Month: January 2024

BlackRock CEO Larry Fink says Bitcoin “Is An Asset Class That Protects You”

In a notable statement, BlackRock CEO Larry Fink has expressed a positive perspective on Bitcoin during an interview today with CNBC, affirming that it “is an asset that protects you.”

“I believe it goes up if the world is frightened, if the people have fearful geopolitical risks, they’re fearful of their own risks,” said Fink. “It’s no different than what gold represented over thousands of years. It is an asset class that protects you.”

Fink’s recognition of Bitcoin as a protective asset suggests helps shift the narrative surrounding the digital currency, emphasizing its role as a safeguard amid economic uncertainties. This endorsement from the head of the world’s largest asset management firm is a significant milestone for Bitcoin’s acceptance within mainstream financial circles.

“Unlike gold where we manufacture new gold, we’re almost at the ceiling of the amount of Bitcoin that can be created,” Fink continued. “What we’re trying to do is offer an instrument that can store wealth.”

The statement comes just two days after the US Securities and Exchange Commission (SEC) approved BlackRock’s, alongside 10 other asset managers, spot Bitcoin ETF. Fink’s positive sentiment further adds to the growing chorus of influential figures recognizing Bitcoin’s potential to play a protective role in an investment portfolio.

As the Bitcoin market continues to evolve, statements like these from key industry figures contribute to shaping a positive narrative around Bitcoin, potentially influencing broader market sentiments and paving the way for increased adoption.

Energy And Bitcoin: An Integrated Analogy

Have you ever looked at the stars and noticed how everything in the universe seems connected? Famous inventor and engineer, Nikola Tesla, thought that this connection is all about energy, how often things vibrate, and the way they move. I believe that as well; our perceptions of every aspect of life can be perceived as a transfer of energy, a simple equation. Let’s take a moment to view the seemingly random interactions in the world as their own version of an energy transaction. The following analogies are different ways to help us think about energy, especially how we use it and share it while also respecting nature’s wisdom. Then, of course, we’ll circle back to how this all relates to understanding how Bitcoin fits into… dare I say “fixes”… this.

Focusing on the internal, energy flows in numerous ways. To have the requisite energy to win the day, I must feed my body a necessary amount of nutrients. Calories are literally a unit of energy in food. I’ve learned a lot recently about the benefits of eating quality proteins (like steak & eggs) as well as the negatives of processed foods, seed oils, etc. The quality of this energy informs the quality of my thoughts and words because we are what we eat, which directly affects my level of inflammation as well as my emotional state. If I don’t charge my battery through quality sleep, I won’t have enough energy to get through the day. My grandfather always said “early to bed and early to rise makes a young man healthy, wealthy, and wise.” It’s hard not to see all of those positive attributes as a result of maintaining the storage of energy.

In my personal interactions throughout the day, I’ve come to the point in my life where I can visualize each connection as a transfer of energy. I see my morning embrace with my wife and kids as a synergistic energy builder; we each walk away more emotionally charged because of it. As I teach throughout the day, I need to keep my energy up in order to be the catalyst, energizing my students’ neural networks through the transmission of knowledge and learning.

Listening to music that resonates within me over my lunch break helps get me pumped up. Commiserating with my coworkers sends ripples of energy, building bridges of understanding and empathy, which help us power through the day. Of course I need my dopamine fix from social media while walking the halls. These tiny sparks of energy from plebs miles away connect us while simultaneously amplifying their message. It could be said that improving our social lives is an attempt to integrate the flow of energy.

Thinking more globally, we’ve learned to harness natural forces and resources and have channeled that energy to improve our living standards. From fire to water to sunlight to oil, we’ve understood the rhythmic patterns of seasons. While respecting nature’s balance, we can see the continuous and harmonious exchange of life-giving forces within our world. We’ve been able to conceptualize a method, admittedly flawed, of transmitting abstract value in the current, traditional form of money. The economy has the potential to be buzzing with activity while sparking growth and innovation in a dynamic cycle of financial exchange. Even governments redirect energy in the form of taxes and imposed morals, shaping our world in profound ways. In politics and power, every decision and policy is like a switch that redirects societal energy, influencing public opinion and behavior, a veritable tug of war over public perception. In this light, society’s goal is to iterate towards fairness of sharing energy.

Bitcoin Integrates This

But if those analogies are valid, then how does Bitcoin fit into the concept of energy? Consider the following… Bitcoin integrates the flow of energy, maintains the storage of energy, and promotes the fairness of sharing energy.

Imagine a river flowing smoothly, finding the easiest path downhill. Bitcoin, with its decentralized nature, acts like this river, finding the most efficient ways to transfer value and energy across the globe, bypassing traditional financial dams and obstacles. But here’s the interesting part – the energy used in the mining process is not wasted. In fact, it is harnessed and put to good use. Miners often set up their operations in areas with abundant and cheap energy sources, such as hydroelectric power plants or capturing flare gas emissions. This means that the energy used to mine bitcoins is clean and sustainable, reducing the carbon footprint associated with traditional mining operations.

Just like a battery stores energy, Bitcoin’s limited supply and digital nature make it a reservoir for storing economic energy. Its value, derived from the energy expended in mining and the trust of its users, allows it to hold energy over time, releasing or absorbing it as the market demands. This means that individuals and businesses can use Bitcoin as a way to store their excess energy. For example, a power company can convert excess energy into bitcoins and store them for later use, effectively turning their excess energy into a valuable asset.

In a world where financial systems often favor the powerful, Bitcoin emerges as a beacon of fairness. Its transparent and immutable ledger ensures that every transaction is recorded and open for verification, promoting a just and fair exchange of energy. In traditional energy systems, there is often a centralized authority that controls the distribution of energy. This can lead to inefficiencies and inequalities in the system. However, with Bitcoin, the decentralized nature of the network ensures that energy can be shared more fairly. Individuals can directly transact their economic energy with each other using Bitcoin, bypassing the need for intermediaries and reducing transaction costs.

Bitcoin doesn’t recognize borders, cultures, or biases. It unites the world under a single, universal protocol for energy exchange, allowing individuals from all corners of the globe to participate in a shared economic ecosystem. As we harness more renewable energy sources and improve our technological capabilities, Bitcoin stands ready to integrate these advances, evolving continuously to channel global energy flows more efficiently.

From the sun’s rays permeating our world to the electricity lighting our homes to the feeling of a warm embrace, the world can be perceived as one elaborate transfer of energy. If this is the case, shouldn’t we be embracing a technology that harnesses, democratizes, and respects the flow of energy. As we embrace the future, let’s recognize the role of Bitcoin in shaping a world where energy flows freely, stored securely, and shared justly, empowering us all in this ongoing odyssey of energy transformation.

This is a guest post by Tim Niemeyer. Opinions expressed are entirely their own and do not necessarily reflect those of BTC Inc or Bitcoin Magazine.

How CTV Can Help Scale Bitcoin

OP_CHECKTEMPLATEVERIFY has once again become a focal point in the conversation about improvements to scale Bitcoin. This time around there are many more alternative designs for covenants being proposed, and actual concrete designs that make use of CTV as scaling solutions (Timeout Trees and Ark). The conversation has a much larger depth of concepts to take into consideration, both in terms of alternatives that could be adopted as well as concrete proposals that CTV could enable.

One narrative circulating from the camp of people against CTV is that “CTV doesn’t scale Bitcoin.” Let’s charitably interpret that to mean that CTV itself does not scale Bitcoin, things you can build with it do. Well, then that is not a coherent argument. Segregated Witness did not scale Bitcoin. CHECKLOCKTIMEVERIFY and CHECKSEQUENCEVERIFY did not scale Bitcoin. But the Lightning Network, which those three proposals enabled, do scale Bitcoin. They add a massive amount of overhead for transactional throughput to grow beyond the constraints of the blockchain itself.

Lightning literally couldn’t exist without those base layer primitives. The problem with Lightning though, is it only scales the number of transactions that can be processed. It does not in any way help improve the scalability of ownership over UTXOs, or increase the number of users who can control one. Lightning is currently not capable of doing that with its current design and the current set of consensus primitives available in Bitcoin script.

CTV can change that.

UTXOs And Virtual UTXOs

Part of the problem of Lightning’s shortcoming regarding scalability of Bitcoin ownership is that in order to open a channel, or control a UTXO, you actually have to transact on the base layer. After that Lightning can facilitate a very large number of transactions off-chain, but a user must still transact on-chain to onboard themselves to Lightning. It massively increases the number of transactions Bitcoin can process, but it does nothing at all to increase the number of people who can own bitcoin.

This is another big problem CTV can help with. Burak coined the term “virtual UTXO” for his Ark proposal, but I think this terminology is a perfect general term useful far beyond the context of Ark. A virtual UTXO is one committed to being created in the future, through mechanisms like a pre-signed transaction, but that hasn’t actually been created on-chain yet. Bitcoin does not have the blockspace for everyone to create a single UTXO at the scale of the world population, but there is definitely potential for people to have their own independent virtual UTXO if the process of committing to those can be made scalable.

Scaling the creation of commitments to vUTXOs is the problem. Right now there is no way to create them except through the use of pre-signed transactions, and this introduces a bottleneck that must be addressed. The number of vUTXOs any real UTXO can commit to is bounded by the size of the multisig set signing these transactions. To trustlessly create vUTXOs, the owner of every vUTXO must be part of the multisig key that is signing the transactions that commit to creating them, otherwise they have no guarantee that conflicting transactions will not be generated that voids their ability to claim their vUTXO if necessary. The problem of coordinating the signing of this between every member of the set introduces practical considerations that will ultimately severely limit the size any pool of vUTXOs can grow to. The only other alternative is to have some trusted party or parties sign the transactions committing to everyone’s vUTXOs, and simply trusting them to not steal those funds from the rightful owners.

CTV offers a solution to both of these problems. By being able to non-interactively commit to a set of future transactions the same way pre-signed transactions do, but without requiring every owner of the vUTXOs those transactions create to coordinate signing, it solves the coordination problem. At the same time because no one needs to interact, a single person could take the role of funding the CTV output that commits to everyone’s vUTXOs unfurling on-chain, and zero trust in that person after the funding transaction is confirmed is required. Once that real UTXO is confirmed in a block, the person who funded it has no ability to undo or double spend the future transactions it has committed to.

Keep in mind that a vUTXO can be whatever you want it to be. It can be a Lightning channel, a multisig script for cold storage, etc. CTV does what the current form of Lightning does not, it scales actual ownership of Bitcoin, not just the number of transactions it can process.

Cut Through The Shortcut

One of the other criticisms of CTV as “not scaling Bitcoin” is that by committing to future transactions you do not escape the need to put them on-chain eventually, and so therefore CTV doesn’t actually help improve scalability. I like to call this “the OP_IF fallacy.” i.e. once people start talking about CTV they forget OP_IF exists, and that scripts can actually have multiple spending conditions to choose from.

The most powerful things about Taproot are the ability to construct multisigs by just adding two public keys together and sign for them with a single aggregate signatures, and to only selectively reveal a single “IF” branch of a script that has multiple ways to be spent. Combined with CTV, this offers a very powerful way to make use of vUTXO commitments. Rather than make a chain of transactions using purely CTV, they can be constructed with the CTV spending path buried inside a taproot tree. The end of the chain of transactions are all the individual vUTXOs each participant owns, locked to that user’s public key alone. As you go backwards towards the root of the tree, each set of keys that are below any node in the tree can simply be added together and used as the Schnorr multisig key that the CTV spend path is buried under.

This means that at any point in the chain of transactions unfurling on-chain to actually turn the vUTXOs into real UTXOs where you can get every participant in an intermediate UTXO to coordinate with each other, everyone can simply cooperatively sign a transaction moving their coins where they want to go in a more efficient way than simply letting the pre-defined transaction flow unfurl all the way to morph their vUTXOs into real ones. This allows small sub groups to escape needing to actually unfurl the entire set of transactions pre-committed to on-chain, without introducing any trusted parties to rely on or weakening the security of each user’s claim to their own vUTXOs.

These two simple realities offer a massive gain in scalability for Bitcoin without compromising on individual sovereignty or security in doing so, and all we need in order to realize them is CTV.

Acknowledgements: I would like to thank everyone who participates at the Chicago Bitdevs for helping me formulate these observations in a concise way through discussion.

Navigating the Uncharted Waters: Challenges Of Managing A Bitcoin Fund

After FTX collapsed, scornful critics widely ridiculed Caroline Ellison’s approach to stop losses. ‘I just don’t don’t think they’re an effective risk management tool,’ she infamously told an audience during FTX’s heyday. But did she have a point?

Venturing into the crypto asset management realm presents a unique set of challenges that differ widely from the traditional fund space. In this primer piece, we will delve into the obstacles that aspiring fund managers face when launching a bitcoin sector fund and examine the key differences that exist when you step outside the world of traditional asset management.

Volatility and Risk Management

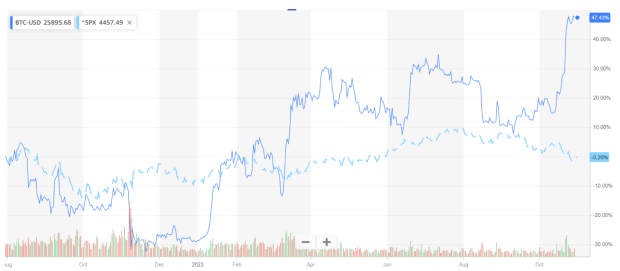

One of the most significant challenges faced by bitcoin sector funds is the extreme volatility that exists within the cryptocurrency market. Bitcoin’s price has witnessed strong bullish surges, driving excitement among investors. However, it has also experienced strong bearish declines, leading to substantial losses for those unprepared for such price swings. Managing risk in such a dynamic environment requires sophisticated strategies, rigorous risk frameworks and assessments, and a deep understanding of market trends.

Unlike most traditional and mainstream blue chip assets, which often experience relatively stable price movements, bitcoin’s price can change meaningfully within a matter of hours. Consequently, bitcoin sector fund managers must be well-equipped to handle sudden price fluctuations to protect their investors’ capital. Traditional stop loss structures may not work to the extent expected, as the closing market order may get executed far below the preset trigger price due to orderbook slippage and rapid price movements, the proverbial “catching of a falling knife”. Using tight stop losses as a foundational risk management mechanism can be your enemy. For example, in a flash crash scenario, positions may be automatically sold at a loss even though the market reverted a few minutes (or seconds) later.

While stop losses are an alternative, they’re not an option! Options are contracts you can buy that give you the right to buy or sell a given asset at a predetermined price (i.e., the strike price) at a given time (i.e., the expiration date). An option to buy an asset is a call and an option to sell one is a put. Buying an out-of-the-money put (i.e., far below the current price) can act as a floor on your potential losses if the price collapses. Think of it as a premium paid to insure your position.

Sometimes to defend against binary result events or particularly high volatility timeframes you just have to flatten your positions and take no risk, living to fight another day in the bitcoin market. Think for example of key protocol update dates, regulatory decisions or the next Bitcoin halving; though note the market moves ahead of those events so you may have to take action beforehand.

Creating an effective risk management plan for a bitcoin sector fund may involve using various hedging techniques, product and instrument diversification (potentially across asset classes), trading venue risk scoring and risk-adjusted allocations, dynamic trade sizing, dynamic leverage settings, and employing robust analytical tools to monitor market sentiment and potential market and operational risks.

Custody and Security

The custody of Bitcoin and other cryptocurrencies is a critical aspect that distinguishes bitcoin sector funds from their traditional counterparts. One key difference is that unlike traditional exchanges that only match orders, bitcoin exchanges do the order matching, margining, settlement, and custody of the assets. The exchange itself becomes the clearinghouse, concentrating counterparty risk as opposed to alleviating it. Decentralized exchanges come with a unique set of risks as well, from fending off miner-extracted value to being ready to move assets in case of a protocol or bridge hack.

For these reasons, safeguarding digital assets from theft or hacking requires robust security measures, including but not limited to multi-signature protocols, cold storage solutions, and risk monitoring tools. The responsibility of securely managing private keys and choosing and monitoring reliable trading venues rests entirely with the fund manager. The burden to monitor the market infrastructure itself introduces a level of technical complexity absent in traditional fund management where custody and settlement are standardized and commoditized standalone systems.

Custodial solutions for bitcoin sector funds must be carefully selected, ensuring that assets are protected against cyberattacks and insider threats. With the history of high-profile cryptocurrency exchange hacks, investors are particularly concerned about the safety of their assets; any breach in security could lead to significant financial losses and damage the reputation of the fund.

Conclusion

Launching a bitcoin sector fund is a thrilling endeavor that offers unprecedented opportunities for investors seeking exposure to the fast-growing cryptocurrency market. It is important, however, to understand that launching a fund is no easy feat with pitfalls going beyond the success of the trading strategy. It is no surprise that every quarter the fund closures are in the same range of fund launches.

Those entering the bitcoin sector fund space should approach it with a pioneering spirit, stay informed, and embrace the dynamic nature of this exciting emerging market. While the road may be challenging, the potential rewards for successful bitcoin sector fund managers could be astronomical.

If you’re ready to start the fund building journey, already en route, or would just like to learn more, reach out to us at advisory@satoshi.capital.

This is a guest post by Daniel Truque. Opinions expressed are entirely their own and do not necessarily reflect those of BTC Inc or Bitcoin Magazine.

Miner Extractable Value (MEV) and Programmable Money: The Good, The Bad, and The Ugly

The core of Bitcoin’s security model relies on this basic game theory—miners, armed with their digital pickaxes, are in a relentless chase for profit. And it’s this pursuit that keeps the network secure. Basic vanilla mining involves producing blocks to earn the block rewards and transaction fees, but have you ever considered that miners might have other ways to extract value from the blockchain beyond this standard mining process? Are there other avenues for profit on the blockchain where miners can leverage their unique position as validators?

What is MEV?

In proof-of-work systems, “Miner Extractable Value” (MEV) is a term that describes the profits miners can earn by manipulating how transactions are prioritized, excluded, rearranged, or altered in the blocks they mine. However, since Ethereum’s upgrade to Ethereum 2.0, which moved the network to proof-of-stake, the concept of MEV has taken on a new name and is now referred to as “Maximal Extractable Value” in proof-of-stake systems. In this context, it’s the block proposers instead of miners—who are the validators—that have the opportunity to extract this value.

Miners (or validators in Ethereum) have a special role in these networks confirming transactions in blocks. Their position places them a step ahead of other users and allows them to determine the final order of transactions in the chain. Inside a block, transactions are typically ordered with the highest fees at the top, but every now and again opportunities open up that would allow miners to take an additional profit by strategically changing the order of transactions for their own benefit.

You might think, what’s the harm in letting miners take a bit of extra profit off the top? The concerns only start to crop up when some of these miners, those equipped with more advanced analytical capabilities and more powerful computing, can identify and exploit MEV profit opportunities more effectively than others.

These opportunities might not always be easy to spot, but the more value that can be extracted through analyzing the chain, the stronger the incentive becomes for research teams equipped with bots to do this work. Over time, this disparity in miner’s profit-making ability creates a trend toward centralization within the network. Ultimately undermining the core principle of the blockchain: decentralization.

This is exactly the scenario the Bitcoin developer community is aiming to prevent when considering how best to manage more expressivity on Bitcoin.

Why Do We Want Programmable Money?

Historically, Bitcoin has operated with relatively simple smart contracts. However, this model struggles with even moderately complex transactions. Bitcoin Script can only validate authentication data, it doesn’t have the capability to impose speed limits on transactions or define coin destinations because Bitcoin Script doesn’t have access to transaction data.

As a somewhat separate issue, working with and writing Bitcoin smart contracts can be challenging for users who don’t fully grasp its security requirements. A proposed feature, known as ‘vaults,’ aims to solve some of these pain points by introducing time-locked conditions for transactions. Essentially, vaults could serve as an emergency “escape hatch,” allowing users to recover their funds in the event of compromised private keys. But features like this are only possible with more expressivity.

Ethereum is widely recognized for its highly expressive scripting capabilities, but it also notably struggles with the issue of MEV. Most users generally assume that Bitcoin has no MEV, in stark contrast to Ethereum, which is viewed as a wild frontier for it. But is this the full story?

Do more expressive smart contracts automatically incentivize more MEV scenarios?

There are several factors that contribute to MEV: (1) mempool transparency, (2) smart contract transparency, and (3) smart contract expressivity. Each of these factors opens up new channels for MEV, we’ll review each here.

The Bad: (1) Mempool Transparency

Like Bitcoin’s mempool, the mempools of most blockchains are fully transparent, open, and visible, so that everyone can see what transactions are pending before being validated and confirmed in a block. Bitcoin blocks typically take about 10 minutes to find, which theoretically gives miners that same amount of time to take advantage and front-run.

In practice, on Bitcoin, this isn’t a source of MEV for a few reasons: (1) Bitcoin transactions are simple enough that no miners have a significant analytic advantage over other miners, and (2) Bitcoin transactions generally don’t execute multi-asset transactions such as swaps or open trades that could be front-run.

Contrast this with Ethereum, which has some of the most complex multi-asset transactions taking place on public decentralized exchanges (DEXs). Officially the block time on Ethereum is 15 seconds, but during periods of high mempool traffic, the required gas fees for immediate block inclusion can easily exceed a hundred dollars. As a result, transactions with lower fees end up waiting minutes or even hours before being included in a block. This can extend the window for these nefarious front-running opportunities, already more prevalent on Ethereum due to the substantial value wrapped up in layer-2 tokens.

The Bad: (2) Smart Contract Transparency

In Bitcoin “smart contracts” are the simple locking and unlocking mechanism inherent in Bitcoin Script. The transaction values, sender, and receiver details are all publicly visible on the blockchain. While this complete and naked transparency isn’t ideal from a privacy perspective, it’s part of how Bitcoin allows all participants in the network to verify the full state of the blockchain. Any observer can analyze these contract details, potentially opening the door to certain MEV-related strategies.

But the Bitcoin scripting language is, by design, quite limited, focusing primarily on the basic functions of sending and receiving funds, and validating transactions with signatures or hashlocks. This simplicity inherently limits the scope for MEV strategies on Bitcoin, making such opportunities relatively scarce compared to other chains.

Platforms like Ethereum, Solana, and Cardano also have fully transparent smart contracts, but they diverge from Bitcoin by also having highly complex and expressive scripting languages. Their Turing-complete systems make it possible to theoretically execute virtually any computational task which has come to include: self-executing contracts, integration of real-world data through oracles, decentralized applications (dApps), layer-2 tokens, swaps within DEXs, and automated market makers (AMMs). These come together to foster a rich environment for MEV opportunities. Zero-knowledge-proof-based schemes, such as STARKex, could theoretically avoid some of these issues, but this trade-off would come with other complexities.

The Ugly: (3) Smart Contract Expressivity

The MEV opportunities are so lucrative on some chains that there are “MEV trading firms” bringing in “high five figures, mid six figures” in profits a month. This trend has become so prominent that there are public dashboards dedicated to scanning for profitable opportunities on Ethereum and Solana. Their profitability is generated by executing the full basket of MEV strategies: front-running, sandwich trading, token arbitrage, back-running, and liquidations to name a few. Each exploiting a different smart contract dynamics for profit.

Some of these MEV strategies apply to both layer-1 and layer-2.

Generalized Front-Running: Bots scan the mempool for profitable transactions, and then front-run the original transaction for a profit.Sandwich Trading: The attacker places orders both before and after a large transaction to manipulate asset prices for profit. This strategy leverages the predictable price movement caused by the large transaction.

Then certain strategies are unique to layer-2 tokens and smart contracts.

Arbitrage Across Different DEXs: Bots exploit price differences for the same asset on various DEXs by buying low on one and selling high on another.Back-running in DeFi Bonding Curves: MEV bots capitalize on predictable price rises in DeFi bonding curves by placing transactions immediately after large ones, buying during uptrends, and selling for profit. DeFi Liquidations: MEV bots spot opportunities in DeFi lending where collateral values fall below set thresholds, allowing validator’s to prioritize their transactions for buying the liquidated collateral at lower prices.

The complexity of contracts significantly contributes to the challenges associated with MEV.

Re-entrancy Attacks: These attacks exploit smart contract logic flaws, allowing attackers to repeatedly call a function before the first execution completes, extracting funds multiple times. In the context of MEV, skilled individuals can significantly profit from this, particularly in contracts with substantial funds.Interconnected Contracts and Global State: On platforms like Ethereum, smart contracts can interact, leading to chain reactions across several contracts from a single transaction. This interconnectivity enables complex MEV strategies, where a transaction in one contract may impact another, offering a chain reaction of profit opportunities.

Part of the problem here is that the total value created by tokens and dApps built on layer-2 often exceeds the value of the blockchain’s native asset on layer-1, undermining the validators incentive to select and confirm transactions purely based on fees.

To make matters worse, many of these opportunities are not strictly limited to network validators. Other network participants with MEV scanning bots can compete for these same opportunities, causing network congestion, raising gas fees, and elevating transaction costs. This scenario creates a negative externality for the network and its users, who are all affected by the price of higher transaction fees, as the chain becomes less efficient and more expensive to operate. MEV in DeFi is so common that users have almost accepted it as an invisible tax on everyone in the network.

Do these MEV opportunities naturally emerge as a byproduct of the highly expressive smart contracts, or is there an alternative route to the dream of fully programmable money?

Short of avoiding protocols with highly expressive smart contracts and layer-2 tokens, users can avoid some of these risks by utilizing protocols that support Confidential Transactions, like Liquid, that conceal transaction details. But unlike these platforms with more expressive scripting languages, Bitcoin lacks the ability to do things you would expect to be able to do with programmable money.

The Good: Trade-Offs to Programmable Money

When considering the evolution of smart contracts on Bitcoin the options we’re given are to (1) push the complexity off-chain, (2) cautiously integrate narrow or limited covenant functionalities, or (3) embrace the path of full expressivity. Let’s explore some of the proposals from each of these options.

(1) A New Structure for Off-Chain Contracts: ANYPREVOUT

Off-chain solutions, like the Lightning Network, aim to enhance Bitcoin’s scalability and functionality without burdening the mainchain, keeping transactions fast and fees low. This all sounds good so far.

SIGHASH_ANYPREVOUT (APO) is a proposal for a new type of public key that allows certain adjustments to a transaction even after it’s signed. It simplifies how transactions are updated, allowing transactions to refer to previous (UTXOs) more easily, making Lightning Network channels faster, cheaper, safer, and more straightforward, especially in resolving disputes.

Under the hood, APO is a new proposed type of sighash flag. Every Bitcoin transaction must have a signature to prove it’s legitimate. When creating this signature, you use a “sighash flag” to determine which parts of the transaction you’re signing. With APO a sender would sign all outputs and none of the inputs, to commit the outputs of the transaction, but not specifically which transaction the funds are going to come from.

APO enables Eltoo, allowing users to exchange pre-signed transactions off-chain. However APO may inadvertently introduce MEV by making transactions reorderable. As soon as you allow a signature that’s binding the transaction graph you have the ability to swap out transactions. Inputs can be swapped, as long as the new inputs are still compatible with the signature.

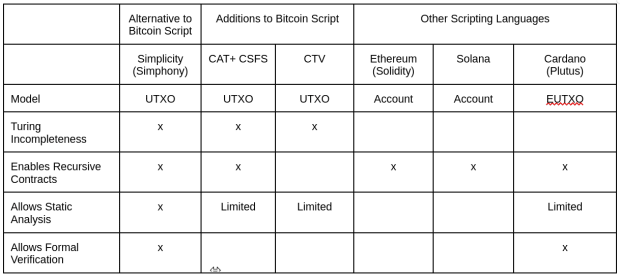

(2) Covenants: CAT + CSFS and CTV

Covenants would allow users to control where coins can move, by imposing speed limits or setting specific destinations for coins in a transaction. There are two different categories of covenants: recursive and non-recursive.

Recursive covenants allow coins to continually return to covenants of the same type.Non-recursive covenants limit this control to the next transaction, requiring the entire future path of the coins to be defined upfront.

CAT + CSFS is a covenant proposal that allows scripts to construct or define certain parts of a future transaction. CHECKSIGFROMSTACK (CSFS) verifies a signature against the data that OP_CAT constructed. By using CSFS to require the signature to match some dynamically constructed format from OP_CAT, we can define how these UTXOs can be spent in the future and create a recursive covenant, albeit clunkily.

OP_CHECKTEMPLATEVERIFY (CTV) is a way of creating non-recursive covenants. Instead of defining and verifying against specific parts of a transaction, CTV restricts how funds can be spent, without specifying the exact next address they must go to. It defines a “template” that the next transaction has to confirm.

One risk with recursive covenants might be possible to create a scenario where coins must follow a set of rules that repeat over and over, that get trapped in a loop without a way of getting out. Another is that, because covenants are transparent and self-executing they could open Bitcoin up to some of the MEV strategies we see on other chains.

What is the good news here?

The good news is that these proposals all introduce new expressivity!

Now what is the maximum amount of expressivity we can get?

(3) Full Expressivity: Simplicity

Simplicity is a blockchain-based programming language that differs from other scripting languages in that it is very low-level. It is not a language on top of Bitcoin Script or a new opcode within it, it’s an alternative to it. Theoretically, it’s possible to implement all covenant proposals within Simplicity, and implement many of the other contracts cypherpunks want from programmable money, but with less of the negative externalities of Ethereum.

Simplicity maintains Bitcoin’s design principle of self-contained transactions whereby programs do not have access to any information outside the transaction. Designed for both maximal expressiveness and safety, Simplicity supports formal verification and static analysis, giving users more reliable smart contracts.

Compare Simplicity to: (1) bitcoin covenant proposals and (2) scripting languages on other blockchains:

The covenant proposals on Bitcoin Script, though much simpler than Simplicity, lack the expressivity to handle fee estimation in Script, due to Bitcoin’s lack of arithmetic functions. There is no way to multiply or divide, no conditionals or stack manipulations opcodes; it is also very hard to estimate a reasonable fee to be associated with a given contract or covenant. Users end up with spaghetti code, where 80% of their contract logic is dedicated to trying to determine what their fee rate should be. Making these covenant contracts super complicated and difficult to reason about.

The EVM has looping constructs which makes static analysis of gas usage very difficult. Whereas with Script or Simplicity, you can just count each opcode, or recursively add up the cost of each function. Because Simplicity has a formal model, you can formally reason about program behavior. You can’t do this with Script even though you can do static analysis of resource usage.

Simplicity would provide users with the highest degree of expressiveness, along with other valuable features like static analysis and formal verification. Users are incentivized, though not restricted, to build smart contracts that are resistant to MEV. Additionally, a combination of different contracts together may give rise to MEV, even when individually they do not. This represents a fundamental trade-off.

The idea of advancing Bitcoin’s smart contract functionality is undeniably promising and exciting. But it’s important to acknowledge that all these proposals carry some degree of MEV risk—albeit likely not to the extent that we see on other chains. As we think about bringing more programmable money to Bitcoin, there are questions we have to ask:

Can we build a protocol with zero MEV risk, or is this an unattainable ideal?Given the inherent risks of MEV in many proposals, what level of MEV risk is acceptable?And finally, what represents the simplest proposal that offers the greatest degree of expressivity?

Each proposal has its own set of advantages and disadvantages. However, regardless of the direction we take, we should always aim to prioritize security and uphold the principle of decentralization.

For detailed updates and more information, keep an eye on the Blockstream Research 𝕏 feed.

This is a guest post by Kiara Bickers. Opinions expressed are entirely their own and do not necessarily reflect those of BTC Inc or Bitcoin Magazine.

The Bitcoin Halving: Why This Time Could Be Different

The fourth Bitcoin halving is almost upon us, and this one has the potential for some very interesting surprises. This halving marks the reduction of the Bitcoin supply subsidy from 6.25 BTC every block to 3.125 BTC per block. These supply reductions occur every 210,000 blocks, or roughly every four years, as part of Bitcoin’s gradual, disinflationary approach to its final capped supply in circulation.

The finite supply of 21 million coins is a, if not the, foundational characteristic of Bitcoin. This predictability of supply and inflation rate has been at the heart of what has driven demand and belief in bitcoin as a superior form of money. The regular supply halving is the mechanism by which that finite supply is ultimately enacted.

The halvings over time are the driver behind one of the most fundamental shifts of Bitcoin incentives in the long term: the move from miners being funded by newly issued coins from the coinbase subsidy — the block reward — to being funded dominantly by the transaction fee revenue from users moving bitcoin on-chain.

As Satoshi said in Section 6 (Incentives) of the whitepaper:

“The incentive can also be funded with transaction fees. If the output value of a transaction is less than its input value, the difference is a transaction fee that is added to the incentive value of the block containing the transaction. Once a predetermined number of coins have entered circulation, the incentive can transition entirely to transaction fees and be completely inflation free.”

Historically the halving has correlated with a massive appreciation in the price of bitcoin, offsetting the impact of the miners’ subsidy being cut in half. Miners’ bills are paid in fiat, meaning that if the price of bitcoin appreciates, resulting in a larger income in dollar terms for the lower amount of bitcoin earned per block, the negative impact on mining operation is cushioned.

In light of the last market cycle, with not even a 4x appreciation from the prior all time high, the degree to which price appreciation will cushion miners from the effects of the halving is an assumption that might not consistently hold true. This coming halving, the inflation rate of bitcoin will drop for the first time below 1%. If the next market cycle plays out similarly to the previous one, with much lower upwards movement than seen historically, this halving could have a materially negative impact on existing miners.

This makes the fee revenue miners can collect from transactions more important than ever, and it will continue to become more central to their sustainability from a business perspective as block height increases and successive halvings occur. Either fee revenue has to increase, or the price needs to appreciate at a minimum by 2x each halving in order to make up for the decrease in subsidy revenue. As bullish as most Bitcoiners can be, the notion that a doubling in price is guaranteed to happen every four years, in perpetuity, is a dubious assumption at best.

Love them or hate them, BRC-20 tokens and Inscriptions have shifted the entire dynamic of the mempool, pushing fees from somewhere in the ballpark of 0.1-0.2 BTC per block prior to their existence, to the somewhat volatile average of 1-2 BTC as of late — regularly spiking far in excess of that.

The New Factor This Time

Ordinals present a very new incentive dynamic to the halving this go around that was not present at any prior halving in Bitcoin’s history. Rare sats. At the heart of Ordinals Theory is that satoshis from specific blocks can be tracked and “owned” based on its arbitrary interpretation of the transaction history of the blockchain, based on assuming specific amounts sent to specific outputs “send that sat” there. The other aspect of the theory is assigning rarity values to specific sats. Each block has a coinbase, thus producing an ordinal. But each block is different in importance to the scheme. Each normal block produces an “uncommon” sat, the first block of each difficulty adjustment produces a “rare” sat, and the first block of each halving cycle produces an “epic” sat.

This halving will be the first one since the widespread adoption of Ordinal Theory by a subset of Bitcoin users. There has never been the production of an “epic” sat while there was material market demand for it from a large and developed ecosystem. The market demand for that specific sat could wind up being valued at absurd multiples of what the coinbase reward itself is valued at in terms of just fungible satoshis.

The fact that a large market segment in the Bitcoin space would value that single coinbase drastically higher than any other creates an incentive for miners to fight over it by reorganizing the blockchain immediately after the halving. The only time such a thing has happened in history was during the very first halving, when the block reward decreased from 50 BTC to 25 BTC. Some miners continued trying to mine blocks rewarding 50 BTC in the coinbase after the supply cut, and gave up shortly after when the rest of the network ignored their efforts. This time around, the incentive to reorg isn’t based around ignoring the consensus rules and hoping people come along to your side, it’s fighting over who is allowed to mine a completely valid block because of the value collectors will ascribe to that single coinbase.

There are no guarantees that such a reorg will actually occur, but there is a very large financial incentive for miners to do so. If it does occur, the length for which it will go on ultimately depends on how much that “epic” sat could be worth on the market to pay for the lost revenue from fighting over a single block rather than progressing the chain.

Each halving in Bitcoin’s history has been a pivotal event people watch, but this go around it has the potential to be much more interesting than past halvings.

How An Epic Sat Battle Could Play Out

There are a few ways this could play out in my opinion. The first and most obvious way is that nothing happens. For whatever reason, miners do not judge that the potential market value of the first “epic” sat mined since Ordinals adoption took off is worth the opportunity cost of wasting energy reorging the blockchain and foregoing the money they could make by simply mining the next block. If miners do not think the extra premium the ordinal can fetch is worth the cost of giving up moving on to the next block, they simply won’t do it.

The next possibility is a result of nuanced scales of economy. Imagine a larger scale mining operation can afford to risk more “lost blocks” engaging in a reorg fight over the “epic” sat. That larger miner with more capital to put on the table can afford to take a larger risk. In this scenario, we might see a few odd reorg attempts by larger miners with smaller operations not even trying, and essentially minimal disruption. This would play out if miners think there is some premium they can acquire for the ordinal, but not a massive premium worth serious disruption to the network.

The last scenario would be if a market develops bidding for the “epic” sat ahead of time, and miners can have a clear picture that the ordinal is valued massively above the market value of the fungible sat itself. In this case, miners may fight over that block for an extended period of time. The logic behind not reorging the blockchain is that you are losing money, you are not only forgoing the reward of just mining the next block, but you are also continuing to incur the cost of running your mining operations. In a situation where the market is publicly signaling how much the “epic” sat is worth, miners have a very clear idea of how long they can forgo moving onto the next block and still wind up with a net profit by attaining the post-halving coinbase reward with the ordinal. In this scenario the network could see substantial disruption until miners begin approaching the point of incurring a guaranteed loss even if they do successfully wind up mining this block without it being reorged.

Regardless of which way things actually play out, this is going to be a factor to consider each halving going forward unless the demand and marketplace for ordinals dies off.

Ego Death Capital To Raise $100 Million To Invest In The Bitcoin Ecosystem

In a move to catalyze the growth within the Bitcoin ecosystem, Ego Death Capital announces the launch of a new funding round, Fund II, aiming to raise $100 million. Founded in 2021, the venture capital firm, led by Jeff Booth, Andi Pitt, Nico Lechuga, with advisory support from Preston Pysh, Lyn Alden, and Pablo Fernandez, has successfully initiated Fund II with a focus on investing in companies driving Bitcoin’s acceleration.

“A parallel system bringing truth, hope, and abundance to our world is growing much faster than people realize and we feel super fortunate to be a part of it,” said founding partner Jeff Booth.

Fund I, which raised $25.2 million, demonstrated the foresight of ego death capital in recognizing Bitcoin’s emergence not just as a store of value but as a foundational layer for a new peer-to-peer decentralized internet tied to energy. The success of their initial fund was marked by strategic investments in companies like Fedi, Breez, Synota, Relai, and Wolf.

The landscape in 2024 still reveals a gap in Series A funding for Bitcoin-only companies, with venture capital yet to fully grasp the transformative nature of the Bitcoin protocol and its layered development. Fund II seeks to bridge this gap, providing crucial support to Bitcoin-focused entrepreneurs who face the challenge of not only pitching their business metrics but also educating investors about the profound shifts in the Bitcoin space.

“I’m super honored to join ego death capital as a GP. Our core thesis is that Bitcoin is different than everything else,” said Preston Pysh. “It’s different because at the base, bedrock layer, Bitcoin is optimized for security and decentralization. In order to do that, scalability must be maximized on the 2nd and 3rd layers, etc. IMHO, anyone building on a different protocol at the base layer is building on top of sand. As we look at the companies building the future of finance, we are hyper-focused, on humble, thoughtful, & constructive leaders that bring unlocked efficiencies and value to their customers and constituents.”

As the world undergoes a transition from operating on a “dishonest ledger,” per the press release, to one built on honesty with Bitcoin, Ego Death Capital’s Fund II aims to play a pivotal role in identifying and nurturing enduring businesses that contribute to this transformative shift. The $100 million fund hopes to represents a significant step toward in fostering innovation and value creation within the burgeoning Bitcoin ecosystem.

Those interested in participating in the funding can reach out here.

The Environmental Cost of Gold Mining

King Ferdinand of Spain, sponsor of Christopher Columbus, had only one command for the conquistadors: “Get Gold! Humanely, if possible, but at all hazards!”

500 years later this sentiment still seems to be the same, with the addition of new hazards. Gold bugs and Bitcoin advocates share the common belief that the fiat currency system is on the brink of collapse, while continuously debasing itself to stay alive. The solution? A commodity-based alternative that ensures the preservation of accrued value, impervious to debasement.

With the upcoming 4th halving of the block subsidy from 6.25 to 3.125 BTC in April 2024 the inflation rate (annual growth rate of total supply) of Bitcoin will be 0.9%. Additionally to its higher portability and divisibility than conventional gold, the “digital gold’s” inflation rate will be lower than gold’s inflation rate (~ 1.7%) and continue to drop to lower rates in the future.

But when asked for their choice of a store of value, many investors say things like:

“I’d choose gold. Not Bitcoin, because of the environment!” Really?!

Contrary to that perception, research tells us that Bitcoin mining can enhance renewable energy expansion (Bastian-Pinto 2021, Rudd 2023; Ibañez 2023; Lal 2023) and incentivize methane emission reduction (Rudd 2023, Neumüller 2023) while having half of the carbon footprint (70 Mt CO2e) of gold mining (126 Mt CO2e).

When people think of gold, they think of a pure and clean substance. The reality of gold production, however, looks very different. As I have watched environmental scientists developing water pollutant adsorbers, I have learned that gold mining is one of the most polluting industries in the world. Further digging into the topic leads to the following facts.

Gold mining ranks second after coal mining (7200 km2) in land coverage. Gold mining sites (4600 km2) cover more than the next 3 metal sites combined (copper: 1700 km2, iron: 1300 km2 and aluminum: 470 km2).

As many high yield gold mines have been exhausted, chemical processes, like cyanide-leaching or amalgamation, with extensive use of toxic chemicals are being used today. The contaminated water from gold mining called acid mine drainage is a toxic cocktail for aquatic life and works its way into the food chain.

Colorado’s Animas River turned yellow after the Gold King Mine spill of 3 million gallons of toxic waste water in August 2015. From:

In the U.S., 90% of the cyanide is used solely to recover hard-to-extract gold. The toxic material and its production and transport is in direct relationship with the gold market. It is estimated that gold mines use more than 100,000 tons of cyanide each year. That means massive production and transport of a compound with a human fatal dose of a few milligrams.

In 2000, a tailings dam at a gold mine in Romania failed and 100,000 m3 of cyanide-contaminated water went into the Danube River watershed. The spill caused a mass die-off of aquatic life in the river ecosystem and contaminated the drinking water of 2.5 million Hungarians. Mines in Brazil and China widely use the historic amalgamation method that creates mercury waste. Roughly 1 kg mercury is emitted for 1 kg of mined gold.

Gold production from artisanal and small-scale mines, mostly in the global South, accounts for 38% of global mercury emissions.

Thousands of tons have been discharged into the environment in Latin America since 1980. 15 million small scale mine workers were exposed to mercury vapor and the residents of downstream communities ate fish heavily contaminated with methylmercury.

Mercury poisoning among these populations causes severe neurological issues, such as vision and hearing loss, seizures, and memory problems. Similarly, in the townships of Johannesburg in South Africa, poor communities are paying the price for the country’s rich gold mining past.

Knowing about the risks, western mining companies have moved increasingly to developing countries as a response to stricter environmental and labor regulations at home. Surprisingly, only 7% of mined gold is used for material property purposes in industry (e.g., in electronics). The rest is processed for jewelry (46%) or directly purchased as a store of value by retail or central banks (47%). That’s why periods of high monetary debasement are boosting the price of gold. Last year central banks bought 1000 tons of bullion, the most ever recorded, while gold has been hovering close to its nominal all-time high (status: December 2023).

The last time gold demand increased its price substantially was the monetary debasement following the 2008 global financial crisis. During that time gold mining in western Amazonian forests of Peru increased by 400%, while the average annual rate of forest loss tripled.

As virtually all of Peru’s mercury imports are used in gold mining, the gold price corresponded with an exponential increase in Peruvian mercury imports.

As a result of the artisanal mercury handling, large quantities of mercury were being released into the atmosphere, sediments and waterways.

The massive mercury exposure can be detected in birds in central America. A region that supports over half of the world’s species.

Figure 1: Gold price, Peruvian mercury imports and mining area, from “Gold Mining in the Peruvian Amazon: Global Prices, Deforestation, and Mercury Imports.” 2011, PLoS ONE 6(4): e18875.

Other natural areas endowed with gold deposits like the Magadan Region in Northeast Russia are experiencing similar expanding mining activity over the past years including environmental destruction in response to high gold prices.

Gold mining, largely driven by demand for a store of value, causes widespread ecological and social harm across the world. It is the coal of value storage mediums.

At least half of today’s gold mining could be prevented by using a different store of value – a digital commodity with higher portability, divisibility and scarcity.

So, next time an environmental conscious investor argues for gold vs. Bitcoin, tell them:

A 21st century store of value should not rely on huge carved out fields of destruction and poisonous hazards but on electricity from non-rival energy, subsidizing renewable expansion.

This is a guest post by Weezel. Opinions expressed are entirely their own and do not necessarily reflect those of BTC Inc or Bitcoin Magazine.

Pricing Out Inscriptions

The battle for the future of Bitcoin is raging in real time on twitter as we are on the cusp of global economic contraction, thanks to 50+ years of the USD fiat regime, and are eagerly waiting for the approval of a spot Bitcoin ETF by the SEC. Yet, in the trenches on Twitter, the skirmish being fought is over what bitcoin is and how it should and shouldn’t be used. I covered this battle in some detail on Orange Label, but to summarize there are two camps in this battle: Monetary Maximalists & Blockspace Demand Maximalist. The big question is should inscriptions be a part of Bitcoin and how can they be stopped?

The purpose of this piece is not to sway you one way or another, but rather share some numbers that make the case that inscriptions will be priced out over time. Over the past year, we saw a doubling of BTC price and hashrate and during that time inscriptions caused some big changes in blockspace demand. We saw fees rise to a 4 year high as mempools were purging reasonable fees1, which means there were so many high fee transactions in mempools that lower fee transactions were being dropped from mempools. In other words, there was no chance for low fee transactions to be included in blocks. What started as a laughable novelty 12 months ago has brought in legions of new bitcoiners. This is an undeniable fact when you look up the number of reachable nodes on the network over the past couple years.

As bitcoin twitter has begun to divide on the topic, a meme has emerged suggesting that inscriptions will be priced out as NGU technology does its thing. This leads to the next logical question… at what point do inscriptions get priced out? That’s for the market to decide. For now, we can simply run the numbers and see how many dollars an inscription will cost as Bitcoin price appreciates.

The Calculator

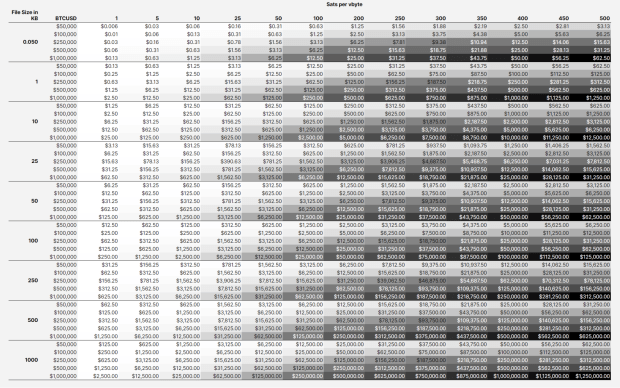

I am a big fan of table calculators23 and use them quite often when creating a story. For this piece I wanted to understand how much it would cost to inscribe a 100kb photograph at various prices. That then turned into asking how much these BRC20 shitcoiners are spending, and when will that nonsense end. These are around 50bytes or 0.05 kb in size for reference. I was able to track down4 a simplified formula for making an inscription:

Ordinal Inscription Cost Calculator Formula

Total USD Cost = ((((Inscription size in kb * 1000) / 4 * Fee Rate)) / 100,000,000 ) * Current BTCUSD Price

The important variables for this calculation is the file size in kilobytes, the fee rate in sats/vbyte, and the current BTCUSD price. With this little bit of information I was able to make a simple static table to see how different sized inscriptions will increase in USD cost as NGU for fees and BTCUSD.

This chart reveals much information and the big takeaway for me is just how expensive it will be to put data in blocks in the not too distant future. Let’s take our 100kb image example. At current fees around 100 sat/vbyte and $50,000 BTCUSD that will cost $1,250 to inscribe. That is a big pill to swallow. Now let’s examine the shitcoin token BRC20 that’s used for money laundering… It is around 0.05kb in size. ‘At current fees around 100 sat/vbyte and $50,000 BTCUSD that will cost $0.63 to inscribe. That is a small amount, but these things are being inscribed by the truckload. We are talking collections with 1m units. So not a small amount and there is not a single BRC20, there are tons popping up. The question about the liquidity for these things is for a different post.

As you move down the chart to higher BTCUSD prices for each inscription size, you can see just how ridiculous things become. Our humble 100kb jpg will cost $62,500 to inscribe when BTCUSD hits $1m and 200 sat/vbyte. Similarly the same BRC20 would increase to $25 for a single token. These kind of prices start to price out the really dumb like monkey pictures and memecoin shitcoins.

As you can see, these inscriptions production cost increases linearly with BTCUSD increases. This alone will price out large portions of the market, however you must ask yourself as the overall market size increases, that will bring new entrants who will drive additional demand, in other words the pond will get bigger and the fish will get bigger, the small fish just won’t get to eat.

What to expect?

Thinking through what happens next is tough, as there are many plausible outcomes but the one I am coming back to is the meme that I mentioned at the start of this article, inscriptions will be priced out. Just run the numbers, they don’t lie. I don’t think we are anywhere near inscriptions dying in the short term, but there will come a point in time where it is just too expensive for dumb things to exist on chain. Low time preference activities will prevail.

I see the overall inscription ecosystem continuing to evolve and that means people’s minds and opinions will continue to change too. We are seeing thoughtful commentary from devs5 warning6 of how changing the protocol to address or eliminate inscriptions usage will only push people to “exploit” other parts of the protocol for it’s precious blockspace. We are seeing novel new ways to crowd fund inscriptions and incentive the seeding of data via bitcoin + torrents such as ReQuest, Durabit, and Precursive Inscriptions. Inscriptions are a thing, blockspace is precious, and people are willing to pay for it. Bitcoin is for enemies, and it is going to get weird(er). Cope and seethe but remember to have fun.

Reasonable is subjective, markets clear. I believe I saw transactions with fees as high as 20 sat/vbyte being purged, which in recent memory feels absurd. ↩︎Demystifying Hashprice ↩︎Satsflow Scenarios ↩︎Someone made this and it is pretty handy. I used this formula to build out my table in google sheets. https://instacalc.com/56229 ↩︎“Concept NACK.

I do not believe this to be in the interest of users of our software. The point of participating in transaction relay and having a mempool is being able to make a prediction about what the next blocks will look like. Intentionally excluding transactions for which a very clear (however stupid) economic demand exists breaks that ability, without even removing the need to validate them when they get mined.

Of course, anyone is free to run, or provide, software that relays/keeps/mines whatever they want, but if your goal isn’t to have a realistic mempool, you can just as well run in -blocksonly mode. This has significantly greater resource savings, if that is the goal.

To the extent that this is an attempt to not just not see certain transactions, but also to discourage their use, this will at best cause those transactions to be routed around nodes implementing this, or at worst result in a practice of transactions submitted directly to miners, which has serious risks for the centralization of mining. While non-standardness has historically been used to discourage burdensome practices, I believe this is (a) far less relevant these days where full blocks are the norm so it won’t reduce node operation costs anyway and (b) powerless to stop transactions for which an existing market already exists – one which pays dozens of BTC in fee per day.

I believe the demand for blockspace many of these transactions pose is grossly misguided, but choosing to not see them is burying your head in the sand.” – Peter Wuille Link ↩︎“Ever since the infamous Taproot Wizard 4mb block bitcoiners have been alight, fighting to try and stop inscriptions. Inscriptions are definitely not good for bitcoin, but how bitcoiners are trying to stop them will be far worse than any damage inscriptions could have ever caused.” – Ben Carman Link ↩︎

Bitcoin Surpasses Silver To Become Second Largest ETF Commodity In The US

Bitcoin exchange-traded funds (ETFs) have surpassed silver ETFs in the United States, securing their position as the second-largest ETF commodity, in terms of assets under management (AUM). The surge in popularity of Bitcoin ETFs signals a growing acceptance of BTC as a mainstream investment vehicle.

As reported by The Block, Bitcoin’s ascent to becoming the second-largest ETF commodity in the U.S. marks a significant milestone for the Bitcoin market. This achievement is attributed to the increasing demand from institutional and retail investors seeking exposure to BTC.

Silver, which has ~$11.5 billion in AUM across five silver ETFs, was passed by spot Bitcoin ETFs which now hold over $28 billion, less than a week after going live.

“Bitcoin ETFs have exceeded silver ETFs in the U.S. in terms of size, driven by the substantial market interest they have received,” Bitfinex Head of Derivatives Jag Kooner told The Block. “The level of trading reflects the pent-up demand for these products, and we expect that it will lead to increased liquidity and stability in the market.”

This development is particularly noteworthy given silver’s traditional status as a prominent commodity investment. The rise of Bitcoin ETFs to the second position underscores Bitcoin’s maturation within the financial markets, gaining credibility and recognition as a formidable investment option.

Investors’ growing appetite for Bitcoin ETFs reflects a broader trend of diversification within portfolios and a recognition of the unique value proposition offered by BTC. As the Bitcoin market continues to evolve, the achievement of surpassing silver ETFs solidifies Bitcoin’s position as a major player in the global financial landscape.