Month: February 2024

Asia FX treads water, dollar edges lower before CPI test

Post Content

Dollar eases as market shrugs off inflation revision data

Post Content

Bitcoin Developer Mailing List Migrates To Google Groups

Today, moderators of the mailing list for Bitcoin developers, Ruben Somsen, Bryan Bishop, and Warren Togami, announced the migration of the mailing list to Google Groups.

“The bitcoin-dev mailing list has migrated from Sourceforge.net where it was originally hosted, to Linux Foundation, to OSUOSL, and now it is migrating to Google Groups,” said Bitcoin developer Bryan Bishop.

Subscribers to the existing mailing list are urged to take action promptly, as emails to the old list will no longer be accepted as of February 2024. Invitations to join the new Google Groups platform will be sent out to all current subscribers, enabling seamless transition to the updated system. The new mailing list location will be accessible here.

For those who missed the invitation or prefer to subscribe manually, alternative options are provided, including email subscription or online interface registration using a Google account. “If you missed the invite and want to subscribe manually you have two options,” the announcement stated. “You can send an email to bitcoindev+subscribe@googlegroups.com and then send a reply to the automated email you’ll receive (check your spam folder). Alternatively, you can also subscribe through the online interface at https://groups.google.com/g/bitcoindev, using a Google account (not the same as gmail – you can create a Google account with any email address you like).”

The announcement also emphasized the importance of staying opted in to receive all messages, to facilitate active participation and maintain continuity in conversations to ensure that replies are threaded together properly.

Furthermore, the migration ensures the preservation and accessibility of archived mailing list contents (no Google account required) with backups available externally, where the old mailing list can be viewed. It is important to note that the moderators “aren’t relying on Google for anything critical here and are merely using them as a conduit for information that is already meant to be public.”

The mailing list moderators also want to remind participants to make sure posts are relevant to everyone in order to maintain a good signal-to-noise ratio. A list of the mailing list rules, which remain unchanged, can be be found here. Moderators can be reached at bitcoindev+owner@googlegroups.com.

Mining Misinformation: How The United Nations University Misrepresents Bitcoin’s Energy Use

F%$K Bad Research: I spent over a month analyzing a bitcoin mining study and all I got was this trauma response.

“We must confess that our adversaries have a marked advantage over us in the discussion. In very few words they can announce a half-truth; and in order to demonstrate that it is incomplete, we are obliged to have recourse to long and dry dissertations.” — Frédéric Bastiat, Economic Sophisms, First Series (1845)

“The amount of energy needed to refute bullshit is an order of magnitude bigger than that needed to produce it.” — Williamson (2016) on Brandolini’s Law

For too long, the world has had to endure the fallout of subpar academic research on bitcoin mining’s energy use and environmental impact. The outcome of this bullshit research has been shocking news headlines that have turned some well-meaning people into angry politicians and deranged activists. So that you never have to endure the brutality of one of these sloppy papers, I’ve sacrificed my soul to the bitcoin mining gods and performed a full-scale analysis of a study from the United Nations University, published recently in the American Geophysical Union’s Earth’s Future. Only the bravest and hardest of all bitcoin autists may proceed to the following paragraphs, the rest of you can go back to watching the price chart.

Click the image above to download a PDF of this article.

Your soft baby ears might have screamed with shock at the strong proclamation in my lede that the biggest and squeakiest research on bitcoin mining is bullshit. If you’ve ever read Jonathan Koomey’s 2018 blog post on the Digiconomist–also known as Alex deVries, or his 2019 Coincenter report, or Lei et al. 2021, or Sai and Vranken 2023, or Masanet et al. 2021, or… Well, the point is that there’s thousands of words already written that have shown that bitcoin mining energy modeling is in a state of crisis and that this is not isolated to bitcoin! It’s a struggle that data center energy studies have faced for decades. People like Jonathan Koomey, Eric Masanet, Arman Shehabi, and those nice guys Sai and Vranken (sorry, we’re not yet on a first-name basis) have written enough pages that could probably cover the walls of at least one men’s bathroom at every bitcoin conference that’s happened last year, that show this to be true.

My holy altar, which I keep in my bedroom closet, is a hand-carved, elegant yet ascetic shrine to Koomey, Masanet, and Shehabi for the decades of work they’ve done to improve data center energy modeling. These sifus of computing have made it all very clear to me: if you don’t have bottom-up data and you rely on historical trends while ignoring IT device energy efficiency trends and what drives demand, then your research is bullshit. And so, with one broad yet very surgical stroke, I swipe left on Mora et al. (2018), deVries (2018, 2019, 2020, 2021, 2022, and 2023), Stoll et al. (2019), Gallersdorfer et al. (2020), Chamanara et al. (2023), and all the others that are mentioned in Sai and Vranken’s comprehensive review of the literature. World, let these burn in one violent yet metaphorically majestic mega-fire somewhere off the coast of the Pacific Northwest. Reporters, and policymakers, please, I implore you to stop listening to Earthjustice, Sierra Club, and Greenpeace for they know not what they do. Absolve them of their sins, for they are but sheep. Amen.

Now that I’ve set the mood for you, my pious reader, I will now tell you a story about a recent bitcoin energy study. I pray to the bitcoin gods that this will be the last one I ever write, and the last one you’ll ever need to read, but my feeling is that the gods are punishing gods and will not have mercy on my soul–even in a bull market. One deep breath (cue Heath Ledger’s Joker) and Here… We… Go.

On a somewhat bearish October afternoon, I got tagged on Twitter/X on a post about a new bitcoin energy use study from some authors affiliated with the United Nations University (Chamanara et al., 2023). Little did I know that this study would trigger my autism so hard that I would descend into my own kind of drug-induced-gonzo-fear-and-loathing-in-vegas state, and hyper-focus on this study for the next four weeks. While I am probably exaggerating about the heavy drug use, my recollection of this time is very much a techno-colored, toxic relationship-level fever dream. Do you remember Frank from the critically acclaimed 2001 film, Donnie Darko? Yeah, he was there, too.

As I started taking notes on the paper, I realized that Chamanara et al.’s study was really confusing. The paper was perplexing because it’s a poorly designed study that bases its raison d’etre entirely on de Vries and Mora et al. It uses the Cambridge Center for Alternative Finance (CCAF) Cambridge Bitcoin Energy Consumption Index (CBECI) data without acknowledging the limitations of the model (see Lei et al. 2021 and Sai and Vranken 2023 for an in-depth analysis of the issues with CBECI’s modeling). It conflates its results from the 2020-2021 period with the state of bitcoin mining in 2022 and 2023. The authors also relied on some environmental footprint methodology that would make you think it was actually possible for you to shrink or grow a reservoir depending on how hard you Netflix and chill. Really, this is what Obringer et al. (2020) inferentially conclude is possible and the UN study cites Obringer as one of its methodological foundations. By the way, Koomey and Masanet did not like Obringer et al.’s methodology, either. I’ll light another soy-based candle at the altar in their honor.

Here’s a more clearly stated enumeration of the crux of the problem with Chamanara et al. (and by the way, their corresponding author never responded to my email asking for their data so I could, you know, verify, not trust.

The authors conflated electricity use across multiple years, overreaching on what the results could reveal based on their methods.

The authors used historical trends to make present and future recommendations despite extensive peer-reviewed literature clearly showing that this leads to overestimates and exaggerated claims.

The paper promises an energy calculation that will reveal bitcoin’s true energy use and environmental impact. They use two sets of data from CBECI: i) total monthly energy consumption and ii) average hashrate share for the top ten countries where bitcoin mining is operated. Keep in mind that CBECI relies on IP addresses that are tracked at several mining pools. CBECI-affiliated mining pools represent an average of 34.8% of the total network hashrate. So, the data used likely have fairly wide uncertainty bars.

After about an hour or so of Troy Cross talking me off a rather impressive, art deco and weather-worn ledge that’s probably seen a few Great Gatsby flappers jump–a result of feeling an overwhelming sense of terror after my exasperated self realized that no amount of cognitive behavioral therapy would get me through this study–I determined the equation that the authors used to calculate the energy use shares for each of the top ten countries with the most share of hashrate (based on the IP address estimates) had to be the following:

Don’t let the math scare you. Here’s an example of how this equation works. Let’s say China has a shared share for January 2020 of 75%. Then, let’s also say that the total energy consumption for January 2020 was 10 TWh (these are made-up numbers for simplicity’s sake). Then, for one month, we’d find that China used 7.5 TWh of energy. Now, save that number in your memory palace and do the same operation for February 2020. Next, add the energy use for January to the energy use found for February. Do this for each subsequent month until you’ve added up all 12 months. You now have CBECI’s China’s annual energy consumption for 2020.

Before I show the table with my results, let me explain another caveat to the UN study. This study uses an older version of CBECI data. To be fair to the authors, they submitted their paper for review before CBECI updated their machine efficiency calculations. However, this means that Chamanara et al.’s results are not even close to realistic because we now believe that CBECI’s older model was overestimating energy use. Moreover, to do this comparison, I was limited to data through August 31, 2023, because CBECI switched to the new model for the rest of 2023. To get this older data, CCAF was generous and shared it with me upon request.

Another tricky thing about this study is that they combined the energy use for both 2020 and 2021 into one number. This was really tricky because if you look at their figures, you’ll notice that the biggest text states, “Total: 173.42 TWh”. It’s also slightly confusing because the figure caption states, “2020-2021”, which for many people would be interpreted as a period of 12 months, not 24 months. Well, whatever. I broke them up into their individual years so everyone could see the steps that were taken to get to these numbers.

Look at the far right column with the header, “Percent Change Between 2020 + 2021 Calculations (%)”. I calculated the percent change between my calculations and Chamanara et al.’s. This is rather curious, isn’t it? Based on my conversations with the researchers at CCAF, the numbers should be identical. Maybe the changelog doesn’t reflect a smaller change somewhere, but our numbers are slightly different nonetheless. China has a greater share and the United States has a smaller share in the data that CCAF shared with me compared to the UN study. Despite this, the totals are fairly close. So, let’s give the authors the benefit of the doubt and say that they did a reasonable job calculating the energy share, given the limitations of the CBECI model. Please bear in mind that noting that their calculation was reasonable doesn’t mean that it’s reasonable to use these historical estimates to make claims about the present and future and direct policy. It isn’t.

One evening while working by candlelight, I glanced to my left and saw Frank’s stabbing, black pupils (the Donnie Darko character I mentioned earlier) staring at me like two pieces of Stronghold waste coal, fixed in a quiet bed of pearly sand. He was reminding me that this report was still not finished and something about time travel. I grabbed my extra-soft curls (I switched to bar shampoo, it’s a godsend for frizz) and yanked as hard as I could. Willie Nelson’s 1974 Austin City Limits pilot episode blasting on my cheap-ass Chinese knock-off monitor’s mono speakers was moving through my ears like heroin through Lou Reed’s 4-lanes wide network of veins. Begrudgingly, I accepted my fate. I needed to go deeper down this rabbit hole. I needed to do a deeper analysis of the 2020 and 2021 CBECI data to show how important it is to do an annual analysis and not blur the years into one calculation. Realizing I was out of my hard liquor of choice, a splash of sherry in a Shirley Temple (shaken, not stirred), I grabbed a bottle of bootleg antiseptic that I got during the pandemic lockdown and chugged.

I flipped through my notes. I have lots of notes because I’m a serious person. What about the mining map issues? Can we do this through an analysis of the two separate years? What was happening for each of the ten countries? Does that tell us anything about where hashrate went after the China ban? What about the Kazakhstan crackdown? That’s post-2021, but the UN study acts like it never happened when they’re talking about the current mining distribution…

Not to the authors’ credit, they failed to mention to the peer-reviewers and to their readers that the mining map data only goes through January 2022. So, even though they talk about bitcoin mining’s energy mix as if it represents the present, they are completely wrong. Their analysis only captures historical trends, not the present and definitely not the future.

See this multi-colored plot of CBECI’s estimated daily energy use (TWh) from January 2020 through August 31, 2023? At this macro scale, we see plenty of variability. But also it’s apparent just from inspection that each year is different from the next in terms of variability and energy use. There are a number of possible reasons for the cause of variability at this scale. Some possible influences on energy use could be bitcoin price, difficulty adjustment, and machine efficiency. More macroscale influences could be as a result of regulation, such as the Chinese bitcoin mining ban that occurred in 2021. Many of the Chinese miners fled the country for other parts of the world, Kazakhstan and the United States are two countries where hashrate found refuge. In fact, the power of the Texas mining scene really came to be at this unprecedented moment in hashrate history.

Look at the histograms for 2020 (top left), 2021 (top right), 2022 (bottom left), and 2023 (bottom right). It’s obvious that for each year, the estimated annualized energy consumption data shows different distributions. Even though we do see some possible distribution patterns, we have to be careful not to take this as a pattern that happens every four-year cycle. We need more data to be sure. For now, what we can say is that some years in our analysis show a bimodal distribution while other years show a kind of skewed distribution. The main point here is to show that the statistics for energy use for each of these four years are different, and distinctly so for the two years that were used in Chamanara et al.’s analysis.

In the UN study, the authors wrote that bitcoin mining exceeded 100 TWh per year in 2021 and 2022. However, if we look at the histograms of the daily estimated annualized energy consumption, we can see that daily estimates vary quite a bit, and even in 2022 there were many days where the estimated energy consumption was below 100 TWh. We’re not denying that the final estimates were over 100 TWh in the older estimated data for these years. Instead, we’re showing that because bitcoin mining’s energy use is not constant from day to day or even minute-to-minute, it’s worth doing a deeper analysis to understand the origin of this variability and how it might affect energy use over time. Lastly, it’s worth noting that the updated data now estimates the annual energy use to be 89 TWh for 2021 and 95.53 TWh for 2022.

One last comment, Miller et al. 2022 showed that operations (specifically buildings) with high variability in energy use over time are generally not suitable for emission studies that use averaged annual emission factors. Yet, that’s what Chamanara et al. chose to do, and what so many of these bullshit models tend to do. A good portion of bitcoin mining doesn’t operate like a constant load, Bitcoin mining can be highly flexible in response to many factors from grid stability to price to regulation. It’s about time that researchers started thinking about bitcoin mining from this understanding. Had the authors spent even a modest amount of time reading previously published literature, rather than operating in a silo like Sai and Vranken noted in their review paper, they might have at least addressed this limitation in their study.

—

So, I’ve never been to a honky tonk joint before. At least not until I found myself in a taxi cab with several other conferencegoers at the North American Blockchain Summit. Fort Worth, Texas, is exactly what you’d imagine. Cowboy boots, gallon-sized cowboy hats, Wrangler blue jeans, and cowboys, cowboys, cowboys everywhere you looked through the main drag. On a brisk Friday night, Fort Worth seemed frozen in time, people actually walked around at night. The stores looked like the kind of mom-and-pop shops you’d see on an episode of The Twilight Zone. I felt completely disoriented.

My companions convinced me that I should learn how to two-step. Me, your standard California girl, whose physics advisor once told her that while you can take the girl out of California, you can’t take California out of the girl, should two-step?! I didn’t know a two-step from an electric slide and the only country I remember experiencing was a Garth Brooks commercial I saw once on television when I was a child. He was really popular in the nineties. That’s about as much country as this bitcoin mining researcher gets. The place was filled with kitschy gift shops and bright lights everywhere radiating from neon signs. At the center of the main room, a bartender wearing a black diamond studded belt with a white leather gun holster and lined with evenly spaced silver bullets. Who the hell knows what kind of gun he was packing, but it did remind me of the guns in the 1986 film, Three Amigos.

It was here, against the backdrop of what sounded like a country band that wasn’t entirely sure that it was country, that I watched the Texas Blockchain Council’s Lee Bratcher address a ball with the kind of trigonometric grace that you could only find at the end of a cue and land that billiard in a tattered, leather pocket for what seemed like the hundredth time that night. The smooth clank of billiard against billiard awoke something inside me. I realized that I was not yet out of the rabbit hole that Frank sent me down. I remembered somewhere scribbled in my notes that I had not plotted the hashrate share over time for the countries mentioned in the UN study. So, at half past three in the morning, I threw my head back to take a swig of some club soda and bumped it against the wall of the photo booth where nuclear families could pose with a mechanical bull, and fell unconscious.

Three hours later, I was back in my hotel room. Thankfully, someone placed some worthless fiat in my hand, loaded me into a cab, and had the driver take me back to the non-smoking room I checked into at the very center of the decay of twenty-first-century business travel, the Marriott Hotel. Fuzzy-brained and bleary-eyed, I let the blinding, dangerously blue light from my computer screen wash over my tired face and increase my chances of developing macular degeneration. I continued my analysis.

What follows are a series of plots of CBECI mining map data from January 2020 through January 2022. Unsurprisingly, Chamanara et al. focus attention on China’s contribution to energy use, and subsequently to its associated environmental footprint. China’s monthly hashrate peaked at over 70 percent of the network’s total hashrate in 2020. In July 2021, that hashrate share crashed to zero until it recovered to about 20 percent of the share at the end of 2021. We don’t know where it stands today, but industry insiders tell me it’s likely still hovering around this number, which means that in absolute terms, the hashrate is still growing there despite the ban.

Russia, also unsurprisingly, gets discussed as well. Yet, based on the CBECI mining map data from January 2020 through January 2022, it’s hard to argue that Russia was an immediate off-taker of exiled hashrate. There’s certainly an immediate spike, but is this real or just miners using VPN to hide their mining operation? By the end of 2021, the Russian hashrate declined to below 5 percent of the hashrate and in absolute terms, declined from a brief peak of over 13 EH/s to a bit over 8 EH/s. When looking at the total year’s worth of CBECI estimated energy use for Russia, we do see that Russia did hold a significant portion of hashrate, it’s just not clear that when working with such a limited set of data, we can make any reasonable claims about the present contribution to hashrate and environment footprint for the network.

The most controversial discussion in Chamanara et al. deals with Kazakhstan’s share of energy use and environmental footprint. Obviously, the CBECI mining map data shows that there was a significant increase in hashrate share both in relative and absolute terms. It also appears that this trend started before the China ban was implemented, but certainly appears to rapidly increase just before and after the ban was implemented. However, we do see a sharp decline from December 2021 to January 2022. Was this an early signal that the government crackdown was coming in Kazakhstan?

In their analysis, Chamanara et al. ignored the recent Kazakhstan crackdown, where the government imposed an energy tax and mining licenses on the industry, effectively pushing hashrate out of the country. The authors overemphasized Kazakhstan as a current major contributor to bitcoin’s energy use and thus environmental footprint. If the authors had stayed within the limits of their methods and results, then noting the contribution of Kazakhstan’s hashrate share to the environmental footprint for the combined years of 2020 and 2021 would have been reasonable. Instead, not only do they ignore the government crackdown in 2022, but they also claim that Kazakhstan’s hashrate share increased by 34% based on 2023 CBECI numbers. CBECI’s data has not been updated since January 2022 and CCAF researchers are currently waiting for data from the mining pools that will allow them to update the mining map.

I know I’ve shown you, my faithful reader, a lot of data, but go ahead and have another shot of the hardest liquor you have in your cabinet, and let’s take a look at one more figure. This one represents the United States hashrate share in the older CBECI mining map data. The trend we see for the United States is also similar for Canada, Singapore, and what CBECI Calls “Other countries”, which represent the countries that did not make the top ten list for hashrate share. There’s a clear signal that reflects what we know to be true. The United States took a significant portion of Chinese hashrate and this hashrate share grew rapidly in 2021. While we know that the CBECI mining map data is limited to less than a majority of the network hashrate, I do think that their share is at least somewhat representative of the network’s geographic distribution. Hashrate geographic distribution seems to be heavily shaped by macro trends. While electricity prices matter, government stability and friendly laws play an important role. Chamanara et al. should have done this kind of analysis to help inform their discussion. If they had, they might have realized that the network is responding to external pressures at varying times and geographic scales. We need more data before we can make strong policy recommendations when it comes to the effects of bitcoin’s energy use.

—

At this point, I was no longer sure if I was a bitcoin researcher or an NPC, lost in a game where the only points tallied were for the intensity of self-loathing I was feeling for agreeing to this undertaking. At the same time, I could smell the end of this analysis was near and that, with enough somatic therapy and EMDR, I might actually remember who I used to be before I got dragged into this mess. Just two days prior, Frank and I had a falling out over whether Courier New was still the best font for displaying mathematical equations. I was alone in this rabbit hole now. I dug my fingers into the dirt walls surrounding me and slowly clawed my way back to sanity.

Upon exiting the hole, I grabbed my laptop and decided it was time to address the study’s environmental footprint methodology, wrap up this puppy, and put a bow on it. Chamanara et al. claimed that they followed the methods used by Ristic et al. (2019) and Obringer et al. (2020). There are a few reasons why their environmental footprint approach is flawed. First, the footprint factors are typically used for assessing the environmental footprint of energy generation. In Ristic et al., the authors developed a metric called the Relative Aggregated Factor that incorporated these factors. This metric allowed them to evaluate the placement of new electricity generators like nuclear or offshore wind. The idea behind this approach was to be mindful that while carbon dioxide emissions from fossil fuels were the main driver for developing energy transition goals, we should also avoid replacing fossil fuel generation with generation that could create environmental problems in different ways.

Second, Obringer et al. used many of the factors listed in Ristic et al. and combined them with network transmission factors from Aslan et al. (2018). This was a bad move because Koomey is a co-author on this paper, so it shouldn’t be surprising that in 2021, Koomey co-authored a commentary alongside Masanet where they called out Obringer et al. In Koomey and Masanet, 2021, the authors chided the assumption that short-term changes in demand would lead to immediate and proportional changes in electricity use. This critique could also be applied to Chamanara et al., which looked at a period when bitcoin was experiencing a run-up to an all-time high in price during a unique economic environment (low interest rates, COVID stimulus checks, and lockdowns). Koomey and Masanet made it clear in their commentary that ignoring the non-proportionality between energy and data flows in network equipment can yield inflated environmental-impact results.

More importantly, we have yet to characterize what this relationship looks like for bitcoin mining. Demand for traditional data centers is defined by the number of compute instances needed. What is the equivalent for bitcoin mining when we know that the block size is unchanging and the block pace is adjusted every two weeks to keep an average 10-minute spacing between each block? This deserves more attention.

Either way, Chamanara et al. did not seem to be aware of the criticisms of Obringer et al.’s approach. This is really problematic because as mentioned at the start of this screed, Koomey and Masanet laid the groundwork for data center energy research. They should have known not to apply these methods to bitcoin mining because while the industry has differences from a traditional data center, it’s still a type of data center. There’s a lot that bitcoin mining researchers can take from the torrent of data center literature. It’s disappointing and exhausting to see papers published that ignore this reality.

What more can I say other than this shit has to stop. Brandolini’s Law is real. The bullshit asymmetry is real. I really want this new halving cycle to be the one where I no longer have to address bad research. While I was writing this report, Alex de Vries published a new bullshit paper on bitcoin mining’s “water footprint”. I haven’t read it yet. I’m not sure that I will. But if I do, I promise that I will not write over 10,000 words on it. I’ve stated my case and made my peace with this genre of academic publishing. It was a fun ride, but I think it’s time to practice some self-care, treat myself to several evenings of healthy binge-watching, and dream of the ineffable.

—

If you enjoyed this article, please visit btcpolicy.org where you can read the full 10,000-word technical analysis of the Chamanara et al. (2023) study.

The No-coiner Texts Arrive: A Bull Market Beckons

The subtle shift in social media conversations. The mentions in the mainstream media: “Bitcoin will now be available for Wall Street investors!”. All the text messages arriving with questions about bitcoin from your no-coiner friends. Bitcoiners know that this is the signal. The bull market is officially here before the 2024 halving. This is a letter and a brief guide with nice tools for all those people who have been asking questions about bitcoin in the last couple days.

“Bitcoin… Should I buy it?” “What is the best way to buy some?” “When should I buy it?” “How much do I buy?” “What strategy do I use to accumulate?” “Do I keep it? How long?”

Gradually and then suddenly. That weird magic internet money you spend your free time researching is all anyone wants to talk about now. Your coworker, usually oblivious to anything outside his immediate domain, starts peppering you with questions about exchanges and wallets. Your high school and college friends text you asking for advice.

The no-coiner texts are more than just a social phenomenon. They’re a barometer of market sentiment, a bellwether signaling the rise of a new wave of interest. When the questions shift from “What is Bitcoin?” to “How do I buy it?” you know something fundamental has shifted.

This isn’t just FOMO (fear of missing out). It’s recognition. People are starting to see what we’ve seen all along: a monetary revolution unfolding before our eyes. The limitations of the old system, the fragility of fiat currencies, are becoming painfully obvious. And Bitcoin, that beacon of sound money and individual sovereignty, shines ever brighter in the growing darkness.

The questions, of course, are varied. “Should I buy now?” asks the cautious one, still scarred by past price swings. “What exchange should I use?” queries the practical one, seeking a secure path to entry. And the adventurous one, eyes gleaming with gold rush fever, wants to know about leverage and trading strategies.

There’s no one-size-fits-all answer, of course. Each journey into Bitcoin is unique, shaped by individual circumstances and risk tolerance. But for those drawn to the flight to quality, let’s go step by step.

“Should I Buy Bitcoin?”

This is not investment advice. Before investing any money, I would suggest that you invest time doing your own research about how to use the Bitcoin network appropriately. That said, the world’s largest asset manager is very bullish on Bitcoin. According to a BlackRock paper from 2022, they believe that an 84.9% bitcoin allocation is the optimal strategy.

Additionally, Fidelity published a paper titled Introduction to Digital Assets For Institutional Investors and they mention Bitcoin 73 times. After that, they published a paper titled Bitcoin First: Why investors need to consider Bitcoin separately from other digital assets.

Again, that doesn’t mean you should trust them with your eyes closed. I encourage everyone to do their own research. This is simply a little bit of context about what giants in the asset management industry are saying lately. There are open source tools that can help you make your own conclusions. Any person can access and understand how to use these tools for their personal wealth management. In fact, you can play with the models and adjust anything if you know some programming in Python. Finally, the Bitcoin network has so many unique characteristics that make it like no other asset we’ve seen before. Bitcoin rocks!

“What Is The Best Way To Buy Some?”

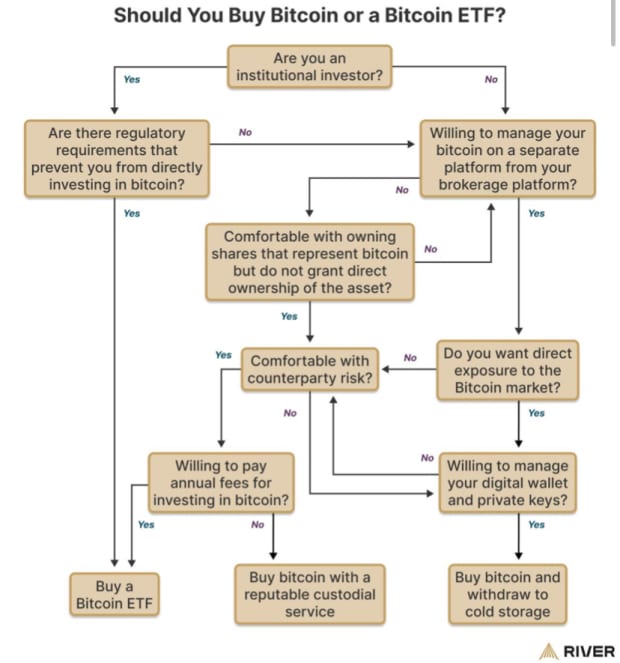

It depends on individual needs, priorities and trade offs. On one side, you need to choose the level of responsibility that you’re comfortable with. On another side, you need to decide on the level of ownership that you want to have over your wealth.

For example, there will be individuals that prefer to give up absolute ownership because they’d rather have a third-party as the custodian of the bitcoin. Long time bitcoiners value absolute ownership and therefore they prefer to be the custodians of their own bitcoins even if that implies more responsibility for them. Holding your own keys is the only way to really own any bitcoin. That’s why they say: “Not your keys, not your bitcoin”. If you really want to be your own bank, you can’t delegate the responsibility of holding your keys to anyone else.

There is no doubt that not everyone prefers the big responsibility of holding their bitcoin. The same thing happened with other assets like gold. Not everyone feels comfortable storing gold in their homes and they send their gold to third-party custodians that have big gold vaults. In cyberspace there are also technicalities that will make some individuals feel unable to keep up with the big responsibility of holding value without the help of a third-party.

Ask yourself the following questions: Do you value absolute ownerships? Do you value privacy? Are you comfortable with the responsibility of holding your keys safely? How much trust do you have in a third-party to custody your wealth? Are you an individual or institutional investor? If you are an institutional investor, are there regulations preventing you from owning real bitcoin? The following diagram from River can help you decide which is the best way for you to buy and hold bitcoin.

In conclusion, there are three different alternatives depending on individual needs. First, owning real bitcoin with a hardware wallet that you own the keys to. Second, buying paper bitcoin and having a third-party do the custody for you. Third, buying a Bitcoin ETF and having your broker keep it for you. After all, you can use a mix of different strategies either to diversify your exposure or invest from different platforms.

“When Should I Buy It?”

Approximately every four years there is an event called the Halving. A halving implies that the amount of bitcoins put into circulation is cut into half. This is known as the Block Reward or Block Subsidy. In 2023, the Block Reward was equivalent to 6.25 Bitcoin coins. The Block Reward refers to the number of coins issued every 10 minutes. This means that 900 bitcoins were created each day.

In 2010, the Block Reward was 50 coins. During a Halving, the Block Reward is halved, marking significant epochs in the life of the Bitcoin network. We are currently in the 4th epoch (Epoch IV), which began in 2020 and will end in 2024.

Therefore, with the Halving in 2024, the monetary issuance will decrease to 3.125 coins every 10 minutes. This halving is expected to occur around April and in other words, a halving causes an anticipated decrease in the growth rate of the monetary base. The halving and the Epoch are crucial considerations for those interested in investing in Bitcoin. In the following graph you can visualize this:

*Graph created by the author with data from a Nasdaq library in R Studio. The data is from December 2010 to December 2023.

The following charts contain Bitcoin price data for each epoch separately (from Epoch I to Epoch IV, respectively). What’s intriguing about these four charts is that they help us visualize a clear pattern that repeats in each epoch. These charts can be valuable to anyone interested in investing in Bitcoin, as they assist us in visualizing a very distinct cycle that repeats every four years.

*Graph created by the author with data from a Nasdaq library in R Studio. .

It is important to mention that we do not know if the four year cycle will continue forever. In the last few years there have been new conversations that suggest that the four year cycle will not always be like that. A popular argument is that the halving will be priced in with anticipation for future epochs when people become more aware of this phenomenon.

There are currently 19.7 billion bitcoins in circulation out of the 21 million that there will ever exist. This means that 93% of the total bitcoins already exist and there is less than 7% of them to be mined. However, the last bitcoins will be mined around the year 2140 and miners will live off of transaction fees after that.

*Source: https://medium.com/swlh/the-mathematics-of-bitcoin-89e7ab59edc

“How Much Do I Buy?”

Once you have decided to buy bitcoin, the next step is to ask yourself how much you want to invest. Remember the advice from that Blackrock publication? You don’t have to be that aggressive and invest 84% of your portfolio in bitcoins. You can begin little by little. In this section, I will use a wonderful open-source tool created by Raphael Zagury (Chief Investment Officer of Swan Bitcoin) and I would suggest everyone to play with the models in the platform by yourself. You can find this dashboard at https://nakamotoportfolio.com/.

In the Nakamoto Portfolio website, you can personalize a portfolio to meet your needs or you can check out default portfolios templates that are already there for you to analyze. Let’s check out a very simple and traditional portfolio:

This portfolio has 60% of its wealth invested in the S&P 500 Index (SPY), 20% in a regular gold trust (GLD), and the other 20% in a Vanguard Bond Market ETF (BND). The time frame used to analyze this portfolio is between January 2018 and January 2024. The green line shows us the actual results that this portfolio would`ve had during that time span. The results tell us that this portfolio would have had an annual return of 8.73%. The total return for the six year period is 65%. The daily volatility of this portfolio is 0.67% and the annualized volatility is 12.85%.

Now let’s focus on the three lines below the green line that represents the original portfolio. These lines give us the results of the original portfolio if they would have had 1%, 5% and 10% of the portfolio in Bitcoin for those six years. Just by having 1% in Bitcoin, the total returns of the portfolio would go from 65% to 71%. The annualized volatility would only increase to 12.91%. A position of 5% in Bitcoin would increase the returns all the way to 94% with the volatility at 13.55%. Finally, a position of 10% in Bitcoin would take the returns all the way to 123% and the volatility would only increase to 15.12%. This exercise illustrates perfectly why exposure to Bitcoin (even minimum exposure) is ideal for any portfolio.

Ray Dalio, the famous investor from Bridgewater Associates, created a portfolio designed to perform well across different economic conditions. This investment strategy is known as the All Weather Portfolio. This portfolio template is available on the Nakamoto Portfolio website to analyze the results of Bitcoin exposure. The following image demonstrates the benefits of adding Bitcoin to a portfolio like this one.

Another interesting portfolio to check out is the Diversified Bond Portfolio. This is a conservative investment strategy for risk-averse individuals. This portfolio includes a mix of Treasury with High Yield ETFs. According to Mr. Zagury, “a Bitcoin allocation is the perfect implementation of a bond portfolio. Even at small amounts, it has the potential to increase risk-adjusted returns.” The following image contains a brief summary of the impact that Bitcoin exposure can have on the Diversified Bond Portfolio. I suggest for everyone to try out the Nakamoto Portfolio by themselves to play with different numbers, portfolios, strategies, etc. There are YouTube tutorials and Twitter Threads to help anyone that is interested in using this wonderful tool.

“What Strategy Do I Use To Accumulate?”

Once you have decided that you want to buy some bitcoin and you have decided on the amount of exposure that you want, the next step is to decide how you want to approach this accumulation phase. What strategy do you want to buy bitcoin? On one hand, you can buy it all at once. On the other hand, you can buy little by little.

There are two main strategies for bitcoin accumulation: Lump-sum Investing and Dollar Cost Averaging (DCA). A lump-sum strategy implies investing all available funds at once. The DCA strategy allocates funds over regular intervals. For example, someone that decides to buy $100 worth of bitcoin each week (no matter the price) is following a DCA strategy. This is a popular strategy among bitcoiners that want to stack sats consistently. Each strategy has its own pros and cons. However, the best strategy depends on the particular needs and preferences of each individual.

The Nakamoto Portfolio website also has a tool where anyone can run the numbers and compare which strategy works better for their particular situation. Check out the BTC Cost Averaging Simulator. According to Swan´s Nakamoto Portfolio, “lump-sum investing has historically outperformed DCA strategies. This is primarily due to Bitcoin’s explosive upward price movements. But DCA can lead to significant outperformance during bear markets. For instance, investors who bought at all-time highs but employed DCA afterward were able to break even significantly quicker. While DCA has potential drawbacks, such as reduced returns in consistently rising markets, it remains a popular method for managing risk and promoting disciplined investing.” After all, most people use a mix of both of these strategies and that might be the best way to go.

“Do I Keep Tt? For How Long?”

Again, that comes down to individual needs, priorities, information, etc. However, this asset should be considered a long-term investment strategy. That means holding your bitcoin for a very long time, regardless of price fluctuations. Many Bitcoin enthusiasts believe that bitcoin will eventually become a global reserve currency, and therefore, they are willing to hold it through the ups and downs of the market. There is a popular saying amongst bitcoiners that changes “hold” into “HODL” (Hold On For Dear Life!). Take a look at awesome bitcoin comics that might also give you some advice…

Other investors prefer trading their bitcoin on a frequent basis. This strategy involves buying bitcoin during the dips and selling during the highs. It sounds too cool but in reality this decentralized market is very difficult to predict. Very rarely do traders get to outsmart the market. Time in the market is more important than timing the market.

I encourage readers to take the next step, whether it’s researching Bitcoin on their own, starting a Bitcoin investment plan, or joining the Bitcoin community. Start your Bitcoin journey today! Dive into the resources, explore the Nakamoto Portfolio, and don’t hesitate to ask questions. Bitcoin awaits those who dare to step into the future. As Bitcoin continues its ascent, how will the world adapt to this new paradigm of sound money and individual sovereignty? Only time will tell, but one thing is certain: the future is orange.

This is a guest post by Santiago Varela. Opinions expressed are entirely their own and do not necessarily reflect those of BTC Inc or Bitcoin Magazine.

Dollar gains as jobless claims affirm resilient US labor market

Post Content

The EIA Emergency Information Collection Is Alarming

In mid-January, a massive winter storm swept across the United States, dropping temperatures in Central Texas into the low 20s and causing Texans to huddle indoors with their heaters running full blast. The Texas power grid creaks and groans when it’s put to the test during extreme weather events and sometimes it goes down leaving citizens out in the cold. However this time the power stayed on and it was in large part due to an unexpected recent phenomenon: Bitcoin Mining. Bitcoin miners turned their operations off to redirect power back to critical infrastructure & reduce stress on the Texas grid. (Lee Bratcher, President of the Texas Blockchain Council, recently wrote about how there is considerable evidence that miners in other ISOs similarly curtailed their operations, and benefitted grids across the country throughout the storm.)

Meanwhile, across the country in DC, the Administrator of the Energy Information Administration (EIA) was drafting a memo to the Office of Management and Budget calling for an emergency review of cryptocurrency mining operations out of concern for “stressed electricity systems” and “heightened uncertainty in electric power markets”. Now, the EIA is conducting an emergency data collection of mining operations and the Bitcoin mining industry is scrambling to respond.

The irony that the EIA launches the emergency data collection based upon grounds of grid instability at the very moment mining empirically demonstrates grid synergy is not lost upon us. Let’s dive into the context for this data collection, the industry response, and our thoughts on the overall situation as it stands.

EIA & Emergency Order Context

The EIA “collects, analyzes, and disseminates independent and impartial energy information to promote sound policymaking, efficient markets, and public understanding of energy and its interaction with the economy and the environment.” If a federal agency wishes to collect information from the public, they must ask the Office of Management and Budget (OMB) for permission to use taxpayer money and submit an Information Collection Request (ICR).

Typically,, the procedure would look like this:

The EIA internally develops the ICR and checks their own internal approval boxes.The ICR must be published in the Federal Register for 60 days to put the industry on notice of the proposed survey and afford the public an opportunity to comment. (Notice & Comment)The EIA reviews all public comments, summarizes them in a report, and makes any changes to the ICR as a result of the notice and comment period.The updated ICR goes back to the Federal Register for another 30 day notice and comment period, and is concurrently submitted to the OMB for final approval.OMB reviews the final documentation, all comments, and issues their final ruling on whether the survey will proceed.

Notice and comment is a critical aspect of the administrative law process. For agencies such as the EIA, it affords them an opportunity to consider innocuous questions from affected businesses such as: Is collecting this information necessary? Do the ends justify the means? How will you make sure the data the EIA collects is useful, high quality, and will be protected adequately?

The EIA has initially selected 82 operations to send this survey to, as identified in their in-depth analysis published Feb 1.

Under normal circumstances, ICRs like this are not unprecedented. The EIA has routinely conducted surveys on energy use for commercial buildings and manufacturers in the US (one survey on datacenter use had a 26% response rate among 50 surveyed), as well as energy producers and distributors. It appears the EIA has never singled datacenters out for their own survey beyond that pilot one, let alone Bitcoin miners specifically.

However, the EIA and the OMB have decided these are not normal circumstances. They have triggered the emergency provisions of the Paperwork Reduction Act to bypass the notice and comment period and go straight to the part where you hand over all of the information pertinent to your mining operations, or else. What is unprecedented is the EIA using these emergency provisions to target a specific industry with no discernment over size, location, or any other cognizable metric.

There is no 60 day period. There is no 30 day period. Survey starts now.

Pushing Back On The Emergency Order

Why should we, as an industry, be particularly critical about the omission of this seemingly arcane part of administrative agency procedure?

The industry is deprived of at least 90 days to coordinate PR responses, conduct research, and plan legal challenges to the underlying validity of the survey.Timelines to develop a compliance plan, converse with attorneys, and coordinate with team members are significantly truncated.The industry is given zero opportunity to interface with regulators over the type of information requested, industry concerns, or any practical insights miners may be able to provide.Notice and comment periods provide transparency into the decision-making processes of administrative agencies and would allow industry participants to ask why these surveys are necessary, and influence their direction.

Therefore, under threat of criminal penalties and fines of up to $10,633 per day of noncompliance, miners are now required to report to the EIA coordinates of facilities, metrics on electricity consumption, identity of power providers, number and age of ASICs, total hashrate, and more.

This all begs the question…what constitutes an “emergency”? According to the statute, agencies are permitted to request emergency processing when “public harm is reasonably likely to result if normal clearance procedures (namely, notice and comment) are followed.”

By consequence, the stance of the OMB and the EIA is this: “If the standard 90 day notice and comment period is observed, then something could happen that is reasonably likely to cause public harm. If we circumvent the notice and comment period and start collecting data now, then public harm is less likely to occur.”

There are two potential takeaways from this:

The EIA and OMB are really reaching for emergency justification, as little reasonable action could be taken in the next 90 days that would have any material effect on miners’ overall market demand for electricity. There may be reason to consider that utilities use off-peak season for future planning & expansion, so this emergency order would accelerate to account for 2024 on-peak planning.There may be intention to take action in the next 90 days based on the findings of the survey that would materially affect miners’ overall market demand for electricity.

(Readers may find it interesting that the Bitcoin halving is almost exactly 90 days from the 1/26 emergency order)

The question remains…what exactly is the emergency here? Here is what we are given in the official approval of the survey published by the OMB:

“EIA has determined that… public harm is reasonably likely if normal clearance procedures are followed. As evidence, the price of Bitcoin has increased roughly 50% in the last three months, and higher prices incentivize more cryptomining activity, which in turn increases electricity consumption. At the time of this writing, much of the central United States is in the grip of a major cold snap that has resulted in high electricity demand. The combined effects of increased cryptomining and stressed electricity systems create heightened uncertainty in electric power markets, which could result in demand peaks that affect system operations and consumer prices, as happened in Plattsburgh, New York in 2018. Such conditions can materialize and dissipate rapidly. Given the emerging and rapidly changing nature of this issue and because we cannot quantitatively assess the likelihood of public harm, EIA feels a sense of urgency to generate credible data that would provide insight into this unfolding issue. “

The Bitcoin mining industry, no strangers to chaotic economic & regulatory environments, has begun responding.

Industry Response

The emergency ICR has been dispatched to approximately 82 miners, who presumably account for the bulk of the United States’ hashrate. While this data will ultimately be gathered from all commercial miners, our direct conversations with several industry participants suggest that awareness of this ICR might not yet be widespread. However, several mining advocacy organizations have already issued formal responses.

The Texas Blockchain Council (TBC) has come out strongly against the emergency ICR:

“The EIA’s mandatory emergency survey of electricity consumption represents the latest in a politically-motivated campaign against Bitcoin mining, cryptocurrency, and US-led innovation. We believe this should cause concern for all industries that rely on data centers as part of their operations”.

The TBC calls this an “abuse of authority” and points to the abundance of voluntary data transparency already available for the young mining industry. It also points to exhibitions of miner’s synergy by offering “critical grid-stabilizing benefits” which were “on full display during recent periods of cold weather in Texas”.

Dennis Porter of the Satoshi Action Fund says “this is not the hill to die on” and that miners should lean into transparent data reporting as the most productive response. Porter says “bitcoin miners need to avoid putting yet another target on their back” and to avoid escalation. Satoshi Action’s Mandy Gunasekara says “Notably missing from the EIA letters is any information pertaining to Bitcoin mining’s record of curtailing operations at key moments to shore up grids when demand spikes” and encourages miners to participate in their voluntary curtailment survey.

Twitter has produced a range of responses, including observations of the specific peculiarities of the survey, such as geographical coordinates & punitive measures for non-response.

https://x.com/AB_Brammer/status/1753057141622014025?s=20

Issues & Mischaracterizations

EIA Administrator Joseph DeCarolis’s memo to the OMB specifically refers to an event 6 years ago where the presence of cryptocurrency mining allegedly contributed to adverse effects on grid pricing, however we see overwhelming empirical demonstration that mining activity is inversely proportional to grid energy prices. This is either a significant omission or deliberate mischaracterization.

Additionally, the memo claims miners are modular and “will flock to low cost electricity, which makes demand projections difficult to plan.” However, we have seen little evidence that Bitcoin miners are capable of such swift mobility at scale. A similar (and viable) criticism of the industry is the relatively short lifespan of some operations, leaving unused grid capacity after the mining rigs are gone.

Another glaring omission is that while the EIA may not have fully assessed the state of domestic Bitcoin mining, regional utilities have conducted these assessments. These utilities work closely with miners and grid operators to adopt sophisticated demand response contingency plans for the very emergency scenario used to justify the ICR.

Finally, the EIA only cites only two examples for their claim that there is any precedent for emergency ICRs such as this. EIA forms 878 and 888 were used in order to respond to challenges directly related to specific events of war or natural disaster (Hurricane Sandy in 2012 & the Iraq War in 1991) to monitor the availability and affordability of fuel reserves.

Those emergency ICRs were targeted in response to unfolding catastrophes like war and natural disaster. Here, we have a much broader survey being conducted in anticipation of an ill-defined, theoretical emergency.

Conclusion

Our friends and colleagues at the Texas Blockchain Council have stated: “Although Bitcoin is resilient and cannot be banned worldwide, the administration is seeking to make the lives of Bitcoin miners, their employees, and their communities too difficult to bear operating in the United States. This is deeply concerning.”

We agree. We find that both the decision to utilize the emergency provision and circumvent a dialogue with our industry and the purported rationale for the emergency to be at best misguided and potentially in bad faith.

Bitcoin mining is not a threat to the American power grid, public safety, or to residential power costs. Bitcoin mining will bring investment into our rural communities, help optimize electricity markets, capitalize on wasted resources, and can bring prosperity to many jurisdictions that embrace this industry. Let’s ensure America remains pro Bitcoin & pro Bitcoin Mining.

This is a guest post by Charlie Spears and Storm Rund, with advisory input from Micah Burdge and Colin Harper. Opinions expressed are entirely their own and do not necessarily reflect those of BTC Inc or Bitcoin Magazine.

Bitcoin ETF: A Decade Of Struggle For Legitimacy

The crypto revolution was finally taken to new heights when the SEC approved 11 Bitcoin spot ETFs in January 2024. Global investors flooded in like never seen before, adding almost $5 billion of inflows on the first day of trading. As a result, the crossover between traditional finance and digital assets is now firmly established, and a new door of opportunities for crypto will open as the market continues to mature. This marks the end of a decade-long struggle for legitimacy, showcasing the success of progress not only in blockchain technology itself but also in the public’s perception of money. Crypto is here to stay.

In the early years of Bitcoin, many native crypto investors believed that Wall Street needed Bitcoin but not vice versa. This one-way love affair was true for a while, but mostly because of the lack of regulatory clarity worldwide.

The crossover from traditional finance to crypto has always been limited and cautious as every time there was a market correction, experts from Wall Street were more than eager to declare “Bitcoin is dead,’ or ‘the bubble finally burst”. In fact, the assumed death of Bitcoin occurred almost more than 400 times according to research on Binance, but every revival and bull run didn’t swing skepticism of this emerging technology. Traditional finance seems to have finally woken up and accepted that the world has changed since the last global financial crisis and is ready for crypto.

But now that the Bitcoin ETF has arrived, the crypto industry celebrates the milestone with mixed feelings. Indeed, it was quite a journey to get there. ETF approval started back in 2013 with the launch of the Grayscale Bitcoin Trust. Gemini’s spot application in the same year was eventually rejected in 2017. Then, the first futures ETF launched in 2021, paving the way for an eventual spot approval this month.

Since the first approval, many early crypto investors pushed back against the spot ETF. They continue to hold onto the belief of ‘not your keys, not your coins.’ Ultimately their concern is that mainstream institutionalization that these ETFs represent will challenge the decentralization concept held dearly by many in the crypto community.

Bitcoin investors are right to be cautious about centralization, and we are indeed heading in a new direction by embracing traditional finance. Rather than holding on to stale beliefs, it’s now time for the Bitcoin industry to transform the existing outdated infrastructure and focus on welcoming more people to enjoy the benefits of digital assets.

We should not forget that one of the fundamental purpose of Bitcoin was financial inclusion and to help the unbanked. But now with the high cost of transaction fees on the Bitcoin network and the increasingly monopolized mining industry, the playing field has tilted to favor those with the most resources and scale of operations.

That said, Bitcoin has transformed into a stronger store of value attracting both crypto and traditional finance, and Institutional investors are rushing in to amass as much crypto as fast as they can. All this is great for the industry to grow and mature, but the people that the technology was designed to help in the first place remain more or less as stuck as before.

Bitcoin has also faced numerous other challenges stemming from the technical, such as the threat of numerous forks and debates over increasing block size, to bans imposed by a number of nation-states. With the approval of the spot ETFs, the global regulatory environment has turned a corner, now feeling much more open and accepting of Bitcoin investors.

As Bitcoin becomes increasingly adopted by the mainstream in the form of various financial products, it delivers a rare opportunity to directly help those in need. From payment firms to green energy transitions, Bitcoin can help struggling economies by backing their foreign currency reserves and bringing in new investment opportunities through Security Token Offerings and Real-World Asset products. Other innovations can include the issuance of tokens that are pegged to Bitcoin or stablecoins for use in financial applications. The list goes on where Bitcoin can make an impact in people’s day-to-day lives by including them in a globally connected digital economy facilitated by blockchain technology.

Looking ahead to the next decade, the revolution to improve lives around the world through cryptocurrencies will continue. This industry, with Bitcoin at the helm, will continue to reshape an understanding of the changing macroeconomic environment, geopolitical risks, and most importantly the challenging concept of money. The industry has achieved stunning growth and is already impacting the way we interact in society. Changing the world sometimes feels like a movie where you don’t know what the ending is, but it is every small step you take that makes you feel hopeful is all worthwhile.

This is a guest post by Yiwei Wang, with contribution from Nick Ruck, COO of ContentFi Labs. Opinions expressed are entirely their own and do not necessarily reflect those of BTC Inc or Bitcoin Magazine.

Nostr Wallet Connect: A Bitcoin Application Collaboration Layer

Going into the future of Bitcoin adoption and development there is one issue of software interacting that is coming to the forefront of roadblocks developers must deal with: compatibility. As applications and protocols in this space become more complex and featureful in order to meet the needs of actual users and use cases, this presents a dilemma that fundamentally has only two real answers; either an application or wallet must internally integrate every protocol and feature necessary to meet the requirements of its purpose, or different applications must be able to talk to each other.

One example of where this issue crops up is the integration of Lightning into different applications and software tools. Lightning is a very complicated protocol stack to implement, involving numerous sub-protocols dictating how to coordinate and process updates to the state of a Lightning channel. This involves the transaction structure for each channel state and what it is enforcing, the order in which each step of crafting and signing new transactions is conducted to guarantee safety of user funds, and functions to watch the blockchain to react in the appropriate way automatically if invalid states are ever submitted to the blockchain.

This is a lot of complexity for a single application developer to take on themselves directly integrating to their project. The obvious conclusion if that requires too much effort is to depend on already produced software handling the problem of implementing Lightning, and simply build your application to talk to that external software. That leads to the next problem: what if your application’s users don’t use that particular Lightning implementation or wallet?

Even by outsourcing that functionality of an app the development team still hasn’t fully escaped the complexity problem. While they don’t have to fully implement Lightning on their own, a developer taking this route now has to handle incorporating API support for any Lightning wallet the user of their application could potentially be using. This necessitates keeping up with any changes or alterations to multiple Lightning wallets, their API, how the internal features of that wallet works and which ones they support. Not keeping up with any changes in a particular wallet would break their application for users of that wallet.

Some standardized mechanism needs to exist for software on both sides of that gap to simply be able to implement that one thing for all of these different tools to talk to each other. This would allow each application developer, and each Lightning wallet developer, to all simply integrate and maintain one single protocol that would enable their applications to communicate with each other.

Nostr Wallet Connect is a protocol making the attempt at being a truly generalized mechanism for fulfilling this need. When seeking to embed Lightning payments into Nostr, all of these complexity issues arriving from how to do it cropped up.

Lightning And NWC

The team behind Amethyst, a Nostr client, and Alby, the web based Lightning wallet, created NWC in order to solve the problem of Nostr users wishing to integrate Lightning into their Nostr experience without having to use a special purpose wallet. The application/protocol is based on Nostr’s identity architecture where every message (event) sent over Nostr is signed by a cryptographic keypair functioning as your identity on Nostr. This allows an application to simply generate a Nostr keypair, and from that alone have a cryptographic authentication mechanism to use in communicating with an external Bitcoin wallet to fulfill the functionality of the app.

[INSERT INFO HERE]

Using the keypair to register the external application with the Lightning wallet, the application can now ping your wallet to initiate a payment. The specification currently supports paying BOLT 11 invoices, making keysend payments (invoiceless payments made to a node’s public key), paying multiple invoices simultaneously, generating an invoice to present to someone else to pay you, and a few other functionalities to allow payment history and wallet balance queries from the external application.

All of this is coordinated over Nostr, allowing for a very redundant means of communication not dependent on a single centralized messaging mechanism or the user needing to depend on complicated software such as Tor or other protocols to facilitate the network connection between an application and wallet software or infrastructure running on their home network. Nostr also supports encrypted direct messages, meaning the communication between the wallet and the application is entirely private, revealing no details about payments being coordinated to the Nostr relays used to communicate.

On the wallet side of the NWC bridge, security restrictions can be implemented to prevent the external application from having unfettered access to wallet funds in the case the Nostr key used to communicate with the wallet was compromised. Restrictions on the amounts allowed to be spent, as well as the frequency of payments, are configurable on the wallet side of the connection.

NWC is useful for far more than simply integrating Lightning into Nostr applications as well. The entire design philosophy of Nostr itself as a protocol was centered around keeping it simple enough that the entire protocol could be easily implemented correctly by any developer with minimal time and resources. Applications that have nothing to do with Nostr can easily integrate NWC or similar protocols with almost no overhead or complexity to address the underlying issues of how to connect a Bitcoin wallet with their application without having to build it directly into the app.

Beyond Lightning

The potential for a protocol like NWC to provide massive value to wallet and application developers goes far beyond integrating Lightning wallets into special purpose applications. The entire long term direction of interacting with Bitcoin, short of some mind blowing fundamental breakthrough no one has yet realized, is towards interactive protocols between multiple users.

Multiparty coinpools are a perfect example. Most of the specific design proposals like Ark or Timeout trees are built around a central coordinating party or service provider, which can easily facilitate a means of message passing between users wallets, but this hamstrings the design space with a single point of failure. If a hundred users are packed into a coinpool together on top of a single UTXO, the security model is based around each user having a pre-signed pathway to withdraw their coins unilaterally on-chain. This mechanism can be exercised in the event of any failure or disappearance of the coordinator to ensure their funds are not lost, but this is the least efficient way to handle such a worst case scenario.

If users were able to find a mechanism to communicate with each other in the absence of the service provider or coordinator, much more efficient on-chain exits could be achieved by using the larger group multisig to migrate their funds elsewhere with a much more efficient (and therefore cheaper) on-chain footprint. NWC and Nostr are a perfect fit for such a scenario.

Collaborative multisignature wallets between multiple parties could also benefit from such a protocol. In combination with standards like PSBT, a simple Nostr communication mechanism could drastically simplify the complexity of different wallets with multisig support coordinating transaction signing in a smooth and user friendly way.

Discreet Log Contracts (DLC) are another amazing use for such a protocol. The entire DLC scheme relies on both parties being able to access oracle signatures to unilaterally close a contract correctly if both parties will not cooperate to settle it collaboratively. Nostr is the perfect mechanism for oracles to broadcast these signatures, and allow for a simple subscription to their Nostr key in users wallets to automatically track and acquire signatures when broadcast by oracles.

As time goes on and more applications and protocols are built on top of Bitcoin with the requirement of interactivity between users, and between different applications, a general purpose communication mechanism to facilitate that without relying on a single point of failure is going to be sorely needed.

Nostr is the perfect underlying protocol to facilitate that given its incredible simplicity and the redundancy of a large set of relays to utilize. NWC is the perfect example of that being a viable solution.

AI Generated Bitcoin Auction Marketplace Launched By SatsCrap

SatsCrap, a marketplace for trading goods for bitcoin, has unveiled a new feature: Bitcoin and AI-powered auctions, streamlining the process of selling items for sats, according to a press release sent to Bitcoin Magazine. This marketplace allows users to list, bid, and purchase items with ease, all while transacting in KYC-free bitcoin.

“Bitcoin is repricing the world,” says Chris Tramount, Chief Executive Pleb of SatsCrap’s parent company Scarce City. “We’re creating an option for people to exchange crap that will lose value in bitcoin terms over time for the hard money of the future.”

Sellers on SatsCrap are required to deposit a small amount of bitcoin as collateral, ensuring accountability and facilitating a seamless seller experience. Leveraging AI technology, the platform automatically suggests auction titles and descriptions based on uploaded item photos, enabling users to create listings in under 60 seconds.

With a mission to offer the lowest prices on the internet for everyday items and collectibles, according to the release, SatsCrap wants to provide buyers with various payment options, including on-chain or Lightning bitcoin, as well as fiat alternatives like credit card, Afterpay, and Cash App Pay.

Powered by Scarce City’s extensive experience in facilitating bitcoin transactions, SatsCrap aims to help redefine the future of online selling by embracing Bitcoin. The company also stated that to celebrate its launch, SatsCrap is waiving listing fees throughout February.