Month: August 2024

Sterling’s stunning rally keeps twitchy currency markets on edge

Post Content

Solo Bitcoin Miner Earns $199,098 After Successfully Mining Block

A solo Bitcoin miner has made headlines by successfully mining block number 858,978 on the Bitcoin blockchain, earning a reward of 3.275 BTC, valued at $199,098 at the time. The block, mined earlier today, contained 2,391 transactions, according to blockchain data.

JUST IN: A solo miner just mined a block worth 3.275 #Bitcoin worth $199,098.

LEGEND 🤯 pic.twitter.com/rqscP29dud

— Bitcoin Magazine (@BitcoinMagazine) August 29, 2024

Bitcoin mining is the process through which new bitcoins are introduced into circulation. It typically involves using powerful computers to solve complex mathematical problems, which verify and add transactions to the blockchain. In return, miners are rewarded with newly minted bitcoins, known as the block subsidy, along with transaction fees paid by users.

The miner’s accomplishment is significant, given the increasingly competitive landscape of Bitcoin mining, where large mining pools usually dominate. Solo miners face the challenge of competing against large, resource-rich mining pools; however, although rare, the rewards can be substantial, as demonstrated by this and many previous solo miners’ successes.

The achievement by this solo miner also serves as a reminder of the decentralized nature of Bitcoin, where anyone with the right resources can contribute to and benefit from the network.

US dollar gains for 2nd day after GDP backs smaller Fed cut

Post Content

The Privacy Issue: Letter From the Editors

Privacy is necessary for an open society in the electronic age. Privacy is not secrecy. A private matter is something one doesn’t want the whole world to know, but a secret matter is something one doesn’t want anybody to know. Privacy is the power to selectively reveal oneself to the world.

Bitcoin finds itself yet again at another crossroad. On one side, the easy road, paved with Number Go Up, highly regulated ETF products, and surveillance state-endorsed stablecoins as the scaling solution for the next billion users. The other path is objectively more difficult to traverse, a darker way forward, despite the illuminating words of Eric Hughes and other pioneers in the field of open source cryptographic tooling.

On March 3, 1993, Hughes published A Cypherpunk’s Manifesto, articulating the direction of the recently-formed Cypherpunks: a Bay Area group of hackers and activists composed of Hughes, Tim May, John Gilmore and others under the moniker created by St. Jude Milhon.

Click here to subscribe and receive your copy of “The Privacy Issue”.

Bitcoin culture –– if such a homogenous thing still exists –– is wrapped up in another culture war distraction while the regulatory moat fills with legislation preventing self custody while penal system reptiles surface to toss those who dared to write code in the pen.

We cannot expect governments, corporations, or other large, faceless organizations to grant us privacy out of their beneficence. It is to their advantage to speak of us, and we should expect that they will speak.

How did we get here? How have we spent the last year arguing about what constitutes spam, and ethical use of Bitcoin, while completely ignoring the overflowing regulatory moat? There were more than enough signs. There were more than enough warnings. Congress is putting together drafted legislation for further internet regulation, stablecoin bills, social media application bans, while the state continues to redefine in real time what a cryptocurrency even is.

To try to prevent their speech is to fight against the realities of information. Information does not just want to be free, it longs to be free. Information expands to fill the available storage space. Information is Rumor’s younger, stronger cousin; Information is fleeter of foot, has more eyes, knows more, and understands less than Rumor.

Bitcoin is a database. Bitcoin is speech. Bitcoin is code. The compliance-driving hypnotists will tell you we must ask permission from our local governing offices for the embrace of bitcoin. So that we can pay our taxes in bitcoin and service our legal debts. Samourai, TornadoCash, Wasabi Wallet… they wrote code. Code that users across the globe, in myriad legal jurisdictions, utilized to exchange alphanumeric strings.

People have been defending their own privacy for centuries with whispers, darkness, envelopes, closed doors, secret handshakes, and couriers. The technologies of the past did not allow for strong privacy, but electronic technologies do.

Writing code is not a crime. Code is speech. Distributing code is an expression between parties of bytes, reduced to bits, to ones and zeroes. Any precedent that establishes anything other than this is in direct violation of the First Amendment, and furthermore, against the natural code of freedom of expression.

Cypherpunks write code. We know that someone has to write software to defend privacy, and since we can’t get privacy unless we all do, we’re going to write it.

There are plenty of ways that Bitcoin the network can spread itself across the globe, and how bitcoin the asset can monetize to astronomical heights without bringing an ounce more freedom to the populace of the world. Bitcoin’s definition has been gaslit by the hypnotists to be within the purview of the regulatory moat, and thus Bitcoin is in dire need of a redefinition. Bitcoin was never about dollar denominated value, it was never about perpetuating the UST market via Treasury-backed tokens utilized by captured, KYC-demanding on- and off-ramps. Bitcoin was never about embracing the state and the furthering of the reach and influence of the psychopathic criminals obsessed with changing the definition of speech and expression, of code and of numbers.

Bitcoin is a tool of empowerment and Bitcoin is for enemies. Well, now our enemy, the state, is empowered.

We know that software can’t be destroyed and that a widely dispersed system can’t be shut down.

Writing code is not a crime. We sat and argued over culture signaling with all the class of drunken sport rivals while watching the bookkeepers take their red felt pen to change the meaning of words, slowly bringing the frogs, and their dictionaries, to a boil.

Privacy only extends so far as the cooperation of one’s fellows in society. We the Cypherpunks seek your questions and your concerns and hope we may engage you so that we do not deceive ourselves. We will not, however, be moved out of our course because some may disagree with our goals.

Bitcoin is just a ledger.

A database.

Let us proceed together apace.

Whispering numbers to a loved one cannot be redefined as a criminal act.

Onward.

The Editors

___________________________________________________________________________

#!/usr/local/bin/perl — export-a-crypto-system sig, RSA in 5 lines of PERL:

($s,$k, $n)=@ARGV; $w=length$n; $k=”O$k”if length($k)&1; $n=”O$n”, $w*+if$w&1; die

“$0 -d-e key mod

SW-=2;$_-unpack (‘B*’ , pack(‘#*’, Sk)): s/~o*//g;s/0/d*ln%/g;s/1/d*In%lm*ln%/g;

Sc=”1$ (_)p” ;while(read (STDIN, Sm, Sw/2))($m=unpack(“H$w”, Sm): chop($a=

echo 160161Um EsmU$nEsn$c|dc*):print pack(‘H*’, ‘0’x($v-length$a).$a);}

___________________________________________________________________________

To test, just save it as file “rsa”, then do:

% chmod 700 rsa

% echo “squeamish ossifrage” | rsa -e 11 ca1 > msg.rsa

% rsa -d ac1 cal

Jack Dorsey-Backed Nostr Emerges as Bitcoin’s Social Layer at Riga Conference

The third edition of NostrWorld’s unconference series took place last week in the picturesque city of Riga, Latvia, bringing together advocates and developers of the Nostr protocol. Spearheaded by Block CEO and Twitter co-founder Jack Dorsey, NostrWorld’s free gatherings are a platform for open-source enthusiasts to exchange ideas, foster collaboration, and ignite initiatives aimed at shaping a freer, more decentralized version of the internet.

Bitcoin Magazine was on the ground in Riga to explore how the evolution of the Nostr protocol could influence Bitcoin’s trajectory. While Nostr’s budding community has famously attracted prominent Bitcoin advocates, Nostriga—as this third NostrWorld conference was dubbed—offered a fresh lens on the growing synergies between these two technologies. Conversations with attendees and observations throughout the two-day event revealed a clear trend: Bitcoin’s path appears increasingly likely to intertwine with Nostr’s promising social network technology.

What’s Nostr?

Nostr is an open-source protocol designed to create a decentralized, censorship-resistant social network. Unlike traditional platforms that rely on centralized servers, Nostr operates on a network of relays where users can publish and receive messages. Nostr is quickly gaining traction as a social layer for Bitcoin, enabling features like micropayments and digital identity management. Beyond social media, Nostr presents an opportunity to build a new internet architecture that frees users from reliance on centralized platforms. This approach empowers individuals by removing the need for intermediaries that typically own user data, monetize attention, and control or censor access.

Micropayments Market Fit

A standout moment of the conference came when Strike CEO Jack Mallers shared a personal story about an acquaintance he had been trying to convince of Bitcoin’s potential for years. It wasn’t until she got onboarded onto Nostr and received Zaps to her account that the power of the technology finally clicked for her.

Zaps are small Bitcoin payments, often sent as tips or rewards on Nostr, allowing users to support content creators directly through the Lightning Network. This micro-payment feature has become a popular way to demonstrate Bitcoin’s utility and value in a social context

The concept of micropayments predates even Bitcoin, but Nostr advocates believe Zaps represent the first successful large-scale implementation of the idea. On a panel alongside Primal CEO Miljan Braticevic, Jack Mallers emphasized the significance of this achievement:

“I think that’s very underappreciated. Something that has been desired on the web for many decades. From anonymous cypherpunks to the most powerful people in the world, all have desired this use case and we seem to have achieved that.”

Micropayments through Nostr introduce a new bootstrapping mechanism that could reshape the traditional Bitcoin onboarding process. Individuals who might not be swayed by Bitcoin’s economic or political narrative might appreciate its unique value once exposed to casual internet tipping and microtransactions. This shift opens Bitcoin up to a broader audience by making it accessible in everyday social interactions already familiar to internet users.

Setting the stage for the Ecash economy

Ecash, one of Bitcoin’s up-and-coming technologies was a recurring theme throughout the event. Cashu protocol developer CalleBTC made a passionate argument for the central role Nostr could play in an ecash-driven economy.

Proposed as a system for private, scalable payments using blind signatures, ecash enables users to transact without revealing their identities, preserving financial privacy. However, this privacy comes with a tradeoff: ecash introduces trusted entities known as mints, which custody users’ Bitcoin deposits in exchange for tokens, often referred to as notes. For ecash to function effectively, a robust market of mints is necessary to provide users with options for whom to trust. As the concept gains traction, this reliance on multiple mints introduces various coordination and discovery challenges—challenges developers believe are ideally suited to be addressed by Nostr’s social features.

Examples of this are bitcoinmints.com and cashumints.space, two Nostr-based websites that offer a Yelp-like interfaces for users to discover new mint providers and for mints to advertise their services and build a reputation. Although the initial implementations are fairly basic, the potential integration of Nostr’s social graph could enable users to make informed decisions about which mints to trust. By leveraging connections within their network and trusted reviews from friends, users could more confidently choose mints based on the relationships and experiences shared by those they know. Eventually, the expectation is that similar Nostr-based services will be integrated directly into Bitcoin ecash wallets, offering users a seamless onboarding experience that avoids imposing trusted defaults.

Similarly, Nostr’s infrastructure provides various methods to bolster the resilience of ecash mints, enabling future implementations to operate independently of the internet’s centralized DNS services. This would allow users to establish direct connections with mints, reducing their exposure to third-party interventions and enhancing the overall security and decentralization of the ecash system.

Another fascinating concept emerging from the convergence of ecash and Nostr communities is the idea known as “nutsack.” Introduced by Nostr developer PabloF7z, Nutsack, or NIP-60, allows users to store ecash notes on Nostr relays, effectively distributing them across the network and tying them to the user’s identity. In effect, the scheme allows universal access to a user’s ecash balance across any Nostr client that supports the feature. This means that, in the future, users could log into any website or online service and have their ecash balance seamlessly follow them, enabling effortless spending across multiple platforms.

Communities and Web-Of-Trust

One of the biggest opportunities—and perhaps the most significant challenge—for Nostr is its ability to reach new internet communities beyond the Bitcoin-centric groups that currently dominate the platform. Announcements like developer Alex Gleason’s Ditto, made last week, have the potential to extend Nostr’s reach into the broader landscape of existing internet communities, such as Mastodon, paving the way for wider adoption.

“With Ditto people find websites they want to join because of a community and then they discover Nostr as a side effect, which gives them the opportunity to learn what it is and why it matters,” explained Gleason in his presentation.

This amplification of Nostr’s network effect could have significant implications for Bitcoin adoption. With features like Zaps, Nostr offers a unique opportunity to introduce non-technical users to the power of an internet-native currency, making Bitcoin more accessible and relatable in everyday digital interactions.

“Bitcoin is revolutionary and I believe it is key to Nostr’s success but social media needs communities.”

Looking ahead, the formation of communities and the adoption of Nostr as an identity system could pave the way for digital economies rooted in the web-of-trust concept. By building social graphs based on cryptographically signed messages, users can carry their reputation across the internet, laying the groundwork for secure, decentralized commerce that operates independently of traditional laws, contracts, and enforcement mechanisms— with Bitcoin at the center of it all.

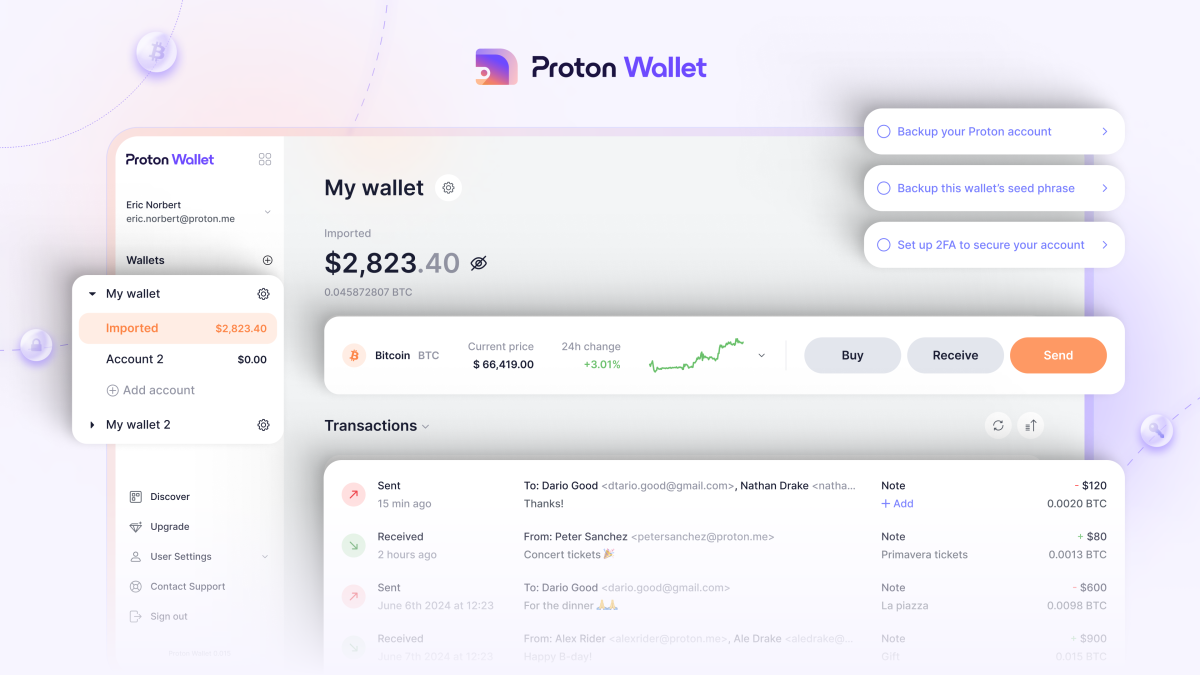

Proton Wallet Review: A Bitcoin Software Wallet That Simplifies Transactions

Proton, the Swiss company behind ProtonMail and ProtonVPN, has released a beta version of the newest offering in its suite of products that help to preserve online privacy — Proton Wallet.

The wallet is great for those looking to send bitcoin on-chain with relative ease, but it leaves some to be desired for more advanced users or for those who want to make smaller payments quickly and cheaply.

Pros And Cons

Proton Wallet’s standout feature is that it allows you to send bitcoin using nothing more than a recipient’s email address, which doesn’t have to be a ProtonMail address. The non-custodial bitcoin-only wallet is also free to use and has an easy-to-navigate user interface (UI).

However, it lacks in that it only allows users to make transactions on the Bitcoin base chain — not over Lightning — which can take upwards of hours to settle, and it doesn’t allow users to manage their UTXOs or adjust fees. Plus, it’s a software wallet and cannot be disconnected from the internet like a hardware wallet, which increases the risk of the wallet’s private keys being compromised.

Getting Started With Proton Wallet

To use the beta version of the product, you need an invitation either from the company or another user. The wallet is currently available via web browser and as an Android app and takes 5 to 10 minutes to set up and begin using.

Once you’ve received an email invitation to use the wallet, you can click on the “Start using Proton Wallet” link in the invitation email to get started setting it up. (Email addresses have been blacked out below and throughout this review to preserve privacy.)

Invitation email for Proton Wallet

You’ll be taken to a “wallet setup” page where you’ll simply click a button to get started with Proton Wallet. You won’t be prompted to write down the 12-word seed phrase as you set up the wallet, which was a nice touch by Proton to help users to more simply get started using the wallet. You can write down the seed phrase later if you please, though.

Wallet setup

As you set up the wallet, Proton makes it clear that your Proton Wallet is a non-custodial Bitcoin wallet, which means that managing the wallet is your responsibility and your responsibility alone.

Warning message

The home screen of the wallet is straightforward and incredibly easy to navigate. It’s as pared down so as to include little more than the basics you need to send, receive and buy bitcoin.

Home screen

Depositing Bitcoin In Proton Wallet

To begin using the wallet, you’ll first have to deposit some bitcoin. You can deposit bitcoin from another wallet you manage. To do so, you’ll need to copy the bitcoin address by clicking on the “Receive” button on the home screen and then clicking the “Copy Bitcoin address” button in the window that pops up on the right of the screen.

Receiving bitcoin

You’ll copy that address into the proper field from the wallet you’re sending it from. It’s good practice to double check that the address you’ve pasted matches the address you’ve copied.

Sending bitcoin from an exchange

The bitcoin won’t appear in your Proton Wallet balance immediately. It usually takes at least a few minutes for the transactions to process, as this depends on how long it takes for block confirmations to occur. Some transactions can take much longer — upwards of hours.

You can see that the funds are on their way, though, in the “Transactions” section of the home screen. You’ll continue to see an “In progress” notification until the necessary amount of block confirmations has occurred.

“In progress” notification

Buying Bitcoin With Proton Wallet

If you don’t have any bitcoin to send to your Proton Wallet, you can also use the wallet to buy some. This process is relatively straightforward.

You can click the “Buy” button on the home screen and you’ll be taken to a page that serves as an interface for crypto asset service providers Ramp and Banxa.

Selecting your location

Complete the fields for how much bitcoin you want to purchase, choose whether you want to use Banxa or Ramp and select your payment method.

Selecting your payment method

Instructions from this point vary depending on the payment method you choose.

Sending Bitcoin With Proton Wallet

You can send bitcoin as simply as clicking the “Send” button on the home screen and then inputting either a bitcoin address or an email address. Note that your recipient doesn’t need a ProtonMail address.

I used an email address to send some bitcoin.

Sending bitcoin with an email address

Next, you’ll be taken to an “Amount” page, where you’ll input the amount of bitcoin you’d like to send, denominated either in either a fiat currency or sats.

Selecting the US dollar amount of bitcoin to send

On the “Review” page, you can leave a message for the recipient. It’s optional to do so.

On this page, you’ll also be presented with the total amount of your transaction, including the network fee, which is non-configurable (you can’t pay higher fees for faster transfers as you can with many other wallets).

You won’t be presented with the option to select UTXOs to spend, an option that a desktop Bitcoin wallet like Sparrow provides you with.

If you’re comfortable with the amount you want to send and the fee, you can click the “Confirm and send” button.

Reviewing transaction details

You’ll be able to see whether or not your transaction has cleared by looking at the “Transactions” section.

In my case, the recipient was notified that the bitcoin was on the way before the transaction received the required number of confirmations on the blockchain.

Transaction details appear at the bottom of the home screen

This particular transaction took over an hour to complete.

Securing Your Proton Wallet

Proton Wallet lets you secure and back up your wallet in different ways.

The first level of security for the wallet is the password you use to log in to it, which you create when you set up the wallet.

Proton Wallet lets you add a second level of security by offering two-factor authentication (2FA).

To set this up, you can click on the “Secure your wallet” tab in the top right hand corner of the home screen. You’ll then be presented with the option to set up 2FA for your wallet.

Securing your wallet

If you want to add 2FA protection to your account, you can click the “Set up 2FA to secure your account” button. When you do so, you’ll be taken to a page on which you can toggle a switch to set up 2FA for the account. If you choose to do this, toggle the “Authenticator app” switch and follow the subsequent instructions.

Enabling 2FA

Backing Up Your Proton Wallet

Proton Wallet allows you to back up your wallet’s seed phrase whenever you’d like. To do so, you can click on “Backup this wallet’s seed phrase” on the home screen.

You’ll then be taken to a screen that explains what a seed phrase is and why it’s important to safely back it up. Click the “View wallet seed phrase” button to view the seed phrase for your wallet.

It’s best practice to store your seed phrase offline (e.g., written on a piece of paper or imprinted on steel) so that it can’t be compromised.

Obtaining your seed phrase

Discover and Customer Service

Proton Wallet has a substantial “Discover” section in which you can learn more about everything from what Bitcoin is to Proton Wallet’s security model.

The “Discover” section

Proton also makes it relatively easy for you to get in touch with customer service staff, though, response times are currently unknown.

Contacting customer service

Conclusion

Proton Wallet is a good Bitcoin wallet for beginners, especially those looking to send bitcoin with relative ease, using nothing more than an email address.

The pros of this non-custodial wallet are that it’s free to use, easy to set up and secure. It’s also bitcoin only and open-source.

However, one notable con of the wallet is that it only allows you to transact on the bitcoin base chain, which means your transactions may incur high fees and take over an hour to fully process. For this reason, you wouldn’t want to use Proton Wallet if you’re looking to make cheap, fast micropayments — the types of transactions you can make over Lightning.

Another drawback of the wallet is that it doesn’t permit you to manage UTXOs or select transaction speed and fees. And it’s a software wallet, which means it’s less secure than a hardware wallet in certain regards.

With that said, if you’re new to Bitcoin and already familiar with the interfaces for Proton products, then this wallet may be a good option for you.

Australian Spot Bitcoin ETF Keeps on Buying

Australia’s two spot Bitcoin ETFs—the VanEck Bitcoin ETF and Monochrome’s IBTC—have steadily accumulated Bitcoin holdings since launching earlier this year. The sustained inflows highlight growing Bitcoin demand in the region.

The VanEck Bitcoin ETF debuted on the Australian Securities Exchange (ASX) on June 20th after receiving regulatory approval. It has attracted $40.72 million in assets under management (AUM).

Meanwhile, the Monochrome Bitcoin ETF (IBTC) began trading on the smaller CBOE Australia exchange on June 4th. Despite its lower AUM, IBTC continues to see small but steady inflows.

As of August 28th, IBTC holds around 123 Bitcoin worth $7.4 million. The fund has continually purchased BTC on dips, regardless of price action or sentiment.

Monochrome Bitcoin ETF (Ticker: $IBTC) AUM as of 28/08/24 pic.twitter.com/04IoMLQEWa

— Monochrome (@MonochromeAsset) August 29, 2024

This contrasts with U.S. spot Bitcoin ETFs, which have faced outflows amid Bitcoin’s failure to convincingly break $60,000. Prominent products from Ark Invest and Grayscale saw major withdrawals this week.

While assets under management remain low, the Australian ETFs are growing steadily. The sustained inflows point to rising interest in Bitcoin in the region. The increasing demand for regulated investment vehicles can boost mainstream acceptance. If growth continues, Australia’s spot Bitcoin ETFs could emerge as significant sources of BTC demand.

The New Mission Critical Facilities: Bitcoin Mining Farms

Life embodies evolution, change, adaptation, and the willingness to thrive. Throughout history, we have experienced numerous changes that have forced society to evolve, adapt, and grow. From the inception of trading to the COVID-19 pandemic and beyond, we have witnessed events that have transformed the world. One of the most important and influential sectors in the world is finance. The world of finance has been shaped by pivotal events that have impacted economies, influenced policies, and altered the course of global markets. One of the most exceptional developments in the past 15 years is the invention of Bitcoin and the emergence of the crypto industry.

The crypto industry, while not yet accessible to everyone, has witnessed remarkable growth and evolution since Bitcoin’s launch in 2009. In the following years, the industry became a dynamic and influential force, drawing the attention of investors and enthusiasts worldwide. In this article, I will share my opinion on why crypto will become a very stable market, potentially replacing current financial or banking methods. This discussion will touch on key topics such as safety, circular economy, and sustainability, which combined with current high potential businesses like Data Centers, will shape the new future.

Crypto Infrastructure and Energy Consumption

The servers supporting the cryptocurrency infrastructure are primarily used for cryptocurrency mining, transaction verification, smart contract execution, and decentralized applications (DApps) hosting. These servers typically possess the following specifications:

• High-performance CPUs and GPUs

• Large memory and storage capacity

• Advanced networking capabilities

• Robust security features

These characteristics translate into expensive, high-power consumption servers. Therefore, we need a robust and reliable space to store these servers and ensure they function as expected.

Energy Consumption

Data transmission currently consumes nearly 3% of the total electricity used worldwide. To ensure data is not only transmitted correctly but also stored and processed properly, we rely on physical spaces known as data centers. These data centers are considered mission-critical facilities. But why are data centers deemed mission-critical? Mission-critical facilities are broadly defined as operations that, if interrupted, would negatively impact business activities, ranging from revenue loss and legal non-compliance to, in extreme cases, loss of life. Data centers, hospitals, laboratories, and military installations are just a few examples of such facilities.

Data center facilities are highly regulated by various organizations and standards for both physical and data infrastructure. This stringent regulation is crucial because data loss can result in massive consequences for millions of people, given the sensitivity of the stored information. Gradually, the

blockchain industry along with emerging markets like AI (Artificial Intelligence) is playing an increasingly significant role in the modern world. The demand for distributed facilities to store nodes that validate crypto transactions and execute smart contracts is rising significantly.

Are current Data Centers ready for Blockchain technology?

Blockchain presents challenges not only for Mechanical, Electrical, and Plumbing (MEP) infrastructure but also for enterprise infrastructure. To accommodate the demanding workloads

associated with blockchain technology, facilities will need to enhance both infrastructure security and MEP capabilities. Currently, the average power density in a data center is around 10 kW per rack. For context, according to several reports, the average power consumed by a home in the United States that

uses electricity for heating and hot water is approximately 10,715 kWh per year. A single rack in a data center, by comparison, consumes nearly 9 times more power per year (8,760 kWh per year), with some facilities designed to provide peak power above 100 MW.

Constructing these facilities requires significant investment, and sometimes the efficiency of the facility is not as desired, leading to higher costs for data management. One issue with current data centers is partial loads, meaning that if the facility consumes determined amount of Watts, the original design was for 1.5 times those Watts. This results in lower performance and efficiency. The closer the facility’s consumption is to its designed energy consumption, the easier it is to improve and control overall efficiency.

The key difference between blockchain and traditional data computation is decentralization. In a decentralized system, the failure of a single node does not impact the performance of the entire digital infrastructure, whereas in traditional systems, a node failure can cause significant and irreversible damage to many businesses. This necessity for high reliability and redundancy explains why data centers typically have high initial costs (CAPEX), with multiple layers of security to ensure continued operation even in the event of equipment failure.

However, the decentralization inherent in blockchain technology offers a distinct advantage: it reduces the need for expensive and redundant facilities to accommodate all crypto servers, as the failure of some nodes does not disrupt the entire system. This raises an important question: what is the solution to integrating traditional data transmission methods with new blockchain technology?

Combining current needs with new Crypto needs

In the data center industry, the terminology of “Tiers” as defined by the Uptime Institute is widely used and accepted globally. This classification system is similar to the levels of redundancy specified by TIA or BICSI standards. While those familiar with the data center market are well-versed in these Tiers, here is an explanation for crypto users who may be new to this terminology: There are four Tiers, each representing a different level of redundancy in a facility:

1. Tier I: No redundancy.

2. Tier II: Redundancy.

3. Tier III: Concurrently maintainable.

4. Tier IV: Fault-tolerant.

These Tiers also correlate with the initial investment required to create the facility. Moving from one Tier to the next typically involves doubling the capital expenditure (CAPEX). Most data centers are ranked as Tier III, indicating they are designed to be concurrently maintainable. This ensures the facility can be kept in optimal condition to prevent failures at any time. It is crucial to note that some IT equipment hosted in a data center is essential for the daily operations of our lives; even traffic lights rely on these services.

For blockchain infrastructure, there is no need to significantly increase CAPEX to ensure the proper operation of the equipment. It is essential to accommodate the servers in an environment where they function correctly with minimal downtime. Since the loss of individual servers does not affect the functionality of the entire blockchain, these operations do not require high availability. Although downtime can affect users earning revenue from transaction validation, it is crucial to evaluate whether the cost of reducing downtime justifies the increased CAPEX.

Therefore, the Tier level of these facilities can be reduced. In some areas of the data center that are not critical to powering the crypto nodes, the Tier can be lowered to Tier II or even Tier I. This approach optimizes resources without compromising the overall blockchain infrastructure.

Crypto Mining as a Single Business?

To support our previous discussions and to foster new ones, consider the following data: Following the Bitcoin halving on April 20, 2024, the return on investment (ROI) per miner has decreased by 50%, irrespective of variations in total hashrate or Bitcoin price. This reduction tightens the overall financial outlook. For instance, a miner costing $2,000, producing 120 TH/s, and requiring no additional capital expenditures (CAPEX) beyond the miner itself, now faces this ROI decrease.

For an installation comprising 100 miners, the total CAPEX investment for the entire facility (including land for one container, MEP infrastructure, and miners) is estimated at around $503,000. The following analysis illustrates the approximate ROI over the next four years (until the next halving) for a facility operating 100 miners, each consuming 3.3 kW and with a price per kilowatt hour equal to 0.08$. To try to make it more accurate, this analysis assumes the hashrate increases by 50% annually, and uses traditional air cooling solutions. The projected future Bitcoin price used in this analysis is $250,000, based on various studies and speculations.

The projected ROI over the next four years, considering a future Bitcoin price of $300,000, shows that crypto mining alone might not be a highly profitable business. This raises the question of why companies continue to invest in crypto mining. The answer is speculation. In bullish times, crypto facilities were highly profitable, but now these facilities need additional revenue streams.

Heat Reuse: A Disruptive Side Hustle

One innovative side hustle is converting these facilities into heating power facilities. Most power consumed by miners/servers is converted into heat. What if we could capture that heat and sell it as energy? For example, selling this energy to a nearby farm for greenhouses at $0.03/kWh makes the business model more viable. Considering a supposed extra investment of $750,000 (please bear in mind that the extra investment has to be calculated according to facility limitations and in this case a ball park number was taken into account for the exercise).

Upon initial analysis, the business model appears to be viable. The integration of a heat reuse side business has effectively doubled the return on investment (ROI). It is important to note that the ROI calculation is based on a four-year period, coinciding with the next Bitcoin halving event. While the facilities may no longer be optimal for the same cryptocurrency operations post-halving, the infrastructure will remain valuable for selling the generated heat.

Moreover, if we consider combining this model with the data center market, the ROI extends beyond the next four years. This represents a long-term investment where the efficient use of electricity could become increasingly significant.

Conclusion

The crypto industry is gaining more importance in our lives. Several companies are adding stablecoins to their portfolios as financial assets, and new technologies are emerging on the blockchain that will require specialized facilities like current data centers (like BlockDAG architecture, Ordinals/NFTs, BRC20 and, most importantly, Runes).

We are at the beginning of a market that will stay and change the current scenario. Combining legacy data centers with crypto-specific areas to facilitate additional businesses like heat reuse is likely just a matter of time, a run to become sustainable. Those who lead this transformation will be the ones to benefit the most.

This is a guest post by Jose Farrona. Opinions expressed are entirely their own and do not necessarily reflect those of BTC Inc or Bitcoin Magazine.

Leading Bitcoin Miner GDA Plans Mining Expansion to 400 MV Leveraging Renewables

Genesis Digital Assets (GDA), one of the world’s largest Bitcoin mining companies, has announced plans to expand its recently launched Texas data centre to 400 megawatts. The ambitious phase two scaling highlights GDA’s commitment to Texas as a mining hub, leveraging the state’s renewable energy and pro-innovation policies.

GDA’s Rowdy Data Center in Vernon is currently operational at 60 MW, supported by the Oklaunion Substation. The site benefits from substantial local wind power and is located near Vernon city in Wilbarger County.

The data centre utilizes grid power with renewable energy sources for its operations. “GDA’s business is a natural fit for the Oklaunion Power Station,” said Tom Walker, Chairman of OPS Board. “This project clearly demonstrates that Bitcoin mining creates entirely new dynamics for the energy industry.”

The Rowdy Data Center repurposes the retired Oklaunion Power Station, bringing back dozens of jobs lost when the plant closed in 2020. So far, GDA’s operations have generated 12 permanent and 150 construction jobs.

“Texas has emerged as a leading hub for local support and renewable energy sources, and the Rowdy data centre is a particularly important location for our operations,” said GDA CEO Andrey Kim.

The company aims to bolster the Bitcoin network’s robustness and security by scaling and innovating mining infrastructure and utilizing renewable energy sources.

ING sees limited movement in dollar amid bearish consolidation

Post Content