Month: January 2024

Goldman Sachs Wants Role as Authorized Participant for BlackRock & Grayscale’s Spot Bitcoin ETF

Financial giant Goldman Sachs is in advanced discussions to secure a pivotal role as an authorized participant (AP) for the proposed spot Bitcoin Exchange-Traded Funds (ETF) from BlackRock and Grayscale Investments, CoinDesk reported.

According to insider sources, Goldman Sachs is positioning itself to play a significant role in the creation and redemption of shares for the anticipated spot Bitcoin ETF. Serving as an authorized participant grants firms the authority to facilitate the creation of ETF shares by exchanging them for the underlying assets, in this case, BTC.

Last week, BlackRock named JP Morgan and Jane Street as APs in it’s spot Bitcoin ETF application. Cantor Fitzgerald is also among the APs mentioned in other applications, with Jane Street also serving as an AP for more issuers as well. CoinDesk reported that “a source at a major trading firm said they expected each bitcoin ETF to ultimately have five to 10 APs.”

The move signals Goldman Sachs’ strategic maneuvering to solidify its foothold in the burgeoning Bitcoin market and capitalize on the increasing institutional interest in Bitcoin. Partnering with BlackRock, the world’s largest asset manager, and Grayscale, a prominent digital currency investment firm, amplifies the credibility and potential impact of this.

Amidst the ongoing quest for regulatory approval of a Spot Bitcoin ETF, such a agreement could help catalyze a significant breakthrough in bringing Bitcoin to mainstream investors through traditional investment avenues. While regulatory green lights have remained elusive in the past, the involvement of established financial institutions like Goldman Sachs and BlackRock signals a maturing market and growing acceptance of Bitcoin.

This prospective potential AP agreement underscores the evolving landscape of finance, where traditional financial powerhouses are embracing the potential of Bitcoin. With Goldman Sachs potentially edging closer to a pivotal role in the forthcoming Bitcoin ETFs, the move could mark a transformative step in the integration of Bitcoin into institutional portfolios and traditional investment vehicles.

The Benefits of Cooperation: Nash Bargaining and Bitcoin

This article is featured in Bitcoin Magazine’s “The Primary Issue”. Click here to get your Annual Bitcoin Magazine Subscription.

Click here to download a PDF of this article.

“Economics I think is sort of like accounting — you know, it doesn’t immediately have any morals. You could go into welfare economics, you try to think of some human values or you go into variations.” – John F. Nash Jr., The University of Scranton, November, 2011.

This quotation from John Forbes Nash Jr. is taken from a lecture Nash gave on “Ideal Money and the Motivations of Savings and Thrift”, some 61 years after the publication of his first game theory paper simply named “The Bargaining Problem” (1950).

“The Bargaining Problem” is significant because it is believed to be one of the first examples where an axiomatic approach is introduced into the social sciences. Nash introduces “The Bargaining Problem” as a new treatment of a classical economic problem — regarding it as a nonzero-sum, two-person game, where a few general assumptions and “certain idealizations” are made so that values are found for the game.

The genealogy from “The Bargaining Problem” to Nash’s later works on Ideal Money is established, where in “The Bargaining Problem” Nash remarks upon the utility of money:

“When the bargainers have a common medium of exchange the problem may take on an especially simple form. In many cases the money equivalent of a good will serve as a satisfactory approximate utility function.” John F. Nash Jr., The Bargaining Problem (1950).

Click the image above to subscribe!

Nash’s bargaining proposal is essentially asking about the fairest way to split $1 between participants in a financial transaction or contract, where each side has a range of interests and preferences and where there must be agreement, or else both sides will get nothing. The axioms which are introduced for a Nash bargain go on to define a unique solution.

Nash Equilibrium versus Nash Bargaining

In The Essential John Nash (2007), Harold Kuhn describes Nash’s subsequent “Non-Cooperative Games” (1950) paper, and what later became known as Nash equilibria, as a “clumsy, if totally original, application of the Brouwer fixed point theorem”. Yet it was Nash’s equilibrium idea which bestowed him a public profile through a Nobel prize in the economic sciences. Nash’s life was later dramatized in the Hollywood film A Beautiful Mind.

In “Non-Cooperative Games”, Nash’s theory is based on the “absence of coalitions, in that it is assumed each participant acts independently, without collaboration or communication with any of the others”. In Adam Curtis’s television documentary The Trap (2007), Nash describes his equilibria as social adjustment:

“…this equilibrium which is used, is that what I do is perfectly adjusted in relation to what you’re doing, and what you’re doing or what any other person is doing is perfectly adjusted to what I am doing or what all other people are doing. They are seeking separate optimisations, just like poker players.” John F. Nash Jr., The Trap (2007, Adam Curtis), F*ck You, Buddy.

The difference between Nash equilibrium and Nash bargaining is that axiomatic bargaining (or reaching a Nash bargain) assumes no equilibrium. Instead, it states the desired properties of a solution. Nash bargaining is regarded as cooperative game theory because of its nonzero-sum characteristic and the existence of contracts. Nash extended the axiomatic treatment of The Bargaining Problem in “Two-Person Cooperative Games” (1953), introducing a threat approach in which there is an umpire to enforce contracts — in the process discounting “strategies” as not containing special qualities and rather focusing on formal representation of a determined game.

Ideal Money and Asymptotically Ideal Money

Just before the turn of the century, John Nash starts writing and lecturing on an evolving thesis called Ideal Money. It assumed different iterations over the years, but Nash defined it as money intrinsically free of inflation or inflationary decadence. Nash isn’t so much critical of Keynes the economist or person, but of the psychology of what’s become known as Keynesianism; Nash regarded it a Machiavellian scheme of continual inflation and currency devaluation. Nash believed if central banks are to target inflation, they should target a zero rate for “what is called inflation”:

“It is only really respectable that there should not be an arbitrary or capricious pattern of inflation, but how should a proper and desirable form of money value stability be defined?” John F. Nash Jr., “Ideal Money and Asymptotically Ideal Money”, 2010.

In “Ideal Money”, Nash returns to the axiomatic approach he first establishes in his inchoate game theory. Ideal Money therefore becomes critical of Keynesian macroeconomics:

“So I feel that the macroeconomics of the Keynesians is comparable to a scientific study of a mathematical area which is carried out with an insufficient set of axioms.” John F. Nash Jr., “Ideal Money and Asymptotically Ideal Money”, 2008.

Nash defines the missing axiom:

“The missing axiom is simply an accepted axiom that the money being put into circulation by the central authorities should be so handled as to maintain, over long terms of time, a stable value.” John F. Nash Jr., “Ideal Money and Asymptotically Ideal Money”, 2008.

In 2002, in the Southern Journal version of Ideal Money, Nash realizes an ideal money can’t be completely free of inflation (or too “good”), as it will have problems circulating and could be exploited by parties who wish to safely deposit a store of wealth. Nash then introduces a steady and constant rate of inflation (or asymptote) which could be added to lending and borrowing contracts.

Indeed, Nash describes the purpose of Ideal Money in a cooperative game and microeconomic context:

“A concept that we thought of later than at the time of developing our first ideas about Ideal Money is that of the importance of the comparative quality of the money used in an economic society to the possible precision, as an indicator of quality, of the contracts for performances of future contractual obligations.” John F. Nash Jr., “Ideal Money and Asymptotically Ideal Money”, 2008.

Bitcoin as an Axiomatic Design

If Nash’s view of economics was that it lacks any immediate morals — and that values, assumptions, axioms, variations, or idealizations can be introduced to determine a nonzero-sum or determined game which provides welfare for all participants — then it is worth considering if these axioms are present in the Bitcoin system, given that Nash, together with Satoshi, were both critical of the arbitrary (or undetermined) nature of centrally managed currencies.

Pareto Efficiency

The presence of Pareto efficiency is perhaps the most demonstrative Nash bargaining axiom (see illustration) in Bitcoin with respect to the cumulative supply density and distribution: The majority of coins are mined relatively early in the Bitcoin lifespan (loosely following the Pareto 80/20 power law).

Scale Invariance

The scale invariance is present through the difficulty adjustment mechanism which keeps bitcoin supply “steady and constant” (a phrase both Nash and Satoshi use). No matter how popular or unpopular bitcoin becomes to mine, the scale invariance should mean players can form realistic expectations on the value of bitcoin, and that their underlying preferences shouldn’t change regarding this. The internal divisibility of bitcoin also means the value a coin is expressed in (whether the U.S. dollar or other currency) shouldn’t matter over shorter or immediate time frames — just as room temperature can be expressed as Celsius or Fahrenheit without affecting the actual temperature. These differences should become clear only over the longer term or in intertemporal transactions.

The adjustment mechanism also keeps total bitcoin supply at just under 21 million, due to a side effect of the system data structure, and therefore introduces the asymptote.

Symmetry

Nash’s symmetry axiom is present in the pseudonymity and decentralization of the Bitcoin network, which provides for equality of bargaining skill (a phrase Nash introduces in “The Bargaining Problem”) through not having to prove first-person identity in participating in the core or primary network. It means there isn’t a centralized or trusted principal responsible for minting the coins, a “grand pardoner” in Nash’s words. In relation to Nash bargaining, two players should get the same amount if they have the same utility function, and are therefore indistinguishable. Alvin Roth (1977) summarizes this as the label of players not mattering: “If switching the labels of players leaves the bargaining problem unchanged, then it should leave the solution unchanged.”

Independence of Irrelevant Alternatives (IIA)

Finally, there is Nash’s most controversial bargaining axiom: the Independence of Irrelevant Alternatives. In simple terms, this means adding a third (or non-winning candidate) to an election between two players shouldn’t alter the outcome to the election (third parties become irrelevant). If peer-to-peer is referring to a two-player game, with the Bitcoin software acting as a third-party arbitrator or umpire to “the game” with the software designed to a set of values or axioms, then it’s possible that IIA is present in Bitcoin’s proof-of-work. This speaks to a social group preference context: The proof-of-work says it solves the problem of the determination of representation in majority decision-making, and that Nash’s axiomatic bargaining (in both “The Bargaining Problem” and “Two-Person Cooperative Games”) explicitly addresses formal representation in determinative games.

Characteristics and Benefits of Cooperation

Generally speaking, there are believed to be three conditions required for a cooperative game:

Reduced participants, as there is less room for verbal complications, i.e., two players.Contracts, where participants are able to agree on a rational joint plan of action, enforceable by an external authority such as a court.Participants are able to communicate and collaborate on the basis of trusted information and have full access to the structure of the game (such as the Bitcoin blockchain).

In respect of a nonzero sum game and the money preference, John Nash reflects on how money can facilitate transferable utility by way of “lubrication”, and makes this observation:

“In Game Theory there is generally the concept of ‘pay-offs’, if the game is not simply a game of win or lose (or win, lose, or draw). The game may be concerned with actions all to be taken like at the same time so that the utility measure for defining the payoffs could be taken to be any practical currency with good divisibility and measurability properties at the relevant instant of time.” John F. Nash Jr., “Ideal Money and the Motivation of Savings and Thrift”, 2011.

Click the image above to download a PDF of the article.

The benefits of cooperation reduce the need for mediation or dispute resolution as contracts and agreements become more trustworthy; less border friction in trading; a nonzero-sum outcome (win-win bargaining or welfare economics); more intuitive, informal decision-making; and the possibility for coalition formation which John Nash ultimately defines as a world empire context. The latter makes resolutions to difficult problems like net zero (or any other problem requiring multilateral coordination) more realistic. Nash likens his Ideal Money proposal to old-fashioned sovereigns:

“Any version of ideal money (money intrinsically not subject to inflation) would be necessarily comparable to classical “Sovereigns” or “Seigneurs” who have provided practical media for use in traders’ exchanges.” John F. Nash Jr., “Ideal Money and the Motivation of Savings and Thrift”, 2011.

Nash also reflects in 2011 on a “game” of contract signatures, as if Ideal Money is the contract:

“It is as if there is another player in the game of the contract signers and this player is the Sovereign who provides the medium of currency in terms of which the contract is to be expressed.” John F. Nash Jr., “Ideal Money and the Motivation of Savings and Thrift”, 2011

Concluding Remarks

It’s plausible to describe the Bitcoin system as a cooperative game in a non-cooperative setting, and while it may be that the axioms present in Bitcoin are not limited to just those required for a Nash bargain, it would appear there are ingredients in the system design that give Bitcoin a deterministic characteristic. At the very least, they contain certain morals as Nash remarked as desirable in his Scranton lecture.

Finally, John Nash first conceived his bargaining solution in 1950. It is perhaps fitting therefore he provides a simpler context to framing the question of money as that of “honesty” in one of his final lectures on the subject delivered to the Oxford Union shortly before his death in 2015.

References

A Beautiful Mind – S Nasar

“The Bargaining Problem” – J Nash

“Non-Cooperative Games” – J Nash

“Two-Person Cooperative Games” – J Nash

The Essential John Nash – H Kuhn & S Nasar

Nash Bargaining Solution – Game Theory Tuesdays – P Talwalkar

This article is featured in Bitcoin Magazine’s “The Primary Issue”. Click here to get your Annual Bitcoin Magazine Subscription.

Click here to download a PDF of this article.

First Ever Bitcoin Duncan Yo-Yo Launches

Today, Collect & HODL Co, a subsidiary of ProSnacktive Sales LLC, in collaboration with the renowned toy company Duncan Toys, has announced the launch of a Limited Edition, first ever Bitcoin-themed Duncan Butterfly XT Yo-yo, per a press release sent to Bitcoin Magazine.

The Yo-yo, symbolizing the market’s ups and downs akin to Bitcoin’s fluctuations, aims to offer a playful representation of the Bitcoin journey. These Bitcoin-themed yo-yos are available for purchase exclusively on Walmart Marketplace.

“We’re back with a new Bitcoin item that all ages can enjoy!” said Chris Coradini, Owner of Collect & HODL Co. “We’ve worked with another iconic, 90+ year old company, Duncan Toys, to bring this to all Bitcoin (and yo-yo) enthusiasts. We continue to feel overly bullish on the market and demand for Bitcoin. That’s why we’re laser focused on blending Bitcoin with meaningful brands that all Bitcoin investors will appreciate!”

In March 2023, the company announced the world’s first Bitcoin-themed PEZ dispenser. Launching a limited 30,000 units of the famous candy dispenser. A few months later in November, the company also helped launch the first ever Bitcoin-themed Crocs.

This is not a paid ad. Bitcoin Magazine is not affiliated with this product. Bitcoin Magazine is not making money from this. Due your own due diligence before purchasing.

Bitcoin As A 21st Century Piece Of Eight

Many commentators compare Bitcoin with gold, the idea being that its finite supply makes it an attractive long-term store of value. There have been historical examples of broad adoption of gold currencies, such as the British Empire’s sovereign and half-sovereign. However, adoption of the sovereigns was often promoted and directed by the British imperial government, much to the dismay of local administrators who often suffered currency shortages. Bitcoin has no nation state to promote its adoption, so the comparison between it and gold sovereigns is a weak one. One of the world’s most heavily used silver currencies, the Spanish silver dollar, may offer a better comparison.

The Spanish silver dollar, or reale as it was originally known, was unusual because it prospered as a trade currency while Spain, its nation of origin, declined. In addition, it was adopted in countries that were never Spanish colonies, thus violating the premise that a currency can only thrive if it has a strong home country promoting its use. The three main factors behind the reale’s success were its availability, quality and verifiability.

The reale was created in 1497, five years after Columbus landed in America, when King Ferdinand and Queen Isabella reformed Spain’s monetary system through the Pragmatica de Medina del Campo. The new silver reale could be divided into eight parts, hence ‘pieces of eight’. Note that it is not to be confused with ‘doubloons’, which were made from gold.

Fifty years later in 1545 the Spanish discovered the Cerro de Potosi in present day Bolivia, which was the richest source of silver in the history of the world. A shortage of coins led to the Spanish crown permitting the minting of reales in New Spain in 1535. At the same time, Portuguese explorers had discovered not only the route to the Indies and China, thus sidestepping the Arabs and the Venetians who traded in gold ducats along the Silk Route, but also that merchants in East Asia preferred silver over gold. Chinese demand was particularly large as a shortage of bronze used in the coins of the Ming dynasty forced merchants to seek alternatives. Demand for silver soon outstripped both Chinese and Japanese supply, creating a ready market for the regular shipments of reales from the colonies of New Spain to the Philippines, another Spanish colony.

Its adoption spread throughout the Americas such that by 1792 it was the de facto currency of the newly independent United States. Indeed, when the US dollar was first issued it was pegged to the reale. 87 years later in 1879 China would do the same thing, pegging its new yuan to the reale or the Mexican peso as it was then known. The growth of the Spanish Empire therefore provided the distribution and availability across both America and Asia, which was the first step towards its success.

The second factor was that the Spanish government ensured the reale’s quality stayed consistent, which in turn meant its value remained stable. Unlike many other currencies of the era, the reale was subject to very limited debasement. However, while the reale remained strong, the domestic Spanish economy weakened. Efforts to combat inflation, some of which involved debasing the domestic vellon coinage, stifled exports and encouraged imports and further crippled the Spanish economy. These policies, when combined with the demands of continuous conflict and profligate royal spending, ultimately led to a great deal of the silver reales being exported to the rest of Europe. The other European nations, particularly the Dutch and the British, were keen to compete with the Spanish empire and so needed the silver to buy tea, silks and spices from China and Asia. The early English East India Company had started out by trying to sell heavy woollen cloth in India and China, unsurprisingly with very limited success. Using silver reales was much easier.

The final factor in the reale’s success was verifiability. Other countries had tried to replicate the reale, but even foreign coins of the same quality and weight were rejected by Chinese and Asian traders, since it was easier to assume that the Spanish reales were consistent. The US was one such unsuccessful competitor. In 1872 the US Treasury noted that while the reale commanded a 6-8% premium in East Asia, American silver suffered a 2% discount. Therefore in 1873 the US Coinage Act authorised the creation of a US ‘Trade dollar’. This new coin came to be known as the ‘Eagle dollar’ owing to its Bald Eagle design. The US expected to profit from seigniorage based on the belief that most of the Eagles would never cross back across the Pacific to where they could be redeemed.

The Eagle had mixed success. Despite an endorsement by the Tongzhi Emperor, it was adopted to a limited extent in the south of China, but not the north. More disappointingly, as the value of silver fell the Eagle started reappearing in the US where its silver content was less than its face value, leading to redemptions. It was gradually phased out and, indeed, from 1873 many countries started to migrate to the gold standard.

So, the question remains whether Bitcoin, which has no nation at all, could ever be treated as a trade currency. Like the Spanish silver dollar it is, in principle, abundantly available since it sits on the open internet. Where the reale was of consistent weight and purity so Bitcoin has a consistent design and structure. The maths that underpins it is the same in any country. Where the reale had earned what was effectively brand recognition, allowing it to be easily recognised by holders, so Bitcoin is easily verifiable because it sits on a public ledger with a hashed immutable structure. It took the reale about a hundred years to gain its recognition and status and the same may be true, in time, of Bitcoin. While there may be criticism of Bitcoin’s suitability as a means of exchange, which the reale certainly had, what is undeniable is that Bitcoin shares several of the features of success that underpinned adoption of the reale in its availability, quality and verifiability.

That one currency achieved wide adoption as its home nation was in decline was remarkable. That Bitcoin has achieved this with no home nation at all is even more remarkable.

This is a guest post by Nick Philpott. Opinions expressed are entirely their own and do not necessarily reflect those of BTC Inc or Bitcoin Magazine.

The Real Implications Of Cash Creation Instead of In Kind

The SEC has been busy, meeting with all of the potential issuers of spot Bitcoin ETFs with active applications in December. These meetings have resulted in the universal adoption of a cash creation methodology by those issuers instead of “in kind” transfers, as is typical for other ETFs. Much has been said about this change, ranging from the absurd to the serious. The TLDR, however, is the overall impact will be minimal to investors, relatively meaningful to the issuers and it reflects poorly on the SEC overall.

In order to provide context, it is important to describe the basic structure of Exchange Traded Funds. ETF issuers all engage with a group of Authorized Participants (APs) that have the ability to exchange either a predefined amount of the funds assets (stocks, bonds, commodities, etc) or a defined amount of cash or a combination of both, for a fixed amount of ETF shares for a predetermined fee. In this case, were “in kind” creation to be allowed, a fairly typical creation unit would have been 100 Bitcoin in exchange for 100,000 ETF shares. With cash creation, however, the Issuer will be required to publish the cash amount, in real time as the price of Bitcoin changes, to acquire, in this example, 100 Bitcoin. (They also must publish the cash amount that 100,000 ETF shares can be redeemed for in real time.) Subsequently the issuer is responsible for purchasing that 100 Bitcoin for the fund to be in compliance with its covenants or selling the 100 Bitcoin in the case of a redemption.

This mechanism holds for all Exchange Traded Funds, and, as can be seen, means that the claims that cash creation means the fund wont be backed 100% by Bitcoin holding is wrong. There could be a very short delay, after creation, where the Issuer has yet to buy the Bitcoin they need to acquire, but the longer that delay, the more risk the issuer would be taking. If they need to pay more than the quoted price, the Fund will have a negative cash balance, which would lower the Net Asset Value of the fund. This will, of course impact its performance, which, considering how many issuers are competing, would likely harm the issuers ability to grow assets. If, on the other hand, the issuer is able to buy the Bitcoin for less than the cash deposited by the APs, then the fund would have a positive cash balance, which could improve fund performance.

One could surmise, therefore, that issuers will have an incentive to quote the cash price well above the actual trading price of Bitcoin (and the redemption price lower for the same reason). The problem with that, is the wider the spread between creation and redemption cash amounts, the wider the spread that APs would likely quote in the market to buy and sell the ETF shares themselves. Most ETFs trade at very tight spreads, but this mechanism could well mean that some of the Bitcoin ETF issues have wider spreads than others and overall wider spreads than they may have had with “in kind” creation.

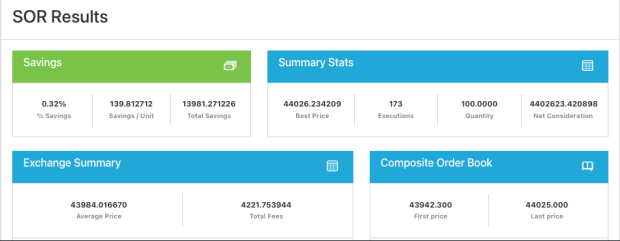

Thus, the issuers have to balance the goal of quoting a tight spread between creation and redemption cash amounts with their ability to trade at or better than the quoted amounts. This requires, however, access to sophisticated technology to achieve. As an example of why this is true, consider the difference between quoting for 100 Bitcoin based on the liquidity on Coinbase alone, vis a vis a strategy that uses 4 exchanges that are regulated in the U.S. (Coinbase, Kraken, Bitstamp and Paxos). This example used CoinRoutes Cost Calculator (available by API) which shows both single exchange or any custom group of exchanges cost to trade based on full order book data held in memory.

In this example, we see that a total purchase price on Coinbase alone would have been $4,416,604.69 but the price to buy across those 4 exchanges would have been $4,402,623.42, which is $13,981.27 more expensive. That equates to 0.32% more expense to buy the same 100,000 shares in this example. This example also shows the technology hurdle faced by the issuers, as the calculation required traversing 206 individual market/price level combinations. Most traditional financial systems do not need to look beyond a handful of price levels as the fragmentation in Bitcoin is much larger.

It is worth noting that it is unlikely the major issuers will opt to trade on a single exchange, but it is likely that some will do so or opt to trade over the counter with market makers that will charge them an additional spread. Some will opt to use algorithmic trading providers such as CoinRoutes or our competitors, which are capable of trading at less than the quoted spread on average. Whatever they choose, we do not expect all the issuers to do the same thing, meaning there will be potentially significant variation in the pricing and costs between issuers.

Those with access to superior trading technology will be able to offer tighter spreads and superior performance.

So, considering all of this difficulty that will be borne by the issuers, why did the SEC effectively force the use of Cash Creation/Redemption. The answer, unfortunately, is simple: APs, by rule are broker dealers regulated by the SEC and an SRO such as FINRA. So far, however, the SEC has not approved regulated broker dealers to trade spot Bitcoin directly, which they would have needed to do if the process was “in kind”. This reasoning is a far more simple explanation than various conspiracy theories I’ve heard, that do not deserve to be repeated.

In conclusion, the spot ETFs will be a major step forward for the Bitcoin industry, but the devil is in the details. Investors should research the mechanisms each issuer chooses to quote and trade the creation and redemption process in order to predict which ones might perform best. There are other concerns, including custodial processes and fees, but ignoring how they plan to trade could be a costly decision.

This is a guest post by David Weisberger. Opinions expressed are entirely their own and do not necessarily reflect those of BTC Inc or Bitcoin Magazine.

Bitcoin Magazine Editorial Policy on Bitcoin Tokens

The creation of arbitrary tokens on top of the Bitcoin protocol is by no means new.

In Bitcoin’s now 15-year history, there have been many attempts to create compatible protocols that leverage the data storage provided by Bitcoin nodes in an attempt to allow the creation of new cryptocurrencies and crypto assets. There have also been numerous attempts to market these assets to the public via sales, mining schemes, or more creative issuances.

However, in response to the heightened market activity surrounding the BRC-20 protocol, we feel the need to take this opportunity to reassert Bitcoin Magazine’s Editorial positioning.

Effective January 2024:

Bitcoin Magazine remains open to platforming dialogue on token standards – From the early days of Counterparty to modern attempts to use Lightning for asset issuance (Taproot Assets, Synonym, RGB), Bitcoin Magazine has always reported on new bitcoin-based token protocols in its news and opinion articles.

As Bitcoin token standards are a technical concept, representing the scientific debate on the limits and potential of the network, we hold that discussing these protocols and increasing understanding of their functioning is in the public interest.

As such, we will continue to publish content on these protocols, the differences between said protocols, as well as how they compare to offerings in the wider crypto market.Bitcoin Magazine remains opposed to platforming dialogue on the market activity of Bitcoin tokens or token issuers – Bitcoin Magazine will uphold its long-standing policy of refraining from covering the market performance of both Bitcoin assets and Bitcoin asset issuers. This will extend to discussing exchange listings and market movements, even when referenced in unrelated news and opinion content.Bitcoin Magazine remains open to platforming dialogue on novel issuance and market distribution mechanisms utilized by Bitcoin token issuers. This includes potential advances in their minting, auctioning, and distribution tactics, as well as the various technical and regulatory ramifications of these methods. Bitcoin Magazine remains open to platforming dialogue and critiques about our policies and their validity. We believe the aforementioned policies offer the greatest benefit to our reader while minimizing the risk of consumer harm, but welcome critical feedback. Submissions can be sent to: editor@bitcoinmagazine.com.

This policy clarification does not apply to our stablecoin or Ordinals coverage.

Further, it pertains only to BitcoinMagazine.com and its Print publication, and does not represent policies enforced by the Bitcoin Magazine social media team, the Bitcoin conference, Rare BTC or UTXO Management, the institutional fund owned and operated by BTC Inc, and which may have exposure to various Bitcoin-based tokens or token issuers.

High Fees vs. “High Fees”: How I Learned To Stop Worrying And Love The Mempool

The recent surge in Bitcoin’s on-chain fees has reignited a familiar discussion within our community, bringing to the surface diverse perspectives on the implications and root causes of this trend. A faction within the community views these heightened fees as a strategic solution to Bitcoin’s security budget concerns. In contrast, others see them as a formidable barrier, potentially stymieing Bitcoin’s global adoption. This issue is especially pertinent for newcomers in Western markets and communities in the global south, where the proportionally higher transaction costs can be especially burdensome.

The marked increase in fees, denominated in BTC, is primarily driven by the rising popularity of ordinal inscriptions, BRC-20 tokens, and similar contrivances on the Bitcoin network. Ordinal inscriptions, which involve embedding data into the witness portion of a transaction, have become increasingly popular for creating digital collectibles and unique assets on the Bitcoin blockchain. While this practice is somewhat novel, it demands additional block space, thereby heightening the overall demand and, consequently, escalating transaction fees.

Moreover, the advent and growing popularity of BRC-20 tokens – a standard akin to Ethereum’s ERC-20, but for the Bitcoin network – has further contributed to network congestion. These tokens, often created for speculation and distribution of memecoins, require complex and often sizable transactions. The aggregate effect of these transactions intensifies the network load, further amplifying the issue of surging fees in BTC terms.

The Fundamental Shift in Network Utilization

It is essential to recognize that these techniques, and others likely to emerge, signify a paradigm shift in the utilization of the Bitcoin network. The resulting elevation in transaction fees, when measured in BTC, mirrors these evolving use cases and underscores the necessity for continual advancements in network scalability and efficiency. Others have discussed some responses to these issues, and I will not comment on specific responses other than the two below.

Re-litigating the Blocksize War

It’s important to acknowledge the topic of blocksize, albeit cautiously. The idea of re-opening the blocksize war, often suggested by some non-bitcoin factions, is not only counterproductive but also disregards the nuanced understanding required to address the current fee environment. The network’s security and efficiency do not necessitate a blocksize increase, especially not in response to the transitory strains caused by specific uses like JPEGs or BRC-20s.

The Mining Sector’s Perspective

As for the mining sector, the burgeoning interest in Bitcoin has led to novel approaches in mining pool operations, as seen with Ocean and Braidpool. These entities enable miners to create their own transaction templates and actively manage network congestion, with Ocean notably filtering out what it considers spam transactions. This evolution in mining strategies represents a balance between profit motives and the responsibility of maintaining an efficient network.

Understanding The Dual Nature of “High Fees”

High Fees in Real Terms vs. BTC Terms

When dissecting the nature of high fees in Bitcoin, it’s imperative to differentiate between fees in real terms (USD) and those in BTC terms. The increase in fees in real terms is a reflection of Bitcoin’s maturation and its growing significance in the global economy, a testament to its success. Conversely, high fees in BTC terms highlight a temporary bottleneck in the network, underscoring the need for technological and community-driven innovations to bolster the network’s efficiency and scalability.

Common Themes of High Fees

A Self-Regulating Economy: Bitcoin’s fee market epitomizes a self-regulating economy. Users valuing prompt and guaranteed transactions willingly pay more, bolstering the network’s security and evolution. This self-regulation is pivotal to Bitcoin’s resilience, adapting organically to market dynamics.Efficient Use of Block Space: The high fees encourage judicious use of block space, fostering innovative applications of the Bitcoin network. Developments in second-layer solutions like Lightning, Fedimint, and Liquid are particularly noteworthy, as they promise faster transactions at reduced costs, albeit with certain trade-offs.

Celebrating High Layer-1 Fees in Real Terms

As Bitcoin forges ahead in its journey to global currency status, the inevitability of high Layer-1 fees, in real terms, is not a cause for alarm but a milestone to be celebrated. The era where transactions at even 1 sat/vB become costly marks a significant chapter in Bitcoin’s success and global influence. Resisting this trend is not just futile, but runs counter to the very ethos of Bitcoin’s growth and stability.

Reflecting Bitcoin’s Value and Demand: The correlation between high transaction fees in real terms and Bitcoin’s increasing value and demand is unmistakable. As Bitcoin cements itself as a viable investment and transactional asset, the willingness to incur higher fees reflects its perceived utility and worth. This is a bullish signal for Bitcoin’s sustainability and long-term success.From Block Rewards to Transaction Fees: The shift from miner revenue based on block rewards to transaction fees is an essential evolution of Bitcoin’s economic model. As we edge closer to the Bitcoin supply cap, high transaction fees in real terms become crucial for compensating miners, ensuring the network’s security and longevity.Signifying Asset Maturation: High transaction fees in real terms also signify Bitcoin’s maturation as an asset class. Similar to traditional financial systems, the presence of transaction fees in the Bitcoin network underscores its evolution from a niche technological experiment to a globally recognized financial asset.Reflecting Deflationary Nature: Unlike fiat currencies, Bitcoin’s deflationary design is expected to increase its value over time. High fees in real terms validate this deflationary nature; as Bitcoin becomes more valuable, the cost to transact in Bitcoin naturally rises. This phenomenon is both expected and indicative of a successful deflationary model.

Challenges Posed by High Fees in BTC Terms

While the narrative of high Layer-1 fees in real terms underscores Bitcoin’s burgeoning role and value, the high fees in BTC terms present unique challenges that warrant careful consideration. This distinction is vital for comprehending both the current state and the future scalability of the network.

Barrier to Widespread Adoption: Exorbitant fees in BTC terms pose a significant obstacle, especially for those in developing regions or engaging in smaller transactions. The universal appeal of Bitcoin as a global currency is intrinsically linked to its accessibility and affordability. If high BTC-denominated fees persist, they risk undermining Bitcoin’s promise as a tool of financial inclusion and empowerment.Network Congestion and User Experience: Rising fees in BTC terms often signal network congestion, leading to prolonged transaction times and a diminished user experience. For Bitcoin to thrive as a practical, day-to-day transactional medium, it must offer consistent reliability and efficiency. Current high fees in BTC terms point to a bottleneck in transaction processing, which can deter both prospective and existing users.Centralization Concerns: While all high fees tend to encourage centralization, those in BTC terms have a pronounced impact, potentially shifting transaction processing towards larger entities capable of affording such fees. This shift challenges Bitcoin’s decentralized ethos, with potential implications for its security, integrity, and overall trustworthiness.

The Myth of the “Security Budget Issue” and the “Mining Death Spiral”

A common misconception within Bitcoin discussions is the fear of a ‘security budget issue’ or a ‘mining death spiral.’ These concerns often stem from misunderstandings about the halvings and the decreasing block subsidy, leading to apprehensions about inadequate miner incentives.

However, such fears fail to account for the crucial factor of purchasing power. Consider this: if Bitcoin’s value reaches $550k, even a constant block fee of around 25M sats would surpass the current 6.25 BTC block subsidy’s purchasing power at today’s $40k/BTC. What matters most is not the quantity of Bitcoin awarded, but the purchasing power it represents. As long as this continues to increase, miner remuneration remains sustainable and secure.

The focus should not be on increasing fees in Bitcoin terms or considering alternatives like tail-emission, but rather on ensuring that the purchasing power derived from transaction fees continues to grow. This is the cornerstone of Bitcoin’s economic model, emphasizing the importance of a unitary currency system.

Layer-2 Technologies and Fee Dynamics

The emergence and integration of Layer-2 technologies represent a critical evolution in Bitcoin’s ecosystem. While these technologies might reduce fees in BTC terms, they are essential for the network’s scalability and future viability. Efficient Layer-2 solutions can potentially compress transactions more effectively than currently possible on Layer-1.

High fees in BTC terms signal the need for more extensive and innovative Layer-2 solutions, to ensure the scalability and efficiency of the network. It’s clear that the Bitcoin blockchain, in its current state, cannot handle a significant fraction of global daily transaction volume – nor should it aim to. The real solution lies in a combination of improved Layer-2 innovations, renegotiating conventions, and possibly revising consensus mechanisms.

Conclusion

In summing up the discourse on Bitcoin’s transaction fees, it becomes evident that the dual perspectives of high fees – in real terms versus BTC terms – are emblematic of a currency in the throes of evolution and maturation. *There is no need for increasing fees in Bitcoin terms, or anything like tail-emission, so long as the purchasing power continues to increase.* Which, you’ll note, is the entire point of a depreciating or unitary currency.

High fees in real terms should be seen not as a deterrent but as a hallmark of Bitcoin’s increasing value and mainstream adoption. This trend, though challenging, is a testament to the growing acceptance of Bitcoin as a significant financial asset on the global stage. It highlights Bitcoin’s journey from a novel digital experiment to a robust, decentralized financial system.

Conversely, the challenges posed by high fees in BTC terms underscore a critical juncture in Bitcoin’s development. They emphasize the need for innovative solutions to enhance network efficiency and scalability, ensuring Bitcoin remains accessible and viable for a diverse, global user base, and an escape hatch on the ever encroaching fiat. As the Bitcoin community navigates these complexities, the focus must remain on advancing technologies and strategies that uphold the core principles of decentralization, security, and inclusivity.

In navigating the future, the Bitcoin ecosystem must balance its growing value with the pragmatic approach to its technical and economic challenges. The evolution of Layer-2 technologies, along with community-driven initiatives, will be pivotal in addressing these challenges. As Bitcoin continues to evolve, it stands not only as a testament to the ingenuity of its design but also as a beacon for the potential of decentralized digital currencies to revolutionize the financial landscape.

The author would like to acknowledge @theemikehobart, @cryptoquick, @GrassfedBitcoin, and @barackomaba, who contributed thoughts and comments during the drafting of this article.

This is a guest post by Colin Crossman. Opinions expressed are entirely their own and do not necessarily reflect those of BTC Inc or Bitcoin Magazine.

VanEck Commits to Donating 5% of Spot ETF Profits Over a Decade to Bitcoin Core Developers

In a significant move showcasing dedication to the broader Bitcoin ecosystem, VanEck, a notable investment management firm, has pledged to allocate 5% of profits generated from their Spot Exchange-Traded Fund (ETF), if approved by the SEC, towards supporting Bitcoin Core developers for a period exceeding a decade.

VanEck has already started this initiative by making an initial $10,000 donation to Brink, an independent nonprofit to support open-source development for Bitcoin.

The announcement underscores the company’s commitment to nurturing and fortifying the fundamental infrastructure of Bitcoin. This initiative aims to provide sustainable support to the developers contributing to the ongoing enhancement and maintenance of the Bitcoin Core protocol. It’s important to note that VanEck is now incentivized to make contributions like this to further Bitcoin development, as the network and asset grow stronger, it could help the sell the appeal for buying their ETF to potential customers.

“We’re not Bitcoin tourists at VanEck. We’re in it for the long haul,” VanEck stated. “That’s why we made an initial $10k donation and signed a pledge to donate 5% of our Bitcoin ETF profits (if approved) to support Bitcoin Core devs @bitcoinbrink for at least 10 years. Your tireless dedication to decentralization and innovation is the cornerstone of the Bitcoin ecosystem, and we’re here to support it—more details to come.”

By dedicating a portion of their ETF profits, VanEck aims for developers to continue fostering innovation, security, and resilience within the Bitcoin network. The pledge not only signifies a financial commitment but also reflects a long-term vision in contributing to the evolution and longevity of Bitcoin.

The move has garnered some praise within the Bitcoin community for its proactive stance in acknowledging the critical role played by Bitcoin Core developers. These individuals contribute significantly to the open-source development of the protocol, ensuring its robustness and adaptability in the face of technological advancements and potential threats.

VanEck’s commitment to allocating a portion of profits towards supporting Bitcoin Core developers illustrates a growing trend of corporate entities recognizing the importance of investing in the sustainability and growth of Bitcoin. As the company positions itself for a potential spot Bitcoin ETF approval, where large amounts of institutional and retail capital can flow into BTC, this pledge could have a profound and enduring impact on the Bitcoin development landscape for years to come.

Developers Don’t Work For You

I have a feeling that I am going to be writing a lot on this topic in general for the foreseeable future, but the philosophical and existential crisis currently confronting the Bitcoin space over what constitutes “spam” is starting to have massive second order effects and consequences in all of the different Bitcoin communities.

I want to specifically focus on the reaction to this debate spilling over into what charitably can be construed as debating with Core developers, but in reality in most cases has taken the form of what can only be called harassment. This can be a very nuanced and subtle aspect of how Bitcoin works, as the relationship between “customers” that actually utilize Bitcoin and the developers that work to maintain, improve, and optimize the protocol and tools built on top of it is not a clear cut category separation. Many people who use Bitcoin are developers, and many developers are users of Bitcoin. There is no hard line distinguishing between the two, and someone who is one or the other can over time become both. In the same regard people who fall into both categories could cease to do so, and simply become solely a developer or solely a user. That is the first thing to understand, the line between users and developers is totally arbitrary, with constant overlap and the potential for that overlap to grow and shrink at any time.

That said, what about the users who are not developers? What is their relationship with the people actually writing and maintaining the software? There is no real black and white clear answer, but I can tell you what the relationship is not: an employer/employee relationship.

Developers do not work for us. Full stop. They are not our employees. We do not pay their bills, we do not fund their work, they do not have any contractual or legal obligations to us whatsoever. We are not product managers, we do not provide them with a project roadmap and dictate what pieces they work on, how they work on them, in what order, or what those pieces should even be or how they should function.

Disabuse yourself of any notion that this ecosystem functions in any way remotely like that. It does not. Developers freely choose to contribute their time to an open source protocol completely on their own terms. They decide how much time to spend, what to spend it on, and the way they actually implement what they chose to work on. Full stop. They have complete and unfettered autonomy in every way regarding how they interact with Bitcoin as a project.

Now turn that around to look at users. Users of Bitcoin are under no obligation whatsoever to adopt a change or tool that developers produce. Nothing is forcing users to change the software they run, or adopt a new tool developers build on top of Bitcoin. Having a Netflix subscription does not obligate you to watch a single piece of content they produce, it does not obligate you to consume any specific volume of content. You can watch as much or as little as you choose to, you can even cancel your subscription if you want. Netflix has literally no control over how you interact with it whatsoever except purely through the power of voluntary persuasion.

This is how Bitcoin works. Harassing developers on GitHub will not change that. It will not magically turn your relationship with developers into one of an employee/employer. Not only will crying on GitHub accomplish nothing whatsoever to create or bring about that power dynamic that many Bitcoiners seem to want to bring into existence, but it accomplishes nothing productive whatsoever. I say that as someone who has personally debated numerous issues with developers over the years, asserted numerous times that developers are incorrect about some issue or plan of action they think is the most appropriate one to take.

GitHub is not the place for arguing what the existential purpose or reason for Bitcoin existing is. It’s a place for narrow concept and implementation debate and criticism, for the express purpose of improving whatever technical proposal is being made. Whether that leads to a proposal being incorporated into Bitcoin, or rejected from Bitcoin, should be entirely up to the outcome of purely rational and logical discussion.

Even in the case where you do have a truly rational argument or piece of input, are you going to actually stick around and contribute or participate in the development process consistently? Or are you just essentially doing a drive by review or input on a specific issue to bikeshed it? Yes? Then even with a rational argument in hand, GitHub is not the appropriate place for those discussions. We have Twitter, we have Reddit, we have Spaces, we have numerous other places to debate and work towards consensus on things without actively interjecting nonsense and philosophical debates about semantics into the development process.

And I reiterate that I am a person who has spent a massive amount of time in this space making arguments about why a specific direction of development is or isn’t a good idea, bolstering those arguments with actual reasoning and logical rationale. I probably never will in any meaningful and consistent way contribute to the development of Bitcoin, so I do not attempt to inject my arguments, opinions, and ideas directly into that development process itself.

I make those arguments to the wider community, or when making them to developers, in other forums or mediums besides GitHub or platforms whose specific purpose and function is for developers to coordinate the development process. If my arguments actually hold merit, they will convince users. They will convince developers out of band from places like GitHub. Eventually, an argument with merit will grow and create consensus around it to the point that it presents a meaningful public signal that developers can choose, if they want, to incorporate into their own reasoning around Bitcoin and what they choose to spend their time and efforts doing to improve it.

Ultimately it doesn’t matter whether you look at these issues and this dynamic from the lens of developers or the lens of users: you have no power or influence whatsoever except the power of persuasion.

If developers produce something that the overwhelming majority of users do not want or find no value in, they can simply ignore it. If developers find an overwhelming majority of users demanding something that is completely irrational in terms of incentive alignment, engineering realities, or anything of that nature, they can simply ignore them.

Bitcoin is a self regulating system. Bad tools produced by developers will not be adopted. Users demanding incoherent or damaging things cannot make developers build that for them, but they can step up and build it themselves if they really want that thing. No one works for anyone else here in this dynamic, it is a completely voluntary process regulated by market forces. So either step up and actually try to be persuasive, do it yourself, or cry harder. You are not going to succeed in trying to force anyone to do something they don’t want to do.

You can find the fork button in the top right corner right here.

Spot Bitcoin ETF Applicants Clear Key Hurdle on Path to SEC Approval

In a significant stride towards the potential approval of Spot Bitcoin Exchange-Traded Funds (ETFs) in the United States, applicants have overcome a pivotal hurdle, marking a crucial milestone in their quest for regulatory approval from the U.S. Securities and Exchange Commission (SEC).

As reported by Bloomberg, the applicants seeking approval for the eagerly anticipated spot Bitcoin ETFs have successfully navigated a critical stage in their regulatory journey. Sources close to the matter revealed that the applicants have addressed and resolved key concerns raised by the SEC, signaling progress in addressing the regulatory queries central to the approval process.

“Securities and Exchange Commission staff told several exchanges and issuers seeking to list the ETFs that they should submit a final version of a key document as soon as Friday, according to four people familiar with the matter who asked not to be named because the discussions are private,” Bloomberg reported. “The staff had no additional feedback on the paperwork for several of the firms after the latest amendments, two of the people said.”

The clearance of this significant hurdle indicates that the applicants have finished addressing regulatory concerns and aligning their proposals with the SEC’s guidelines. The successful resolution of these issues bodes well for the prospects of the spot Bitcoin ETFs, potentially paving the way for their introduction into traditional financial markets.

Applicants are seemingly getting closer to obtaining SEC approval, potentially marking a significant milestone in the integration of Bitcoin into conventional investment avenues through regulated ETFs. The deadline for ARK 21Shares spot Bitcoin ETF application is January 10, leaving the SEC only just a few more days to approve or deny the funds.