Month: January 2024

US dollar flat as Japan, European policy meetings loom

Post Content

Bitcoin falls to $40,000, lowest level since bitcoin ETF launch

Post Content

Asia FX muted before more US cues, yen flat as BOJ keeps dovish course

Post Content

Spirit of Satoshi Releases Its First Annual Bitcoin and AI Industry Report

In an culmination of efforts at the intersection of Bitcoin and Artificial Intelligence (AI), the “Nexus – Bitcoin & AI Industry Report” has been unveiled by Spirit of Satoshi, the world’s first Bitcoin centric AI, highlighting significant advancements and debunking misconceptions within these realms.

The report’s core emphasis revolves around the convergence of 280 participants dedicated to refining the Spirit of Satoshi model and bolstering its “Nakamoto Repository” with over 33,000 invaluable Bitcoin resources. These milestones signify a robust amalgamation of community-driven contributions and partnerships, establishing a cornerstone for AI development facilitated by Bitcoin and Lightning payments.

Noteworthy highlights within the report include the Lightning-Enabled-Crowdsourced LLM (LECS-LLM) tool’s creation, amassing over 40,000 responses from 280 contributors. This effort curated an extensive repository of 33,000 Bitcoin and Austrian economics resources, sourced both from the community and through collaboration with the Mises Institute.

Also showcased in the report is the Code-Satoshi, the world’s first Bitcoin Code-Pilot. This tool, aimed at developers, streamlines the coding process for Bitcoin and its related languages and protocols. Currently in its Alpha phase, it aids in code production, correction, and explanation via English or visualizations, focusing initially on Script and MiniScript.

Moreover, the report expounds on the integration of the Lightning Network’s L402 protocol, emphasizing its role in facilitating machine-to-machine economic activities. This integration aims to enhance user privacy and also mitigate fraud and chargeback risks, contrasting starkly with centralized AI models.

Essential myth-busting surrounding AI misconceptions forms a significant segment within the report. From debunking the “More Data Myth” to dispelling fears about AI replacing human labor and addressing concerns about Artificial General Intelligence (AGI), the report underscores the need for transparent and diverse AI models.

Another aspect highlighted is the collaborative effort in building the Spirit of Satoshi Bitcoin language model. With community validation, refined datasets, and reinforcement learning, the model aims for accuracy and alignment with a Bitcoin-centric perspective.

The “Nexus – Bitcoin & AI Industry Report” showcases the collaborative innovation between these two realms, which could usher in a new era of AI development empowered by Bitcoin, paving the way for transformative applications in both spheres.

Why the Bitcoin Price Will Rise or Fall on the ETF Ruling

Bitcoin is up over 150% in 2023, and that momentum has captured hearts and minds on Wall Street, resulting in a landmark rush for its firms to launch the first-ever Bitcoin exchange-traded fund (ETF).

All eyes are now on the upcoming decision by the U.S. Securities and Exchange Commission (SEC) regarding the approval of a spot Bitcoin ETF, slated for January 10.

If the past is any indication, the ruling will have a significant impact on Bitcoin’s price, though whether positive or negative remains to be seen.

Potential for a Price Rise

Proponents of a Bitcoin ETF argue that its approval by the SEC would open the door to a flood of institutional and retail investments, driving the price of Bitcoin to new heights.

History offers a glimpse into how expectations surrounding ETFs have affected Bitcoin’s price.

In 2017, the price of Bitcoin surged to over $1,400, driven in part by the anticipation of the first Bitcoin ETF. This was up from lows in the $600 range just the year before.

Investors believed then that the introduction of a Bitcoin ETF would make it easier for institutional money to enter the market, leading to a frenzy of buying. However, the SEC ultimately rejected the proposal, causing a sharp decline in Bitcoin’s price.

Within days, the price was trading back below $1,000.

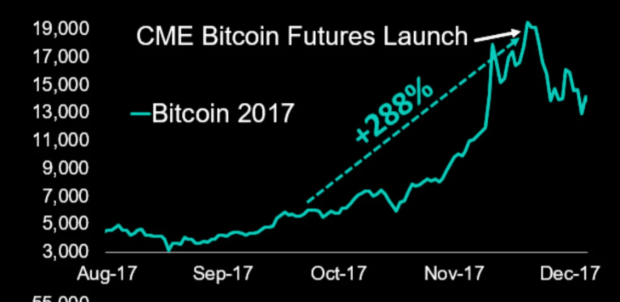

Ultimately, however, the arrival of Bitcoin futures would bring new attention in 2017, the market surging above $20,000 that year.

Price increase from CME Bitcoin futures announcement to listing.

Elsewhere, we can fast forward to 2021, when Bitcoin once again rallied to all-time highs, reaching over $60,000.

This time, the rally was partly fueled by the successful launch of Bitcoin futures ETFs in Canada and Europe. These ETFs allowed investors to gain exposure to Bitcoin without holding the cryptocurrency directly. The anticipation of a similar product in the U.S. contributed to the bullish sentiment.

Finally, in the wake of fake news of an ETF approval earlier this year, Bitcoin’s price rose by several thousand dollars in minutes, a move that suggests upside volatility on approval is likely.

The Bitcoin price spikes on fake news of an ETF approval.

Potential for a Price Fall

On the flip side, there are arguments suggesting that the approval of a Bitcoin ETF could lead to a price correction.

Some market experts fear that the ETF could become a target for short sellers, leading to increased volatility, or that the ETF could be a “sell the news event.”

Moreover, the approval of a Bitcoin ETF may bring greater regulatory scrutiny to the cryptocurrency market as a whole. This heightened oversight could lead to increased taxation, reporting requirements, and potential restrictions on the use of Bitcoin, which may dampen enthusiasm among investors.

Additionally, some believe the market may already have priced in the possibility of a Bitcoin ETF approval, and any decision to deny it might lead to disappointment and a sell-off similar to what was witnessed in 2017 when the Winklevoss Bitcoin ETF was rejected.

Bitcoin price sell-off after the ETF rejection in 2017.

The final decision by the SEC is eagerly awaited by the crypto community, but it’s essential to remember that it is just one of many factors influencing Bitcoin’s price.

Market sentiment, macroeconomic conditions, and geopolitical events will also play their part in shaping the coin’s future.

Conclusion

In conclusion, Bitcoin’s price is at a crossroads as investors await the SEC’s decision on the Bitcoin ETF.

While past instances have shown that ETF expectations can have a substantial impact on Bitcoin’s price, it is crucial to consider the broader market dynamics. Whether Bitcoin’s price rises or falls after the SEC ruling will depend on a multitude of factors, including how the market interprets and reacts to the decision.

As the crypto world holds its breath, the future of Bitcoin remains uncertain, but it’s undeniably a pivotal moment for the world’s only decentralized cryptocurrency.

Bitcoin’s Role In Global Healthcare Access

Like so many industries today, the medical sector is seeing increasing global engagement. Patients aren’t just limited to the health and dental care that’s available on their doorstep. Medical facilities can effectively connect to consumers from across the planet. This has created a thriving medical tourism market.

It should come as no surprise that greater freedom of choice in healthcare is being supported by decentralized currency solutions. More than ever before, patients and facilities are using Bitcoin, in particular, for treatment payments.

Let’s look a little closer at this trend.

Facilitating Access To Wellness

One of the key challenges facing patients today is a lack of healthcare access in their home country. In some instances, communities have a shortage of physicians, while for others quality care isn’t particularly affordable. This isn’t just about primary care doctors or surgeries, either. The state of oral healthcare in the U.S. is also fraught with accessibility issues. A lack of dental insurance, rising costs of relatively basic treatments, and care inequality are among the contributors to poor oral health outcomes. This doesn’t just disrupt dental wellness, either. Oral unwellness can have knock-on effects on other areas of health.

The challenges at home mean many Americans are seeking treatment elsewhere in the world. Countries such as Thailand and Mexico are common targets for good-quality healthcare that is more affordable. Nevertheless, the different currencies in these areas can result in either administrative complications, additional transfer costs, or conversion fees. This is one of the reasons some international medical providers have begun to integrate Bitcoin technology.

It means that Bitcoin can be a tool for breaking down some of the barriers to affordable care. Using this decentralized currency tends to mean that patients aren’t hit with unnecessary conversion fees from their banks or credit card providers. Therefore, they can lower the costs of their overall care even further. Bitcoin’s prominence in the crypto market may also mean it is likely to be the specific coin care providers accept now and in the future.

Maintaining Security And Privacy

Global medical care has a unique set of challenges. Perhaps the primary among these is how healthcare providers can effectively manage risks. Like many industries, solid hazard mitigation practices boost reputation and improve efficiency. Most importantly, though, a focus on maintaining security and privacy protocols reduces both facility and patient exposure to breaches. Bitcoin may be a component of these efforts.

One of the privacy and security risks in traditional international transactions is that there’s a very direct digital paper trail to patients’ financial and personal data. When breaches occur, criminals may have access to not just financial information but also link it to medical records. Patients also can’t always guarantee the same level of regulatory standards of data protection abroad as they would at home.

Bitcoin, on the other hand, offers built-in security and privacy protocols. Firstly, it’s traded and stored on blockchain systems. This tends to make it particularly difficult for cybercriminals to gain access to the ledger and pull coins or — importantly — sensitive information from it.

Additionally, the decentralized nature of Bitcoin means transactions can be anonymized to some extent. This means patients can reduce the potential for Bitcoin transactions to be traced to them and their medical data. That said, maintaining anonymity requires effective protocols. For instance, patients could use IP address hiding tools during transactions. They could also agree with medical providers to utilize pseudonyms for transactions.

Linking Investment To Payments

One of the often overlooked components of Bitcoin concerning global healthcare is its built-in investment protocols. When patients use their credit or debit cards to pay for their treatment abroad, this currency doesn’t necessarily benefit from potential value rises. Sure, funds in medical savings accounts may accrue interest over time. Yet, this may well still be negatively affected by the aforementioned currency conversion fees when it comes time to pay for services abroad.

Bitcoin, on the other hand, is inherently subject to crypto market fluctuations. It can be volatile, of course. Yet, sometimes this can work in favor of investors.

For instance, patients can track the cryptocurrency markets and use forecasting tools to make predictions about purchasing coins at their lowest value. They can then plan elective treatments abroad for when currency values are expected to rise again. As a result, they may get the most medical treatment out of their investments.

Similarly, healthcare providers abroad can keep Bitcoin payments in dedicated wallets rather than withdrawing immediately. With a responsible approach to market tracking and forecasting, they can use rises in value to reinvest in their businesses. This could empower them to make improvements to their facilities. They could also have more funds to put toward marketing tactics. For instance, arranging comprehensive health tourism trip packages that have become popular among dental tourism patients.

That said, both patients and care providers should be extremely mindful of the significant risks this reliance on Bitcoin presents. On the patient’s side, it’s rarely wise to put all the eggs in one basket, particularly when it comes to saving for medical care. It can be better to diversify with other forms of more traditional health insurance and health savings. It’s also good to consider limiting Bitcoin-driven medical tourism only to non-essential electives. This prevents the potential for wellness to be too heavily influenced by the crypto markets.

Conclusion

Bitcoin is being accepted by more healthcare providers worldwide. This doesn’t just offer convenience and security benefits. It may also help some patients to afford more treatments they wouldn’t otherwise have access to in the U.S. It’s vital to recognize, though, that this is not a watertight solution to healthcare access. As with any Bitcoin investment, its use by patients and facilities alike must be based on informed decision-making. With a responsible approach, though, there is potential for this currency to be a useful tool in a wider healthcare strategy.

This is a guest post by Miles Oliver. Opinions expressed are entirely their own and do not necessarily reflect those of BTC Inc or Bitcoin Magazine.

Instant Settlement: The Logistics Industry

Now that we have seen how instant settlement can affect the construction industry let’s see the next industry that can have a huge impact – logistics.

To begin, let’s examine the logistics industry through the lens of an online order example. What unfolds when we select a product on a website that requires delivery to our door? Who are the entities involved in this process, and what does the payment process entail?

So I pick something from the website and order it. I pay for it and wait for the product to be delivered to my door and hope that what will arrive at my door is what I expect.

Because I am paying upfront, I am taking the risk in this case. I may choose to pay on delivery but the risk for all involved does not disappear, it is just shifted to who is taking that risk now, the seller. But more on that a bit later.

When using a card for payment, a 1.5%-3% transaction fee is typically charged by the bank issuing the card. After payment, the retailer or seller is notified to send the product to the buyer’s address. Subsequently, the retailer arranges delivery through a logistics company. A delivery person is dispatched to the warehouse to collect the ordered product along with others, optimizing the route. The product then navigates through the delivery company’s ecosystem, involving various warehouses and personnel, until it reaches the final delivery person who brings it to the buyer’s doorstep.

The efficient movement of the product through space is generally understood within the system so that is not the problem. Faster delivery benefits everyone involved, as quick and reliable service enhances customer satisfaction and loyalty. However, the actual delivery personnel may not directly benefit from the speed of delivery, but we’ll delve into that aspect later. Swift delivery is crucial for customer retention, as a prompt and reliable service encourages customers to choose the same platform for future orders rather than seeking alternatives.

Where Are The Problems Then?

The logistics industry, much like the construction industry we discussed in the previous article here, has problems that predominantly revolve around payment processes. These payment-related issues cascade into other aspects of the logistics chain.

Let’s trace the journey of money in this context:

I make a card payment to the website, and the bank deducts a 1-3% transaction fee from the retail value. The website, having received the payment, needs to pay the retailer the value of the product, and again, the bank deducts 1-3% from this payment. The retailer, in turn, has to pay the delivery company, with the bank deducting another 1-3% from this transaction.

The above is just about the fees to the bank. What about the settlement between all the entities involved in the delivery?

The website receives their money from me fast, unless it is an international delivery it is the same day.The website then batches all the payments that have to be paid to the retailer for the month so they do not have to pay each individual sale to them. They most likely will pay once a month so it could be up to 30-day credit at this point.Then the retailer has the same arrangement with the delivery company and there is up to a 30-day delay of the payment at this point also.

The monthly batching of payments may streamline processes, but it introduces a significant element of risk into the transaction chain. If any entity in this chain were to face financial issues, such as bankruptcy, within 30 days, the subsequent parties may never receive the funds they are owed. This risk compounds throughout the logistics ecosystem, emphasizing the need for more secure and efficient payments.

If I opt to pay on delivery, the risk dynamic in logistics is inverted – the money is collected by the delivery company, then forwarded to the retailer, and eventually passed on to the website. This way of operating has introduced additional complexities. As the number of orders increases, individual financial ledgers between the companies become more intricate due to the waiting period for money to reach the designated recipient. There is a ledger between the website and the retailer, tracking how many orders have been paid to the website and are awaiting payment. There is another ledger between the delivery company and the retailer, which, in turn, is awaiting payment. Regardless of my preferred payment method as the buyer, the retailer remains significantly exposed because they never receive the money first. The third-party risk for them is consistently high.

In both scenarios, the banking system charges fees of 3% or more for each delivery, and various parties face multiple third-party risks depending on the order of payment. To provide a more nuanced understanding of risk, it’s crucial to note that even if all involved entities are reliable and face no business issues, this doesn’t eliminate counterparty risk associated with the banks themselves. In the event of a bank failure, even a well-intentioned company may find itself unable to settle its debts, highlighting the vulnerability inherent in the current financial infrastructure.

Other Problems In The Logistics Ecosystem

The system encounters additional challenges within the workforce, particularly among delivery personnel. A fundamental conflict exists between these workers and the companies they serve. Workers are compensated for their time, while companies derive revenue from delivered products. This misalignment of incentives prompts companies to set aggressive targets for delivery personnel. When I run a marathon I do not sprint because I will burn out in the first part of the race. I have to pace myself to finish and may increase or decrease the speed depending on the particular situation. When you make the delivery men “sprint” in the “marathon” of delivering packages, it is only a matter of time before they burn out and quit much sooner than finding their pace and finishing their month/year the proper way.

The intense pressure to meet unrealistic delivery targets can have severe consequences on the quality of service provided by delivery workers. The rush to complete deliveries quickly may lead to damaged products and unattended packages that get stolen. Additionally, they do not have time for bathroom breaks and have to figure out how to do their business in the delivery vehicle. This not only impacts the overall customer experience but also poses risks to the well-being of the workers themselves.

The burnout process is expedited by the mental struggle faced by delivery personnel. A conflicting incentive structure compounds the challenge: while the company seeks maximum exploitation for increased profits, delivery personnel are motivated to minimize their workload since their compensation remains constant. This incongruity not only hampers the optimization of profits for both parties but also introduces mental stress for the delivery personnel. How do you expect to have no friction between them if both parties wanting to increase their profits means they have to do completely opposite actions.

Another source of friction between the delivery company and its personnel revolves around the vehicles they use. Similar to the issue of tool maintenance in the construction industry, the lack of ownership over the vehicles leads to neglect in upkeep. The company, focused on maximizing profits, may exploit the delivery personnel, who, in turn, might exploit the vehicles to enhance their personal gains. This dynamic creates a detrimental cycle where both parties prioritize individual interests over the long-term well-being of the shared resources.

Instant Split Payments And Delivery Dynamics

The most apparent benefit is that the banking system would not levy fees of 4.5%-9% for each product delivered. Even if funds are transferred between entities, the fees in the Lightning Network would be approximately 0.3%. This alone marks a significant improvement, reducing transaction costs by an order of magnitude compared to the current system. Now, let’s delve deeper into additional advantages.

The risks associated with multiple third parties are eradicated in this ecosystem. There’s only one third-party risk, namely the buyer of the product. As soon as the buyer receives the product, they make a Lightning Network payment. Moreover, the delivery company, the retailer, and the website all receive their payments simultaneously without funds passing from one to another. The split payment will crush the fees even further because it is one payment so the fee is ~0.1%. Just to mention that those fees do not go to the banking system, they go to the LSPs like us at Breez that are facilitating the actual payment. And because we are a non-custodial solution we do not introduce any third-party risk. There is no waiting at any point for someone to settle their bill with someone else. All participants have their funds instantly and decide what to do with them from then on.

This is a huge improvement, and just that is enough for someone to disrupt the logistics payments market, but the effects of instant split payment do not stop there.

The adoption of instant split payments in the logistics industry will significantly alter the incentives for all delivery workers. A key transformation is the shift from receiving compensation solely for time – to being actively engaged in each payment related to their deliveries. Similar to how companies receive split payments, with each entity getting its share, every individual in the delivery company involved in moving the product can now receive their share too. The funds received by the delivery company will be split further, ensuring that delivery personnel are paid for their specific contributions rather than time spent. This eliminates the need for brutal targets, allowing those who deliver more packages to receive proportional compensation for their work and fostering a fair and performance-based payment structure.

In this new paradigm of instant split payments, delivery workers will be incentivized to use their own vehicles for product deliveries. When using a company vehicle, their share of the payment for each delivery is smaller. However, if they utilize their personal vehicle, the percentage from each delivery will be more substantial, directly contributing to their earnings. This shift encourages a sense of ownership and responsibility among delivery personnel, fostering a more efficient and cost-effective system.

The revolutionary aspect of this system is that it opens up opportunities for anyone with a vehicle to become a convenient and flexible delivery person. Individuals can integrate delivery tasks into their existing plans, making extra bitcoin while heading in a specific direction. This decentralized approach allows for the optimization of routes on an individual basis. People with their own vehicles are no longer bound to a single delivery company; instead, they can work for various companies in their local area. This not only encourages individual optimization of routes but also shifts the focus to serving those expecting deliveries rather than working solely for a centralized delivery company. The reputation of the app will be enhanced by well-delivered packages, creating a positive feedback loop for more orders in the future, akin to the success of platforms like Uber.

Absolutely, the introduction of an instant settlement system with split payments has the potential to decentralize various aspects of the delivery ecosystem:

Decentralization of Delivery Companies: Logistics can shift from a few large delivery companies to numerous small entities and even individuals participating in the delivery process. This allows for a more distributed and flexible delivery network.Decentralization of Income for Delivery Personnel: Delivery individuals will no longer be reliant on a centralized source of income. Instead, they can participate in each delivery payment, earning money directly proportional to their contribution, thereby decentralizing their income.Decentralization of Options for Buyers: Buyers will have a broader range of options for who delivers their products. With a more decentralized delivery ecosystem, they can choose from various delivery providers, including independent agents and smaller delivery companies.

Overall, this decentralization has the potential to create a more efficient, adaptable, and user-centric delivery system.

Now there needs to be a person who understands the logistics market and makes that app. Unlike the construction companies, this will be even more decentralized because many more individuals can manage a delivery. Not everyone can manage a complex construction project but anyone can deliver something. Remember in the past the newspaper kids? A person with his scooter can deliver a few packages to his neighbors on the way. That will also have a social layer effect by bonding you more and more with the people in your area. We can use that in big urban areas because most of the time we are passing our neighbors without saying “Hello”. And the neighbors will prefer to receive product deliveries from people that they are familiar with. The potential for a decentralized and more community-oriented delivery system is quite exciting

Now let’s go and deliver that app.

This is a guest post by Ivan Makedonski. Opinions expressed are entirely their own and do not necessarily reflect those of BTC Inc or Bitcoin Magazine.

Webb: Unmasking Farmington – FTX, Fluent Finance and the Coming Digital Dollar

Originally posted on Unlimited Hangout.

One of the oddest and most mysterious relationships that emerged out of the collapse of FTX last year was Alameda Research’s unusual relationship with Farmington State Bank, one of the smallest, rural banks in the United States that came under the control of Jean Chalopin in 2020. Chalopin is best known as the chairman of Deltec, one of the main banks for Alameda Research – FTX’s trading arm that played a central role in its collapse — and still one of the main banks for the largest fiat-backed stablecoin, Tether (USDT). Chalopin had acquired control over Farmington via FBH Corp., where Chalopin was listed as executive officer. Interestingly, Noah Perlman, a former DOJ and DEA official who is now Chief Compliance Officer at Binance and the son of Jeffrey Epstein associate and musician Itzhak Perlman, was also listed as a director of FBH Corp and has never publicly explained his connection with this Chalopin-controlled entity.

As Unlimited Hangout reported last December, soon after its acquisition by Chalopin’s FBH Corp., Farmington “pivoted to deal with cryptocurrency and international payments” after decades upon decades of serving as a single branch community bank in rural Washington. Soon after its pivot into the crypto space, Farmington struggled to move money and sought approval to become part of the Federal Reserve system. It also changed its name from Farmington State Bank to Moonstone Bank. The approval of Farmington by the Federal Reserve has been deemed highly unusual and as having “glossed over Moonstone’s for-profit foreign interests.” Late last December, Eric Kollig, spokesman for the Federal Reserve, told reporters that he could not comment “about the process that federal regulators undertook to approve Chalopin’s purchase of the charter of Farmington State Bank in 2020.”

Just days after Farmington formally changed its name to Moonstone in early March 2022, FTX-affiliated Alameda Research poured $11.5 million into the bank, which was – at the time – more than twice its entire net worth. Moonstone’s Chief Digital Officer, Jean Chalopin’s son Janvier, later stated that the funding from Alameda Research had been “seed funding … to execute our new plan of being a tech-focused bank.”

Upon Alameda’s taking a stake in the bank, Jean Chalopin stated that this move “signifies the recognition, by one of the world’s most innovative financial leaders, of the value of what we are aiming to achieve. This marks a new step into building the future of banking.” Outlets like Protos have noted how unusual it is that a Bahamas-based company like FTX was “able to purchase a stake in a federally approved bank” without attracting the attention of regulators.Washington State regulators have stated that they were “aware” of Alameda’s investment in Farmington/Moonstone and defended their decision not to intervene or take further regulatory action.

Notably, the influx of new money into the remodeled Farmington was not exclusive to FTX/Alameda. A New York Times article on the matter noted that Farmington/Moonstone’s deposits – which had hovered around $10 million for many decades – quickly surged to $84 million, with $71 million coming from only four new accounts during this same relatively short period in 2022.

As Unlimited Hangout previously noted, the same day the Alameda investment was announced, Moonstone installed Ronald Oliveira as CEO. Oliviera had previously worked for the fintech company Revolut, a “leading digital alternative bank” financed by Jeffrey Epstein associate Nicole Junkermann. Roughly two months later, the bank hired Joseph Vincent as its legal counsel. Immediately prior to joining Farmington/Moonstone, Vincent had served as the general counsel for Washington State’s Department of Financial Institutions and its director of legal and regulatory affairs for 18 years.

Shortly before FTX’s collapse, which put Farmington/Moonstone under heavy scrutiny, Farmington/Moonstone partnered with a relatively unknown company called Fluent Finance. Fluent Finance, both then and now, has evaded scrutiny from the media aside from Unlimited Hangout’s investigation into Farmington, published last December. However, since FTX’s unraveling and the shuttering of Farmington/Moonstone in the months that followed, Fluent Finance has been quite busy, developing significant government partnerships in the Middle East and looking to become a central part of the coming Central Bank Digital Currency (CBDC) paradigm for both West and East.

A likely reason behind the lack of media interest in Fluent Finance and their apparent success after the FTX scandal is the fact that Fluent, from its earliest days, has been operating as an apparent front for some of the most powerful commercial banks in the world and building out “trusted” digital infrastructure for the economy to come. This investigation, an examination of Fluent’s past and its current trajectory, may help elucidate the true motives behind the efforts of Chalopin, Bankman-Fried and others to turn the tiny Farmington State Bank into “Moonstone.”

Fluent Finance’s Deep and Early Connections to Wall Street Banks

Fluent Finance was created in 2020 and was co-founded by Bradley Allgood, Oliver Gale and Jaime Plata. Allgood began his career with the US Army and later went on to serve in NATO’s Governmental Operations division with an apparent focus on NATO activity in Afghanistan. After leaving NATO, Allgood “immediately jumped” into economic development, specifically the creation and expansion of Special Economic Zones (SEZs), specifically one partnered with the Catawba Indian Reservation in South Carolina. That SEZ, officially named the Catawba Digital Economic Zone, was co-founded by Allgood in 2019 and he still serves as its head of Commercial Banking.

Sitting on just two acres of land, the zone aims to “become the worldwide registration hub for crypto companies” as well as to “take a huge chunk out of Delaware’s market for company registration or even to replace it as the gold standard.” The zone is backed by a venture capital firm tied to Bradley Tusk, the former Deputy Governor of Illinois under disgraced former Governor Rod Blagojevich and the former campaign manager for billionaire Mike Bloomberg. In addition, Tusk’s companies count Google, the Rockefeller Foundation and Ripple (XRP) among their clients. Tusk’s different VC firms have invested in Coinbase and Circle, the issuer of the USDC stablecoin, and Uber as well as the economic zone co-founded by Allgood.

Shortly after leaving the military, Allgood also worked on the early development of digital transformation of governments, digital identities, people and property registries and the tokenization of carbon credits and commodities. Later motivated by “the sheer number of unbanked and underbanked in the world”, Allgood hosted roundtables around the world with central bank “regulators, tier one institutions, innovators, [and] technology providers” and decided he could act as “a good connector” for the different actors in his growing network.

Allgood claims to have spoken to a few “really senior” banking executives at HSBC, Citi and Barclays and to have educated “them on new innovative technologies for custody [and] better digital identity.” After “building a team” of these “senior bankers from tier one financial institutions,” Allgood and his team “went out into the market and started servicing the [cryptocurrency] space and helping innovative companied find homes and large core banking systems and tier one financial institutions.” While working with these various titans of finance and guiding their views on the future of banking, Allgood met his co-founders of Fluent Finance: Oliver Gale and Jaime Plata.

Oliver Gale is one of the co-founders of Central Bank Digital Currencies (CBDCs), having pioneered the first CBDC project in the Eastern Caribbean and, per Allgood, Gale “went on to do them in Nigeria” and helped create the highly controversial e-Naira. Gale notably describes himself as the inventor of CBDCs and has previously collaborated with the UN, MIT and the IMF. Jaime Plata, Fluent’s other co-founder, “did the core banking systems of the Eastern Caribbean Central Bank during the first CBDC [launch].” Aside from Gale and Plata, Allgood has revealed that other top Fluent Finance executives, who are not listed on the company’s website, hail from the Wall Street titan Citi – with the company’s CFO being “the CFO of Citi of all of Latin America” and its COO being “one of the senior, most senior, managing directors from Citi.” He has also stated that other important employees of Fluent include the former chief innovation officer of General Electric as well as “an early board member at [the now collapsed crypto exchange] Celsius [that] helped them get to market.”

Fluent Finance was initially founded with two main and interrelated products: the Fluent Protocol and the US+ stablecoin. Fluent has described the Fluent Protocol as “a financial network that seamlessly bridges traditional finance and digital assets,” while US+ is a “bank-led”, US dollar-pegged stablecoin “built on principles” and designed to be “forward-compatible with CBDC initiatives.” Fluent asserts that US+ resolves “the inherent flaws of web3-native stablecoins” by having US+ be operated by a network of banks partnered with Fluent Finance. Fluent has not made the identities of these banks available to the public.

“When we examined stablecoins, we knew that the lack of institutional uptake of the technology was due to risk,” explained Allgood. “With that in mind, when we approached the design of US+, we did so in terms of de-risking. We knew we needed to provide real-time and transparent reserves monitoring.” Fluent’s answer to providing the reserve metrics needed to tap into the heavily regulated traditional finance market emerged through its partnership with Chainlink, first announced in September 2022.

Chainlink is a blockchain oracle network, meaning it connects blockchains to external systems. It was launched in 2017 on the Ethereum blockchain and later registered in the Cayman Islands as SmartContract Chainlink Limited SEZC in March 2019. In December 2021, the former Google CEO Eric Schmidt, who has unprecedented control over the Biden administration’s technology policies, joined Chainlink Labs as a strategic advisor. At the time, Schmidt commented that “it has become clear that one of blockchain’s greatest advantages — a lack of connection to the world outside itself — is also its biggest challenge.”

Fluent’s partnership with Chainlink dealt with regulatory necessities by providing a reliable way for the Fluent Protocol to access real-time, off-chain data from external sources. Fluent’s goal was/is to provide proof of the size, performance, and risk of its asset reserves in order to meet its stablecoin protocol liquidity requirements. Reliable confirmation and publishing of the state of these reserves was seen as crucial by Allgood and others at Fluent in order to manufacture trust from both retail users and membership banks.

Fluent is far from the only partner of Chainlink working on providing trusted stablecoin reserve architecture. Among them is Paxos, the former issuer of Binance’s BUSD and their own PAX, and who recently began providing infrastructure for PayPal’s PYUSD stablecoin. Paxos relied on Chainlink to provide on-chain Proof of Reserve Data Feeds for Paxos’ assets, ensuring verification that PAX tokens are 1:1 backed by US Dollars. This was taken a step further with their gold-backed PAXG tokens, in which Chainlink claimed to be able to provide verification of off-chain, physical gold bars held in Paxos’ custody.

Another Chainlink partner is the XinFin Network, also known as the XDC network, which uses Chainlink’s Price Reference Data framework to introduce price feeds for major national currencies such as the Hong Kong Dollar, the Singaporean Dollar, and the United Arab Emirates Dirham. In October 2022, Fluent Finance announced a partnership with Impel to bring its US+ stablecoin to the XDC network. Impel itself is a startup birthed out of XinFin Fintech led by CEO and founder Troy S. Wood. The company boasts a team of advisors including XDC Network co-founders Ritesh Kakkad and Atul Khekade, in addition to long time SWIFT employee André Casterman.

In March 2021, XinFin leveraged the DASL Crypto Bridge designed by LAB577 to bring their XDC token to R3’s Corda blockchain. R3 began as a consortium of banks and is not only closely connected to Fluent Finance, but, as will be discussed shortly, is also a major driver of CBDC and stablecoin development globally. Before this XDC-Corda bridge was created, there was no liquidity or token of value on the R3 Corda Network. This bridge opened up the opportunity for traditional financial institutions, such as those that fund R3, to interact with cryptocurrency indirectly without having to operate on under-regulated public networks that could land them in hot water with regulators. It also gives access to those already utilizing Ethereum-based tokens (i.e. ERC20 or ERC721) to the business networks and financial institutions on the Corda network.

XDC co-founder and Impel advisor Atul Khekade remarked that the both government regulators and commercial banks had settled on XDC and Corda as the means through which many major banks would access blockchain technologies:

“Regulatory agencies and financial institutions have selected both Corda and the XDC Network as suitable platforms to engage with blockchain technology […] They did not just randomly throw a dart at a board.”

Fluent Meets Moonstone

In late October 2022, Fluent Finance, now deeply ensconced in the Web3 ambitions of major commercial banks, announced its partnership with Farmington/Moonstone. In a press release on the partnership, Fluent wrote that “Moonstone will be a custody partner in Fluent’s growing network of banks, with plans to expand into a full-node member soon,” which would “allow Fluent and Moonstone to connect the traditional financial system to the emerging Web3 economy.”

At the time the partnership was announced, Fluent’s CEO Bradley Allgood stated the following:

“Moonstone Bank is now a key player in Fluent’s financial ecosystem and will serve as an initial custodian partner. Fluent plans to eventually bring Moonstone Bank on as a full-node partner, which will allow the bank to mint and burn US+. Collaborating with Moonstone is incredibly exciting and will help Fluent bring a safe and secure stablecoin to market while allowing for instant payments along with lower fees. It will also clearly demonstrate the benefits that stablecoins can bring to the banking sector, businesses, and everyday end users alike.”

Notably, this was – and remains – the only Fluent Finance press release to name a member of Fluent’s consortium that supports its “bank-led” stablecoin, US+. In addition, given Allgood’s statements on the partnership, he clearly felt that partnering with Moonstone was a critical part of bringing US+ to market.

However, with the collapse of FTX that November, Farmington/Moonstone came under heavy scrutiny, even attracting the attention of U.S. Senators who cited Farmington/Moonstone’s relationship with FTX as reason to launch federal investigations into the relationships between banks and cryptocurrency firms. The many unanswered questions about Alameda’s relationship with Farmington/Moonstone, Chalopin’s involvement and potential connections to Deltec and Tether as well as the apparent negligence of regulators caused major reputational and trust issues for Farmington/Moonstone.

A few months after the FTX collapse, in January 2023, Farmington announced it would drop the Moonstone name and return to its “original mission as a community bank” and would discontinue “its pursuit of an innovation-driven business model to develop banking services for industries such as crypto assets or hemp/cannabis.” Just a few days after that announcement, federal prosecutors seized $50 million from Farmington/Moonstone, which they alleged had been deposited as “part of FTX founder Sam Bankman-Fried’s wide-ranging scheme to defraud investors through his massive cryptocurrency exchange business.” That sum, significantly more than what Alameda Research had initially invested, was more than half of the bank’s total assets based on the most recent FDIC filings at the time of the seizure. The $50 million seized was all under one account under the name of “FTX Digital Markets,” per court records cited by local Washington newspapers.

Then, in May, the bank announced it would be selling its deposits and assets to the Bank of Eastern Oregon. The Federal Reserve subsequently took enforcement action against Farmington as well as its parent FBH Corp. a few months later in August. According to local newspapers, the Fed “issued a cease-and-desist order against the firms and directed them to take a number of actions as Farmington closes its business – including preserving records and not acquiring any additional brokered deposits.” The Fed asserted that Farmington had violated commitments it had made as part of the approval process which granted it access to the Federal Reserve system. However, it is unknown which commitments were allegedly violated, as the Fed has refused to come clean about its highly unusual and irregular approval of Farmington/Moonstone and, even after its enforcement actions against the bank. Fluent Finance issued a statement after the Fed’s announcement and referred to Farmington for the first time as a “prior tentative” collaborator and sought to distance itself from the bank. Most recently, in November, FBH Corp., Jean Chalopin’s vehicle for acquiring and then controlling Farmington, failed to file an annual report in Washington State for 2023, meaning that it will be terminated sometime within December.

While 2023 could not have been worse for Moonstone/Farmington, Fluent Finance managed to successfully reinvent itself by partnering with the government of the United Arab Emirates (UAE) and R3, a blockchain company that focuses on accelerating digital currencies (particularly CBDCs) and is backed by some of the biggest banks in the world.

Building the Rails for CBDC settlement in the UAE

In late July, a few weeks before the Fed announced its enforcement action against Farmington/Moonstone, Fluent Finance announced that they would be opening an office in Abu Dhabi in the United Arab Emirates, an expansion explicitly backed by the UAE Ministry of Economy. According to a press release, “As part of their move into the region, Fluent Finance is getting support from the office of the Ministry of Economy, further cementing their relationship with regulators and leaders in the region to unveil innovative solutions for cross-border payments.” The UAE government was explicitly backing Fluent Finance so that the company could “advance the UAE’s trade finance and cross-border payments landscape.”

Fluent’s new UAE entity, called Fluent Economic Bridge, focuses on deposit tokens, i.e. commercial bank-issued tokens backed by deposits, with the explicit intention of connecting deposit token and CBDC systems within the UAE and, eventually, beyond. As previously mentioned, Fluent is partnered with the company R3, which is currently under contract with the UAE’s Central Bank to build out the nation’s CBDC system. Fluent Economic Bridge uses R3’s Corda DLT (distributed ledger technology) in order to “bring CBDC-compatible deposit token infrastructure for borderless payments.”

A few months later, in October, Fluent Finance – described in reports from this period as a “US-based developer of a cryptocurrency-based payment platform” – joined an UAE government program called NextGenFDI, which aims to offer a litany of incentives to foreign web3-focused companies to relocate to the country. Reports praising Fluent’s participation in the program noted that Fluent’s focus had moved to “mak[ing] cross-border trade easier” and that the company’s UAE-based Fluent Economic Bridge would be “used by importers and exporters to settle transactions through bank-issued cryptocurrencies, known as stablecoins or deposit tokens.” “I am optimistic about the possibilities of the Fluent Economic Bridge, and the potential for digital currencies to improve the efficiency and accessibility of global supply chains,” UAE Minister of State for Foreign Trade Dr. Thani Al Zeyoudi was quoted as saying.

Fluent’s collaboration with the UAE government was notably designed to align “with the [UAE’s] Ministry of Economy’s TradeTech initiative, which, with the participation of the World Economic Forum, aims to promote the use of advanced technology tools in global supply chains, as well as the country’s comprehensive economic partnership agreement programme, which aims to achieve frictionless trade between the UAE and other economies.”

Articles on the development also stated that “by working with banks and regulators in Abu Dhabi, Fluent aims to boost the transparency of cryptocurrency with the security and regulatory structure of the traditional banking system.” Claims were made that Fluent has been piloting this program in Kenya, but Fluent’s website makes no mention of any such program and no information about any such pilot is available online at the time this article was published. This suggests that Fluent’s pilot in Kenya is operating under a different name with no overt ties to the company being publicized.

A few days later, Emirati news reported that Fluent Finance would be partnering with the UAE’s Ministry of Economy to develop “deposit token-based tech” and “stablecoin technologies.” The company stated that by “collaborating with banks and regulators[,] its platform provides the immediacy and transparency of cryptocurrency with the security and regulatory structure of the traditional banking system.” Allgood framed much of the collaboration as a key part of the UAE’s effort to “modernize” multilateral trade. He stated that “The UAE has positioned itself as a global leader for digital assets through their special economic zone initiatives, regulation foresight, and global trade expansion with strategic MoUs [memorandums of understanding],” specifically MoUs with India and China, key members of the BRICS bloc. Since these reports, even more MoUs have been signed between the UAE and BRICS countries. For instance, earlier this month, China’s central bank signed a $400 million “cooperation memorandum” with the UAE’s central bank that is specifically focused on the interchange of the countries’ respective CBDCs. As previously noted, the UAE’s coming CBDC, the digital dirham, is being developed by R3, which is closely tied to Fluent Finance.

A report in Gulf Business on Fluent’s collaborations with the UAE noted that, with respect to the MoUS, “the agreements account for more than $100bn in bilateral trade, with a focus on strengthening the use of new technologies and settlement with digital currency. Deposit tokens issued by commercial banks are poised to offer a borderless missing link to accelerate trade settlement to central bank digital currency.” In other words, it seems that Fluent is positioning itself as an accelerator for CBDCs via deposit tokens, related infrastructure and its “low counterparty risk stablecoin” US+.

R3 – Accelerating Financial Surveillance

Further evidence of Fluent’s intentions to accelerate a CBDC-deposit token paradigm can be found in Fluent Finance’s cozy relationship with R3, a self-described “leader in the digitization of financial services” that is responsible for the Corda DLT platform. As previously mentioned, R3’s backers include some of the biggest names in finance, among them several of the massive commercial banks who had an early role in the creation of Fluent Finance.

Fluent’s connection with R3 was present early on, including before its ill-fated attempt to partner with Farmington/Moonstone. For instance, Fluent’s early partnership with XDC in October 2022 was influenced the fact that XDC was also “heavily related to R3” as well as XDC’s focus on “trade finance” according to Allgood. Notably, XDC is also very active in the UAE and was described by Emirati media as a “driving force” behind the country’s ambition to become “the successor to Silicon Valley” in articles published roughly a month before Fluent announced its partnership with the UAE’s Ministry of Economy.

In addition, Fluent’s head of engineering Will Hester, who joined the company in April 2022, previously worked as R3’s tech lead and previously as a R3 software engineer. Other Fluent employees, such as software engineer John Buckle, had also previously worked for R3. In addition, Fluent Finance’s US+ utilizes a private Corda network (Corda being a R3 product) to tokenize US+’s fiat currency (i.e. US $) reserves. Reports on Fluent’s expansion into the UAE note that the company chose to use Corda in order to “introduce CBDC-compatible deposit token infrastructure for borderless payments.”

While Fluent has been relatively quiet about its commercial banking partners, what Allgood has revealed is an apparent association between the early days of the company with HSBC, Citi and Barclays, suggesting that these banks could be among the members of its banking consortium backing its US+ stablecoin. R3, which notably began as a consortium of commercial banks, is backed by major banks including HSBC, Citi and Barclays as well as other top names in finance including BNY Mellon (which now holds the bulk of the reserves for the USDC dollar-pegged stablecoin after the banking crisis earlier this year), Deutsche Bank and Wells Fargo. R3’s relationship with Wells Fargo is particularly notable as the company’s Corda platform is playing a critical role in Wells Fargo’s pilot of a dollar-pegged stablecoin that will be used “initially for internal settlement across the company’s business.” The Wells Fargo dollar-pegged stablecoin on Corda is being pitched for essentially the same use cases as Fluent’s US+.

Though R3 has considerable ties to a coming digital dollar, through Wells Fargo, Fluent Finance and others, they are also a key player in a number of CBDC projects globally. As previously mentioned, in April of this year, the UAE announced that it had selected R3 to begin implementing its CBDC strategy. The company, which describes itself as having been “at the forefront of CBDC innovation since 2016,” is also involved with CBDC development in France, Kazakhstan, South Africa, Australia, Malaysia, Switzerland, Singapore, and Sweden and is partnered directly with the central banks of those countries. R3 was also involved in Italy’s Project Leonidas, a wholesale CBDC trial between Italy’s central bank and the Italian Banking Association. R3 was even named 2023’s CBDC partner of the year by the publication Central Banking.

However, R3 is focused on much more than CBDCs, as evidenced by their Digital Currency Accelerator (DCA), which offers “an end-to-end solution that enables central banks, commercial banks, and monetary authorities to issues, manage, transact, and redeem CBDCs and privately-issued digital currencies.” In other words, R3’s DCA facilitates the creation of CBDCs for central banks and deposit tokens and stablecoins for commercial banks, all of which would likely be inter-operable with other currencies on R3’s Corda network. The central bank component of the DCA, the CBDC accelerator, was designed specifically to meet CBDC specifications laid out by the Bank of International Settlements (BIS). R3’s CBDC accelerator, as well as what it offers for deposit tokens, allows the issuer to “define and configure a delegated programmability framework,” which is important given that programmability is one of the most controversial components of CBDCs.

One key partnership highlighting R3’s role in accelerating commercial banks’ forays into the digital currency era was forged in August 2022, when R3, along with The Depository Trust & Clearing Corporation (DTCC) –– a prominent post-trade market service provider in the global financial services industry — announced the successful launch of its Project Ion platform. This private and permissioned Distributed Ledger Technology (DLT) platform was developed in collaboration with key industry players (most of whom directly back R3) and technology providers such as BNY Mellon, Charles Schwab, Citadel Securities, Citi, Credit Suisse, Fidelity, Goldman Sachs, J.P. Morgan, Robinhood Securities, and the State Street Corporation, among others. In 2011 alone, DTCC facilitated the settlement of the majority of securities transactions within the United States and processed nearly $1.7 quadrillion in transactions, solidifying its position as the world’s foremost financial value processor.

In order to best take advantage of the coming issuance of trillions of dollars in highly regulated stablecoins, R3 purchased stablecoin issuer Ivno in October 2021. This acquisition came only 6 months after the completion of a collateral tokenization trial Ivno had held with 18 partnered banks including Egypt’s CIB, Singapore’s DBS, Brazil’s Itaú Unibanco, National Bank of Canada, Natixis, Austria’s Raiffeisen Bank International and US Bank as well as three unnamed securities exchanges.

Invo was far from the only prospective stablecoin issuer that have partnered with R3. For instance, in September 2019, Fnality and Finteum both joined forces to leverage their Utility Settlement Coin (USC) on the Corda blockchain. Fnality, headed by CEO Rhomaios Ram, the former Global Head of Product Management for Transaction Banking at Deutsche Bank, identifies as a wholesale payments firm, and boasts institutional shareholders such as Goldman Sachs, Barclays, BNY Mellon, CIBC, Commerzbank, DTCC, Euroclear, and ING, among others. In December 2023, Fnality, along with Lloyds Banking Group, Santander and UBS, executed the first ever transaction settlement of digital central bank funds with balances of sterling using an “omnibus account” at the Bank of England. The weight of the moment was not lost on Hyder Jaffrey, Managing Director at UBS: “The creation of a new systemically important global payment system is a once in a generation event.”

With the DTCC’s experience in settling the lion’s share of dollar-denominated securities, and with Fnality and Ivno’s collaborations with some of the largest players in the international banking system, R3 have quietly positioned themselves as suppliers of potentially essential infrastructure within the imminent global system of interoperable CBDCs and their commercial bank equivalents.

R3 partner Fluent Finance, and more specifically its UAE-based Fluent Economic Bridge, is seeking to serve as the connective tissue between the deposit tokens and stablecoins to be issued by commercial banks both in the UAE, as well as abroad, and CBDCs by ensuring their compatibility. Indeed, Fluent’s website – in both the past and present – has promoted its products’ “CBDC bank compatibility.” Given Fluent’s long-standing collaboration and affiliation with R3 and the banks behind it, Fluent Economic Bridge and its stablecoin protocol have likely been built with CBDCs running on R3’s Corda in mind.

In addition, just as R3 is developing CBDCs and other digital currencies far beyond the UAE, Fluent is also looking to expand its “economic bridge” and US+ far beyond the Emirates. In an interview Allgood gave to R3 on January 2023, he stated that Fluent has been in talks with the UAE government to issue a US+ equivalent but for their local currency, the dirham (i.e. a bank-issued dirham stablecoin that would be interoperable with its R3-developed CBDC). He also claimed to be far along in developing a US+ equivalent for the Mexican peso.

In addition, in the same interview, Allgood revealed that Fluent is “looking to do a US dollar stablecoin but with local banking in Africa” and is in talks with multiple banks across 36 different African countries in pursuit of that particular project. Allgood, while busy championing and building an interoperable network of CBDCs across the globe, has begun to turn Fluent’s attention beyond just US+ and towards the dollar system itself.

Building the Digital Dollar: The Synthetic Deposit Token

The US, despite the launch of CBDC pilots in China, Japan, Russia, India, Israel, Saudi Arabia, the UAE, and elsewhere, has yet to formally launch any sort of government-issued digital dollar. In a June 2023 white paper titled “Central Bank Digital Currency Global Interoperability Principles”, the World Economic Forum reflected on the serious push by governments around the world to explore CBDC issuance. The paper makes mention of “over 100 countries actively engaged in CBDC research and development”, while quoting the managing director of the International Monetary Fund, Kristalina Georgieva, making the distinction that “there is no universal case for CBDCs because each economy is different”. It seems that the US has plans to be “different” from most countries. For instance, in November 2022, two days before FTX filed for bankruptcy, Coinbase CEO Brian Armstrong was a guest on the Circle CEO Jeremy Allaire’s podcast, and stated that “every major government pretty much is going to want to have a CBDC”, while delineating the path for the US would likely be different from the rest of the world. “I think in the US’s case, it is going to end up using USDC [the dollar-pegged stablecoin issued by Circle] as sort of like a de facto CBDC.”

In the WEF’s white paper, two US efforts related to CBDCs are mentioned: Project Hamilton, the Boston Fed’s 2020 collaboration with the Massachusetts Institute of Technology’s (MIT) Digital Currency Initiative; and the 2022 report by The New York Fed titled Project Cedar. The former, Project Hamilton, focused mostly on payment throughput of a retail-facing digital currency, while the latter, Cedar, was an experiment on a deposit token to be exchanged by banks during wholesale settlement. The delineation between Project Hamilton and Project Cedar is nearly identical to the fork in the road currently facing the founding fathers of the coming digital Federal Reserve.

In a February 2022 analysis, Gerard DiPippo – an 11 year veteran of the US intelligence community (specifically the CIA) who has long been focused on economic issues in the Global South – stated that:

“Dollar stablecoins have at least one major advantage over a potential U.S. CBDC: they already exist. Even if Congress were to decide the Fed should create a CBDC, the process of development, experimentation, and deployment would probably take at least a few years.”

In that same analysis, published by the National Security State-adjacent Center for Strategic and International Studies (CSIS), DiPippo added that: “The United States should not delay in establishing a regulatory framework to enable safe but speedy development of dollar stablecoins to gain a first-mover advantage in related payments and technologies.”

Indeed, just as DiPippo noted, the digital dollar is already here. In fact, it has been here for a long time. A Fall 2021 piece from Harvard Business Review made the claim that “over 97% of the money in circulation today is from checking deposits – dollars deposited online and converted into a string of digital code by a commercial bank.” But while the vast majority of dollar circulation may have been reduced to 1’s and 0’s on some private bank’s spreadsheet over the last few decades, the assets that actually uphold the US dollar system — US Treasuries — have evolved to the digital age a bit slower. While programs like TreasuryDirect do exist, in which users can set up an account online and purchase securities directly issued by the US Department of Treasury, the actual interbank securities clearing network had remained relatively antiquated until the launching of FedNow this past summer.

FedNow, on first glance, seems innocuous enough – a new communications tool for Federal Reserve-partnered banks to exchange securities. But, on second glance, its necessity in the 21st century implementation of dollar hegemony becomes clear. The settlement and exchange of Treasuries, the asset that actually backs the digital dollars created from checking deposits by private capital creators, has now become further regulated, centralized, and controlled.

A reverse repo, or a reverse repurchase agreement, is the preferred method for banks to seek yield by temporarily loaning securities, specifically Treasuries, for cash due to the fact that each party physically exchanges the assets, with an agreement to repurchase the securities the next day with an added service fee. Banks much prefer to do this as opposed to a more traditional loan structure due to the mitigated liability risk that comes downstream of physically holding on to the collateral in the agreement. Say a cash-strapped bank has recently secured a loan to meet current liquidity needs, but before they can repay the loan, the culmination of financial woes causes the bank to declare bankruptcy and ultimately be seized by authorities. The lending bank now not only loses out on its service payments, but also the entire liability of the loan principal. If they had agreed to a reverse repo exchange, while the lender would still lose out on collecting their fees, they would at least retain the rights to the exchanged Treasuries currently within their custody.

The US banking system makes a lot of money by buying US Treasuries and using them to create dollars. The US Department of Treasury also benefits as it is able to service the budget of the US government by selling its debt to the US banking system. Neither of these entities want to muck up their racket: The US government doesn’t want to be directly responsible for managing retail account balances for citizens (as would be the case with a direct-issued dollar CBDC), and the biggest banks certainly don’t want to lose their effective monopoly of private capital creation by letting some outsider fintech company secure the contract for directly issuing digital dollars for the government. FedNow is strictly a wholesale product. In fact, it isn’t really a product at all ––there is no token and it only aims to allow regulators to more closely surveil the exchange of Treasuries.

The purchasing of Treasuries, however, is rapidly shifting towards an entirely new customer class: stablecoin issuers. Much like how a private-sector bank would purchase government-issued securities to back the issuance of dollars in a retail checking account, stablecoin issuers such as Tether (USDT) or Circle (USDC) have become net-buyers of short-term Treasuries referred to as T-bills. Tether CEO Paolo Ardoino tweeted in September 2023 that “Tether reached $72.5 billion exposure in US T-bills, being [a] top 22 buyer globally, above the United Arab Emirates, Mexico, Australia and Spain.” Just three months later, in December 2023, Tether’s Treasury holdings were over $90 billion. For reference, the largest single holder of US Treasuries is Japan with just over $1 trillion held –– Tether alone already commands nearly a tenth of their balance sheet. In our current high interest rate environment, the yield from these short duration securities can be substantial, leading to large revenue streams for not only these stablecoin issuers, but the companies and banks that custody their assets.

Tether’s substantial Treasury holdings are distributed among three main custodians: Charles Schwab, Fidelity and Cantor Fitzgerald. Cantor Fitzgerald is perhaps most famous for having its flagship office destroyed during the events of 9/11, but it continues today as one of the 24 primary dealers authorized to trade US government securities with the Federal Reserve Bank of New York. Earlier this month, Howard Lutnick, the CEO of Cantor Fitzgerald, made an appearance on CNBC Money Movers Podcast in which he stated “I’m a big fan of this stablecoin called Tether…I hold their treasuries. So I keep their treasuries, and they have a lot of treasuries.” He further stated his affinity for the company by making reference to Tether’s recent trend of blacklisting of retail addresses flagged by the US Department of Justice. “With Tether, you can call Tether, and they’ll freeze it.”

Just this October, Tether froze 32 wallets for alleged links to terrorism in Ukraine and Israel. In November, $225 million was frozen after a DOJ investigation alleged that the wallets containing these funds were linked to a human trafficking syndicate. This month alone, over 40 wallets found on the Office of Foreign Assets Control’s (OFAC) Specially Designated Nationals (SDN) List have been frozen. Ardoino explained these actions by stating that “by executing voluntary wallet address freezing of new additions to the SDN List and freezing previously added addresses, we will be able to further strengthen the positive usage of stablecoin technology and promote a safer stablecoin ecosystem for all users.” Just a few days ago, Ardoino claimed that Tether has frozen around $435 million in USDT for the US DOJ, FBI and Secret Service. He also explained why Tether has been so eager to help the US authorities freeze funds – Tether is seeking to become a “world class partner” to the US to “expand dollar hegemony globally.”

The stablecoin ecosystem, where US dollar-pegged stablecoins dominate, has become increasingly intertwined with the greater US dollar system and – by extension – the US government. The DOJ has the retail-facing Tether on a leash after pursuing the companies behind it for years and now Tether blacklists accounts whenever US authorities demand. The Treasury benefits from the mass purchasing of Treasuries by stablecoin issuers, with each purchase further servicing the federal government’s debt. The private sector brokers and custodians that hold these Treasuries for the stablecoin issuers benefit from the essentially risk-free yield. And the dollar itself furthers its effort to globalize at high velocity in the form of USDT, helping to ensure it remains the global currency hegemon.

In effect, Treasuries are being bought hand over fist, and dollars are being spent en masse. Much like the discrepancy between Bitcoin’s UTXO or coins model and Ethereum’s account balance model, Treasuries and dollars behave exceptionally differently in economic terms. A government could never directly issue what is known as M0 –– base money –– to retail accounts, and thus a CBDC could never serve as anything but M1 — a programmable checking account that relies on trust in a financial service provider to be exchanged. Perhaps a directly-issued US dollar-denominated CBDC is a red-herring. Just ask the Fed.

For instance, Federal Reserve Vice Chair for Supervision Michael Barr stated this past November that “There’s obviously a lot of innovation happening in the private sector,” while later implying that the Federal Reserve has a “very strong interest” in regulating, approving and supervising US dollar-pegged stablecoin issuers. Deputy Secretary of the Treasury Wally Adeyemo recently lobbied Congress on behalf of the US Treasury to extend the regulatory powers over dollar-denominated stablecoins beyond US companies and even US citizens. “Legislation could explicitly authorize OFAC to exercise extraterritorial jurisdiction over transactions in stablecoins pegged to the USD (or other dollar-denominated transactions) as they generally would over USD transactions,” the proposal suggested, even for transactions that “involve no U.S. touchpoints.”

Last month, the Atlantic Council also wrote of “the current [Federal Reserve] policy trajectory favoring private stablecoin issuance rather than official CBDC issuance,” making note of an August 8 regulation letter stating that “the Federal Reserve formally shifted its stance to promote stablecoin issuance by banks.”

Over a year before Barr’s statements or the Atlantic Council’s post, Bruno Sultanum, an economist in the Research Department at the Federal Reserve Bank of Richmond wrote in a July 2022 brief that “privately issued stablecoins could be equivalent to CBDCs” and that “there may be a pathway to create an effective ‘synthetic’ CBDC in the form of stablecoins. More generally, the discussions around the introduction of CBDCs should always include an evaluation of the possibility of considering well-regulated stablecoins as a viable (and possibly preferable) alternative.”

In addition, the aforementioned CSIS brief authored by CIA veteran DiPippo mentions multiple architectures the US government could adopt for their digital dollar, while realizing the advantages of a bank-issued deposit token. “A synthetic CBDC, is not really a CBDC at all, because the central bank would not be issuing the digital currency. A synthetic CBDC is a stablecoin with a twist: the issuing financial institution would back its stablecoin with reserves at the Fed.” He then noted that “A synthetic CBDC, or a system permitting the issuance of multiple fully backed dollar stablecoins, would be as safe as a CBDC while offering more private-sector competition and innovation.” In November 2021, the President’s Working Group on Financial Markets (PWG), the Federal Deposit Insurance Corp. (FDIC) and the Office of the Comptroller of the Currency (OCC) released a joint report on stablecoins, which highlighted that stablecoins could improve the US payment system but could also create financial risks if left unregulated. In general, realizing any benefits from stablecoins would require government regulation.

In prepared remarks this October, Barr stated “research is currently focused on end-to-end system architecture, such as how ledgers that record ownership of and transactions in digital assets are maintained, secured, and verified, as well as tokenization and custody models.” Barr also made the claim that any USD-denominated token “borrows the trust of the central bank,” and thus “the Federal Reserve has a strong interest in ensuring that any stablecoin offerings operate within an appropriate federal prudential oversight framework, so they do not threaten financial stability or payments system integrity.” Due to the popularity of and volume present in both the Treasury and stablecoins markets, there are currently many private banks attempting to digitize the securities market by creating a synthetic deposit token that acts like Treasuries.

In addition, the recent push in the US toward regulated stablecoins/deposit tokens and away from a direct-issued CBDC has other motives. While this push is at least partially motivated by the “bad reputation” that the term stablecoin has developed in the aftermath of the TerraLuna fraud in early 2022 and subsequent scandals in the crypto industry, commercial banks – including those that back Fluent Finance, R3 and their equivalents – want to issue the stablecoins/deposit tokens themselves in order to continue fractional reserve banking.

Fractional reserve banking, long controversial due to its role in facilitating bank runs and bank insolvency and characterized as some as little more than embezzlement, has long been a cornerstone of the US banking system. However, the current stablecoin paradigm, including that formerly embraced by Fluent Finance, have fallen out of favor with commercial banks as the 1:1 peg means that banks would have to hold onto equivalent reserves for every coin/token issued. In fractional reserve banking, banks engage in “credit creation” by loaning out the bulk of the money deposited by its customers and are unable to immediately (or even quickly) redeem customers’ money upon request – the entire purpose of the 1:1 ratio that characterizes most of today’s stablecoins. For banks to continue “business as usual”, the issuance of stablecoins and deposit tokens must come under their purview, as opposed to existing stablecoin issuers or even the Fed. Fluent Finance, as a company heavily influenced and guided by powerful commercial banks, is clearly positioning itself to be a key part of this bank-led digital dollar system.

In January 2023, Fluent’s Bradley Allgood told CoinDesk how the United States has been establishing its preference for a private-public model. He specifically pointed to the Federal Reserve Bank of New York and highlighted its initiatives in testing deposit tokens backing digital dollars for wholesale transactions in collaboration with major banks:

“When you look at the Fed of New York and what they have been doing in their innovation offices, this has been setting the standard, with all of it leaning towards wholesale, tokenized deposits or tokenized liability network settlement between bank to bank.”

During much of 2022, and particularly the timeframe in which Fluent Finance was forging its early partnerships including with Farmington/Moonstone, the behind-the-scenes push to create a synthetic CBDC for the US dollar in the form of regulated dollar-pegged stablecoins and/or deposit tokens was well underway. Fluent, from its earliest days, has sought to develop this synthetic CBDC and make it interoperable with any future direct-issued CBDC from the Federal Reserve while also exporting this synthetic dollar CBDC to the Global South. In light of the company’s (and US+’s) trajectory, it now makes sense to revisit the most likely motivation behind Moonstone’s partnership with Fluent prior to FTX’s collapse as well as the likely real goal behind Farmington’s transition into Moonstone.

The Bankman-Fried Stablecoin That Almost Was

Prior to the collapse of the Sam Bankman-Fried-led exchange FTX, there was already considerable speculation about the unusual relationship between FTX and its subsidiaries, Deltec and the dollar-pegged stablecoin Tether (USDT). For instance, nearly a year before FTX went under, Protos reported that “over two-thirds of all Tether minted across multiple years went to just two crypto companies”, one of which was the FTX-linked Alameda Research, the same Alameda Research that would later pour millions into Farmington State Bank during its suspect transition into Moonstone. Earlier that year, Alameda executive Sam Trabucco essentially admitted on Twitter that Alameda would use its massive holdings of USDT to maintain USDT’s peg to the US dollar (something also admitted by former FTX executive Ryan Salame). By October of 2021, Alameda had been issued almost $37 billion worth of USDT and had immediately forwarded $30 billion of that to FTX. Around that same time, FTX issued a $50 million loan to Deltec, which was a key bank for FTX and still is for Tether and whose chairman, Jean Chalopin, had recently acquired Farmington State Bank.

Over the next several months, Alameda Research and Sam Bankman-Fried himself would pour many millions into the Chalopin-controlled entity, making Farmington/Moonstone the newest entity of the Deltec-FTX-Tether nexus. This brings us to the big question: If Deltec and FTX were so close to Tether, why was the bank they controlled – Farmington/Moonstone – seeking to partner so intimately with another US dollar-pegged stablecoin – Fluent Finance’s US+?