Author: linkteam

Dollar edges lower ahead of key data; ECB meeting looms large

Post Content

Sterling and Australian Dollar brace for economic data release

Post Content

US dollar flat as Japan, European policy meetings loom

Post Content

Yen strengthens ahead of Bank of Japan meeting; markets await central bank decisions

Post Content

Asia FX muted before more US cues, yen flat as BOJ keeps dovish course

Post Content

Bitcoin falls to $40,000, lowest level since bitcoin ETF launch

Post Content

Spirit of Satoshi Releases Its First Annual Bitcoin and AI Industry Report

In an culmination of efforts at the intersection of Bitcoin and Artificial Intelligence (AI), the “Nexus – Bitcoin & AI Industry Report” has been unveiled by Spirit of Satoshi, the world’s first Bitcoin centric AI, highlighting significant advancements and debunking misconceptions within these realms.

The report’s core emphasis revolves around the convergence of 280 participants dedicated to refining the Spirit of Satoshi model and bolstering its “Nakamoto Repository” with over 33,000 invaluable Bitcoin resources. These milestones signify a robust amalgamation of community-driven contributions and partnerships, establishing a cornerstone for AI development facilitated by Bitcoin and Lightning payments.

Noteworthy highlights within the report include the Lightning-Enabled-Crowdsourced LLM (LECS-LLM) tool’s creation, amassing over 40,000 responses from 280 contributors. This effort curated an extensive repository of 33,000 Bitcoin and Austrian economics resources, sourced both from the community and through collaboration with the Mises Institute.

Also showcased in the report is the Code-Satoshi, the world’s first Bitcoin Code-Pilot. This tool, aimed at developers, streamlines the coding process for Bitcoin and its related languages and protocols. Currently in its Alpha phase, it aids in code production, correction, and explanation via English or visualizations, focusing initially on Script and MiniScript.

Moreover, the report expounds on the integration of the Lightning Network’s L402 protocol, emphasizing its role in facilitating machine-to-machine economic activities. This integration aims to enhance user privacy and also mitigate fraud and chargeback risks, contrasting starkly with centralized AI models.

Essential myth-busting surrounding AI misconceptions forms a significant segment within the report. From debunking the “More Data Myth” to dispelling fears about AI replacing human labor and addressing concerns about Artificial General Intelligence (AGI), the report underscores the need for transparent and diverse AI models.

Another aspect highlighted is the collaborative effort in building the Spirit of Satoshi Bitcoin language model. With community validation, refined datasets, and reinforcement learning, the model aims for accuracy and alignment with a Bitcoin-centric perspective.

The “Nexus – Bitcoin & AI Industry Report” showcases the collaborative innovation between these two realms, which could usher in a new era of AI development empowered by Bitcoin, paving the way for transformative applications in both spheres.

Why the Bitcoin Price Will Rise or Fall on the ETF Ruling

Bitcoin is up over 150% in 2023, and that momentum has captured hearts and minds on Wall Street, resulting in a landmark rush for its firms to launch the first-ever Bitcoin exchange-traded fund (ETF).

All eyes are now on the upcoming decision by the U.S. Securities and Exchange Commission (SEC) regarding the approval of a spot Bitcoin ETF, slated for January 10.

If the past is any indication, the ruling will have a significant impact on Bitcoin’s price, though whether positive or negative remains to be seen.

Potential for a Price Rise

Proponents of a Bitcoin ETF argue that its approval by the SEC would open the door to a flood of institutional and retail investments, driving the price of Bitcoin to new heights.

History offers a glimpse into how expectations surrounding ETFs have affected Bitcoin’s price.

In 2017, the price of Bitcoin surged to over $1,400, driven in part by the anticipation of the first Bitcoin ETF. This was up from lows in the $600 range just the year before.

Investors believed then that the introduction of a Bitcoin ETF would make it easier for institutional money to enter the market, leading to a frenzy of buying. However, the SEC ultimately rejected the proposal, causing a sharp decline in Bitcoin’s price.

Within days, the price was trading back below $1,000.

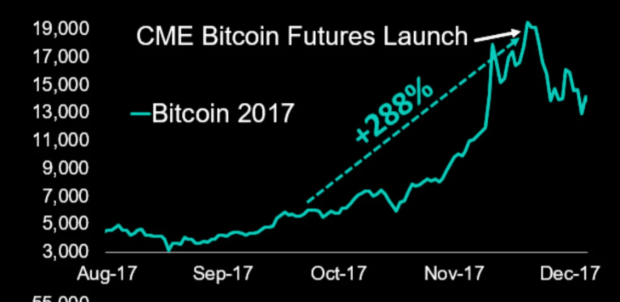

Ultimately, however, the arrival of Bitcoin futures would bring new attention in 2017, the market surging above $20,000 that year.

Price increase from CME Bitcoin futures announcement to listing.

Elsewhere, we can fast forward to 2021, when Bitcoin once again rallied to all-time highs, reaching over $60,000.

This time, the rally was partly fueled by the successful launch of Bitcoin futures ETFs in Canada and Europe. These ETFs allowed investors to gain exposure to Bitcoin without holding the cryptocurrency directly. The anticipation of a similar product in the U.S. contributed to the bullish sentiment.

Finally, in the wake of fake news of an ETF approval earlier this year, Bitcoin’s price rose by several thousand dollars in minutes, a move that suggests upside volatility on approval is likely.

The Bitcoin price spikes on fake news of an ETF approval.

Potential for a Price Fall

On the flip side, there are arguments suggesting that the approval of a Bitcoin ETF could lead to a price correction.

Some market experts fear that the ETF could become a target for short sellers, leading to increased volatility, or that the ETF could be a “sell the news event.”

Moreover, the approval of a Bitcoin ETF may bring greater regulatory scrutiny to the cryptocurrency market as a whole. This heightened oversight could lead to increased taxation, reporting requirements, and potential restrictions on the use of Bitcoin, which may dampen enthusiasm among investors.

Additionally, some believe the market may already have priced in the possibility of a Bitcoin ETF approval, and any decision to deny it might lead to disappointment and a sell-off similar to what was witnessed in 2017 when the Winklevoss Bitcoin ETF was rejected.

Bitcoin price sell-off after the ETF rejection in 2017.

The final decision by the SEC is eagerly awaited by the crypto community, but it’s essential to remember that it is just one of many factors influencing Bitcoin’s price.

Market sentiment, macroeconomic conditions, and geopolitical events will also play their part in shaping the coin’s future.

Conclusion

In conclusion, Bitcoin’s price is at a crossroads as investors await the SEC’s decision on the Bitcoin ETF.

While past instances have shown that ETF expectations can have a substantial impact on Bitcoin’s price, it is crucial to consider the broader market dynamics. Whether Bitcoin’s price rises or falls after the SEC ruling will depend on a multitude of factors, including how the market interprets and reacts to the decision.

As the crypto world holds its breath, the future of Bitcoin remains uncertain, but it’s undeniably a pivotal moment for the world’s only decentralized cryptocurrency.

Instant Settlement: The Logistics Industry

Now that we have seen how instant settlement can affect the construction industry let’s see the next industry that can have a huge impact – logistics.

To begin, let’s examine the logistics industry through the lens of an online order example. What unfolds when we select a product on a website that requires delivery to our door? Who are the entities involved in this process, and what does the payment process entail?

So I pick something from the website and order it. I pay for it and wait for the product to be delivered to my door and hope that what will arrive at my door is what I expect.

Because I am paying upfront, I am taking the risk in this case. I may choose to pay on delivery but the risk for all involved does not disappear, it is just shifted to who is taking that risk now, the seller. But more on that a bit later.

When using a card for payment, a 1.5%-3% transaction fee is typically charged by the bank issuing the card. After payment, the retailer or seller is notified to send the product to the buyer’s address. Subsequently, the retailer arranges delivery through a logistics company. A delivery person is dispatched to the warehouse to collect the ordered product along with others, optimizing the route. The product then navigates through the delivery company’s ecosystem, involving various warehouses and personnel, until it reaches the final delivery person who brings it to the buyer’s doorstep.

The efficient movement of the product through space is generally understood within the system so that is not the problem. Faster delivery benefits everyone involved, as quick and reliable service enhances customer satisfaction and loyalty. However, the actual delivery personnel may not directly benefit from the speed of delivery, but we’ll delve into that aspect later. Swift delivery is crucial for customer retention, as a prompt and reliable service encourages customers to choose the same platform for future orders rather than seeking alternatives.

Where Are The Problems Then?

The logistics industry, much like the construction industry we discussed in the previous article here, has problems that predominantly revolve around payment processes. These payment-related issues cascade into other aspects of the logistics chain.

Let’s trace the journey of money in this context:

I make a card payment to the website, and the bank deducts a 1-3% transaction fee from the retail value. The website, having received the payment, needs to pay the retailer the value of the product, and again, the bank deducts 1-3% from this payment. The retailer, in turn, has to pay the delivery company, with the bank deducting another 1-3% from this transaction.

The above is just about the fees to the bank. What about the settlement between all the entities involved in the delivery?

The website receives their money from me fast, unless it is an international delivery it is the same day.The website then batches all the payments that have to be paid to the retailer for the month so they do not have to pay each individual sale to them. They most likely will pay once a month so it could be up to 30-day credit at this point.Then the retailer has the same arrangement with the delivery company and there is up to a 30-day delay of the payment at this point also.

The monthly batching of payments may streamline processes, but it introduces a significant element of risk into the transaction chain. If any entity in this chain were to face financial issues, such as bankruptcy, within 30 days, the subsequent parties may never receive the funds they are owed. This risk compounds throughout the logistics ecosystem, emphasizing the need for more secure and efficient payments.

If I opt to pay on delivery, the risk dynamic in logistics is inverted – the money is collected by the delivery company, then forwarded to the retailer, and eventually passed on to the website. This way of operating has introduced additional complexities. As the number of orders increases, individual financial ledgers between the companies become more intricate due to the waiting period for money to reach the designated recipient. There is a ledger between the website and the retailer, tracking how many orders have been paid to the website and are awaiting payment. There is another ledger between the delivery company and the retailer, which, in turn, is awaiting payment. Regardless of my preferred payment method as the buyer, the retailer remains significantly exposed because they never receive the money first. The third-party risk for them is consistently high.

In both scenarios, the banking system charges fees of 3% or more for each delivery, and various parties face multiple third-party risks depending on the order of payment. To provide a more nuanced understanding of risk, it’s crucial to note that even if all involved entities are reliable and face no business issues, this doesn’t eliminate counterparty risk associated with the banks themselves. In the event of a bank failure, even a well-intentioned company may find itself unable to settle its debts, highlighting the vulnerability inherent in the current financial infrastructure.

Other Problems In The Logistics Ecosystem

The system encounters additional challenges within the workforce, particularly among delivery personnel. A fundamental conflict exists between these workers and the companies they serve. Workers are compensated for their time, while companies derive revenue from delivered products. This misalignment of incentives prompts companies to set aggressive targets for delivery personnel. When I run a marathon I do not sprint because I will burn out in the first part of the race. I have to pace myself to finish and may increase or decrease the speed depending on the particular situation. When you make the delivery men “sprint” in the “marathon” of delivering packages, it is only a matter of time before they burn out and quit much sooner than finding their pace and finishing their month/year the proper way.

The intense pressure to meet unrealistic delivery targets can have severe consequences on the quality of service provided by delivery workers. The rush to complete deliveries quickly may lead to damaged products and unattended packages that get stolen. Additionally, they do not have time for bathroom breaks and have to figure out how to do their business in the delivery vehicle. This not only impacts the overall customer experience but also poses risks to the well-being of the workers themselves.

The burnout process is expedited by the mental struggle faced by delivery personnel. A conflicting incentive structure compounds the challenge: while the company seeks maximum exploitation for increased profits, delivery personnel are motivated to minimize their workload since their compensation remains constant. This incongruity not only hampers the optimization of profits for both parties but also introduces mental stress for the delivery personnel. How do you expect to have no friction between them if both parties wanting to increase their profits means they have to do completely opposite actions.

Another source of friction between the delivery company and its personnel revolves around the vehicles they use. Similar to the issue of tool maintenance in the construction industry, the lack of ownership over the vehicles leads to neglect in upkeep. The company, focused on maximizing profits, may exploit the delivery personnel, who, in turn, might exploit the vehicles to enhance their personal gains. This dynamic creates a detrimental cycle where both parties prioritize individual interests over the long-term well-being of the shared resources.

Instant Split Payments And Delivery Dynamics

The most apparent benefit is that the banking system would not levy fees of 4.5%-9% for each product delivered. Even if funds are transferred between entities, the fees in the Lightning Network would be approximately 0.3%. This alone marks a significant improvement, reducing transaction costs by an order of magnitude compared to the current system. Now, let’s delve deeper into additional advantages.

The risks associated with multiple third parties are eradicated in this ecosystem. There’s only one third-party risk, namely the buyer of the product. As soon as the buyer receives the product, they make a Lightning Network payment. Moreover, the delivery company, the retailer, and the website all receive their payments simultaneously without funds passing from one to another. The split payment will crush the fees even further because it is one payment so the fee is ~0.1%. Just to mention that those fees do not go to the banking system, they go to the LSPs like us at Breez that are facilitating the actual payment. And because we are a non-custodial solution we do not introduce any third-party risk. There is no waiting at any point for someone to settle their bill with someone else. All participants have their funds instantly and decide what to do with them from then on.

This is a huge improvement, and just that is enough for someone to disrupt the logistics payments market, but the effects of instant split payment do not stop there.

The adoption of instant split payments in the logistics industry will significantly alter the incentives for all delivery workers. A key transformation is the shift from receiving compensation solely for time – to being actively engaged in each payment related to their deliveries. Similar to how companies receive split payments, with each entity getting its share, every individual in the delivery company involved in moving the product can now receive their share too. The funds received by the delivery company will be split further, ensuring that delivery personnel are paid for their specific contributions rather than time spent. This eliminates the need for brutal targets, allowing those who deliver more packages to receive proportional compensation for their work and fostering a fair and performance-based payment structure.

In this new paradigm of instant split payments, delivery workers will be incentivized to use their own vehicles for product deliveries. When using a company vehicle, their share of the payment for each delivery is smaller. However, if they utilize their personal vehicle, the percentage from each delivery will be more substantial, directly contributing to their earnings. This shift encourages a sense of ownership and responsibility among delivery personnel, fostering a more efficient and cost-effective system.

The revolutionary aspect of this system is that it opens up opportunities for anyone with a vehicle to become a convenient and flexible delivery person. Individuals can integrate delivery tasks into their existing plans, making extra bitcoin while heading in a specific direction. This decentralized approach allows for the optimization of routes on an individual basis. People with their own vehicles are no longer bound to a single delivery company; instead, they can work for various companies in their local area. This not only encourages individual optimization of routes but also shifts the focus to serving those expecting deliveries rather than working solely for a centralized delivery company. The reputation of the app will be enhanced by well-delivered packages, creating a positive feedback loop for more orders in the future, akin to the success of platforms like Uber.

Absolutely, the introduction of an instant settlement system with split payments has the potential to decentralize various aspects of the delivery ecosystem:

Decentralization of Delivery Companies: Logistics can shift from a few large delivery companies to numerous small entities and even individuals participating in the delivery process. This allows for a more distributed and flexible delivery network.Decentralization of Income for Delivery Personnel: Delivery individuals will no longer be reliant on a centralized source of income. Instead, they can participate in each delivery payment, earning money directly proportional to their contribution, thereby decentralizing their income.Decentralization of Options for Buyers: Buyers will have a broader range of options for who delivers their products. With a more decentralized delivery ecosystem, they can choose from various delivery providers, including independent agents and smaller delivery companies.

Overall, this decentralization has the potential to create a more efficient, adaptable, and user-centric delivery system.

Now there needs to be a person who understands the logistics market and makes that app. Unlike the construction companies, this will be even more decentralized because many more individuals can manage a delivery. Not everyone can manage a complex construction project but anyone can deliver something. Remember in the past the newspaper kids? A person with his scooter can deliver a few packages to his neighbors on the way. That will also have a social layer effect by bonding you more and more with the people in your area. We can use that in big urban areas because most of the time we are passing our neighbors without saying “Hello”. And the neighbors will prefer to receive product deliveries from people that they are familiar with. The potential for a decentralized and more community-oriented delivery system is quite exciting

Now let’s go and deliver that app.

This is a guest post by Ivan Makedonski. Opinions expressed are entirely their own and do not necessarily reflect those of BTC Inc or Bitcoin Magazine.

Bitcoin’s Role In Global Healthcare Access

Like so many industries today, the medical sector is seeing increasing global engagement. Patients aren’t just limited to the health and dental care that’s available on their doorstep. Medical facilities can effectively connect to consumers from across the planet. This has created a thriving medical tourism market.

It should come as no surprise that greater freedom of choice in healthcare is being supported by decentralized currency solutions. More than ever before, patients and facilities are using Bitcoin, in particular, for treatment payments.

Let’s look a little closer at this trend.

Facilitating Access To Wellness

One of the key challenges facing patients today is a lack of healthcare access in their home country. In some instances, communities have a shortage of physicians, while for others quality care isn’t particularly affordable. This isn’t just about primary care doctors or surgeries, either. The state of oral healthcare in the U.S. is also fraught with accessibility issues. A lack of dental insurance, rising costs of relatively basic treatments, and care inequality are among the contributors to poor oral health outcomes. This doesn’t just disrupt dental wellness, either. Oral unwellness can have knock-on effects on other areas of health.

The challenges at home mean many Americans are seeking treatment elsewhere in the world. Countries such as Thailand and Mexico are common targets for good-quality healthcare that is more affordable. Nevertheless, the different currencies in these areas can result in either administrative complications, additional transfer costs, or conversion fees. This is one of the reasons some international medical providers have begun to integrate Bitcoin technology.

It means that Bitcoin can be a tool for breaking down some of the barriers to affordable care. Using this decentralized currency tends to mean that patients aren’t hit with unnecessary conversion fees from their banks or credit card providers. Therefore, they can lower the costs of their overall care even further. Bitcoin’s prominence in the crypto market may also mean it is likely to be the specific coin care providers accept now and in the future.

Maintaining Security And Privacy

Global medical care has a unique set of challenges. Perhaps the primary among these is how healthcare providers can effectively manage risks. Like many industries, solid hazard mitigation practices boost reputation and improve efficiency. Most importantly, though, a focus on maintaining security and privacy protocols reduces both facility and patient exposure to breaches. Bitcoin may be a component of these efforts.

One of the privacy and security risks in traditional international transactions is that there’s a very direct digital paper trail to patients’ financial and personal data. When breaches occur, criminals may have access to not just financial information but also link it to medical records. Patients also can’t always guarantee the same level of regulatory standards of data protection abroad as they would at home.

Bitcoin, on the other hand, offers built-in security and privacy protocols. Firstly, it’s traded and stored on blockchain systems. This tends to make it particularly difficult for cybercriminals to gain access to the ledger and pull coins or — importantly — sensitive information from it.

Additionally, the decentralized nature of Bitcoin means transactions can be anonymized to some extent. This means patients can reduce the potential for Bitcoin transactions to be traced to them and their medical data. That said, maintaining anonymity requires effective protocols. For instance, patients could use IP address hiding tools during transactions. They could also agree with medical providers to utilize pseudonyms for transactions.

Linking Investment To Payments

One of the often overlooked components of Bitcoin concerning global healthcare is its built-in investment protocols. When patients use their credit or debit cards to pay for their treatment abroad, this currency doesn’t necessarily benefit from potential value rises. Sure, funds in medical savings accounts may accrue interest over time. Yet, this may well still be negatively affected by the aforementioned currency conversion fees when it comes time to pay for services abroad.

Bitcoin, on the other hand, is inherently subject to crypto market fluctuations. It can be volatile, of course. Yet, sometimes this can work in favor of investors.

For instance, patients can track the cryptocurrency markets and use forecasting tools to make predictions about purchasing coins at their lowest value. They can then plan elective treatments abroad for when currency values are expected to rise again. As a result, they may get the most medical treatment out of their investments.

Similarly, healthcare providers abroad can keep Bitcoin payments in dedicated wallets rather than withdrawing immediately. With a responsible approach to market tracking and forecasting, they can use rises in value to reinvest in their businesses. This could empower them to make improvements to their facilities. They could also have more funds to put toward marketing tactics. For instance, arranging comprehensive health tourism trip packages that have become popular among dental tourism patients.

That said, both patients and care providers should be extremely mindful of the significant risks this reliance on Bitcoin presents. On the patient’s side, it’s rarely wise to put all the eggs in one basket, particularly when it comes to saving for medical care. It can be better to diversify with other forms of more traditional health insurance and health savings. It’s also good to consider limiting Bitcoin-driven medical tourism only to non-essential electives. This prevents the potential for wellness to be too heavily influenced by the crypto markets.

Conclusion

Bitcoin is being accepted by more healthcare providers worldwide. This doesn’t just offer convenience and security benefits. It may also help some patients to afford more treatments they wouldn’t otherwise have access to in the U.S. It’s vital to recognize, though, that this is not a watertight solution to healthcare access. As with any Bitcoin investment, its use by patients and facilities alike must be based on informed decision-making. With a responsible approach, though, there is potential for this currency to be a useful tool in a wider healthcare strategy.

This is a guest post by Miles Oliver. Opinions expressed are entirely their own and do not necessarily reflect those of BTC Inc or Bitcoin Magazine.