The Halving currently only impact a small subset of the world’s population. Those who hold, transact with or mine bitcoin are really the only ones even paying attention. But it’s fun to consider how the commemoration of The Halving might evolve and expand as worldwide adoption of this pristine asset continues to accelerate. Uncertainty and anticipation of the occasion aside, the underlying celebratory aspect of each halving points to one of Bitcoin’s most important properties which is its perfectly knowable and universally auditable scarcity. There can only ever be 32 total halvings because there will only ever be 21 million bitcoin. As the block reward is cut in half, the number of bitcoin mined each epoch, is also cut in half. This means that each halving can essentially be understood as a mini-celebration leading up to the eventual cessation of halvings altogether. The 32nd and final halving is of course when the final few sats will finally be mined, circa 2140. If bitcoin continues on its current trajectory and one day becomes the default currency for humans everywhere, it’s not far off to imagine that the actual holiday which might be celebrated by future generations could become whatever fateful day it happens to be when block 6,720,000 is mined and the final sats enter into the total supply. I get fomo just thinking about it.

Even if I live to be 100 years old, that means I will only be around to see bitcoin reach its 18th or 19th epoch. The block reward will be about 10,000 sats and only 20 full coins will be mined by the entire network for the duration of the epoch. Compared to today’s numbers, these facts are simply mind boggling. Rather than lament missing out on the grand finale of bitcoin’s 32nd and final halving, I want to attempt to properly commemorate the handful of halvings I will have the opportunity to experience, starting with the upcoming 4th halving, estimated to take place sometime in April of 2024. Since this is still a new tradition, we’ve yet to establish any sense of cohesion around how to best ring in each epoch. Some high time preference miners might even argue that it’s more a day of mourning than a cause for excitement. Because there is no central authority in Bitcoin, there will likely be numerous manifestations when it comes to how various pockets of the bitcoin community will mark the occasion. There’s probably no “wrong” way or even a necessity or expectation for a uniform way to celebrate the halving. But there might be value in exploring some possible ways to make the milestone a little more memorable by borrowing insights from other holidays.

If we consider the primary ways in which humans have historically marked special occasions we are able to draw some inspiration when it comes to considering ways to approach the upcoming halving and future halvings that will occur in our lifetimes. I would point to 3 elements in particular that I’m interested in exploring further:

Reflection RitualRenewal

Reflection: 4 years or 210,000 blocks feels like a long ass time in bitcoin years. This feeling is likely more pronounced in our present day because we are still in the early stages of bitcoin’s existence. Either way, it seems like taking time to reflect on the previous epoch as each halving approaches, could serve us well. A lot has happened since block height 630,000 and taking a moment to pause and consider how far we’ve come, might offer a healthy practice and foster deeper collaboration among those of us working to bring about a universal bitcoin standard. This past epoch we saw, among other highlights: El Salvador adopt bitcoin as legal tender, Microstrategy, Tesla and SpaceX add bitcoin to their corporate treasuries, professional athletes demand their multi-million dollar contracts be paid in bitcoin, USD price going as low as $3k and as high as $69,420 and even politicians adopting strategic talking points in an effort to court bitcoiners. We rallied around Hodlnaut and we collectively changed our profile pictures to include laser eyes. We’ve seen bitcoin super bowl ads and the emergence of spot bitcoin ETFs. We’ve made significant progress in a short period of time and reflecting on these moments can allow us to strengthen our resolve to continue fighting alongside fellow bitcoiners, yes, even the ones who enjoy an occasional salad.

Ritual: since we don’t know the exact date or time the halving block will be mined, it can be difficult to plan and execute a party or celebration to commemorate the halving. But few subsets of the population are as creative as bitcoiners when it comes to solving problems and this logistical hurdle is nothing compared to the battles we’ve fought and the bears we’ve slain. If we really want to pull off a party that has a moving target for the invitation’s “when” line, we will find a way. Perhaps the key to creating meaningful rituals is to ensure that we’re among fellow bitcoiners at the turn of the halving. By intentionally seeking out a shared celebration, which can be repeated for each halving, we might receive similar benefits found in other holiday traditions such as creating memorable moments, deepening friendships and building community. This seems especially important for younger or newer bitcoiners who are still wrapping their heads around what is even taking place at the halving. But even the OGs might find value and inspiration in experiencing the tangible growth and momentum from epoch to epoch simply by being surrounded by other bitcoiners as the momentous block is mined.

Renewal: with each new halving comes new opportunity. It’s impossible to predict what the next epoch will bring or what new milestones we’ll achieve. All we can control is our own attitude, posture and commitment to this crazy idea we’ve all bought into and continue to show up for. Bitcoiners have the audacity to believe that a better world is possible. Many of us are here because we’ve rejected the lie that we must accept the prevailing norms of our corrupt monetary system. We envision an optimistic future which allows people to preserve the wealth that they’ve rightfully earned and transact with their peers without requiring permission from tyrannical authorities. It can be easy for us to drift away from this vision, especially as the harsh reality of intense bear markets takes its toll or the latest drama spirals on bitcoin twitter. But with each epoch we have a chance to hit reset on our mindset and return to the original reason for why we’re here to begin with, why we’ve decided to accept the ridicule of friends and family and why we’re more committed to seeing this through than we were when we first started. The practice of renewal offers a fresh sense of hope and reminds us that we are not fighting with each other, but with those who attempt to stand in the way of the sovereignty we are ultimately pursuing.

By combining these 3 habits and finding ways to implement them into our approach to each halving, I believe we can rediscover common ground, limit petty infighting and accelerate progress towards our shared objective of defeating fiat currency and its toxic societal byproducts.

The Halving is a unique occasion and a worthy holy day. We frankly don’t have to do anything at all and we will still receive the hard coded benefits of predictable supply and knowable scarcity. But for bitcoiners to truly maximize the potential of each halving, the people behind the protocol must intentionally rise to the occasion of developing rich traditions to effectively commemorate these unique and scarce milestones.

This article is featured in Bitcoin Magazine’s “The Halving Issue”. Click here to get your Annual Bitcoin Magazine Subscription.

The Bitcoin Halving Is Happening: Supply to Drop to 3.125 BTC Today

Today marks a significant event as Bitcoin experiences its fourth scheduled halving. This event, also known as the halving, occurs approximately every four years and has far-reaching implications for the Bitcoin ecosystem. As Bitcoin Magazine prepares for a halving livestream, powered by Kraken, to commemorate this event, it’s crucial to understand what the halving is and why it’s so important.

What is the Bitcoin Halving?

The Bitcoin halving refers to the process by which the reward for mining new blocks on the Bitcoin blockchain is reduced by half. This reduction occurs approximately every 210,000 blocks, or roughly every four years.

Not all bitcoin were released onto the market at the same time, but rather new coins are slowly mined by Bitcoin miners every day as a reward for mining new blocks in the blockchain. The halving is encoded into Bitcoin’s protocol to control its inflation rate and ensure that only 21 million bitcoins will ever be mined, making it a deflationary asset.

In the very beginning of Bitcoin’s history, the first block reward was 50 BTC. After the first halving in 2012, the block reward was cut in half to 25 BTC per block, and then cut in half again in 2016 to 12.5 BTC per block, and once more in 2020 to 6.25 BTC per block. Now, the block reward is getting cut in half to 3.125 BTC per block, with the next halving expected in 2028, cutting the reward down to 1.5625 BTC per block.

Bitcoin will continue to cut its new supply creation in half until there is no more bitcoin left to be mined, which is currently slated for the year of 2140 in May.

Importance of the Halving

The halving event is significant for several reasons. Firstly, it directly impacts the supply of new bitcoins entering circulation. With the block reward reduced, the rate of new bitcoin creation slows down, leading to a gradual decrease in the available supply. This scarcity is a fundamental factor driving Bitcoin’s value proposition as a store of value.

Secondly, the halving has historically been associated with bullish price movements. Previous halvings, such as those in 2012 and 2016, were followed by substantial increases in Bitcoin’s price. This pattern is partly attributed to the reduced supply coupled with sustained demand, leading to a potential imbalance that favors price appreciation.

Bitcoin has increased around 743% since the last halving in 2020, rising from ~$8,755 to an all time high of $73,790 on March 14, 2024. While past performance is no guarantee of future results, market participants are expecting to see another increase in the price of BTC, as strong institutional demand for the asset is coming in from recently approved spot Bitcoin exchange traded products in the United States, Germany and Hong Kong, as well as the London Stock Exchange that is getting ready to offer physical Bitcoin exchange traded notes.

Bitcoin Magazine and Kraken Halving Livestream

To celebrate this momentous occasion, Bitcoin Magazine is hosting a halving livestream event tonight, powered by Kraken. This livestream, which will feature key players in the Bitcoin industry like Strike CEO Jack Mallers, as well as celebrities like Dave Portnoy, will delve into the top 21 moments of the last Bitcoin epoch, highlighting important milestones and developments within the Bitcoin ecosystem.

The livestream isn’t just about reflecting on the past; it’s also about looking towards the future of Bitcoin. The winners of the Nitrobetting Bitcoin Halving 1 BTC prize challenge are also to be announced during the event, it showcases the growing interest and engagement surrounding Bitcoin and its halving events.

The livestream can be found here.

Dollar hands back gains after Israeli strike; weekly gains likely

Post Content

BofA lowers EURUSD year-end forecast to 1.12 amid Fed policy shift

Post Content

UBS cautious on USD/CAD gains, sees rate cut by Fed later in 2023

Post Content

USD/CNY to grind higher in near term: Analysts

Post Content