Month: October 2024

Lightspark Announces New Bitcoin L2 and Upgraded UMA Capabilities

At Lightspark Sync, Lightspark’s first partner summit on Thursday, the company announced new products and features that will allow users to make global payments with both bitcoin and fiat.

The company announced that it has launched an alpha version of Spark, a Bitcoin Layer 2 that’s interoperable with Lightning and that makes it cheaper to onboard users to a non-custodial Bitcoin layer.

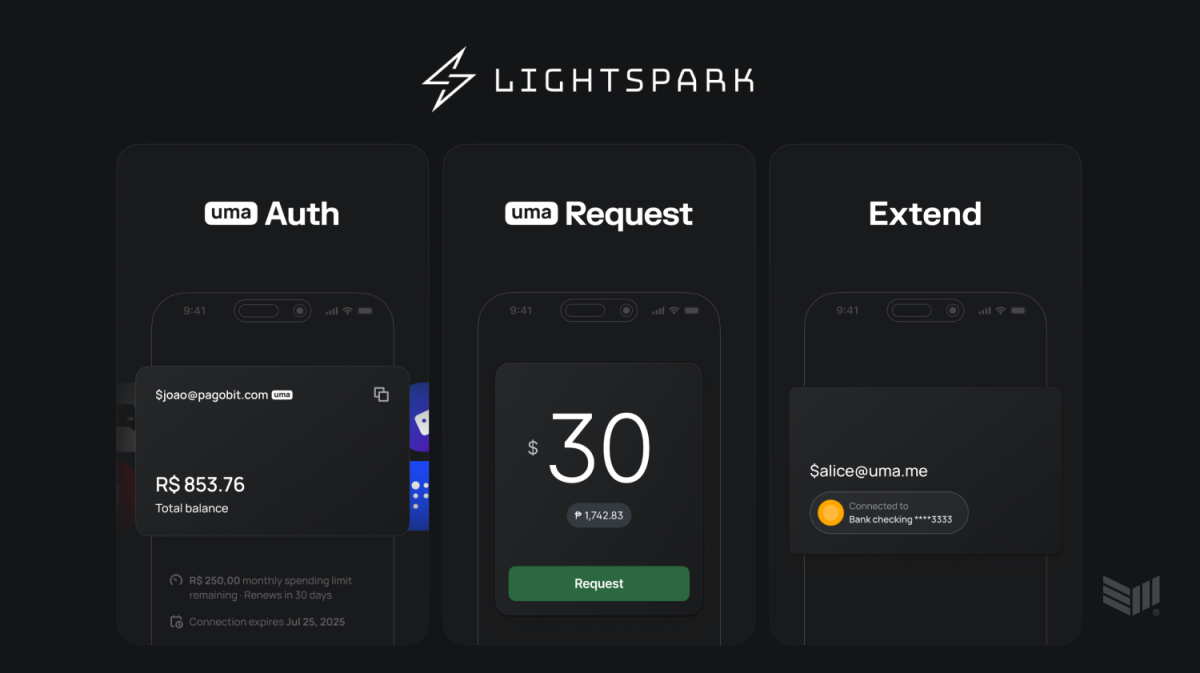

The company also announced new capabilities for UMA, the company’s open-source and regulatory compliant payment solution that makes sending money as simple as sending an email.

With UMA Extend, the Lightning Network can serve as a bridge between traditional banks globally, while with UMA Auth and UMA Request, UMA users can tip, pay subscription fees and make payments to merchants within apps.

Lightspark CEO David Marcus speaking at Lightspark Sync.

Spark — Lightspark’s Bitcoin Layer 2

Spark is a Layer 2 protocol for Bitcoin that leverages statechain technology. In short, users can hold fractions of bitcoin off-chain, and transfer these by sending private keys to other users (rather than signing transactions with the keys).

Lightspark created Spark to better support the onboarding of users to the Lightning Network, which normally requires an on-chain transaction for each payment channel as well as the locking up of some amount of bitcoin in these channels so users can send and receive transactions.

The layer 2 was primarily borne from the frustration that the Lightspark team encountered in trying to create a non-custodial Lightning wallet for users.

“Self-custodial Lightning wallets, especially at scale, just aren’t viable,” Lightspark CTO Kevin Hurley told Bitcoin Magazine.

“If you are opening channels for billions of users, fees are going to go through the roof, and you’re going to fill up block space. It’s just something that’s not going to be reasonable and you lock up liquidity for every single user,” he added.

Hurley also shared that Lightspark didn’t want to wait for the enabling of Bitcoin opcodes (like CheckTemplateVerify or TapleafUpdateVerify) that would make it cheaper to open new Lightning channels. Lightspark wanted to offer users a non-custodial option immediately.

So, they built Spark, a Bitcoin Layer 2 that offers users cheap, instant payments as well as a permissionless, unilateral exit to the Bitcoin base layer. It also enables offline receive, or the ability to receive bitcoin even when your device isn’t connected to the internet.

Besides statechains, Spark also utilizes atomic swap technology. Its design is similar to that of Mercury Layer in that it enables the off-chain transfer of ownership of Bitcoin UTXOs while benefiting from near instant and fee-free transactions, according to Hurley.

“Mercury has a lot of core limitations that we go beyond,” explained Hurley.

“In Mercury, for example, you can transfer whole UTXOs only. You have absolute time bombs where you have to go back on chain at some absolute time. So, you can only do so many transactions. Also, we pull in different pieces like connector transactions from Ark, for example, but, other than that, we’re not similar to Ark at all,” he explained.

“I think it’s hard to compare it to something, because it pulls in a lot of different components, and I think the trade-offs that we chose to make are different than many others probably chose to make.”

Besides bitcoin, it’s also possible to issue and use stablecoins on Spark. Or you can issue stablecoins via Taproot assets, LRC-20 or RGB on the base layer and transfer them to Spark.

A unique dimension of Spark, though, is that the assets on the layer 2 are all UMA enabled.

“You can now have non-custodial users sending directly to the bank accounts of UMA Extend users,” said Hurley, mentioning one of the new functionalities of UMA addresses.

Lightspark CTO Kevin Hurley speaking at Lightspark Sync.

UMA Extend

UMA Extend integrates the Lightning Network with traditional banking systems, allowing users to make international bank transfers in seconds. With this new technology, UMA Extend users can send any other UMA Extend user a near instant cross-border payment from one bank to another over Lightning as easily as sending an email.

“It’s designed to facilitate money movement across any currency,” Nicolas Cabrera, VP of Product at Lightspark, told Bitcoin Magazine. “I can be in Brazil sending my local currency, the Brazilian real, to a user based in Europe that wants to receive euros or someone in the US who wants to receive USD.”

The Brazilian reals leave the sender’s bank account, are converted into sats by the bank (or an entity like Zero Hash, if the banks can’t touch crypto), which are then received by the recipient’s bank, which converts it back into euros, USD of whatever currency the recipient holds in their bank account. All of this occurs within 30 seconds or so, a radical shift compared to the two to three days it often takes for international money transfers to settle.

“This is the first time connecting the Lightning Network to traditional banking routes and bank systems,” Cabrera added.

UMA Extend utilizes Real-Time Payments (RTP), which enables real-time payments for federally insured depository institutions in the United States, and comparable services in the other countries in which UMA Extend is available. All banks in the US who use RTP support Extend. Currently, Lightspark’s partners support on- and off-ramps for 44 fiat currencies in over 100 countries.

The traditional financial institutions involved with these transactions will set the fees for the transactions, which tend to range between 0.25% and 0.5% — significantly cheaper than the 6.35% customers often pay to make international remittance payments via traditional financial rails.

Those interested in using UMA Extend can do so via this link.

UMA Auth

At the event, Lightspark also introduced UMA Auth. The technology leverages OAuth (Open Authentication) technology (the backend tech for when a website gives you the option to sign into a third-party app or website with Google or Facebook), an open-standard authorization protocol that provides users with secure access to a website or application.

UMA Auth was built using Nostr Wallet Connect (NWC), a protocol developed by the team at Alby. NWC now supports UMA features like cross-currency transactions and client app registration.

“We wanted to expand the coverage of UMA beyond wallets to applications,” Shreya Vissamsetti, a member of the Lightspark engineering team that works on UMA, told Bitcoin Magazine.

“UMA Auth is a new extension on top of UMA that allows you to integrate payments directly into an application. The idea is that it’s a lot like OAuth, but for money,” she added.

“All you have to do is input your UMA address and then we form a connection to your Lightspark wallet straight from the application. That gives the app access to communicate with your wallet and push money in right from the application.”

UMA Auth enables users to do everything from tipping their favorite artists to paying a subscription fee to paying a friend through their preferred messaging app.

“Say I’m listening to Taylor Swift,” began Vissamsetti.

“I can link my UMA account, and if my favorite song is playing, I can just tap a button and send her a super small tip,” she explained.

“Tipping is one of the main uses we’re going after with this product,” said Cabrera. “Lightning is again a good foundation layer for us because it allows for sending small amounts.”

UMA Request

UMA Request is another new dimension of UMA, one that allows any UMA user to request a payment from another UMA user.

Merchants can use UMA Request to request payments via an invoice, which comes in the form of a QR code, for the product sold or service rendered. UMA Request also supports zero-sum invoices, through which invoice recipients can pay whatever amount they’d like.

“Previously with UMA, the sender initiated the payment, but we’ve flipped it around,” said Vissamsetti.

Another standout feature of UMA Request is that it ensures both parties involved in the transaction receive a record of the transaction.

UMA Request makes purchasing items online — especially across borders — easier and cheaper than using credit cards.

Moving Forward

Lightspark’s CEO David Marcus, the former president of PayPal, believes that it’s only a matter of time until more banks and platforms come to adapt new technologies like UMA Extend, UMA Auth and UMA Request.

“At the end of the day, if you build a more efficient network that enables global money movements to move faster, cheaper, in real time 24/7 with no blackout dates, then that’s where money is going to flow and the financial system and the ecosystem players are just going to need to adapt to that,” Marcus told Bitcoin Magazine.

Regarding Spark, the Lightspark team is looking for feedback from users on how to improve the product.

“We are going to fully engage with the community,” said Hurley.

“We want to make this completely out in the open, completely open-source. Anyone can audit it, spin up their own versions if they want to,” he added.

“We want this to be a collaborative thing where the community joins in, where they hopefully submit pull requests and help find things that they want to improve.”

Christina Smedley, co-founder and Chief Marketing and Comms Officer at Lightspark, echoed Hurley’s sentiment as she discussed both Spark and UMA’s new functionalities.

“We’re trying to [onboard] the next billion or couple of billion,” Smedley told Bitcoin Magazine, “so it’s really important that what we do is open-source and community-led.”

Is Bitcoin Repeating Previous Bull Cycles?

Bitcoin’s price cycles have long been a source of intrigue for investors and analysts alike. We can gain insights into potential price movements by comparing current trends to previous cycles, especially with Bitcoin seemingly coming to an end of its consolidation period, many wonder if the next leg up is around the corner.

Comparing Bitcoin Cycles

To begin, it’s crucial to look at how Bitcoin has performed since hitting its recent cycle low. As we examine the data, a clear picture begins to form: Bitcoin’s current price action (black line) is showing patterns similar to previous bull cycles. Although it has been a choppy consolidation period, where the price has been relatively stagnant, there are key similarities when we compare this cycle to those in 2015-2018 (purple line) and 2018-2022 (blue line).

Figure 1: BTC Growth Since Cycle Lows showing similarities with our previous two cycles. View Live Chart 🔍

Where we are today, in terms of percentage gains, is comparable to both the 2018 and 2015 cycles. However, this comparison only scratches the surface. Price action alone doesn’t tell the full story, so we need to dive deeper into investor behavior and other metrics that shape the Bitcoin market.

Investor Behavior

One key metric that gives us insight into investor behavior is the MVRV Z-Score. This ratio compares Bitcoin’s current market price to its “realized price” (or cost basis), which represents the average price at which all Bitcoin on the network was accumulated. The Z-Score then just standardizes the raw MVRV data for BTC volatility to exclude extreme outliers.

Figure 2: Bitcoin MVRV Z-Score gives insights into profits and losses for the average investor. View Live Chart 🔍

Analyzing metrics such as this one, as opposed to purely focusing on price actions, will allow us to see patterns and similarities in our current cycle to previous ones, not just in dollar movements but also in investor habits and sentiment.

Correlating Movements

To better understand how the current cycle aligns with previous ones, we turn to the data from Bitcoin Magazine Pro, which offers in-depth insights through its API. Excluding our Genesis cycle, as there is little correlation and isolating the price and MVRV data from Bitcoin’s lowest closing prices to its highest points in our current and previous three cycles, we can see clear correlations.

Figure 3: Price and MVRV correlations between this cycle and our previous three.

2011 to 2013 Cycle: This cycle, characterized by its double peak, shows a strong 87% correlation with the current price action. The MVRV ratio also shows a high 82% correlation, meaning that not only is Bitcoin’s price behaving similarly, but so is investor behavior in terms of buying and selling.

2015 to 2017 Cycle: This cycle is actually the closest in terms of price action, boasting an 89% correlation with our current cycle. However, the MVRV ratio is slightly lower, suggesting that while prices are following similar paths, investor behavior might be slightly different.

2018 to 2021 Cycle: This most recent cycle, while positive, has the lowest correlation to current trends, indicating that the market may not be following the same patterns it did just a few years ago.

Are We in for Another Double Peak?

The strong correlation with the 2011-2013 cycle is particularly noteworthy. During that period, Bitcoin experienced a double peak, where the price surged to new all-time highs twice before entering a prolonged bear market. If Bitcoin follows this pattern, we could be on the verge of significant price movements in the coming weeks. After overlaying the price action fractal from this period over our current cycle and standardizing the returns, the similarities are instantly noticeable.

Figure 4: Overlaying a standardized fractal of the 2013 double peak cycle on our current price action.

In both cases, Bitcoin had a rapid run-up to a new high, followed by a long, choppy period of consolidation. If history repeats itself, we could see a massive price rally soon, potentially to around $140,000 before the end of the year when accounting for diminishing returns.

Patterns In Investor Behavior

Another valuable metric to examine is the Value Days Destroyed (VDD). This metric weights BTC movements by the amount being moved and the time since it was last transferred and multiplies this value by the price to offer insights into long-term investors’ behavior, specifically profit-taking.

Figure 5: VDD initial run-up and cool-off confirm similarities in investor behavior. View Live Chart 🔍

In the current cycle, VDD has shown an initial spike similar to the red spikes we saw during the 2013 double peak. This run-up as BTC ran to a new all-time high earlier this year before a sustained consolidation period could see us reaching new highs soon again if this double peak cycle pattern continues.

A More Realistic Scenario

As Bitcoin has grown and matured as an asset, we’ve seen extended cycles and diminishing returns in our two most recent cycles compared to our initial two. Therefore, it’s probably more likely that BTC follows the cycle in which we’re seeing the strongest correlation in price action.

Figure 6: Overlaying a fractal of the 2017 cycle on our current price action.

If Bitcoin follows the 2015-2017 pattern, we could still see new all-time highs before the end of 2024, but the rally would likely be slower and more sustainable. This scenario predicts a price target of around $90,000 to $100,000 by early 2025. After that, we could see continuous growth throughout the year, with a potential market peak in late 2025, although a peak of $1.2 million if we follow this pattern exactly may be optimistic!

Conclusion

Historical data suggests we’re approaching a critical turning point. Whether we follow the explosive double-peak cycle from 2011-2013 or the slower but steady rise of 2015-2017, the outlook for Bitcoin remains bullish. Monitoring key metrics like the MVRV ratio and Value Days Destroyed will provide further clues as to where the market is headed, and comparing correlations with our previous cycles will give us better insights into what may be coming.

With Bitcoin poised for a breakout, whether in the next few weeks or in 2025, if BTC even remotely follows the patterns of any of our previous cycles, investors should prepare for significant price action and potential new all-time highs sooner rather than later.

For a more in-depth look into this topic, check out a recent YouTube video here: Comparing Bitcoin Bull Runs: Which Cycle Are We Following

Dollar on track for weekly gain; next week’s payrolls looms large

Post Content

Asia FX muted as dollar holds weekly gains; yen steady with election in focus

Post Content

South Korea to regulate cross-border trade of virtual assets

Post Content

Putin says existing BRICS infrastructure is enough for cross-border payments

Post Content

BlackRock’s IBIT Bitcoin ETF is the Most Successful New ETF in 4 Years

Ever since BlackRock filed for its spot Bitcoin ETF last year, Bloomberg ETF analysts Eric Balchunas and James Seyffart have been providing valuable insights and data regarding everything Bitcoin ETFs. If you’re not already following either of them on X, I highly recommend you do.

Today, Balchunas shared a new mind blowing statistic about BlackRock’s spot Bitcoin ETF IBIT specifically. Over the last four years, there were over 1,800 ETFs launched in the United States. Out of all of those, IBIT has taken in the most inflows at over $26 billion dollars.

Great stats, never ceases to amaze. I’ll go one further: in the last four years 1,800 ETFs have launched and $IBIT is the most successful of all of them at $26b. https://t.co/8Nq6YwXhYj

— Eric Balchunas (@EricBalchunas) October 24, 2024

BlackRock had another giant inflow of $323 million yesterday, massively outperforming all its competitors. I’m not sure if it’s just their brand name alone that’s able to out compete the other ETFs, or if they’re marketing IBIT to their customers behind the scenes that is making their ETF a standout success. Probably a bit of both and then some.

These numbers once again highlight that spot Bitcoin ETFs have been a smashing success in America. Since launch, these ETFs have together seen inflows in 9 out of the last 10 months, and I feel like these inflows are not going to stop anytime soon, especially as we head further into the bull market.

While I would much rather see investors who hold their own keys, I understand that might not be suitable for large corporations and small retail investors who don’t want the responsibilities that come with self custody.

Whether you like it or not, the institutions are here and they are driving up the price of Bitcoin (for now). I’m super interested to see how these ETFs will hold up in a bear market, and if they will HODL or if we will see record outflows. Only time will tell.

This article is a Take. Opinions expressed are entirely the author’s and do not necessarily reflect those of BTC Inc or Bitcoin Magazine.

Factbox-The main takeaways from the BRICS summit

Post Content

Does Jack Dorsey Influence Bitcoin?

Follow Vivek on X.

I recently stumbled upon a fantastic report from 1A1z on “Funding Bitcoin.” I was surprised to learn that Jack Dorsey funds over 60% of Bitcoin Core’s development via different organizations: over $5 million annually, out of a total of only $8.4 million in funding. Wild, right? For a $1.2 trillion asset, I expected way more diverse support.

Now, you might be worried that that concentration risks him having too much sway. If he turned against Core’s principles, his funding leverage could be a real concern.

But does Dorsey’s power really extend to controlling Bitcoin itself? Nope, no way. Bitcoin’s decentralisation means no single entity can dictate terms, not even the chief donor of the main Bitcoin implementation.

Here’s the key difference: Bitcoin Core versus the Bitcoin network. Core adds useful features, but people choose what nodes to run. If Core went rogue, people would just reject its changes or use different software.

So Dorsey can’t force changes to Bitcoin. His influence has hard limits, even if he decides to dictate to developers what to work on or what to push. Nodes hold the real power over Bitcoin’s evolution. (You can read more about Bitcoin Core’s governance here: Who Controls Bitcoin Core? by Jameson Lopp.)

Still, I think there should be more donors and organisations funding Bitcoin Core or other implementations. Many crypto companies benefit and earn millions in monthly profits, depending on Bitcoin’s success, but surprisingly, they don’t contribute anything. Ideally, people should also fund different implementations of Bitcoin in addition to Bitcoin Core.

Bitcoin will only thrive through decentralization. We’ve got to apply that ethos to funding Core, too. Dorsey’s funding concentration challenges it, while spreading the donor base protects Bitcoin’s antifragility.

This article is a Take. Opinions expressed are entirely the author’s and do not necessarily reflect those of BTC Inc or Bitcoin Magazine.

The ECB Economists Aren’t Exactly Wrong About Bitcoin (They’re Just Useless)

Earlier this month, the European Central Bank (ECB) published a paper in which the authors claim the existence of Bitcoin could impoverish non-holders and latecomers.

Specifically, they wrote:

“Since Bitcoin does not increase the productive potential of the economy, the consequences of the assumed continued increase in value are essentially redistributive, i.e. the wealth effects on consumption of early Bitcoin holders can only come at the expense of consumption of the rest of society.”

It drew the ire from many bitcoiners, including Frank in his Take… but isn’t this essentially what hyperbitcoinization is? If bitcoin becomes the money of the world, HODLers become the new wealthy elite while the fiat bag holders would effectively go broke, right?

The real crux, I think, lies in the first part of the quote. Many bitcoiners, including myself, believe that Bitcoin in fact would increase the productive potential of the economy. (There are several reasons for this, but a big one is that it gets rid of fiat currency’s Cantillon effect, which largely benefits governments.)

If it had been possible in 2009 to swap all fiat currency in the world for bitcoin so everyone received a representative share (thus no redistributive effects), that may arguably have been preferable… but the ECB economists would still be against it: they just don’t see the benefit of bitcoin in the first place.

Since Satoshi Nakamoto had no way to swap everyone’s fiat for bitcoin even if he wanted to, it makes sense that he launched the project the way he did, allowing anyone to adopt this superior money whenever that fits their individual risk-appetite.

If the ECB economists believe there is a better way to distribute this new form of money, I’d suggest they use their Cantillon-funded salaries to write a paper about that.

This article is a Take. Opinions expressed are entirely the author’s and do not necessarily reflect those of BTC Inc or Bitcoin Magazine.