Author: linkteam

Brian’s Big ETF Bags

What is the dollar amount where the Banking Cartel starts asking tough questions like “Who’s holding the bag?” and ”Who’s holding our coins?” As we are near the approval of the ETF, I can’t help but wonder to myself “Who’s carrying the bags?” And while everyone on Twitter seems to be ETF experts and are breaking news on punctuation changes to applications, Coinbase has quietly positioned themselves in perhaps one of the most important roles in the future of paper Bitcoin. Coinbase is now listed as custodian on 9 of the 12 Bitcoin Spot ETF applications. Read that again.

Bitcoin Spot ETF Custodian List

Source: Bloomberg Intelligence, SEC Filing

With their role in these ETFs all but across guaranteed for Coinbase, it makes you wonder what is happening behind the scenes. Less than 10 days ago, Coinbase made a remarkable change in leadership by nuking their custody CEO, Aaron Schnarch, and brought in 30 year Wall Street veteran Rick Schonberg1 to lead the business. So let me get this straight, two weeks before the ETF approval, Coinbase has 75% of the custodian roles in all US Spot Bitcoin ETF business locked down, and they nuke their Custody boss and replace him with the most on-brand guy possible. Call me crazy but this is how the NY Banking Cartel operates. You think outsiders are welcome? You think the NY Banking cartel will simply bend the knee to bay area grays2?

Besides the idea of some shady dealings with the NY Banking Cartel, the position Coinbase is in is worth some scrutiny, especially if you care3 about custodial risk. Custodial risk is associated with entrusting a third party, often known as a custodian, with the safekeeping and management of financial assets.

Custodial Risk. the risk associated with entrusting a third party, often known as a custodian, with the safekeeping and management of financial assets.

This risk can take various forms:

Operational Risk: The risk of loss due to the custodian’s operational failures, such as administrative errors, technology failures, process breakdowns, and losing the keys.Fraud Risk: The risk that the custodian could engage in fraudulent activities, such as misappropriation of assets or manipulation of records.Credit Risk: The risk that the custodian might become insolvent or unable to fulfill its obligations, potentially leading to the loss of assets.Legal and Regulatory Risk: The risk of loss due to non-compliance with laws and regulations, which could result in fines, penalties, or legal actions.Counterparty Risk: In situations where the custodian enters into transactions with other parties on behalf of the client, there is a risk that the counterparty may default or fail to honor its obligations.Security Risk: The risk of theft or loss of assets due to poor security measures, both physical and digital.

As I look through this list I am putting a mental checkmark next to every line item as legitimate custodial risk since 75% of the Bitcoin ETFs are going through Coinbase’s hands. Now look, I am not writing this to be a concern troll. I am just saying that the change in leadership is very weird, and the concentration of funds into a single custodian is a major red flag. If anything this situation leads to a more probable 6102 Bitcoin scenario.

The developments surrounding Coinbase’s role as custodian for nine out of twelve Bitcoin Spot ETF applications raise significant concerns regarding custodial risk. With over 75% of the market share locked up under Coinbase’s control, investors should carefully consider the potential dangers associated with relying on a single entity for the storage and management of their paper bitcoins’ reserves. The convenience offered by centralized custody services may seem appealing, but the risks can’t be ignored. It’s crucial for individuals to do their own research and understand the implications of custodial arrangements before investing in any Bitcoin ETF. By doing so, they can make informed decisions and minimize exposure to threats posed by 6102 bitcoin, regulatory seizures, cyber attacks, and other unforeseen events. Ultimately, the ETF is going to be approved, things are going to get very weird, the NY Banking Cartel will sink their teeth into Bitcoin, and then there’s Brian’s Big Bags.

FOOTNOTES

This man’s resume is so on-brand for the role, just have a look if you like to schizo on these things. The point I am making is that they brought in a stud to do this job. ↩︎The term “grays” was coined (to my knowledge) by Balaji last year when he went on the epic 3 hour podcast rip with Marty, but the idea of a gray is that the country is divided into Blues and Reds as political tribes, but there is a third tribe which he calls the grays who have no allegiance to either party. Grays are capitalist builders who just want to build. ↩︎I don’t really care about this product as I am not a customer, I am just noticing the elephant in the room. Not your keys not your coins. ↩︎

How Two Digital Nomads Launched The Fastest Growing Bitcoin Community In El Salvador

Based on the number of merchants that now accept bitcoin in Berlin you might think this article is about the German capital city. Instead, it’s about a small picturesque mountain town in El Salvador with a population of 20,000 people.

How it came to have over 100 merchants accepting bitcoin in a 6 month period is an interesting story of persistence, passion and belief about bitcoin. It also is the story of an area whose inhabitants were proud of their beautiful city. The town in Germany may have many more inhabitants, but the lesser known Berlin has far more bitcoiners descending upon it every day than its much better known counterpart.

Magic Internet Money

It all begins with Gerardo Linares and his girlfriend Evelyn Lemus who were working as digital nomads in El Salvador for US companies for 10 years before they discovered bitcoin. Both are natives of ES and first heard about bitcoin when the country designated bitcoin as legal tender back in June 2021.

Like many of their countrymen, they were curious about bitcoin after the announcement and began going to meetups in San Salvador and El Zonte to learn more about this magic internet money. Like many, they downloaded the Chivo wallet and collected their $30 worth of bitcoin in September 2021 when the law took effect. The more they learned about this new global digital monetary network that allows you to be your own “decentral bank” the more they liked it.

They noticed that having bitcoin as legal tender in their country attracted many outside visitors and tourists who were bitcoiners to their country, but very few natives were adopting bitcoin outside of El Zonte and San Salvador. They wanted to change that, so they quit their digital nomad jobs and began a journey that resulted in them settling in Berlin which is a small mountain town about 2 hours east of San Salvador.

Sharing The Bitcoin Gospel

After learning more about Bitcoin’s impact and the opportunities it afforded to local communities, they wanted other Salvadoran natives to understand Bitcoin too. In the early stages of their journey they traveled to many smaller towns and villages in El Salvador and never missed a chance to educate the students in the local schools who wanted to learn about Bitcoin. They eventually teamed up with Mi Primer Bitcoin which is a bitcoin education company that began in El Salvador. As Cory Klippsten, CEO of Swan Bitcoin, has been saying for years, “To educate people on bitcoin is to market bitcoin.”

When I asked how many towns they visited in the country Gerardo said “21.” I’m not sure he caught the irony of his answer to my question since many bitcoiners consider 21 to be a special number. One of the places where they gave classes on bitcoin was in Berlin. They eventually decided to start their effort to develop a circular economy in this mountain town because the town officials took great pride in their community and were eager to attract tourists to the area.

Any time you want people to adopt new technology it is the first few early adopters which are the hardest, and Berlin was no exception. In the beginning, the two of them were able to on board 17 merchants via many one-on-one conversations and tutoring. These first Berlin merchants were open to this new payment rail [lightning network] because they wanted more tourism. In addition, another advantage they had in Berlin was that most of the merchants and shopkeepers were so small that they didn’t have employees, which means they could speak directly to the decision maker on the spot. There were no employees standing in their way as “middle men.” They also had the added advantage of Bitcoin being legal tender in their country. After the initial wave of 17 merchants more locals got involved in recruiting their fellow shop keepers. Gerardo and Evelyn were quick to credit the locals for the increased adoption. This wasn’t a success solely because of Bitcoin, however. They organized community supported clean-up projects that transformed the area and made it more appealing for locals and tourists alike.

Many of the merchants and shopkeepers in Berlin had heard of Bitcoin and most knew of the success in attracting tourists to El Zonte, which was a small surfing town 30 minutes outside San Salvador and about 3 hours away from Berlin. Another advantage of the shops in Berlin was that they accepted only cash (El Salvador had stopped issuing its own currency in 2001 at which time they made the US dollar their legal tender) and had no method for accepting digital payments, which means tourists were less likely to visit.

Challenges and Solutions

Some even had the Chivo wallet from when Bitcoin was first launched because that wallet was required to receive your $30 in bitcoin from the government. However, they found out quickly that the Chivo wallet defaulted to generating a QR code for US dollars NOT bitcoin. There was a way to accept bitcoin on the merchant’s Chivo wallet but it was not the default setting and it was NOT user friendly.

They needed to do a work around to get the Chivo wallet to accept Bitcoin which made it less than ideal. Most shops are small and were not yet accepting ANY FORM of electronic payments. Gerardo and Evelyn refer to Bitcoin as “electronic money” or “dinero electronico”. Accepting Bitcoin became the method for these shopkeepers and merchants to enter the digital age for payments, instantly creating a tourist destination for the many bitcoiners descending on El Salvador after the law was passed in 2021.

At first success was slow and only one or two shop owners were willing to try it. And when they made a sale in bitcoin they would often call Gerardo and ask him to convert the Bitcoin into USD. However, many have watched the price of Bitcoin skyrocket in 2023 and are now much more inclined to keep hold on to their Bitcoin. Gerardo and Evelyn eventually showed them how to use the Blink wallet because it was much more user friendly than the Chivo wallet and Blink has a stable sats feature that lets the shopkeeper avoid the volatility of Bitcoin.

Getting shopkeepers to accept Bitcoin was only half the equation though because they needed customers and no one in Berlin was paying in Bitcoin. The couple began inviting bitcoiners from El Zonte and San Salvador to Berlin. As these groups of Bitcoin visitors grew in size and frequency they made a point of organizing lunches and dinners at the restaurants where Bitcoin was accepted. It didn’t take long before other shop keepers noticed these large groups going to their competitors who accepted Bitcoin.

Gradually, then suddenly…

Gerardo explained that once they reached a tipping point of about 50 shops the whole need to recruit owners flipped. At that point, the shopkeepers and owners started coming to them and asking how to accept Bitcoin. He added that “people here in Berlin are excited about Bitcoin.” Recently, Gerardo and Evelyn opened a small office in Berlin where they teach people about Bitcoin for free and they teach the locals who want to learn English for a modest fee.

There is no doubt that the success and buzz created from El Zonte played an important role in adoption but there are now over 100 shops and merchants that accept Bitcoin in Berlin which Gerardo estimated represents about one quarter of the shops and businesses in town.

It is not without irony that I suggested to Gerardo during the interview that Berlin is the “fastest growing bitcoin community in El Salvador.” He seemed reticent about making that claim, but those are the facts. He made it clear there is still much more to do in educating the locals and building out the circular economy. I was surprised to learn they have a 15 page strategic plan for developing their new hometown into a global tourist destination which they wrote before they began. Their ultimate goal is for the project to be self-sustaining.

They have been so effective in putting the town of Berlin on the map that if you’re a Bitcoiner who lands in San Salvador you have a decision to make: “Do I head 30 minutes south to El Zonte or do I go east 2 hours to Berlin?” Do I want the beach [El Zonte] or the mountains [Berlin]?

In either case, there will be many merchants and shopkeepers in both who will happily accept your Bitcoin. Meanwhile, tourism continues to grow in El Salvador and circular economies are popping up in the unlikeliest of places.

This is a guest post by Mark Maraia & Beren Sutton Cleaver. Opinions expressed are entirely their own and do not necessarily reflect those of BTC Inc or Bitcoin Magazine.

Jevons Paradox: What It Actually Means For Bitcoin

From an economic standpoint, Jevon’s Paradox is arguably the foundation of the scaling road we have started walking down for Bitcoin. Pushing things off-chain is attempting to make the use of the scarce resource that blockspace is much more efficient to accommodate a materially larger user base than the blockchain can facilitate on its own. Jevon’s Paradox states that in the presence of elastic demand for something, when the efficiency of using that thing increases, i.e. the cost per use decreases, the aggregate demand for that thing among participants will increase.

The typical example given is the fuel efficiency of cars. If cars suddenly become twice as efficient at using gasoline, people will travel more as the cost of travel has been cut in half. With people traveling more often because the cost to the individual has lowered, the net increase in demand for fuel can exceed the original aggregate demand for fuel before the gain in efficiency was realized. This is the point where the paradox occurs, aggregate demand surpassing what it was before a realized efficiency in the use of that thing.

This is the entire economic thinking behind why second layers are a viable solution. One of the huge contentions from big blockers during the Block Size Wars was that going off-chain will essentially steal money from miners and undermine the game theoretical stability of miners surviving purely off of transaction fees in the distant future. The factor they completely ignored during those debates is Jevon’s Paradox, and many of them still to this day completely ignore this dynamic.

The Contentions

The counter argument, at least the valid one, is that demand rebounding after efficiency improvements does not always exceed the aggregate demand seen before that efficiency gain. It still rebounds in many cases almost to the point it was at, but does not surpass it. This comes down to the inputs that ultimately set a cost on producing something. In the case of the fuel example, the reality is that the cost of fuel is not the only factor in people’s ability to travel with their own car. The cost of producing that car, i.e. the labor, materials, energy for production, etc. and the ultimate cost of the car itself factor into this as well. These factors generally dampen the rebound in demand, preventing it from exceeding the levels it was at before efficiency increases.

Here’s the thing about Bitcoin though: the cost to produce a block is the only factor of “input costs” in producing blockspace. The real kicker is that no matter what happens to that input cost, the available amount of blockspace stays exactly the same on average. This is the entire novelty and value of the difficulty adjustment in Bitcoin, no matter what the price and net hashrate do, the network circles around this Schelling point of the same average amount of blockspace available. The only way that will change is a consensus change to alter the blocksize, or block interval, or other such core variables that will have an impact on the amount of space available.

Therefore the only real factor to consider when applying Jevon’s Paradox to Bitcoin, is how efficiently can users make use of that existing blockspace. One person owning a UTXO on their own and directly transacting on-chain can be seen as a baseline. Lightning, allowing two people to share a single UTXO and conduct numerous transactions off-chain before settling them on-chain, is the first major efficiency gain. After Lightning, something like Ark or a channel factory would be the next level of efficiency gain. In all of these cases, there are no extraneous factors to consider. If you have Bitcoin, and the ability to use that Bitcoin gets cheaper and cheaper, you are more likely to put that Bitcoin to actual use. There are no extra barriers to Bitcoin other than having the Bitcoin. You don’t HAVE to buy a super expensive hardware device to use it, it might be best security practices to do so if you have a large sum of money, but it is not necessary.

Ordinals and BRC-20 tokens kind of prove this point in my opinion. Shoving jpegs into the blockchain, which are pretty big pieces of data relative to the blocksize limit, is a highly inefficient use of blockspace. BRC-20 tokens, which are simply tiny JSON blobs, are relatively efficient relative to jpegs. Which one of these things really drove the demand for blockspace driving up fees lately? The BRC-20 tokens, not the jpegs.

It’s Going To Happen Anyway

The cold hard reality in my opinion is that blockspace use will get more efficient, and we will see Jevon’s Paradox play out regarding the market for that blockspace, regardless of anything we do. If using blockspace directly becomes prohibitively expensive for users transacting, they will find ways to abstract that away. They don’t need covenants, or forks in general, or anything we are building on layer twos to do so.

Custodians.

All they need is custodians. Using blockspace more efficiently comes down to a single thing: people sharing their UTXOs with each other. The trust model of how they do that, whether they can reclaim their money unilaterally without permission, who they have to interact with to withdraw their money, all of these things are completely and utterly irrelevant to Jevon’s paradox playing out.

If blockspace gets too expensive for people, they will stop using it. Demand will drop off, if not in aggregate, then for a class of users. Unless they want to just entirely stop using Bitcoin, they will seek out more efficient ways to use Bitcoin (which inherently requires using blockspace, no matter how abstracted that use is). The only truly scalable way to do this in the long term right now is through custodians.

That means without actually addressing the problem of “what does Bitcoin need to scale in a self custodial way” we are essentially implicitly admitting that the economic incentives of how this system works inherently forces people into custodial platforms and mechanisms for making use of their Bitcoin. To deny that is to deny the realities of what makes Bitcoin work: economics and incentives.

It has been argued quite a lot recently that “spam filtering” is simply another way for Jevon’s Paradox to occur. It is not, and it has no relationship to Jevon’s Paradox at all. Stopping a particular use case from competing with another is not increasing the efficiency of the other use case, it is simply trying to distort and manipulate the market of them both competing for the same resource. That argument fails to understand what Jevon’s Paradox actually is. It doesn’t care about one use case versus another, or which uses are “legitimate”; it is completely agnostic to specific use cases of a resource. It simply speaks to any use case of a resource becoming more efficient, and in the absence of unaccounted for input costs, what the results of that efficiency gain will be on aggregate demand for the use of that resource by that specific use case.

If we are right, this will play its course no matter what we do. The only influence we have on any of this is what the trust model of any efficiency gains in blockspace use are, we have no control over whether those efficiency gains will happen.

Spot Bitcoin ETFs Are A “Done Deal”, Trading To Start Thursday: FOX Business

Charles Gasparino, FOX Business Senior Correspondent, has reported that the long-anticipated Spot Bitcoin Exchange-Traded Funds (ETFs) are indeed a “done deal,” with trading slated to commence this Thursday.

This confirmation from FOX Business cements earlier speculations, affirming that the final green light for Spot Bitcoin ETFs has been granted, signaling an imminent leap into the regulated investment sphere for Bitcoin.

The potential commencement of trading on Thursday would mark a watershed moment for the Bitcoin industry, providing a gateway for both institutional and retail investors to access BTC exposure through traditional financial instruments.

It is important to note that the SEC has not yet officially approved any spot Bitcoin ETFs at the time of writing. But with the approval or denial decision due tomorrow, it is expected by industry experts that the ETFs will be approved.

As the countdown begins towards tomorrows expected approval and Thursdays potential launch, anticipation builds among market participants, eager to witness this historic milestone that is poised to reshape the dynamics of Bitcoin investments and potentially pave the way for further institutional adoption of Bitcoin.

Why I Am Already A Nostr Maximalist

After being inspired by a podcast with Preston Pysh and Will Casarin in January of 2023 I experienced my first interaction with ‘the nostr’ using a rather clunky interface. Since that time, nostr has gradually become more user friendly and an increasingly meaningful part of my life. I have now deleted all other social media accounts in favor of this blossoming decentralized alternative. My slow exodus away from centralized social media started over ten years ago, but the formation of a functional substitute was the final nail in the coffin. Making the jump at such an early stage may have been premature, but after two months using both nostr and Twitter I chose to make the transition permanent. I’ve written this article to explain my reasoning and provide an assessment of the nostr network as I understand it today.

Nobody is in charge of nostr, I have no one to ask if NOSTR should be capitalized or lowercase. I also have not reached a definitive conclusion regarding how it should be pronounced. Frankly it wouldn’t matter if anyone had an opinion about either of those things. Nostr is what the users and developers make it. Nostr is not a website and it is not a company. Nostr does not rely on a blockchain to function and there are no central servers dictating who can participate in the network. With the exception of shared interest and lightning ‘zap’ integration, it is independent from Bitcoin. Those who already understand Bitcoin seem to have an easier time wrapping their head around the importance of nostr, but I have also met several non-bitcoiners who are passionate about what is being built.

Nostr is a protocol which is designed to have applications built on top of it, or rather to interface with it. Users are free to choose from dozens of applications (clients) to access the protocol. The client they choose determines the nature of the user experience. The name NOSTR is an acronym for Notes and Other Stuff Transmitted by Relay. The functionality of the protocol is in the name, but I will not be diving into the technicalities here. I also will not be discussing the pros and cons of the various clients used to access nostr. Though that would be a helpful resource if someone would like to write that up!

As a non-technical enthusiast of freedom focused technology, I attended Nostrasia in November of 2023 with one primary question in mind; “What applications can’t be replicated on nostr?” At this point there are too many unknowns to answer this conclusively, but my understanding of nostr and its potential applications expanded dramatically during my time in Tokyo. The conference included talks on decentralized versions of nearly every application you can imagine. Twitter, Twitch, Youtube, Reddit, Spotify, Maps, Amazon, GitHub, Goodreads and others. None of these decentralized alternatives are carbon copies of those services. In many ways they seem to have the potential to become even better versions due to lightning integration and open-source user input.

At times I have wondered if what is being built will ultimately become a new decentralized version of the entire internet. As far as current limitations are concerned, the primary challenge I heard being discussed at nostrasia is that of creating a nostr equivalent for signal or telegram. Private encrypted chat may be more addressable by something like SimpleX. At this time it is unclear if the applications in development will be successful or scalable, but given the progress I have witnessed in the space since joining, I am feeling enthusiastic.

Optimism aside, it is hypothetically possible that nostr will not survive long enough to accomplish any of the bold objectives that are currently being proposed. There are many financial and technical challenges ahead. It is possible that I made a mistake in putting all my nostrich eggs in one basket. That choice is not for everyone and I fully appreciate that. However, having waited for a decentralized and open-source alternative to social media for many years, I am willing to take the risk associated with adopting this technology early. I would rather experience the unpolished user interface and potentially wade through a lot of frustration than continue putting my energy into a system I see as obsolete.

Every choice carries risk. When it comes to asset management, the risk of poorly allocating financial capital has drastic and permanent implications. In the case of social media, the risk of poorly allocating social capital is noticeable, but much less dramatic. The truth is that by using a centralized social media platform you have already sacrificed control over any social capital you have expended. At any moment, that site could shift its policies in a way that negatively affects you or they can delete your account at their own discretion. All the connections and content you have developed on those platforms is hanging at the whim of mega-corporations and government intervention. Personally, I have more faith in open-source code than I do in human institutions.

When creating an identity on nostr, a cryptographic signature is fashioned for you by open-source internet magic (as far as my pleb mind can ascertain). This signature has a private and public key, referred to as the nsec and npub respectively. An npub looks like the one below and can be used to find other users:

npub1jfn4ghffz7uq7urllk6y4rle0yvz26800w4qfmn4dv0sr48rdz9qyzt047 (add me 🧡🫂💜)

The npub is a novel form of online identification which is not required to be linked to your meatspace identity in any way. The nsec is used to sign in to new clients and to prove that you are the owner of the account; similar to bitcoin private keys. This key pair can be used anywhere in the nostrverse to prove that you are a particular individual or account. Follows, followers, and posted content are associated with a npub through the relays that npub is using. This means that if you are interested in trying out a new client or migrating away from the one you are using you may do this without any loss of connections or content.

This novel approach to online identity and data storage creates a much more competitive space for the developers creating applications, but also enables interoperability. Two critical factors which are altogether missing in today’s existing social media landscape. Current social media behemoths rely on the fact that it is challenging to leave and difficult to communicate between platforms. I deleted my Facebook years ago and for many months received emails about ‘So-and-so misses you! Look at what they posted recently.’ Naturally, I would be forced to log back in to view the content. The blatant and desperate emotional manipulation was too much to stomach. Nostr has the potential to obliterate the walled garden model where your digital life is held hostage for ad revenue and data collection.

In addition to the structural issues with legacy social media, it is clear that online censorship is on a steep increase. However you may feel about censorship when it is happening to someone you disagree with, you won’t like it when the censors turn on you. Some people appreciate censorship because there is a lot of content they would rather not see. Personally, I would like to make that choice myself rather than have some faceless corporation without a customer service line make it for me.

Ultimately the social media giants have been placed in an impossible position. Legislators will not stop pushing them to maintain the Overton window in their favor. Whether a social media provider wishes to be a propaganda tool or not, the nature of any centralized platform will ensure that it becomes one. Centralized dissemination of what is ‘appropriate content’ and what is considered ‘misinformation’ will inevitably narrow the scope of human understanding to a point where self-censorship is the norm. To a large extent this has already happened.

Some believe that misinformation is the most dangerous aspect of the internet. Allowing people to communicate freely in an open marketplace of ideas is too much to bear for these people. They feel the need to control what people say and by extension control what people think. This fear based need for control over the population does not align with my values. Despite the inevitable failure of such approaches in the age of the internet, we will likely see an increase in attempts to KYC (know-your-customer) everyone on centralized networks. The social credit system in China has provided the world with a case study to be weary of. When your bank card gets declined at the grocery store for a meme you re-posted on Xitter don’t say I didn’t warn you. Have I already become a toxic nostr maxi?… Maybe. 🧡🫂💜

Michel Foucault’s writings on disciplinary power outline a methodology towards an essentially non-violent oppression of the masses. Looking at his conceptualization and the current state of affairs in the social media landscape, I have a difficult time telling them apart. The final result of such a system is a society in which authentic connection and genuine behavior become impossible. Physical prisons are only one form of enslavement. The true prison of the dystopian future manifests inside the mind of the individual. Bitcoiners who have watched their personal time preference expand understand this intuitively.

There are people in the bitcoin community who see nostr as a distraction and there are people in the nostr community who see bitcoin as an impediment to adoption. All I see is a massive synergistic upward spiral between the orange badger and the purple ostrich. These two protocols feed each other and enable new use cases which culminate in something much greater than the two independent parts. Bitcoin is essential for shifting the world away from debt slavery into proof of work. Nostr is essential for shifting the world away from top down dissemination of information to a free market of content. In this way the two technologies are ideologically aligned with volunteerism and personal liberty.

Most bitcoiners would agree that financial freedom is essential in maintaining one’s personal agency. However, without the ability to communicate freely the new found financial liberation is handicapped. The ability to reliably coordinate commerce and correspond in a peer-to-peer fashion is much more essential than many seem to acknowledge at this moment. Additionally, the reason the fiat system is so potent in its deception is not exclusively a result of the accountants and politicians engaged in the fraud. The real strength of the fiat leviathan is a function of global propaganda efforts to maintain the perpetual delusion. If hyperbitcoinization occurs and the propaganda apparatus remains in place, most people are unlikely to benefit from its liberating qualities. In order for the full impact of bitcoin to take root on this planet we will also need a means of sharing information openly and efficiently.

All of this rhetoric is a bit grandiose for the moment given that the estimates I have received regarding daily active users ranges around 10,000. It could be that this article and the protocol itself will age poorly, but many of the concepts in this article will remain relevant to the importance of a decentralized method of mass communication. If nostr fails, something will take its place. Given the development I have witnessed so far, I would be surprised to see nostr fall flat. The protocol is drawing in talent and checking off bounties at an exponential rate. As the bitcoin price increases I anticipate this trend to continue. Those who believe that bitcoin is a distraction to nostr underestimate the electromagnetism of the bull market. Those who believe that nostr is a distraction from bitcoin didn’t meet the former ethereum dev at nostrasia who became a bitcoiner because of nostr. The purple pill helps the orange pill go down.

On a more subjective level, I have noticed a dramatically better user experience on nostr than I did in the legacy system. The effect is so pronounced that I can say that my mental health has noticeably improved since I got off of Twitter. There are several variables I could attribute to that improvement. The lack of enraging algorithms, the general size of the community I am interacting with, the shared interest of that community, or the conscious understanding that I am free to say whatever I want. Whatever it is, I am not the only one who has noticed a much better vibe on the nostr.

I have noticed that some of the popular Twitter accounts have not been quite as popular on nostr and some lesser known accounts have gained traction. I currently have more followers than I ever did on Twitter (a whopping 1400). Some of the larger accounts on Twitter are sharing on a more personal level on nostr than they do in the larger forum. These effects may not stay this way as the network grows, but at the moment it feels as though some of my favorite people are more accessible and more comfortable to share openly with the nostr community.

Earlier in my bitcoin journey I was of the opinion that the greater diversity of viewpoints I could interact with, the more comprehensive my understanding of the world would become. I was cautious of ending up in a filter bubble or an echo chamber of certain niche opinions. As time went on I made a point to exclusively follow people on twitter who were outspokenly ‘Bitcoin Only’. This provided a simple heuristic for me to narrow my field of interactions to people who had put in enough work to jump the hurdle out of the clown coin casino. I remain realistic about the possibility that I have intentionally manufactured confirmation bias in my online experience, but with the impending AI boom it will become increasingly difficult to remain in an unfiltered social pool.

By narrowing my online interactions to a specific group I run the risk of missing out on unique opinions, but so far this pruning has continuously increased the signal in my feed while reducing the noise. The scope of nuanced perspectives between bitcoiners on nostr has provided me with plenty to consider and learn from. In any case I still get a daily dose of intellectual debris to sort through from the normies I talk to in meatspace. When it comes to my online life, I concluded I would rather spend time getting to know this merry band of internet pioneers than stay connected to the rest of the traditional social media system.

Some have suggested that by leaving legacy social media I might be surrendering to irrelevance and obscurity. Personally I see the exodus of bitcoiners from Xitter gradually culminating in that network fading into irrelevance. I give credit to those of you who remain in the fray to fight the good fight, but my days engaging in that digital mosh pit are over. While my own learning process was accelerated by debates on Twitter, nine times out of ten I don’t see productive outcomes from online arguments. What I have found productive and rewarding has been interacting with people who are passionate enough about freedom to roll the dice on this new protocol.

It is very likely that every person early in this movement will be doxxed. However, in the long run we are supporting a technology that will enable future generations the freedom to choose how much privacy they maintain and how much information they share with the world. We are enabling a future where people have the freedom to be as authentic as they want without artificial limitations on the scope of human expression.

Being on nostr in 2023 feels a lot like pre-gaming the greatest internet party the world has ever seen. The sound system has some bugs, the decorations are still in process, and nobody knows for sure if anybody else will show up, but spirits are high. I’ve often equated sites like Xitter and F-book with a crappy dive bar that everybody goes to exclusively because everybody goes there. The more that they kick people out, water down the drinks, and raise prices; the more they will chase their customers off. I didn’t write this article to shame anyone or to pressure them into joining nostr, but if it ignited a spark in you to learn more, my objective was accomplished. There’s no rush, but when you decide you’re fed up with the status quo we will be waiting for you with open arms.

This is a guest post by Source Node. Opinions expressed are entirely their own and do not necessarily reflect those of BTC Inc or Bitcoin Magazine.

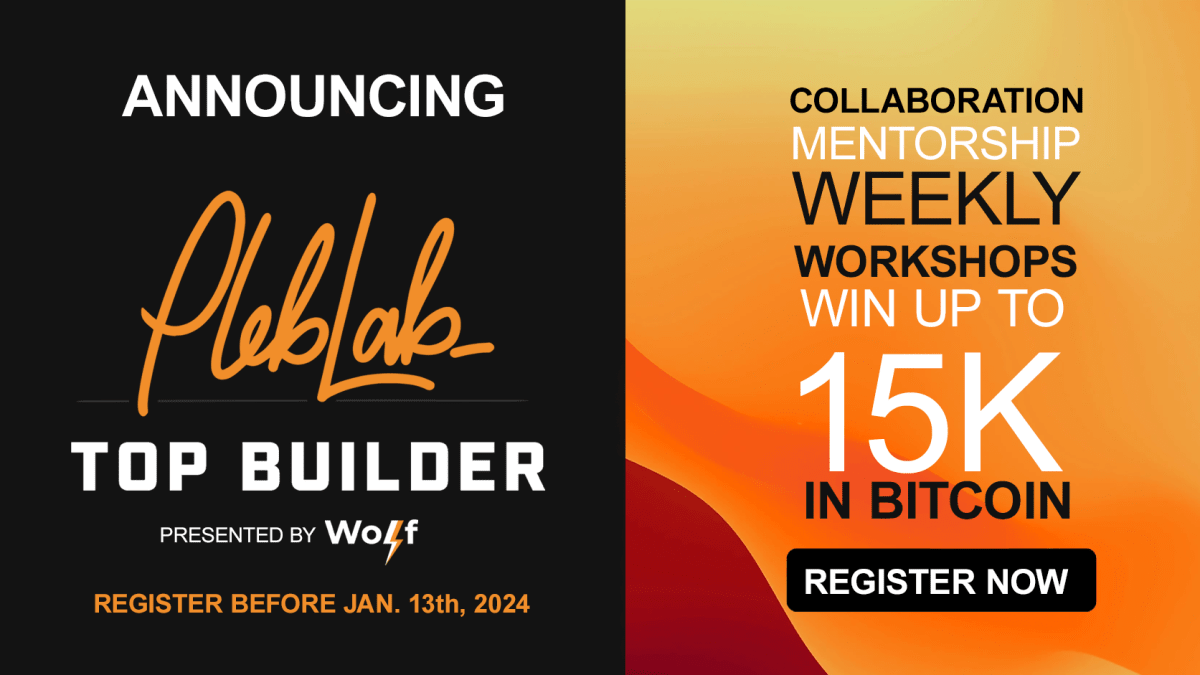

PlebLab Announces TopBuilder: A Unique Bitcoin Competition

PlebLab is hosting TopBuilder, a three month-long hackathon starting in January and ending in March. The application deadline is January 13th, so if you’re reading this now and wish to apply, get to it today.

The hackathon will take place across three roughly month-long rounds, where they are judged against milestones they have set for their projects at the beginning of the prior round. Judges will include Lisa Neigut, founder of Base58 and the Bitcoin++ Conference, as well as Kelly Brewster, CEO of Wolf, a Bitcoin startup accelerator based in New York.

They are looking for any project related to Bitcoin and Lightning that has the potential to offer innovative solutions to existing problems facing users and scaling both systems today. There is also the chance to win $15K in Bitcoin as a prize for first place in the final round of judging.

For the exact specifics, their FAQ is available here.

WHAT: This event is an exciting blend of builder sessions, workshops, announcements, and speaker panels, all designed to foster learning and growth within our community.

WHEN: From January 13th, 2024 until March 14th, 2024

WHERE: Participate remotely or at PlebLab until StartUp day (March 14th). If selected as a finalist, your team will present its project during StartUp Day on March 14th, 2024, at Bitcoin Commons in Austin, TX.

HOW: Apply now and until January 13th, 2024, at https://www.topbuilder.dev. Limited spots are available.

Learn more and apply now at https://www.topbuilder.dev/

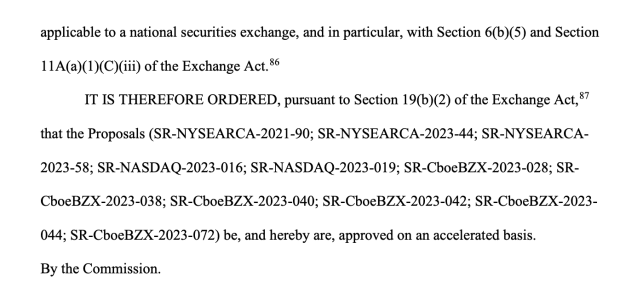

APPROVED: Spot Bitcoin ETFs to Trade on US Markets in Historic Milestone

Today, the United States Securities and Exchange Commission (SEC) has officially approved the listing of the first-ever spot Bitcoin Exchange-Traded Funds (ETFs). This move marks a historic milestone in the evolution of Bitcoin adoption within traditional financial markets.

“Today, the Commission approved the listing and trading of a number of spot bitcoin exchange-traded product (ETP) shares,” said SEC Chair Gary Gensler. “While we approved the listing and trading of certain spot bitcoin ETP shares today, we did not approve or endorse bitcoin. Investors should remain cautious about the myriad risks associated with bitcoin and products whose value is tied to crypto.”

The approval comes after extensive deliberation and anticipation surrounding the introduction of spot Bitcoin ETFs, which are anticipated to offer investors direct exposure to the BTC.

The introduction of spot Bitcoin ETFs in the United States is expected to unlock unprecedented opportunities for both institutional and retail investors, offering a more accessible and regulated avenue for participating in the burgeoning Bitcoin market.

Industry analysts predict that the approval of these ETFs will catalyze a surge in institutional capital inflow into Bitcoin, potentially fueling BTC’s value to new all time highs and solidifying its position as a legitimate asset class.

The exact launch date of the ETFs are expected tomorrow, Thursday January 11. Investors and Bitcoin enthusiasts alike are eagerly anticipating the ETFs’ debut on major stock exchanges, anticipating their impact on market dynamics and investor sentiment.

The SEC’s decision signifies a significant shift in regulatory stance towards embracing Bitcoin, signaling increased acceptance and recognition of it within the traditional financial realm. This approval is expected to pave the way for future developments in bitcoin-related investment products, potentially opening doors for a more diversified range of BTC-based financial instruments for investors.

As the SEC finalizes preparations for the listing of the first spot Bitcoin ETFs, market participants are on the edge of their seats, awaiting a new era in the investment landscape shaped by the integration of bitcoin into mainstream portfolios.

Spot Bitcoin ETF Issuer Bitwise Pledges 10% of Profits To Fund Open-Source BTC Development

Today, Bitwise Asset Management unveiled a new initiative, confirming their pledge to allocate 10% of profits from the Bitwise Bitcoin ETF (BITB) towards supporting Bitcoin open-source development, according to a press release sent to Bitcoin Magazine.

The donations will benefit three esteemed non-profit organizations – Brink, OpenSats, and the Human Rights Foundation’s Bitcoin Development Fund.

“Bitcoin was launched 15 years ago without a fundraise and has always been maintained by a dedicated community of open source developers,” said Bitwise CEO Hunter Horsley. “We’re excited for the Bitwise Bitcoin ETF (ticker: BITB) to provide a source of recurring funding for those unsung heroes who work tirelessly to improve the Bitcoin network’s security, scalability, and usability every day.”

The donations, to be made annually for the next decade, come without any strings attached, reinforcing Bitwise’s long-term dedication to fostering sustainable support for Bitcoin Core Development.

“It is important to support Bitcoin Core Development in a long-term sustainable way,” said Mike Schmidt, the executive director of Brink. “Bitwise’s decade-long pledge is a win-win-win with Bitwise profits leading to developer funding leading to improvements to the open source software underpinning the industry.”

The recipient organizations were carefully chosen based on their established track record and commitment to funding Bitcoin open-source development, subject to annual review for continued alignment with Bitwise’s mission, according to the release.

Acknowledging Bitwise’s proactive stance, Matt Odell, cofounder of OpenSats, lauded the company for setting a precedent in supporting open-source contributors vital to the Bitcoin ecosystem: “It is great to see large institutions supporting the open-source contributors who make this ecosystem possible. Bitwise is leading by example for all Bitcoin ETF issuers going forward.”

This commitment to donating 10% of spot Bitcoin ETF profits doubles what another issuer, VanEck, pledged to donate last Friday. VanEck will also be donating their profits to Brink.

“Bitcoin is a critical piece of freedom technology serving financially oppressed people around the world today,” said Alex Gladstein, the chief strategy officer of the Human Rights Foundation. “We started the Bitcoin Development Fund to support the developers who make this all possible, and we’re delighted that Bitwise is committed to supporting this important cause.”

For more details on BITB and the donation program, interested parties can visit their website here, heralding a new era of sustained support for Bitcoin’s foundational development.

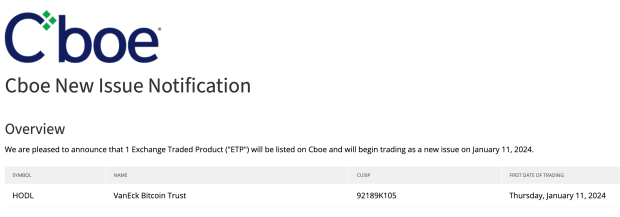

Spot Bitcoin ETFs “Will Begin Trading” Tomorrow: CBOE

The Chicago Board Options Exchange (CBOE) has declared on their website that VanEck, Fidelity, and ARK 21Shares Spot Bitcoin Exchange-Traded Funds (ETFs) will officially commence trading starting tomorrow, pending regulatory approval and effectiveness.

The CBOE’s announcement signifies a major milestone in the quest for regulated and direct exposure to Bitcoin through ETFs, allowing both institutional and retail investors a pathway to Bitcoin exposure.

This development follows meticulous regulatory evaluations and market preparations, positioning the Spot Bitcoin ETFs for an eagerly awaited debut on the trading floor. The CBOE’s confirmation reinforces the growing acceptance and recognition of Bitcoin as a legitimate and regulated investment asset class.

The imminent commencement of trading for Spot Bitcoin ETFs underlines a historic moment poised to reshape the investment landscape, providing broader access to Bitcoin within traditional financial markets. However it is important to note, at the time of writing, the U.S. Securities and Exchange Commission (SEC) has yet to officially approve the ETFs for trading, which approvals are expected later today.

What to Expect from Bitcoin’s Spot ETF Launch

The below is an excerpt from a recent edition of Bitcoin Magazine Pro, Bitcoin Magazine’s premium markets newsletter. To be among the first to receive these insights and other on-chain bitcoin market analysis straight to your inbox, subscribe now.

This week’s topics

Monumental SEC failureBitcoin ETF multipleGerman economic updateTaiwan elections and China response

SEC’s 2FA Failure

Bitcoin is a great teacher. Many of us have learned so much, from studying and following Bitcoin over the years, not just about money but about life. Once again, Bitcoin provides us with a teachable moment in the hack of the SEC’s X/Twitter account. First, even if you are a normie in favor of heavily regulated markets, this event should open your eyes to the fact that the regulators have grown into a systemic risk themselves. They are a risk to the investors they are supposed to protect. The SEC is even in a battle at the Supreme Court battle over their in-house semi-judicial system.

Secondly, this scandal happened because the SEC didn’t use 2FA, months after warning everyone about the use of 2FA. This shocking incompetence might wake many out there and spread the use of 2FA — something long overdue.

The total damage based on the SEC’s failure was $30 billion wiped from the market cap with $90 million worth of open positions liquidated. Of course, the SEC did not apologize for their failure and will likely be facing legal consequences. Spicy take, this bitcoin-inspired scandal might result not only in us getting the ETFs approved, but also the SEC getting taken down a peg.

Bitcoin Market Cap Multiple of Inflows

Estimates of inflows on the bitcoin ETF’s first days of trading are expected to be massive. Issuers have publicly stated they are seeding their funds with $312.9 million so far. These are commitments by private players to immediately create shares to seed liquidity. This does not include other money from regular trading.

The fee structures submitted this week by issuers have clauses for introductory periods based on the inflow of assets under management. For example, ARK is offering a 0.0% management fee for the first 6 months or until $1 billion in AUM. Invesco is offering 0.0% for 6 months or $5 billion AUM. This means they expect those time periods and AUM to be a practical expectation. If we add up all these special fees discounts, we arrive at $13 billion of expected AUM growth in the first 6-12 months from 5 issuers alone. That does not mean inflows exactly because bitcoin bought earlier will appreciate adding to AUM.

Source: @JSeyff

The seeding funds are small potatoes compared to the total $25 trillion AUM of the issuers. If 1% were to come into the bitcoin ETFs over the first 12 months, that is $250 billion.

Back in 2021, near the ATH, Bank of America put out a study that bitcoin had a 118x multiplier on inflow to market cap appreciation. So, for every $1 million in fresh buying, the market cap would increase by $118 million. That multiplier relies on many different factors, like speed of inflow, number of available bitcoin on exchanges, and block reward. Bank of America made their estimate when there were 2.7 million BTC on exchanges, today there are only 1.8 million — or 607,000 when considering the major US exchanges Coinbase, Gemini and Kraken only. In other words, the multiplier could be greater than 118x this time.

The largest single ETF launch in history saw $2 billion of inflows. The bitcoin ETF event promises to be bigger than that because it is a group of 11 ETFs and is a new asset class. $2 billion is therefore conservative, but we’ll use it for our purposes here. $2 billion times 118 means $236 billion market appreciation on day one. The market cap at time of writing is $900 billion, meaning the first day move could be ~25%, taking us to $58,000.

German De-industrialization

People think it can’t happen, that’s why it is happening. Some Germans are beginning to understand the effect of deglobalization on their economic model, and the effect that communist climate policies will have on heavy industry. Large companies like BASF, Linde, and Volkswagen all have plans to move out of Germany. Energy-intensive industrial production is being hit the worst. 2024 is going to be a massive recessionary year around the world.

Source: Financial Times

The latest number for November showed the sixth straight month of industrial production, the worst stretch since the Great Financial Crisis.

Source: Bloomberg

Source: @SoberLook

Taiwan Elections and China’s Economic Disaster

One of the most consequential elections this year is happening Saturday in Taiwan. As it stands, it is a three-way race for president with the more anti-China Democratic Progressive Party, Lai Ching-te, as the front-runner. He is friendly to the US and will be a thorn in the side of the CCP. Certainly, China has invested heavily in stopping him and spreading propaganda within Taiwan. Despite this, the anti-China candidate is still favored.

Source: NHK Japan Broadcasting Corporation

Source: Fulcrum Asset Management

This election has global consequences as you can imagine. In an article yesterday on Bloomberg, they highlighted the possibility that the election of Lai could lead directly to conflict with China and potentially cost the global economy $10 trillion.

This is also happening as the Chinese economy is falling apart. Their blue-chip stock market CSI 300, recently hit 5-year lows, standing in stark contrast to the US stock markets rallying to near ATHs.

Source: Yahoo Finance

Last but not least, the foreign direct investment (FDI) numbers for 2023 have come out and they are a total disaster. Money is fleeing China at the fastest pace in modern history. All this is to say that the election in Taiwan and the economic pressures in China could move the world closer to conflict over Taiwan.

Source: @Geo_papic