Month: January 2024

Asia FX muted, dollar steadies ahead of inflation, Fed test

Post Content

To Meme, Or Not To Meme: The CAT

Is it really surprising, given that cats have essentially dominated the internet for the last two decades, that cat memes have finally taken over the Bitcoin space as well in the last few weeks? Cats are the most viral meme on the internet, so it’s not shocking in the least bit that the Taproot Wizards have leaned into it, reinforced by the trolling Luke over his “dietary choices.”

The question has to be asked though, are meme campaigns really how we want to go about deciding and discussing consensus changes to a protocol as valuable as Bitcoin? I’ve seen numerous music videos, campaigns to go out in the world and “educate” people on OP_CAT, and the whole “Quest” system that Taproot Wizards has launched taking place…but the reality is the vast majority of this content that I have seen has been incredibly superficial.

Rijndael, “Artificer” at Taproot Wizards and one of the few people, if not the only person, actually tinkering and playing with OP_CAT to build out use case examples, has made a demo of a OP_CAT based covenant script.

This script enforces a specific amount of Bitcoin be sent to a specific address, and by consensus there is no other way to spend these coins except with a transaction that meets those exact conditions. Look at the size of this script:

OP_TOALTSTACK OP_CAT OP_CAT OP_CAT OP_CAT de890a8209d796493ee7bac9a58b62fbced10ccb7311e24f26c461c079ead08c OP_SWAP OP_CAT OP_CAT OP_CAT OP_CAT OP_CAT OP_CAT OP_CAT OP_CAT OP_CAT 54617053696768617368 OP_SHA256 OP_DUP OP_ROT OP_CAT OP_CAT OP_SHA256 424950303334302f6368616c6c656e6765 OP_SHA256 OP_DUP OP_ROT 79be667ef9dcbbac55a06295ce870b07029bfcdb2dce28d959f2815b16f81798 OP_DUP OP_DUP OP_TOALTSTACK 2 OP_ROLL OP_CAT OP_CAT OP_CAT OP_CAT OP_SHA256 OP_FROMALTSTACK OP_SWAP OP_CAT OP_FROMALTSTACK OP_DUP 1 OP_CAT OP_ROT OP_EQUALVERIFY 2 OP_CAT 79be667ef9dcbbac55a06295ce870b07029bfcdb2dce28d959f2815b16f81798 OP_CHECKSIG

This is what it takes to emulate CHECKTEMPLATEVERIFY. The equivalent script using CTV would simply be:

CTV .

I ask, what is the value of something like OP_CAT in emulating the case of basic template covenants (things requiring a spending transaction to fulfill certain conditions defined ahead of time to be valid) like this? We know exactly how to handle schemes enforcing a template on transactions spending an output locked to a template covenant, and have multiple proposals for them. CTV, TXHASH, OP_TX, and even APO can emulate these schemes by stuffing a signature in the locking output of a transaction at the cost of an extra 64 bytes.

What actual use is OP_CAT in “experimenting” to meet the needs of a class of use cases that are mature enough in design that there are at least 4 covenant proposals that can handle those use cases with a tiny fraction of the data cost? “Oh, we want to experiment with CAT because it’s flexible!” You want to use 30 OP calls to do something that can be done in one? That is a reason to actually enact a consensus change to Bitcoin? The logic of that is beyond absurd.

Downplaying Risks

In a vacuum OP_CAT is sold as “simply concatenating two strings”, and many of the memes attempt framing it as “how can that be dangerous?” This is a wildly disingenuous narrative surrounding the proposal, and it completely ignores how it interacts with other existing and future aspects of script.

In particular CSFS + CAT opens a massive amount of possibilities in terms of what can be done with Bitcoin script, not all of it necessarily positive. CSFS allows you to verify a signature on an arbitrary piece of data in the course of executing a script, and CAT allows you to “glue” different pieces of data together on the stack. These two things create a massive design space for what it is possible to do with Bitcoin.

One concrete example would be the potential to enforce amounts, or relationships between different amounts, of specific inputs and outputs in a transaction. CAT allows you to build up a transaction hash from individual pieces on the stack, and CSFS allows you to verify a signature against a public key in the locking script against arbitrary pieces of that transaction as it is built up. This could ultimately enable the creation of open-ended UTXOs anyone can spend, as long as the spending transaction meets certain criteria, such as a specific amount of coins be sent to a specific address. Combine this with the reality of OP_RETURN based assets, and this starts getting into the territory of Decentralized Exchanges (DEX).

Some of the worst incentive distortion problems that have come to fruition on other blockchains ultimately stem from the creation of DEXes on those chains. Having direct non-interactive exchange functionality on the blockchain is one of the worst forms of MEV, especially when the potential exists for miners to lock-in their profit across multiple trades in the span of a single block, rather than having to actually carry the risk of a position across multiple blocks before closing it out and realizing profit.

Part of the movement behind Taproot Wizards is “bringing the innovation back.” I.e. that lessons learned in shitcoin land are coming home to Bitcoin, now while I firmly reject the notion that anything useful has been developed on other coins in the last decade other than the basic concept of zero knowledge proofs, this mantra getting louder ignores a massive component of that dynamic even if you disagree with my view there: there are lessons to be learned regarding what NOT to do as well as what TO do.

DEXes are one of the things NOT to do. Nothing has caused as much chaos, volatility in fee dynamics (which we need to smooth out over time for sustainability of second layers), and just all around incentive chaos regarding the base consensus layers of these protocols and their degree of centralization. The idea that we should rush to bring these types of problems to Bitcoin, or exacerbate them by introducing a way to trustlessly embed the bitcoin asset into them in more dynamic and flexible ways, is frankly insane. This to me speaks of large swaths of people who haven’t learned anything from watching what happened on other blockchains in the last half decade or so.

Forever Shackled By The Cat

Looking at the dynamic above between CSFS + CAT, it is worth pointing out that Reardencode’s recent LNHANCE proposal (CTV + CSFS + Internal Key) offers a path to give us eltoo for Lightning in a way that is actually more blockspace efficient than using APO. If this argumentation, and build out of proof of concepts, winds up winning over Lightning developers who want LN symmetry in order to simplify Lightning channel management and implementation maintenance, we very well could wind up getting CSFS in the process. If OP_CAT were active prior to this, then there is no way to avoid the types of detrimental side effects of the two proposals being combined.

This would hold true for every soft fork proposal going forward if OP_CAT were ever activated. It would be impossible to escape whatever side effects or use cases were enabled by combining OP_CAT with whatever new proposals come in future. On its own OP_CAT is clunky, inefficient, and rather pointless. But in combination with other OPs it begins to get stupidly flexible and powerful. This would be a dynamic we would never be able to escape, and features that might wind up being critically necessary in the future for Bitcoin’s scalability could inescapably come with massive downsides and risks simply because of the existence of OP_CAT.

Is this a reality we want to enter simply because of a meme campaign? Because people want to tinker with wildly inefficient means of doing things instead of looking through much more efficient and purpose built proposals? I would say no.

Meme campaigns can be fun, I know this. They foster a sense of community and involvement, it’s an inherent and inescapable part of the internet and the numerous cultures that exist on it. But this is not how we should be deciding the development process of Bitcoin. They can be fun, and they can even be viciously savage at stabbing directly to the heart of matters people dance around or equivocate on. But they are atrocious at capturing nuance and complexity in many regards.

Trying to steer the consensus of a network like Bitcoin purely based on the value of a meme, rather than reasoned consideration of proposals and their implications, is a disaster waiting to happen. The conservatism and caution of Bitcoin development is what has kept it at the forefront of this space as shitcoins have come and gone, imploding in the consequences of their fly by night carefree development attitude. As much as Bitcoin sorely needs to break out of its current rut of stagnation and lack of forward progress, devolving to uncritical memes and music videos is not how to do that. It risks destroying what made Bitcoin valuable in the first place, its solid and conservative foundation.

US dollar gains after GDP data; euro falls to six-week low after dovish ECB, Lagarde

Post Content

A Bitcoin Standard Unleashed

Introduction

The transition from Fiat Standards to the Bitcoin Standard, though highly desirable, is not inevitable or necessarily imminent. The timing and occurrence of these changes hinge on the adoption choices made by individuals, organizations, and public entities. These decisions are influenced not only by rational considerations but also by emotional and irrational factors (greed and fear above all). The collective will, formed by the intentions of a critical mass with sufficient capital and agency, plays a crucial role in displacing central banks and the entrenched power structures in favor of a new system centered around Bitcoin. Despite Bitcoin’s evident technical, economic, and ethical superiority over other form of money, this struggle will undoubtedly be a formidable one, with the outcome far from assured.

Nonetheless, it is crucial to reflect on the consequences that this potential revolution, if realized (as we all hope), could have on every facet of social existence. These implications span from the nature of states and international relations to the functioning of economic systems, prevailing value systems, and even the energy market and technological innovation. In this article, without the pretense of being exhaustive, we aim to briefly explore some of these aspects and suggest plausible trajectories.

Bitcoin and Fractional Reserve Banking

As Hal Finney correctly forecasted, a hypothetical Bitcoin Standard would be incompatible with central banks but not necessarily with a fractional reserve banking system. Algorithmic limits on the number of transactions per block will certainly prevent Layer 1 from serving as a retail payment system. Over time, fewer transactions will occur on it, and these will be of a very high value (in practice, only whales or large public and private institutions, given the high costs, will be able to afford them).

Some form of free banking 2.0 on Layer 2 would then be quite inevitable in the medium to long term for a Bitcoin-based monetary system. In the absence of a central bank as the lender of last resort and with much easier reserve verifiability than with gold, this Layer 2/layer 3 FRB (Fractional Reserve Banking) will be much more fragile than the current fractional reserve system supported by legal tender, central bank, and practical indistinguishability between the monetary base and the money supply. This will only reinforce the importance of Layer 1 as the solid foundation of the monetary system, similar to the role gold played in past millennia.

Macroeconomic Implications

Ceteris Paribus, in the medium term, the adoption of a hypothetical Bitcoin Standard should significantly dampen economic cycle fluctuations, preventing excessive indebtedness, mal-investment, and credit bubbles in the private sector, leading to systemic debt crises. Monetary repression would also result in much slower but steady real growth rates in economies in the medium to long term. With the absence of the engine of monetary and credit expansion, i.e., the inflationary policies of central banks, the nominal growth of output within a Bitcoin Standard will be modest, but real growth will remain significant. In other words, any increase in multi-factor productivity will result in a decline in consumer prices measured in satoshis rather than an increase in nominal output. In this context, even in the short term, economic growth will depend on demographic, ecological, and economic factors rather than monetary or credit factors.

In this regard, with the Bitcoin Standard, there will be a gradual shift of wealth from the financial sector, which has become voracious today, to the real and productive economy. This is a consequence of the significant downsizing of bond and money markets (reduction in the level of indebtedness of economies) and therefore the entire industry profiting from them.

Among the businesses that will experience the most downsizing are centralized payment and clearing systems, traditional credit institutions, fiduciary agents such as notaries (replaced by smart contracts on Layer 2 and 3 of Bitcoin), and those involved in financial, real estate, and insurance intermediation.

On the contrary, anything leveraging the potential of Bitcoin’s layers (for smart contracts) and DeFi will experience a real boom.

(Geo)political Implications

Regarding the immutability of the monetary base, it would force states into strict fiscal discipline as the option to monetize deficits or debt as a form of public spending financing would disappear. This will profoundly influence the ability of nation-states to provide welfare or wage wars. In the absence of a monetary printing press and, thus, the insidious tax called inflation, fiscal pressure and the allocation of public spending will become the subject of serious negotiations and political disputes, as they will directly affect the pockets of citizens/subjects/taxpayers.

On one hand, this could encourage more direct forms of democracy (facilitated by the spread of blockchains and DAOs) to give citizens a greater say in tax and spending decisions. On the other hand, a world based on the Bitcoin Standard could lead to a much more fragmented and apolar geopolitical landscape, given the intrinsic unsustainability of maintaining such large and inefficient state apparatuses, resembling more the classic medieval feudalism. Instead of the sword/blood/robe aristocracy, Bitcoin whales would become the dominant social class, where non-coiners would be a kind of new serfdom. The former, individuals, families, and institutions with huge Bitcoin holdings (created in the early stages of adopting this technology, i.e., in the first two decades of its existence), would be able to provide welfare, work, and protection to citizens/subjects in exchange for loyalty, services, and obedience to their “feudal” rule. The latter, the vast majority of the population whose ancestors arrived too late to adopt and convert their fiat capital into Bitcoin (for various ideological or practical reasons, including economic constraints), would find themselves at the bottom of the pyramid and would be forced to earn their living through the sweat of their brow or (more likely, given technological advances) through the generosity, more or less interested, of philanthropic whales. This dynamic would also apply internationally: there would be pioneering regions or nations that, having adopted Bitcoin as legal tender first, would enjoy a significant relative wealth advantage that would be hard to match by latecomers.

These would not necessarily be the currently dominant nations; in fact, some may not even exist at present. The ultimate result would be a much more fragmented international system than the current one, consisting of a mix of democratic, socialist, or oligarchic city-states, crypto-aristocratic fiefdoms centered around individual families, and large anarchic and chaotic regions. All these entities would be in competition/cooperation with each other, forming a completely new and constantly evolving geopolitical-ideological landscape. In a world where old identity affiliations (national, ideological, and religious) would overlap and mix with new identities based on the interpretation of the Bitcoin revolution. Given the technological assumptions and ideological foundations of Bitcoin culture, a “coinist” religion could emerge, tied to certain ritualistic and faith-based aspects that are already glimpsed among its staunch supporters (immaculate conception, decentralization, worship of Satoshi, algorithmic infallibility). In any case, the Bitcoin Standard would impose on the societies adopting it some economic norms closely influencing public morality. Among them are the sense of limit, the ethic of saving, prudence in investments, long-termism, honesty in commercial transactions, individual responsibility, fiscal discipline, and, of course, the independence and incorruptibility of money from state powers.

Nodes, Mining, and Geopolitics

Nodes are the heart of the Bitcoin network and would, therefore, receive significant attention from political powers. Controlling full nodes (and thus potential miners) within a specific territory by public authorities would be extremely important for claiming sovereignty internally and influencing the international scene. Naturally, given other variables, nations capable of producing energy at lower costs or on a larger scale would have an advantage in allocating and thus controlling significant shares of the global bitcoin hashrate. An eternal struggle for control of the global hashrate will be the new center of geo-economic disputes. That being said, it is by no means guaranteed that most territorial political entities will be able to effectively exert this control, and it’s uncertain how they will go about doing so.

While legitimate physical coercion might seem like the obvious choice, given the specific nature of states, it may not necessarily be the most successful approach in a geopolitically more fragmented and competitive landscape than the current one. Thanks to the high mobility of Bitcoin and the fiscal constraints imposed on traditional states by this monetary system, miners and whales alike could quite easily opt to move elsewhere if their property rights and entrepreneurial freedom end up in danger, finding sanctuary in more libertarian jurisdictions. On the flip side, a different scenario may unfold for those novel ‘neo-aristocratic’ state entities built around one or more Whales; in this case, the monopoly over mining and the necessary energy resources might be more pronounced, given the immense economic power held by their governing bodies.

Energy Market Implications

Bitcoin is not a commodity currency but an energy one. The power it encapsulates is the energy consumed to create and transfer it. As the lifeblood of the new monetary paradigm, therefore, energy will be even more at the core of the economic system than today. This will radically inform progress in the energy sector, generating a race for technological innovations on both the extraction and energy-saving sides. A whole range of energy sources previously neglected as uneconomical could now become convenient and accessible thanks to their use for mining. Think of the sun in African and Asian deserts, deposits of methane and natural gas in remote locations, or geothermal energy from volcanoes and geysers, or even some systems based on wave motion and temperature differentials in the depths of the oceans.

With an ever-increasing demand for energy, there will be a growing incentive to generate more energy and do so more efficiently in a virtuous circle that could lead to a major energetical revolution, potentially bringing humankind closer to a level 2 civilization on the Kardashev scale, certainly contributing to electrifying the planet even in the remotest places. Another likely consequence of a Bitcoin Standard will be the reversal of roles between energy producers and consumers. The largest energy consumers (mining farms) will over time become the main energy producers in a vertical integration of assets and energy infrastructure that, starting from the bottom, will assimilate the entire energy industry. Whether this will lead to greater or lesser concentration versus decentralization of energy producers remains to be seen, but it will certainly depend on the commercial dynamics of the mining industry.

This is a guest post by Michele Uberti. Opinions expressed are entirely their own and do not necessarily reflect those of BTC Inc or Bitcoin Magazine.

Swan Bitcoin Launches Mining Division, Targets Over 8 Exahash by March

Today, BTC-only exchange Swan Bitcoin unveiled its new mining division, Swan Mining, which was previously operating in stealth mode, according to a press release sent to Bitcoin Magazine. The division is now positioned under Swan Institutional, with a focus on securing the Bitcoin network while contributing to the expansion of energy production and stabilization of electrical grids.

Having commenced operations in Summer 2023, Swan Mining is already a substantial contributor to the Bitcoin network, providing 4.5 exahash, according to the release. With plans to enhance its capacity to over 8 exahash, the unit has rapidly purchased and deployed mining equipment, expecting full deployment by March. Notably, Swan Mining stated it has already successfully mined over 750 bitcoin.

“We are proud to play a role in keeping Bitcoin mining decentralized,” said Rapha Zagury, Swan CIO and head of Swan Mining. “Our understanding is that this is the fastest-ever initial deployment of hashrate at this scale in Bitcoin history. With hard work and a little luck, we hope Swan Mining will help to secure the network for many decades.”

Zagury further stated that to avoid causing disruption in ASIC pricing, Swan Mining first launched in stealth mode, which also allowed the company to develop its strategy to partner with operators in the space.

Swan’s mining business follows a funding model with no debt, with entities legally segregated from the rest of Swan’s operations. The launch of Swan Mining is also playing a important role in the growth of Swan Institutional, the company stated, fostering strategic partnerships with major industry players. Swan’s institutional unit supports capital raises and balance sheet restructuring, aiming to unlock notable operational and financial potential for its partners.

“Swan Mining is a great example of our company thesis playing out,” said Swan founder and CEO Cory Klippsten. “With our exclusive focus on Bitcoin adoption and helping the industry grow, we continue to attract the talent, opportunities, and capital required to launch new business lines and grow them rapidly.”

Riding on a year of substantial expansion, Swan Bitcoin has doubled its team size and grown revenue to over $125 million annualized, according to the release. With plans to raise Series C financing in the coming months, Swan Bitcoin intends to allocate capital equally between financial services, mining, and acquisitions. Swan Bitcoin’s CEO, Cory Klippsten, also disclosed the company’s active pursuit of a public listing within the next 12 months.

Dollar steadies ahead of 4Q GDP; euro awaits ECB meeting

Post Content

Japan’s top forex diplomat vigilant to market impact from BOJ stimulus exit

Post Content

Asian FX bears gain momentum as hopes of early US rate cuts wane: Reuters poll

Post Content

Asia FX steady amid China stimulus cheer, dollar muted before GDP data

Post Content

Dr Craig Wright Offers Settlement To COPA in Legal Confrontations Over Bitcoin

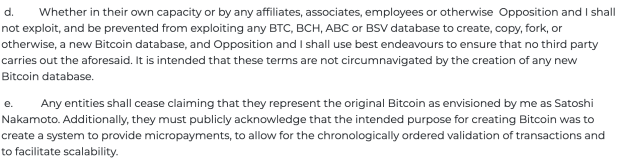

Today, Dr Craig S Wright, who claims to be Satoshi Nakamoto despite providing no concrete evidence, has issued a settlement offer to members of the Crypto Open Patent Alliance (COPA) and all other parties involved. The letter, published on Wright’s personal blog, outlines the terms of the proposed settlement.

The letter from Dr. Wright expresses a willingness to reach settlement on multiple cases of prolonged legal confrontations that he started. The proposed settlement offers to waive Wrights database rights and copyrights relating to BTC, BCH and ABC databases, and “to offer an irrevocable license in perpetuity to my opposing parties who collectively control, operate, and/or own those databases.” It is important to note that Bitcoin (BTC) is a decentralized and distributed ledger, meaning no one individual or organization owns and controls the network.

“Obviously if he’s not Satoshi (which is COPA’s case) then the “database rights and copyrights” are not his to grant licenses to,” reportedly said WizSec Bitcoin Research. “Calvin and Craig probably think they’re playing 5D chess by building this “offer” on such an obvious false premise.”

A part of Wright’s terms is that COPA must not create, copy, or fork Bitcoin. It is important to note that Craig Wright’s Bitcoin Satoshi Vision (BSV), is a fork of Bitcoin Cash (BCH), which was a fork of the first and original cryptocurrency, Bitcoin (BTC).

Wright also wrote verbiage in his offer that attempts to continue his stance as self proclaiming himself as Satoshi Nakamoto, demanding in his offer that entities shall cease claiming that they represent Bitcoin, and must publicly acknowledge what he believes Bitcoin was created for.

While it may seem to those who are not up to date on these trials that Wrights offer is reasonable, many Bitcoiners in the community who have been involved in reporting on these cases think Wright is just doing this to “keep on scamming with the Satoshi moniker, and avoid jail time for his 500+ self-made forgeries.”

“Been following COPA – Wright case pending in UK, and I have to say, in 35+ years of litigating I’ve never seen anything in 35 years like the level of document falsification in a lawsuit by a party,” said J Nicholas Gross of Berkeley IP Law Mastery. “At this point I don’t understand how CW’s lawyers can continue to represent a party they can clearly see is committing fraud on the court right in plain sight and now with their complicity?”

The response from COPA members and other involved parties will be pivotal in determining the trajectory of the dispute. COPA, an organization advocating for patent non-aggression in the crypto community, faces the decision of whether to engage in settlement discussions or continue the legal battle. It has until 4pm on January 31st to review and accept or deny the offer from Dr Wright.