Month: January 2024

How Two Digital Nomads Launched The Fastest Growing Bitcoin Community In El Salvador

Based on the number of merchants that now accept bitcoin in Berlin you might think this article is about the German capital city. Instead, it’s about a small picturesque mountain town in El Salvador with a population of 20,000 people.

How it came to have over 100 merchants accepting bitcoin in a 6 month period is an interesting story of persistence, passion and belief about bitcoin. It also is the story of an area whose inhabitants were proud of their beautiful city. The town in Germany may have many more inhabitants, but the lesser known Berlin has far more bitcoiners descending upon it every day than its much better known counterpart.

Magic Internet Money

It all begins with Gerardo Linares and his girlfriend Evelyn Lemus who were working as digital nomads in El Salvador for US companies for 10 years before they discovered bitcoin. Both are natives of ES and first heard about bitcoin when the country designated bitcoin as legal tender back in June 2021.

Like many of their countrymen, they were curious about bitcoin after the announcement and began going to meetups in San Salvador and El Zonte to learn more about this magic internet money. Like many, they downloaded the Chivo wallet and collected their $30 worth of bitcoin in September 2021 when the law took effect. The more they learned about this new global digital monetary network that allows you to be your own “decentral bank” the more they liked it.

They noticed that having bitcoin as legal tender in their country attracted many outside visitors and tourists who were bitcoiners to their country, but very few natives were adopting bitcoin outside of El Zonte and San Salvador. They wanted to change that, so they quit their digital nomad jobs and began a journey that resulted in them settling in Berlin which is a small mountain town about 2 hours east of San Salvador.

Sharing The Bitcoin Gospel

After learning more about Bitcoin’s impact and the opportunities it afforded to local communities, they wanted other Salvadoran natives to understand Bitcoin too. In the early stages of their journey they traveled to many smaller towns and villages in El Salvador and never missed a chance to educate the students in the local schools who wanted to learn about Bitcoin. They eventually teamed up with Mi Primer Bitcoin which is a bitcoin education company that began in El Salvador. As Cory Klippsten, CEO of Swan Bitcoin, has been saying for years, “To educate people on bitcoin is to market bitcoin.”

When I asked how many towns they visited in the country Gerardo said “21.” I’m not sure he caught the irony of his answer to my question since many bitcoiners consider 21 to be a special number. One of the places where they gave classes on bitcoin was in Berlin. They eventually decided to start their effort to develop a circular economy in this mountain town because the town officials took great pride in their community and were eager to attract tourists to the area.

Any time you want people to adopt new technology it is the first few early adopters which are the hardest, and Berlin was no exception. In the beginning, the two of them were able to on board 17 merchants via many one-on-one conversations and tutoring. These first Berlin merchants were open to this new payment rail [lightning network] because they wanted more tourism. In addition, another advantage they had in Berlin was that most of the merchants and shopkeepers were so small that they didn’t have employees, which means they could speak directly to the decision maker on the spot. There were no employees standing in their way as “middle men.” They also had the added advantage of Bitcoin being legal tender in their country. After the initial wave of 17 merchants more locals got involved in recruiting their fellow shop keepers. Gerardo and Evelyn were quick to credit the locals for the increased adoption. This wasn’t a success solely because of Bitcoin, however. They organized community supported clean-up projects that transformed the area and made it more appealing for locals and tourists alike.

Many of the merchants and shopkeepers in Berlin had heard of Bitcoin and most knew of the success in attracting tourists to El Zonte, which was a small surfing town 30 minutes outside San Salvador and about 3 hours away from Berlin. Another advantage of the shops in Berlin was that they accepted only cash (El Salvador had stopped issuing its own currency in 2001 at which time they made the US dollar their legal tender) and had no method for accepting digital payments, which means tourists were less likely to visit.

Challenges and Solutions

Some even had the Chivo wallet from when Bitcoin was first launched because that wallet was required to receive your $30 in bitcoin from the government. However, they found out quickly that the Chivo wallet defaulted to generating a QR code for US dollars NOT bitcoin. There was a way to accept bitcoin on the merchant’s Chivo wallet but it was not the default setting and it was NOT user friendly.

They needed to do a work around to get the Chivo wallet to accept Bitcoin which made it less than ideal. Most shops are small and were not yet accepting ANY FORM of electronic payments. Gerardo and Evelyn refer to Bitcoin as “electronic money” or “dinero electronico”. Accepting Bitcoin became the method for these shopkeepers and merchants to enter the digital age for payments, instantly creating a tourist destination for the many bitcoiners descending on El Salvador after the law was passed in 2021.

At first success was slow and only one or two shop owners were willing to try it. And when they made a sale in bitcoin they would often call Gerardo and ask him to convert the Bitcoin into USD. However, many have watched the price of Bitcoin skyrocket in 2023 and are now much more inclined to keep hold on to their Bitcoin. Gerardo and Evelyn eventually showed them how to use the Blink wallet because it was much more user friendly than the Chivo wallet and Blink has a stable sats feature that lets the shopkeeper avoid the volatility of Bitcoin.

Getting shopkeepers to accept Bitcoin was only half the equation though because they needed customers and no one in Berlin was paying in Bitcoin. The couple began inviting bitcoiners from El Zonte and San Salvador to Berlin. As these groups of Bitcoin visitors grew in size and frequency they made a point of organizing lunches and dinners at the restaurants where Bitcoin was accepted. It didn’t take long before other shop keepers noticed these large groups going to their competitors who accepted Bitcoin.

Gradually, then suddenly…

Gerardo explained that once they reached a tipping point of about 50 shops the whole need to recruit owners flipped. At that point, the shopkeepers and owners started coming to them and asking how to accept Bitcoin. He added that “people here in Berlin are excited about Bitcoin.” Recently, Gerardo and Evelyn opened a small office in Berlin where they teach people about Bitcoin for free and they teach the locals who want to learn English for a modest fee.

There is no doubt that the success and buzz created from El Zonte played an important role in adoption but there are now over 100 shops and merchants that accept Bitcoin in Berlin which Gerardo estimated represents about one quarter of the shops and businesses in town.

It is not without irony that I suggested to Gerardo during the interview that Berlin is the “fastest growing bitcoin community in El Salvador.” He seemed reticent about making that claim, but those are the facts. He made it clear there is still much more to do in educating the locals and building out the circular economy. I was surprised to learn they have a 15 page strategic plan for developing their new hometown into a global tourist destination which they wrote before they began. Their ultimate goal is for the project to be self-sustaining.

They have been so effective in putting the town of Berlin on the map that if you’re a Bitcoiner who lands in San Salvador you have a decision to make: “Do I head 30 minutes south to El Zonte or do I go east 2 hours to Berlin?” Do I want the beach [El Zonte] or the mountains [Berlin]?

In either case, there will be many merchants and shopkeepers in both who will happily accept your Bitcoin. Meanwhile, tourism continues to grow in El Salvador and circular economies are popping up in the unlikeliest of places.

This is a guest post by Mark Maraia & Beren Sutton Cleaver. Opinions expressed are entirely their own and do not necessarily reflect those of BTC Inc or Bitcoin Magazine.

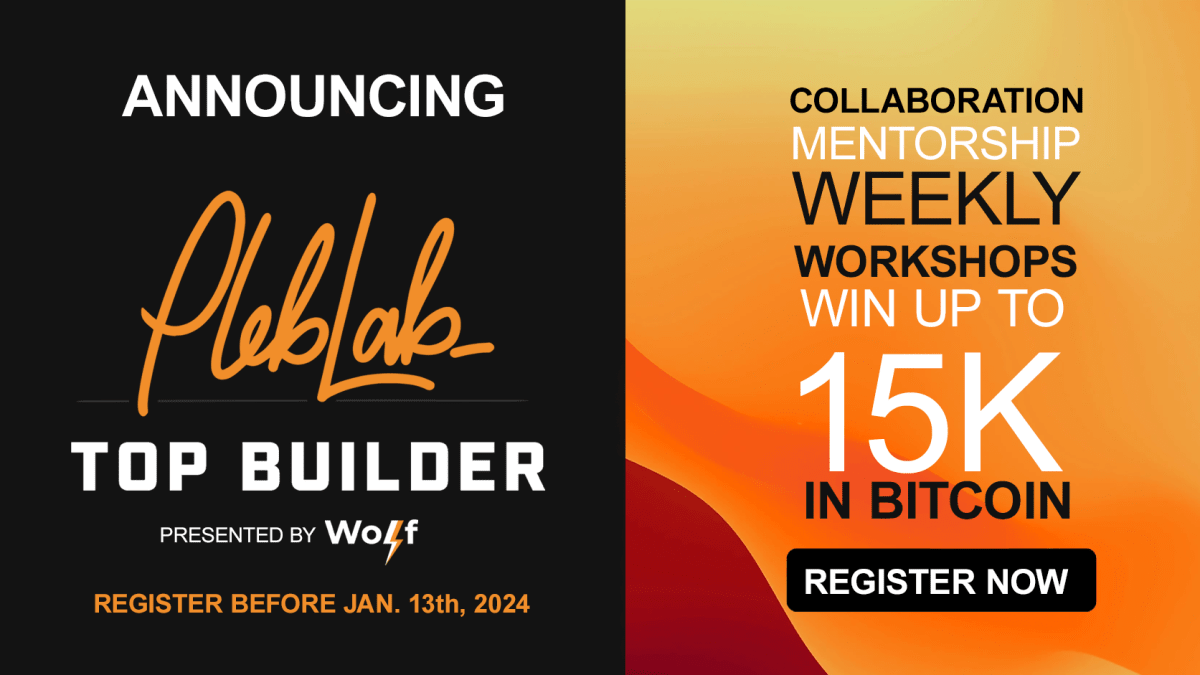

PlebLab Announces TopBuilder: A Unique Bitcoin Competition

PlebLab is hosting TopBuilder, a three month-long hackathon starting in January and ending in March. The application deadline is January 13th, so if you’re reading this now and wish to apply, get to it today.

The hackathon will take place across three roughly month-long rounds, where they are judged against milestones they have set for their projects at the beginning of the prior round. Judges will include Lisa Neigut, founder of Base58 and the Bitcoin++ Conference, as well as Kelly Brewster, CEO of Wolf, a Bitcoin startup accelerator based in New York.

They are looking for any project related to Bitcoin and Lightning that has the potential to offer innovative solutions to existing problems facing users and scaling both systems today. There is also the chance to win $15K in Bitcoin as a prize for first place in the final round of judging.

For the exact specifics, their FAQ is available here.

WHAT: This event is an exciting blend of builder sessions, workshops, announcements, and speaker panels, all designed to foster learning and growth within our community.

WHEN: From January 13th, 2024 until March 14th, 2024

WHERE: Participate remotely or at PlebLab until StartUp day (March 14th). If selected as a finalist, your team will present its project during StartUp Day on March 14th, 2024, at Bitcoin Commons in Austin, TX.

HOW: Apply now and until January 13th, 2024, at https://www.topbuilder.dev. Limited spots are available.

Learn more and apply now at https://www.topbuilder.dev/

Why I Am Already A Nostr Maximalist

After being inspired by a podcast with Preston Pysh and Will Casarin in January of 2023 I experienced my first interaction with ‘the nostr’ using a rather clunky interface. Since that time, nostr has gradually become more user friendly and an increasingly meaningful part of my life. I have now deleted all other social media accounts in favor of this blossoming decentralized alternative. My slow exodus away from centralized social media started over ten years ago, but the formation of a functional substitute was the final nail in the coffin. Making the jump at such an early stage may have been premature, but after two months using both nostr and Twitter I chose to make the transition permanent. I’ve written this article to explain my reasoning and provide an assessment of the nostr network as I understand it today.

Nobody is in charge of nostr, I have no one to ask if NOSTR should be capitalized or lowercase. I also have not reached a definitive conclusion regarding how it should be pronounced. Frankly it wouldn’t matter if anyone had an opinion about either of those things. Nostr is what the users and developers make it. Nostr is not a website and it is not a company. Nostr does not rely on a blockchain to function and there are no central servers dictating who can participate in the network. With the exception of shared interest and lightning ‘zap’ integration, it is independent from Bitcoin. Those who already understand Bitcoin seem to have an easier time wrapping their head around the importance of nostr, but I have also met several non-bitcoiners who are passionate about what is being built.

Nostr is a protocol which is designed to have applications built on top of it, or rather to interface with it. Users are free to choose from dozens of applications (clients) to access the protocol. The client they choose determines the nature of the user experience. The name NOSTR is an acronym for Notes and Other Stuff Transmitted by Relay. The functionality of the protocol is in the name, but I will not be diving into the technicalities here. I also will not be discussing the pros and cons of the various clients used to access nostr. Though that would be a helpful resource if someone would like to write that up!

As a non-technical enthusiast of freedom focused technology, I attended Nostrasia in November of 2023 with one primary question in mind; “What applications can’t be replicated on nostr?” At this point there are too many unknowns to answer this conclusively, but my understanding of nostr and its potential applications expanded dramatically during my time in Tokyo. The conference included talks on decentralized versions of nearly every application you can imagine. Twitter, Twitch, Youtube, Reddit, Spotify, Maps, Amazon, GitHub, Goodreads and others. None of these decentralized alternatives are carbon copies of those services. In many ways they seem to have the potential to become even better versions due to lightning integration and open-source user input.

At times I have wondered if what is being built will ultimately become a new decentralized version of the entire internet. As far as current limitations are concerned, the primary challenge I heard being discussed at nostrasia is that of creating a nostr equivalent for signal or telegram. Private encrypted chat may be more addressable by something like SimpleX. At this time it is unclear if the applications in development will be successful or scalable, but given the progress I have witnessed in the space since joining, I am feeling enthusiastic.

Optimism aside, it is hypothetically possible that nostr will not survive long enough to accomplish any of the bold objectives that are currently being proposed. There are many financial and technical challenges ahead. It is possible that I made a mistake in putting all my nostrich eggs in one basket. That choice is not for everyone and I fully appreciate that. However, having waited for a decentralized and open-source alternative to social media for many years, I am willing to take the risk associated with adopting this technology early. I would rather experience the unpolished user interface and potentially wade through a lot of frustration than continue putting my energy into a system I see as obsolete.

Every choice carries risk. When it comes to asset management, the risk of poorly allocating financial capital has drastic and permanent implications. In the case of social media, the risk of poorly allocating social capital is noticeable, but much less dramatic. The truth is that by using a centralized social media platform you have already sacrificed control over any social capital you have expended. At any moment, that site could shift its policies in a way that negatively affects you or they can delete your account at their own discretion. All the connections and content you have developed on those platforms is hanging at the whim of mega-corporations and government intervention. Personally, I have more faith in open-source code than I do in human institutions.

When creating an identity on nostr, a cryptographic signature is fashioned for you by open-source internet magic (as far as my pleb mind can ascertain). This signature has a private and public key, referred to as the nsec and npub respectively. An npub looks like the one below and can be used to find other users:

npub1jfn4ghffz7uq7urllk6y4rle0yvz26800w4qfmn4dv0sr48rdz9qyzt047 (add me

The npub is a novel form of online identification which is not required to be linked to your meatspace identity in any way. The nsec is used to sign in to new clients and to prove that you are the owner of the account; similar to bitcoin private keys. This key pair can be used anywhere in the nostrverse to prove that you are a particular individual or account. Follows, followers, and posted content are associated with a npub through the relays that npub is using. This means that if you are interested in trying out a new client or migrating away from the one you are using you may do this without any loss of connections or content.

This novel approach to online identity and data storage creates a much more competitive space for the developers creating applications, but also enables interoperability. Two critical factors which are altogether missing in today’s existing social media landscape. Current social media behemoths rely on the fact that it is challenging to leave and difficult to communicate between platforms. I deleted my Facebook years ago and for many months received emails about ‘So-and-so misses you! Look at what they posted recently.’ Naturally, I would be forced to log back in to view the content. The blatant and desperate emotional manipulation was too much to stomach. Nostr has the potential to obliterate the walled garden model where your digital life is held hostage for ad revenue and data collection.

In addition to the structural issues with legacy social media, it is clear that online censorship is on a steep increase. However you may feel about censorship when it is happening to someone you disagree with, you won’t like it when the censors turn on you. Some people appreciate censorship because there is a lot of content they would rather not see. Personally, I would like to make that choice myself rather than have some faceless corporation without a customer service line make it for me.

Ultimately the social media giants have been placed in an impossible position. Legislators will not stop pushing them to maintain the Overton window in their favor. Whether a social media provider wishes to be a propaganda tool or not, the nature of any centralized platform will ensure that it becomes one. Centralized dissemination of what is ‘appropriate content’ and what is considered ‘misinformation’ will inevitably narrow the scope of human understanding to a point where self-censorship is the norm. To a large extent this has already happened.

Some believe that misinformation is the most dangerous aspect of the internet. Allowing people to communicate freely in an open marketplace of ideas is too much to bear for these people. They feel the need to control what people say and by extension control what people think. This fear based need for control over the population does not align with my values. Despite the inevitable failure of such approaches in the age of the internet, we will likely see an increase in attempts to KYC (know-your-customer) everyone on centralized networks. The social credit system in China has provided the world with a case study to be weary of. When your bank card gets declined at the grocery store for a meme you re-posted on Xitter don’t say I didn’t warn you. Have I already become a toxic nostr maxi?… Maybe.

Michel Foucault’s writings on disciplinary power outline a methodology towards an essentially non-violent oppression of the masses. Looking at his conceptualization and the current state of affairs in the social media landscape, I have a difficult time telling them apart. The final result of such a system is a society in which authentic connection and genuine behavior become impossible. Physical prisons are only one form of enslavement. The true prison of the dystopian future manifests inside the mind of the individual. Bitcoiners who have watched their personal time preference expand understand this intuitively.

There are people in the bitcoin community who see nostr as a distraction and there are people in the nostr community who see bitcoin as an impediment to adoption. All I see is a massive synergistic upward spiral between the orange badger and the purple ostrich. These two protocols feed each other and enable new use cases which culminate in something much greater than the two independent parts. Bitcoin is essential for shifting the world away from debt slavery into proof of work. Nostr is essential for shifting the world away from top down dissemination of information to a free market of content. In this way the two technologies are ideologically aligned with volunteerism and personal liberty.

Most bitcoiners would agree that financial freedom is essential in maintaining one’s personal agency. However, without the ability to communicate freely the new found financial liberation is handicapped. The ability to reliably coordinate commerce and correspond in a peer-to-peer fashion is much more essential than many seem to acknowledge at this moment. Additionally, the reason the fiat system is so potent in its deception is not exclusively a result of the accountants and politicians engaged in the fraud. The real strength of the fiat leviathan is a function of global propaganda efforts to maintain the perpetual delusion. If hyperbitcoinization occurs and the propaganda apparatus remains in place, most people are unlikely to benefit from its liberating qualities. In order for the full impact of bitcoin to take root on this planet we will also need a means of sharing information openly and efficiently.

All of this rhetoric is a bit grandiose for the moment given that the estimates I have received regarding daily active users ranges around 10,000. It could be that this article and the protocol itself will age poorly, but many of the concepts in this article will remain relevant to the importance of a decentralized method of mass communication. If nostr fails, something will take its place. Given the development I have witnessed so far, I would be surprised to see nostr fall flat. The protocol is drawing in talent and checking off bounties at an exponential rate. As the bitcoin price increases I anticipate this trend to continue. Those who believe that bitcoin is a distraction to nostr underestimate the electromagnetism of the bull market. Those who believe that nostr is a distraction from bitcoin didn’t meet the former ethereum dev at nostrasia who became a bitcoiner because of nostr. The purple pill helps the orange pill go down.

On a more subjective level, I have noticed a dramatically better user experience on nostr than I did in the legacy system. The effect is so pronounced that I can say that my mental health has noticeably improved since I got off of Twitter. There are several variables I could attribute to that improvement. The lack of enraging algorithms, the general size of the community I am interacting with, the shared interest of that community, or the conscious understanding that I am free to say whatever I want. Whatever it is, I am not the only one who has noticed a much better vibe on the nostr.

I have noticed that some of the popular Twitter accounts have not been quite as popular on nostr and some lesser known accounts have gained traction. I currently have more followers than I ever did on Twitter (a whopping 1400). Some of the larger accounts on Twitter are sharing on a more personal level on nostr than they do in the larger forum. These effects may not stay this way as the network grows, but at the moment it feels as though some of my favorite people are more accessible and more comfortable to share openly with the nostr community.

Earlier in my bitcoin journey I was of the opinion that the greater diversity of viewpoints I could interact with, the more comprehensive my understanding of the world would become. I was cautious of ending up in a filter bubble or an echo chamber of certain niche opinions. As time went on I made a point to exclusively follow people on twitter who were outspokenly ‘Bitcoin Only’. This provided a simple heuristic for me to narrow my field of interactions to people who had put in enough work to jump the hurdle out of the clown coin casino. I remain realistic about the possibility that I have intentionally manufactured confirmation bias in my online experience, but with the impending AI boom it will become increasingly difficult to remain in an unfiltered social pool.

By narrowing my online interactions to a specific group I run the risk of missing out on unique opinions, but so far this pruning has continuously increased the signal in my feed while reducing the noise. The scope of nuanced perspectives between bitcoiners on nostr has provided me with plenty to consider and learn from. In any case I still get a daily dose of intellectual debris to sort through from the normies I talk to in meatspace. When it comes to my online life, I concluded I would rather spend time getting to know this merry band of internet pioneers than stay connected to the rest of the traditional social media system.

Some have suggested that by leaving legacy social media I might be surrendering to irrelevance and obscurity. Personally I see the exodus of bitcoiners from Xitter gradually culminating in that network fading into irrelevance. I give credit to those of you who remain in the fray to fight the good fight, but my days engaging in that digital mosh pit are over. While my own learning process was accelerated by debates on Twitter, nine times out of ten I don’t see productive outcomes from online arguments. What I have found productive and rewarding has been interacting with people who are passionate enough about freedom to roll the dice on this new protocol.

It is very likely that every person early in this movement will be doxxed. However, in the long run we are supporting a technology that will enable future generations the freedom to choose how much privacy they maintain and how much information they share with the world. We are enabling a future where people have the freedom to be as authentic as they want without artificial limitations on the scope of human expression.

Being on nostr in 2023 feels a lot like pre-gaming the greatest internet party the world has ever seen. The sound system has some bugs, the decorations are still in process, and nobody knows for sure if anybody else will show up, but spirits are high. I’ve often equated sites like Xitter and F-book with a crappy dive bar that everybody goes to exclusively because everybody goes there. The more that they kick people out, water down the drinks, and raise prices; the more they will chase their customers off. I didn’t write this article to shame anyone or to pressure them into joining nostr, but if it ignited a spark in you to learn more, my objective was accomplished. There’s no rush, but when you decide you’re fed up with the status quo we will be waiting for you with open arms.

This is a guest post by Source Node. Opinions expressed are entirely their own and do not necessarily reflect those of BTC Inc or Bitcoin Magazine.

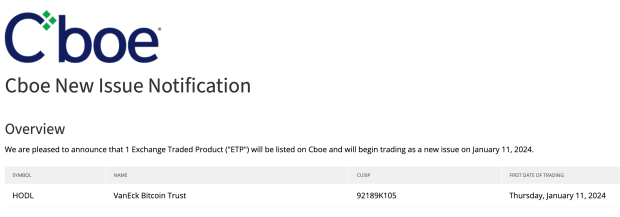

Spot Bitcoin ETFs “Will Begin Trading” Tomorrow: CBOE

The Chicago Board Options Exchange (CBOE) has declared on their website that VanEck, Fidelity, and ARK 21Shares Spot Bitcoin Exchange-Traded Funds (ETFs) will officially commence trading starting tomorrow, pending regulatory approval and effectiveness.

The CBOE’s announcement signifies a major milestone in the quest for regulated and direct exposure to Bitcoin through ETFs, allowing both institutional and retail investors a pathway to Bitcoin exposure.

This development follows meticulous regulatory evaluations and market preparations, positioning the Spot Bitcoin ETFs for an eagerly awaited debut on the trading floor. The CBOE’s confirmation reinforces the growing acceptance and recognition of Bitcoin as a legitimate and regulated investment asset class.

The imminent commencement of trading for Spot Bitcoin ETFs underlines a historic moment poised to reshape the investment landscape, providing broader access to Bitcoin within traditional financial markets. However it is important to note, at the time of writing, the U.S. Securities and Exchange Commission (SEC) has yet to officially approve the ETFs for trading, which approvals are expected later today.

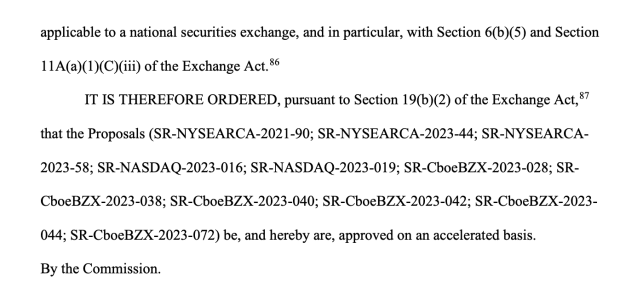

APPROVED: Spot Bitcoin ETFs to Trade on US Markets in Historic Milestone

Today, the United States Securities and Exchange Commission (SEC) has officially approved the listing of the first-ever spot Bitcoin Exchange-Traded Funds (ETFs). This move marks a historic milestone in the evolution of Bitcoin adoption within traditional financial markets.

“Today, the Commission approved the listing and trading of a number of spot bitcoin exchange-traded product (ETP) shares,” said SEC Chair Gary Gensler. “While we approved the listing and trading of certain spot bitcoin ETP shares today, we did not approve or endorse bitcoin. Investors should remain cautious about the myriad risks associated with bitcoin and products whose value is tied to crypto.”

The approval comes after extensive deliberation and anticipation surrounding the introduction of spot Bitcoin ETFs, which are anticipated to offer investors direct exposure to the BTC.

The introduction of spot Bitcoin ETFs in the United States is expected to unlock unprecedented opportunities for both institutional and retail investors, offering a more accessible and regulated avenue for participating in the burgeoning Bitcoin market.

Industry analysts predict that the approval of these ETFs will catalyze a surge in institutional capital inflow into Bitcoin, potentially fueling BTC’s value to new all time highs and solidifying its position as a legitimate asset class.

The exact launch date of the ETFs are expected tomorrow, Thursday January 11. Investors and Bitcoin enthusiasts alike are eagerly anticipating the ETFs’ debut on major stock exchanges, anticipating their impact on market dynamics and investor sentiment.

The SEC’s decision signifies a significant shift in regulatory stance towards embracing Bitcoin, signaling increased acceptance and recognition of it within the traditional financial realm. This approval is expected to pave the way for future developments in bitcoin-related investment products, potentially opening doors for a more diversified range of BTC-based financial instruments for investors.

As the SEC finalizes preparations for the listing of the first spot Bitcoin ETFs, market participants are on the edge of their seats, awaiting a new era in the investment landscape shaped by the integration of bitcoin into mainstream portfolios.

Spot Bitcoin ETF Issuer Bitwise Pledges 10% of Profits To Fund Open-Source BTC Development

Today, Bitwise Asset Management unveiled a new initiative, confirming their pledge to allocate 10% of profits from the Bitwise Bitcoin ETF (BITB) towards supporting Bitcoin open-source development, according to a press release sent to Bitcoin Magazine.

The donations will benefit three esteemed non-profit organizations – Brink, OpenSats, and the Human Rights Foundation’s Bitcoin Development Fund.

“Bitcoin was launched 15 years ago without a fundraise and has always been maintained by a dedicated community of open source developers,” said Bitwise CEO Hunter Horsley. “We’re excited for the Bitwise Bitcoin ETF (ticker: BITB) to provide a source of recurring funding for those unsung heroes who work tirelessly to improve the Bitcoin network’s security, scalability, and usability every day.”

The donations, to be made annually for the next decade, come without any strings attached, reinforcing Bitwise’s long-term dedication to fostering sustainable support for Bitcoin Core Development.

“It is important to support Bitcoin Core Development in a long-term sustainable way,” said Mike Schmidt, the executive director of Brink. “Bitwise’s decade-long pledge is a win-win-win with Bitwise profits leading to developer funding leading to improvements to the open source software underpinning the industry.”

The recipient organizations were carefully chosen based on their established track record and commitment to funding Bitcoin open-source development, subject to annual review for continued alignment with Bitwise’s mission, according to the release.

Acknowledging Bitwise’s proactive stance, Matt Odell, cofounder of OpenSats, lauded the company for setting a precedent in supporting open-source contributors vital to the Bitcoin ecosystem: “It is great to see large institutions supporting the open-source contributors who make this ecosystem possible. Bitwise is leading by example for all Bitcoin ETF issuers going forward.”

This commitment to donating 10% of spot Bitcoin ETF profits doubles what another issuer, VanEck, pledged to donate last Friday. VanEck will also be donating their profits to Brink.

“Bitcoin is a critical piece of freedom technology serving financially oppressed people around the world today,” said Alex Gladstein, the chief strategy officer of the Human Rights Foundation. “We started the Bitcoin Development Fund to support the developers who make this all possible, and we’re delighted that Bitwise is committed to supporting this important cause.”

For more details on BITB and the donation program, interested parties can visit their website here, heralding a new era of sustained support for Bitcoin’s foundational development.

What to Expect from Bitcoin’s Spot ETF Launch

The below is an excerpt from a recent edition of Bitcoin Magazine Pro, Bitcoin Magazine’s premium markets newsletter. To be among the first to receive these insights and other on-chain bitcoin market analysis straight to your inbox, subscribe now.

This week’s topics

Monumental SEC failureBitcoin ETF multipleGerman economic updateTaiwan elections and China response

SEC’s 2FA Failure

Bitcoin is a great teacher. Many of us have learned so much, from studying and following Bitcoin over the years, not just about money but about life. Once again, Bitcoin provides us with a teachable moment in the hack of the SEC’s X/Twitter account. First, even if you are a normie in favor of heavily regulated markets, this event should open your eyes to the fact that the regulators have grown into a systemic risk themselves. They are a risk to the investors they are supposed to protect. The SEC is even in a battle at the Supreme Court battle over their in-house semi-judicial system.

Secondly, this scandal happened because the SEC didn’t use 2FA, months after warning everyone about the use of 2FA. This shocking incompetence might wake many out there and spread the use of 2FA — something long overdue.

The total damage based on the SEC’s failure was $30 billion wiped from the market cap with $90 million worth of open positions liquidated. Of course, the SEC did not apologize for their failure and will likely be facing legal consequences. Spicy take, this bitcoin-inspired scandal might result not only in us getting the ETFs approved, but also the SEC getting taken down a peg.

Bitcoin Market Cap Multiple of Inflows

Estimates of inflows on the bitcoin ETF’s first days of trading are expected to be massive. Issuers have publicly stated they are seeding their funds with $312.9 million so far. These are commitments by private players to immediately create shares to seed liquidity. This does not include other money from regular trading.

The fee structures submitted this week by issuers have clauses for introductory periods based on the inflow of assets under management. For example, ARK is offering a 0.0% management fee for the first 6 months or until $1 billion in AUM. Invesco is offering 0.0% for 6 months or $5 billion AUM. This means they expect those time periods and AUM to be a practical expectation. If we add up all these special fees discounts, we arrive at $13 billion of expected AUM growth in the first 6-12 months from 5 issuers alone. That does not mean inflows exactly because bitcoin bought earlier will appreciate adding to AUM.

Source: @JSeyff

The seeding funds are small potatoes compared to the total $25 trillion AUM of the issuers. If 1% were to come into the bitcoin ETFs over the first 12 months, that is $250 billion.

Back in 2021, near the ATH, Bank of America put out a study that bitcoin had a 118x multiplier on inflow to market cap appreciation. So, for every $1 million in fresh buying, the market cap would increase by $118 million. That multiplier relies on many different factors, like speed of inflow, number of available bitcoin on exchanges, and block reward. Bank of America made their estimate when there were 2.7 million BTC on exchanges, today there are only 1.8 million — or 607,000 when considering the major US exchanges Coinbase, Gemini and Kraken only. In other words, the multiplier could be greater than 118x this time.

The largest single ETF launch in history saw $2 billion of inflows. The bitcoin ETF event promises to be bigger than that because it is a group of 11 ETFs and is a new asset class. $2 billion is therefore conservative, but we’ll use it for our purposes here. $2 billion times 118 means $236 billion market appreciation on day one. The market cap at time of writing is $900 billion, meaning the first day move could be ~25%, taking us to $58,000.

German De-industrialization

People think it can’t happen, that’s why it is happening. Some Germans are beginning to understand the effect of deglobalization on their economic model, and the effect that communist climate policies will have on heavy industry. Large companies like BASF, Linde, and Volkswagen all have plans to move out of Germany. Energy-intensive industrial production is being hit the worst. 2024 is going to be a massive recessionary year around the world.

Source: Financial Times

The latest number for November showed the sixth straight month of industrial production, the worst stretch since the Great Financial Crisis.

Source: Bloomberg

Source: @SoberLook

Taiwan Elections and China’s Economic Disaster

One of the most consequential elections this year is happening Saturday in Taiwan. As it stands, it is a three-way race for president with the more anti-China Democratic Progressive Party, Lai Ching-te, as the front-runner. He is friendly to the US and will be a thorn in the side of the CCP. Certainly, China has invested heavily in stopping him and spreading propaganda within Taiwan. Despite this, the anti-China candidate is still favored.

Source: NHK Japan Broadcasting Corporation

Source: Fulcrum Asset Management

This election has global consequences as you can imagine. In an article yesterday on Bloomberg, they highlighted the possibility that the election of Lai could lead directly to conflict with China and potentially cost the global economy $10 trillion.

This is also happening as the Chinese economy is falling apart. Their blue-chip stock market CSI 300, recently hit 5-year lows, standing in stark contrast to the US stock markets rallying to near ATHs.

Source: Yahoo Finance

Last but not least, the foreign direct investment (FDI) numbers for 2023 have come out and they are a total disaster. Money is fleeing China at the fastest pace in modern history. All this is to say that the election in Taiwan and the economic pressures in China could move the world closer to conflict over Taiwan.

Source: @Geo_papic

Surviving The Bull Run

We all have a journey to Bitcoin. Some started as sound money advocates who adored Austrian economics and gold. Others fell out of the TradFi world when they knew something wasn’t quite right. Most Bitcoiners have gone through trials and tribulations of altcoin hell. However you made it here and to Bitcoin, welcome–and buckle the F*ck up.

When I first became interested in Bitcoin, it was July of 2017, and it was already well into the bull market of that year. I bought some and watched its value increase. Then I bought more. As tends to happen during these parabolic bull runs, I kept watching the price rise and my interest go from:

Interested to Disbelief to Infatuation to Degenerate Buying to Despair.

This is a trajectory you can avoid during the next bull run if you prepare yourself properly.

If you are reading this hoping to find all the answers, I have some unfortunate news. There are no right answers in Bitcoin or life. We are all on a journey to figure out what to do and how to approach. I hope to guide you, but ultimately, your personal goals and disposition will dictate how you handle volatility. Bitcoin will test your resolve.

During the later phase of the 2017 bull run, I talked about Bitcoin to everyone in my life—completely obsessed. My neighbor at the time was older than me and had experienced the dot-com boom. I will never forget the advice he gave me; this advice was born of gaining (and losing) a lot of money during the dot-com bubble. He listened to my fervent interest in Bitcoin, and he took a very measured approach to my evident LOVE for this asset. He told me that during the dot-com boom, he made more money than he ever believed he would have, and in the end, he was right back where he began—because he rode the bull market over the top and didn’t sell anything. His advice was, “I’m glad you are doing well, but don’t forget to take some profit.” He advised me to sell 50% and keep 50%—a simple hedging strategy. I did heed his advice shortly after Bitcoin hit its all-time high and sold some of my holdings near that local top.

Now, I know that this is sacrilege to many hodlers. We don’t sell our bitcoin, right?? Well, that is a personal decision, and depending on your risk tolerance and place in life, you may want to take some risk off the table. That is part of investing, and as the old saying goes, no one ever loses money selling for a profit. This article aims to give the advice I wish I had gotten when I first discovered Bitcoin. I hope this helps newcomers to the space understand how to navigate the bombastic environment that bitcoin produces during its bull runs.

I have seen two bull runs, one in 2017 and one in 2021. These bull runs were VERY different, and I suspect that if you spoke to those involved in bull runs prior to 2017, you would find that those also had a very different feel.

The first thing I want to get off my chest is this—No one knows what is going to happen:

Balaji talks about 1 million in 3 months Nobel laureates are saying it will go to zero Buffett and Munger(RIP) call it rat poison

Whoever you are listening to, no matter how long they have been in the space or how correct they have been in the past, IT DOES NOT MATTER. They have no idea what the future holds.

In investing, there is an idea called survivorship bias. Those who have been correct have survived, and they seem like geniuses because they have been correct. The VAST majority of those who have been wrong are forgotten. You don’t hear about them. I won’t throw anyone under the bus here, but there were prominent people in Bitcoin calling for MUCH higher prices when we were sitting at 68K in 2021. I’m not saying that they are bad people; I’m sure that they had a good reason to forecast these numbers, but if you had taken their advice at that time, you would have bought at the worst time possible and gotten crushed for YEARS.

In my view, there are different tiers of crystal ball holders out there, and the lowest tier is the technical analyst type. These are the dime-a-dozen people you see on Twitter spouting off about momentum, price levels, cup and handles, etc. These people were calling for 10K bitcoin when it bottomed at 16k. I’m not saying that TA is all nonsense; fundamentally, it is a system for predicting human action through probability. It’s a consideration at best. It should never be used in a vacuum to determine your allocations. If you use it in conjunction with fundamentals, it can be much more helpful. The point I am driving at here is there are GRAVEYARDS of TA analysts out there who told you to buy at 68K and not to buy at 16K. They are throwing probabilistic darts. Don’t put your financial future on someone’s educated guess.

The second brand of crystal ball aficionados out there are macro analysts. These people have more credibility in my view because they are assessing the general trend in the economy. They are considering interest rates, Fed movements, and economic data. These types are MUCH closer to base reality because they have their finger on the pulse of the economic heartbeat. But, as with TA analysts, these people can be TOTALLY wrong. Many said that Fed funds rates couldn’t exceed x or y, or the entire economy would collapse. Well, the interest rates have been elevated to levels well above their doomsday predictions, and we have not seen a collapse.

Whether you follow a TA analyst or a Macro analyst, they can be utterly WRONG because of a black swan. Nicholas Taleb—famously hated by Bitcoiners—coined the phrase black swan to label events that happen from time to time that simply cannot be predicted in standard modeling because they are so unlikely. Covid was a black swan. The war in Ukraine was a black swan. And guess what, there could be another unpredictable black swan tomorrow that could render all of the TA and macro analysts completely wrong. The world has a ton of randomness. By the way, black swans aren’t always bad. They are just as likely to be positive catalysts.

So does this mean we should remain paralyzed with fear and not trust anyone??

Absolutely not. It means we should make the effort to EDUCATE OURSELVES! You need to take responsibility for yourself and your decisions. You can take the information from the TA analysts and the macro analyst and make your own educated decisions. THIS IS OF THE UTMOST IMPORTANCE.

Educate Yourself

Bitcoin is an incredibly simple yet endlessly complex animal. Your education will never be complete, but you can incrementally expand your understanding. We did a 10-episode Bitcoin Basics Series with Dazbea and Seb Bunney, and I don’t feel like we even scratched the surface!

You want to be educated for resiliency. If you have a solid grasp of Bitcoin and how it works, you will not be easily shaken. The psychology here is VERY IMPORTANT. If you understand what you are investing in, and the market is hit by an exchange failure similar to what happened to FTX, you will understand a few things that the average person may not.

Bitcoin is unaffected The price drop is temporary and without merit Therefore, this is a great time to be accumulating Bitcoin

Now, the opposite of this is also true. When you see mainstream headlines fawning over Bitcoin, with the gains never seeming to end, and you feel like you should drop every bit of money into Bitcoin because its price is going nowhere but up—BE CAUTIOUS. I have found that my psychology is typical. I have fear when the price is getting crushed, and I have irrational exuberance when the price is rising quickly. If I do EXACTLY the opposite of what my monkey brain tells me, I find I’m often doing the right thing. That is to say, when you feel extreme fear, this is the time to buy, and when you feel elated, this is the time to sell.

Panic buying is dangerous. When you feel an uncontrollable urge to buy Bitcoin, take a deep breath. I can assure you that you will be able to buy some, and if you are feeling the urge this strongly, the market is probably ripe for a pullback. That is no guarantee, but in my experience, this has been the likely case. I am not advocating for trading BTC, not at all. I can honestly say that I have lost more BTC than I have gained by trading, and if most people are honest, they will admit the same. Trading is a skill and discipline that very few people master.

The typical psychological roadblocks that hang people up are fear and greed. Reflect on your feelings and recognize when you are experiencing these emotions. They will cause you to make mistakes. The simplest way to mitigate all of this is simply to dollar-cost average. Swan is the PERFECT place for DCA. Dollar-cost averaging takes all the stress out. Full stop. If you level into this asset at this moment and it drops to 30% overnight, ask yourself honestly: Do I have the stomach for that? Do I have the conviction for that? Do I have the educational chops to understand why the dollar price doesn’t matter in the short term? Will I panic sell? If you aren’t convicted, dollar-cost averaging will save you. You are getting the average price over a long period of time.

I have a little DCA tactic that is simple and works for me:

When the price corrects I increase my DCA, when the price gets frothy, I feather back and average in with less. Over months and years, this supercharges your average buy.

Don’t Feel Like A Sellout For Selling BTC

Have a plan and be ready to execute. My neighbor’s plan is a solid place to start. Once you have doubled your money, take the initial investment out. There is a significant asterisk involved in this—What are you going to buy instead of Bitcoin? Inflating cash? The choices for where else you put your money these days are very limited. This might be controversial to many in the space, but I think it’s perfectly reasonable to sell some Bitcoin. If you have been holding for YEARS, and your stack could meaningfully make your life better, by all means, sell a portion.

Time is the one asset that is more valuable than BTC; we have a truly finite amount of time on this earth. If you hodl your BTC and then take a dirt nap, what was the point? If you can sell a portion of your stack and pay off your house, or get out of crushing debt, I think that is a sound decision. It may not be the BEST financial decision, especially if your house is on a low-interest rate loan, but it’s an understandable decision because of the peace of mind this could bring. However, you must also remember that selling Bitcoin will very likely be a painful decision in the long term.

Selling Bitcoin for toys on the other hand is not a great move. When you buy that 250k moon Lamborghini, which loses 50% of its value in 3 years while Bitcoin has gained more than that percentage to the upside, the regret will be unbearable. Robert Kiyosaki comes to mind. His book Rich Dad Poor Dad has been very influential on me, and his description of assets vs. liabilities hit home:

An asset generates cash flow A liability subtracts cash flow

If you buy assets, your net worth will increase substantially on an exponential curve. If you are buying liabilities, you are simply getting poorer. If you sell Bitcoin, you will likely regret it in the long term.

Time Preference

Time preference is a topic often visited in Bitcoin. Having a low time preference means you are willing to forgo niceties today for a better future. Every worthwhile cathedral, every classic piece of art, everything beautiful in this world has been built because people worked with an eye to the future, not the present. If DaVinci taped bananas to the wall we would have never remembered him. If the great pyramids had been built of clay, they would be gone. If Civilization spent all of its wealth on the here and now without investing in the future it would not last.

Bitcoin itself is a digital artifact that has been crafted to perfection by a mysterious architect. It is designed to last eons; if civilization lasts, it will have perfect fidelity into the future. Because no one can change it or control it, Bitcoin is anti-entropic. This is the epitome of low-time preference craftsmanship. Bitcoin is a Da Vinci in a world of bananas taped to walls. It’s so apparent once the work is put in that it’s embarrassing more people don’t understand the value proposition.

In stark contrast to this Bitcoin masterpiece, we have the sand hills we call alt-coins or shitcoins. These have been built using Bitcoin’s technology but introducing entropy. Fidelity is lost in altcoins because each has a founder or group who controls them. When humans can control something, they inevitably manipulate it to their benefit. And whether consciously or subconsciously, it will degrade. Most of these shitcoins have been designed from the outset to scam you. Some of these alt-coins have leadership that may be well-intentioned, but they are human and capable of being influenced and coerced. The problem is LEADERSHIP. Bitcoin and its time chain have been designed to remove the human element as a primary characteristic. Introducing humans into the mix causes entropy to destroy value through seigniorage.

Bitcoin’s invention was that of NON-INTERVENTION by humans.

These are insights that take years for many people to understand completely. If you want the TL;DR on altcoins, it’s simple. Just don’t bother. You are better off taking your money to a casino and playing craps. The deck is stacked heavily against you in the crypto world; you are simply getting lucky if you make money. Take the low-time preference route and stack Bitcoin while learning as your investment grows. I can confidently say that you will be much further ahead in 5 years dollar-cost averaging into Bitcoin than you will be gambling on shitcoins.

5-Year Outlook Minimum

Most people get interested in Bitcoin during one of its parabolic bull runs. I was one of them. We are all interested in getting ahead financially, especially with the specter of inflation hanging over our heads.

If you are new to Bitcoin and this is your first foray, make sure you are prepared to hold this asset for a minimum of 5 years. You are likely here during a bull run, and unless you got lucky, it’s probably on the trailing end of the bull run. As of the date of writing in December 2023, I believe we are at the beginning of the next bull market. With the ETF approval, the halving in April 2024, and the Fed poised to turn dovish, many catalysts are aligned. This does NOT make it inevitable. Black swans are always a possibility. With that black swan caveat aside, we seem poised for massive price appreciation in the next few years.

Self Custody

The first time you buy Bitcoin at the exchange of your choice, it will feel like buying any other asset at a brokerage. You buy Bitcoin, and the number on the screen reflects the amount of bitcoin you now “own.”

It is critically important that you take custody of your Bitcoin. We have seen exchange failure and downright fraud go on very recently. When these frauds are uncovered and prosecuted and the price of Bitcoin gets hammered because many people associate the asset Bitcoin with the exchanges that sell it, this becomes a HUGE buying opportunity. When FTX failed 1 year ago, the price of Bitcoin was negatively affected, and those who understood that Bitcoin had no fundamental problem loaded up. They understood that fear was coursing its way through the market (back to why being educated is SO IMPORTANT in this space). If you bought Bitcoin at that time (around 16k), you secured well over a 100% gain in a year!

Think of seed keys as the password to your Bitcoin, which must be protected because if anyone else gets it, they can take possession of your Bitcoin—no bueno. Bitcoin Seed keys are generally protected by a hardware wallet or signing device. This device protects your seed keys from hackers or bad actors. I have been using Coldcards for years, and they are some of the best devices for protecting seed keys. It works very simply. You create your secret keys using the device; it saves them and keeps them offline, never connected to the internet. That last point is IMPORTANT. You do not EVER want to save these words on an internet-connected computer. The only place to safely store your Seed Keys is on a device designed for them. If the computer is compromised (and believe me, it is VERY LIKELY COMPROMISED) the signing device will protect your Bitcoin.

This may all sound very difficult and complex if you have never done it before, but trust me, it’s easy. I would recommend that you watch BTC Sessions videos about using the signing device you choose. He has incredible walk-through videos on YouTube that explain how to do everything in detail.

Collaborative custody with a company like Swan Bitcoin or Unchained Capital is also a good idea for those new to the space. They will hold your hand and protect you from making simple mistakes that can cause issues. Collaborative custody is worth the cost if you are worried about losing your Bitcoin. Unchained offers a collaborative custody product that can hold multiple keys and can help your relatives retrieve your Bitcoin in the case of your demise.

DO NOT BRAG ABOUT YOUR BITCOIN. There is a temptation to brag about success. If you stay the course for five years, you will likely have it. You are proud that you have had the discipline and self-control to master yourself and successfully acquire what you view as a significant amount of Bitcoin. Don’t share how much you have with others. This should be obvious, but there are people that may not be so excited for you. They may tell their friends, and sooner or later someone who you don’t know, who may have the capacity for violence, may decide you are an appetizing target. This is yet another reason to use a multi-sig setup. Even if someone obtained 1 of 3 keys, they cannot steal your Bitcoin.

Don’t Buy Bitcoin That You Don’t Control

Don’t purchase the shiny new ETF Wall Street is offering. Buy Bitcoin only at places that allow you to take actual custody of your Bitcoin. Don’t put your Bitcoin on any kind of service that offers a yield, especially if that yield seems unrealistically high. As a general rule of thumb, just don’t do it.

The first and most important reason you should take custody of your Bitcoin is that you have absolute and complete control of it. There is a saying in Bitcoin, “not your keys, not your coins.” If you do not have custody of your Bitcoin, you simply have an IOU. This is the entire reason for Bitcoin’s existence. To remove middlemen and allow people to control their financial destiny.

When you have custody, you do not incur a fee like you would with an ETF. These fees can seem low, but over time they can be SIGNIFICANT. GBTC is a trust that is the most similar to a Bitcoin ETF. GBTC charges a 2% fee PER YEAR (now 1.5% with the ETF). Over time this can be significant. Additionally, the ETF products that Wall Street is selling don’t allow you to EVER custody the bitcoin. An ETF could make sense for some people in some scenarios, but for anyone who can confidently build a Lego set, taking custody of Bitcoin is of similar complexity. Just do it yourself.

As Bitcoin becomes more mainstream, it will be possible to use it as collateral. Yes, I understand that using your Bitcoin as collateral takes it out of your possession and requires trust in a 3rd party. This is another case where you should educate yourself and be SURE that you have chosen a lender that is trustworthy and will not go bust. Always defer to self-custody if in any doubt.

Borrowing against your Bitcoin is impossible if you don’t have custody of it yourself. You cannot lend the Bitcoin that Blackrock is holding on your behalf. This is significant. There are tax benefits from borrowing against Bitcoin instead of selling it. If you don’t control your Bitcoin, you are boxing yourself out of some predictable use cases in the near future and many unpredictable uses that have yet to be invented. Programmable money is not useful if you don’t have custody of it.

The final reason you should hold your Bitcoin is a bit darker. Bitcoin was designed to be uncensorable and unconfiscatable. When it becomes apparent to the state that it is losing control of the money, it will likely come for yours. This has precedent in U.S. history. In 1933, Executive Order 6102 made it illegal to own gold for U.S. citizens. They compelled people to turn in gold and receive $20 per ounce. The government then repriced gold at $35 per ounce. You could get jailed for owning gold coins in the U.S. from 1933 until the mid-1970s. This could happen again, and you have optionality if you hold Bitcoin yourself. Custodians WILL be compelled to give the government your Bitcoin in this scenario. What you do with your Bitcoin in this situation should be YOUR call, not a custodian’s.

Responsibility

If you take the steps to self-custody your bitcoin, you are responsible. This is a type of radical responsibility that can worry people. If you lose your seed keys, your Bitcoin is lost forever. There is no number to call, and no one who can help you. IT. IS. GONE.

In 2017, one of my friends at the firehouse lost what was then $1300 worth of bitcoin because he put the Bitcoin on a paper wallet. These aren’t used anymore because they are so insecure, but you can print out a QR code that will hold your bitcoin. He left the piece of paper in his car. He then cleaned out his car and vacuumed up the paper wallet. That Bitcoin is gone forever. It is now worth somewhere in the range of 4-5 thousand dollars, and it’s just gone. Well, it’s technically not gone, it’s still there; just not accessible to anyone. Without the password, no one can move the bitcoin, so it’s effectively bitcoin that is frozen forever.

Another good friend of mine lost a significant amount of Bitcoin at a company called BlockFi. This was an exchange that offered yield on Bitcoin kept at their exchange. That Bitcoin is not frozen, but it is now locked up in litigation for the foreseeable future. To add insult to injury—because the Bitcoin when held by BlockFi was not technically his, it is theirs based on the “agreement” he signed when opening the account, he will at some future date get the dollar value of that bitcoin at the price when BlockFi went bust—which is 16 thousand dollars—we have rounded squarely back to why you should take self-custody seriously!

The old saying in bitcoin is “Not your keys, not your Coins.”

Bitcoin is an endless learning journey. If you want a rabbit hole to explore, you are in luck! The amount of solid content offered in the space is light-years better than in 2017. You can go from zero to proficient in a fraction of the time it would have taken back then. As was alluded to above a couple times, we have curated a Basics Series at Blue Collar Bitcoin that you can use to get started. The list of great content creators and resources is so long that we can’t name them all. Just go exploring and be careful to verify, not trust.

Continue learning, and above all—think for yourself!

Remember the wisdom of Matt Odell: “Stay humble and stack Sats.”

This is a guest post by Josh. Opinions expressed are entirely their own and do not necessarily reflect those of BTC Inc or Bitcoin Magazine.

Vanguard Reportedly Restricts Customer Access to Spot Bitcoin ETFs

Vanguard, a major player in the investment management industry with over $7 trillion in assets, has taken a surprising stance by blocking customer access to Spot Bitcoin Exchange-Traded Funds (ETFs), according to multiple reports. The move comes as a notable deviation from the growing trend of institutional interest and adoption of Bitcoin-related financial products.

Vanguard says it has no plans to offer spot Bitcoin ETFs or crypto related products, reported The Block. The firm citied that the high volatility nature of Bitcoin goes against the company’s goal of helping investors get ‘real returns’ over the long term.

Reports from clients are stating that while they can not purchase the newly listed spot ETFs, they can however sell shares of GBTC, Grayscale’s spot Bitcoin ETF. One client reportedly spoke with a company representative, who stated, “Currently we aren’t allowing those to be purchased as it doesn’t fit with Vanguard’s investment philosophy.”

Vanguard’s decision to restrict customer access comes just a day after the SEC approved spot Bitcoin ETFs for the first time, which have seen over $2.3 billion in trading volume on launch day. It remains to be seen whether the renowned asset manager will backtrack on their stance, and allow customers to participate in the burgeoning Bitcoin market.

Bitcoin Is A Database

Get ready, brace yourself. Reading this might enrage and confound you, it might confuse you, you might even get mad enough to punch your screen (don’t do that.) Consider this a trigger warning.

Bitcoin is a database. Period. That is what it is. The blockchain is a database for storing past updates to be able to reproduce the current state of that database, the UTXO set. The entire Bitcoin protocol is built around the database. What is a valid entry in that database, and what is not a valid database entry? Who is allowed to propose entries to that database, how do you ensure that only those users’ entries will be considered and accepted? What is the authentication mechanism restricting writing entries to this database? How do you throttle database entries so that people can’t make so many it overloads or crashes the software managing the database? How do you ensure that people can’t make single entries that are large enough to cause other denial of service concerns?

It’s all about the database.

Proof-of-work? The entire purpose of that in the protocol is to manage who can actually process updates to the database. Bitcoin is meant to be a decentralized system, so it needed a way for the database to be updated in a decentralized way while still allowing users to come to consensus with all their individual copies of the database on a single update to it. If everyone is just updating their own copy of the database by themselves, there is no way everyone will come to consensus on a single version of the database. If you depend on some authority figures to handle updates, then the update process is not truly decentralized. This was the point of POW, to allow anyone to process an update, but not without incurring a verifiable cost in doing so.

Proof-of-work is simply a decentralized mechanism for updating a database.

The entire peer-to-peer network architecture? It exists solely to propagate proposed database update entries (transactions), and finalized database updates (blocks). Nodes verifying transactions as they enter their mempool? It’s to pre-filter proposed entry updates to the database and ensure they are valid. Nodes verifying that a block meets the required difficulty target? It’s to pre-filter a proposed database update and ensure it’s valid before passing it on to other nodes to update their local copy.

The peer-to-peer network exists purely to reconcile multiple copies of the same database.

Bitcoin script? It literally exists for the sole purpose of functioning as an authorization mechanism for entries in the database. In order to delete an existing entry in the current database state, the UTXO set, a user proposing that update must provide authentication proof meeting the conditions of the script locking the existing database entry. Only existing entries, or UTXOs, can be “spent” in order to authorize the creation of new entries into the database. Miners are the only ones in the protocol allowed to create entries without meeting the condition of removing an existing one by meeting the authorization requirements set out in it’s locking script.

Bitcoin script is simply a mechanism to control and restrict who can write to the database.

Every single aspect of what Bitcoin is revolves around the core central function of maintaining a database, and ensuring that many network participants all retaining their individual copies of that database remain in sync and agree on what the current state of the database is. All of the properties that make Bitcoin valuable as a form of money, or a means of payment, are literally derived from how it functions as a database.

Many people in this space think that this database should be used solely for a means of payment, or a form of money, and I empathize with that view. I too think that is the most important use case for it, and I think that every effort should be taken in order to scale that particular use case as much as possible without sacrificing the sovereignty and security of being able to directly interact with that database yourself.

But it is still just a database when you boil down to the objective reality of what Bitcoin is. People willing to pay the costs denominated in satoshis to write an entry that is considered valid under the rules of that database can do so. There is nothing you can do in order to stop them short of changing what is considered a valid entry in that database, which entails convincing everyone else to also adopt a new ruleset regarding what is a valid entry.

People can freely compete within the consensus rules to write whatever they want to this database, as long as they pay the costs required of the rules and incentive structure of mining to do so. Period. Are many of the things people can and are entering into the database stupid? Yes. Of course they are. The internet is littered with mind numbing amounts of stupid things in siloed databases all over the place. Why is that? Because people are willing to pay the cost to put stupid things in a database.

Whether that is users of the database paying the provider and operator, or the operator themselves allowing certain things to be entered as part of operations without passing the cost to a user, is irrelevant. These stupid things only exist somewhere in digital form because in some way, the cost is paid to do so.

Bitcoin is fundamentally no different from any other database in that regard. The only difference is that there is no singular owner or gatekeeper dictating what is allowed or not. Every owner of a copy of the Bitcoin database is capable of allowing or not allowing whatever they want; the problem is if they choose to refuse something that everyone else finds acceptable, they fall out of consensus with everyone else. Their local database is no longer in sync with the global virtual database that everyone else is following and using.

If you find certain database entries unacceptable, then by all means change the rules your local copy validates new entries against. But that is cutting off your nose to spite your face. At the end of the day Bitcoin runs on one simple axiom: pay to play. If people pay the fee, they get to play. That’s just how it works.

At the end of the day, it is entirely up to every individual what they want to allow or not allow in their database, but cutting through all the semantics and philosophical debates going on right now one thing remains unquestionably and objectively true: Bitcoin is a database.