Month: July 2024

Alby Opens Waitlist For Alby Hub: A One-Click Lightning Node

Alby is officially launching the waitlist for their new product, Alby Hub. The Hub is a one-click install Lightning Node application that aims to make self-custodial Lightning use as painless as possible. Users can sign up to join the waitlist here.

Alby Hub integrates a one click Lightning node, a self-custodial Lightning wallet, and an app store that enables easy connection between a user’s Lightning wallet and other applications such as Damus, Stacker News, podcast apps, and external Lightning wallets to control their nodes with.

Easy migration from Alby’s web wallet to Alby Hub is supported.

There will also be an Alby Hub Cloud plan for 21k satoshis a month to easily spin up an Alby Hub instance run in the Alby Cloud. The plan includes live channel management support and setup support, and access to the Alby Buzz community. Alby Hub will also be made available as a DIY tool to install on your own desktop or server. It will even be possible to run on a Raspberry Pi Zero.

Alby Hub was developed to remove the friction in running your own self-custodial Lightning Node. Given the dominance of custodial Lightning solutions in the space currently, the goal of Alby Hub is to make it as painless as possible for users to manage their own Lightning funds in a self custodial environment, making them a truly sovereign Lightning user.

Michael Bumann, the founder of Alby, had this to say:

“At Alby, we always focused on building tools and protocols to natively use the Lightning Network on the web like the Alby Extension, which changed the way Lightning is used in web browsers. With Alby Hub, we are now taking Lightning Network self-custody to the next level by rethinking the utility behind running a lightning node. What does a node and wallet look like that can integrate with any bitcoin-powered app with just a few clicks? With Alby Hub, users now have endless possibilities for self-sovereign payments on the web without the technical overhead.”

Join the waitlist here now.

Ferrari To Accept Bitcoin and Crypto Payments In Europe

Luxury sports car manufacturer Ferrari announced it will expand the ability to pay with Bitcoin and crypto to its European dealerships starting this month. The move comes after Ferrari first began accepting Bitcoin and crypto payments at its US dealers last year.

JUST IN: Luxury Cars Manufacturer Ferrari to accept #Bitcoin and crypto payments in Europe. pic.twitter.com/PxT7Z7OwbP

— Bitcoin Magazine (@BitcoinMagazine) July 24, 2024

Ferrari said the rollout to Europe will occur by the end of July, enabling customers to purchase new vehicles using Bitcoin and crypto. The company plans to expand the Bitcoin payment option to dealers worldwide by the end of 2024, where legally permitted.

Ferrari continues its partnership with leading Bitcoin payments processor BitPay to process the payments. When a purchase is made in Bitcoin, BitPay instantly converts it to traditional fiat currency for Ferrari’s dealers to remove exposure to Bitcoin and crypto volatility.

The ability to pay with Bitcoin and other crypto caters to Ferrari’s tech-savvy customer base with sizeable Bitcoin wealth. It also taps into growing mainstream adoption, as more major companies accept Bitcoin payments including Microsoft, AT&T, and travel site Expedia.

Ferrari said accepting Bitcoin and crypto provides customers with additional flexibility and convenience in purchasing the company’s luxury vehicles. The automaker saw strong demand after enabling Bitcoin payments in the US last year.

As luxury and high-end brands adopt Bitcoin payments, it helps legitimize the asset class as a currency and not just an investment. The ability of consumers to spend Bitcoin at more retailers was also cited as a factor in the recent Bitcoin market rally.

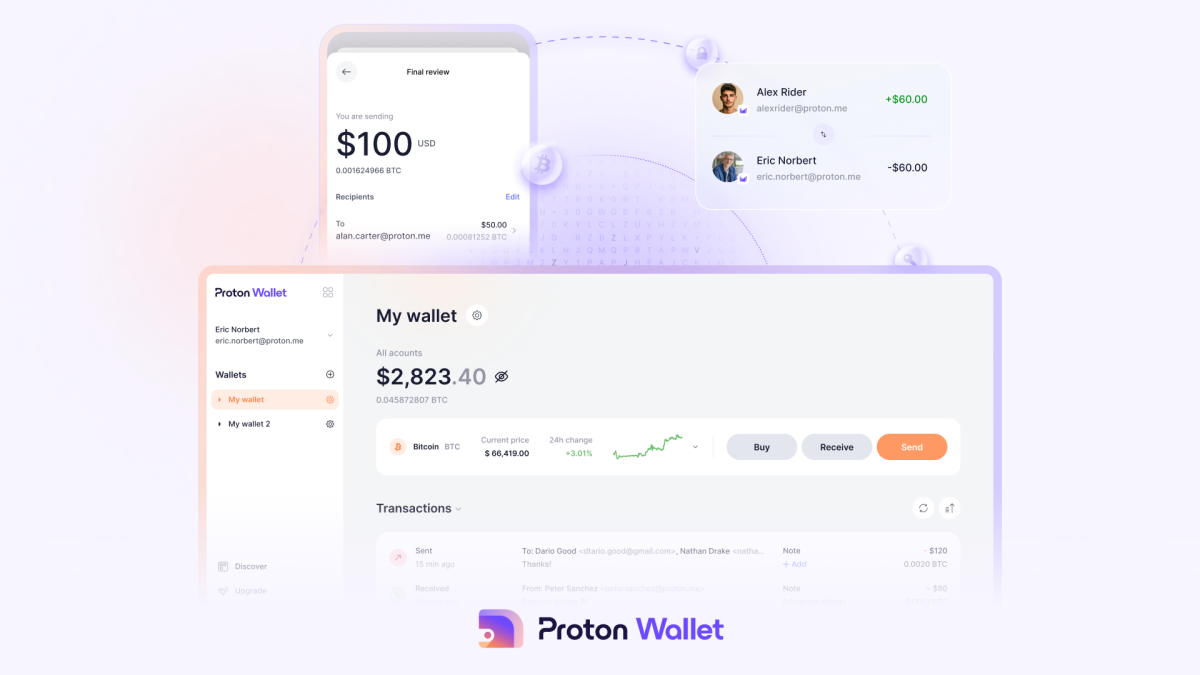

ProtonMail Maker Proton Is Launching Its Own Bitcoin Wallet

Proton, the Swiss technology company that creates privacy-preserving online tools like ProtonMail and ProtonVPN, is launching Proton Wallet, a self-custody Bitcoin wallet.

This new product will be integrated with ProtonMail and will enable users to send bitcoin as easily as sending an email.

“Bitcoin’s value to society has been hindered by the difficulty of transacting and security concerns, and we designed Proton Wallet to specifically address both,” said Andy Yen, founder and CEO of Proton in a press release shared with Bitcoin Magazine. “Proton Wallet’s ability to support Bitcoin via email now makes Bitcoin transactions as easy to use as PayPal, while preserving the decentralized and non-custodial nature of Bitcoin.”

Proton Wallet is the latest in its suite of end-to-end encrypted tools that help Proton users maintain privacy when using the internet.

Before diving into the details of this new product, it’s important to understand Proton’s motivation in creating it.

For Proton, Proton Wallet Is Personal

If it weren’t for Bitcoin, Proton might not exist.

“This summer is actually the 10 year anniversary of Proton,” Yen told Bitcoin Magazine in an interview.

“In July 2014, we had our original crowdfunding campaign, and halfway through the campaign, PayPal actually froze our funds. So, Proton actually had a near-death experience at the very beginning,” he added.

“We added a bitcoin donation link when the crowdfunding campaign got shut down, and that’s when we started receiving our first bitcoin. It was at that moment 10 years ago that we first realized the true power of Bitcoin and what it can enable.”

Yen also touched on how happy the team Proton was when Credit Suisse, the bank it used to manage its fiat business funds, collapsed in March 2023.

“Credit Suisse had that moment of limbo where we were not sure if they were going to get bailed out or not,” recalled Yen. “The fact that we had a big portion of our reserves in bitcoin was actually something that was prudent to do because it more or less ensured the long-term sustainability of the business.”

Dingchao Lu, Director of Proton Wallet and the company’s first employee, is also grateful for the role that Bitcoin has played in the history of Proton, and he wants it to play a similar role for Proton users worldwide.

“We want to reduce the world’s dependence on centralized financial institutions,” said Lu in the press release shared with Bitcoin Magazine. “By giving users control of their own encryption keys and their own digital assets, we’re offering financial freedom, improved privacy and safety to millions of people around the world.”

Lu also shared that Proton has felt the financial benefits of holding the bitcoin it’s accepted for payments over the years.

“We’ve been taking Bitcoin payments since we launched out of beta back in 2016,” he told Bitcoin Magazine in an interview.

“That has been working well for us. The Bitcoin price has gone up something like 100 times since those early days, and we’ve held onto our Bitcoin,” he added.

The Details

Proton will leverage its existing infrastructure to make Proton Wallet more user-friendly.

To use Proton Wallet to make a bitcoin transaction, both the sender and receiver must have the wallet. The sender need only have the recipient’s email address, whether that address is a ProtonMail address or not, to send the bitcoin.

Behind the scenes, Proton will rotate Bitcoin addresses each time a user sends or receives bitcoin, which helps to prevent the addresses from being linked a user’s identity.

As mentioned, Proton Wallet is non-custodial, which means that only users have access to the funds in the wallet. Proton will offer “robust recovery methods” for said keys, though it has yet to offer what those recovery methods will look like. Bitcoin managed in Proton Wallet can be retrieved even if Proton goes offline.

All transactions using Proton Wallet will occur on the base chain, as Proton has not implemented Lightning yet for one main reason.

“Lightning is very difficult to do in a non-custodial way,” said Yen.

“If you want to do non-custodial lightning and you want to have people open up channels of their own, that’s a user experience that at the present moment still isn’t really solved,” he added.

“But Lightning support is something that we can add in the future as we find ways to work around the user experience problem.”

Proton will also make it easier for people to buy bitcoin, as it will provide on-ramp integrations in over 150 different countries.

What is more, Proton Wallet will also provide support for two-factor authentication, including hardware security keys, and it will offer users access to Proton Sentinel, which employs machine learning and AI to help stop malicious login attempts. Proton Sentinel helps protect users’ accounts in the event that the account has been compromised or if an attacker has obtained access to a user’s login information.

How To Get Started With Proton Wallet

Proton Wallet is currently only available to Proton Visionary users, a Proton plan normally only for legacy users but that has been re-opened for a limited time, and “select Bitcoin community members” as part of an early access program.

These participants can invite friends to join, while the product will be available to all Proton users in the future.

In the press release shared with Bitcoin Magazine, Proton also shared that it will issue a wait list for those looking to get started with Proton Wallet.

Dollar edges higher, euro slips after weak PMI data

Post Content

Yen advances for 2nd day ahead of BOJ meeting next week; dollar firmer

Post Content

Bitcoin Mining and HPC Leaders Unite to Create Synteq Digital

SunnySide Digital (SunnySide) and Cryptech Solutions (Cryptech), two wholesale distributors and service providers for digital asset mining and HPC data center equipment, have joined forces to launch Synteq Digital (Synteq).

Synteq Digital aims to meet the needs of the digital mining and HPC industries at scale by growing the reach of its digital hardware wholesaling business as well as rolling out new services.

“We are very excited to create a new market participant by combining our respective teams, core values, and reputational cache to form Synteq,” Taras Kulyk, CEO of Synteq and founder and former CEO of SunnySide, said in a press release shared with Bitcoin Magazine.

“This new entity will provide the scale and breadth of services to our enterprise and commercial scale clients and partners in the HPC & digital mining data center sectors. Our dynamic blend of leadership, technical strength, and a robust track record of execution experience will be pivotal as we continue to grow our new verticals,” he added.

New Services From Synteq

The new offerings from Synteq include procurement, colocation and wholesaling of enterprise-focused GPU/HPC hardware; Just-In-Time (JIT) DataCenter consignment parts & supply; and an Enterprise Fleet Refresh Service Model, which includes cleaning, upgrading and repairing older digital mining hardware.

With the expansion of its new verticals, Joe Stefanelli, Synteq President and founder and former CEO of Cryptech, is optimistic that his new company will quickly gain traction worldwide.

“I see Synteq quickly becoming the global go-to platform for HPC and digital mining data centers,” Stefanelli said in the press release. “Our team’s focus is on delivering top-notch services and solutions marked by expertise, integrity, and reliability.”

Synteq’s Deal With Bitmain

One of Synteq’s first new partners will be Bitmain Technologies (Bitmain), a China-based industry leader in Bitcoin mining rig production. Synteq will be Bitmain’s exclusive distribution partner for the United States.

“It’s the first time that Bitmain is acknowledging partners in the industry,” Stefanelli told Bitcoin Magazine in an interview. “We’re the first company that’ll be a distributor — they call it a Hashrate Ambassador — for Bitmain.”

Aside from its deal with Bitmain, Synteq will continue its partnerships with Rosseau Immersion and ePIC Blockchain among other existing partnerships from both SunnySide and Cryptech, according to Kulyk.

A Reaction To Industry Consolidation

SunnySide and Cryptech decided to join forces because of shifting winds in the digital mining and HPC industry.

“The industry is going through a consolidation,” said Kulyk.

“There’s a ton of M&A and our clients are scaling up and getting bigger,” he added.

“We’re now dealing with operators that have a gigawatt of power under operation and control, and they want somebody who can provide services and solutions at the scale that they need in a timely fashion with reliability as well as professionalism.”

Stefanelli, who clarified that Synteq isn’t the result of a merger between SunnySide and Cryptech but a new entity all together, shared that it felt logical for Cryptech and SunnySide to work together.

“There were a lot of synergies between what we both did and a lot of overlap with clients,” he said.

“We shared a lot of the same values as individuals and as companies, we like to run our companies the same way and we were pretty good competition to each other,” he added.

“We really saw the benefit of bringing everyone together.”

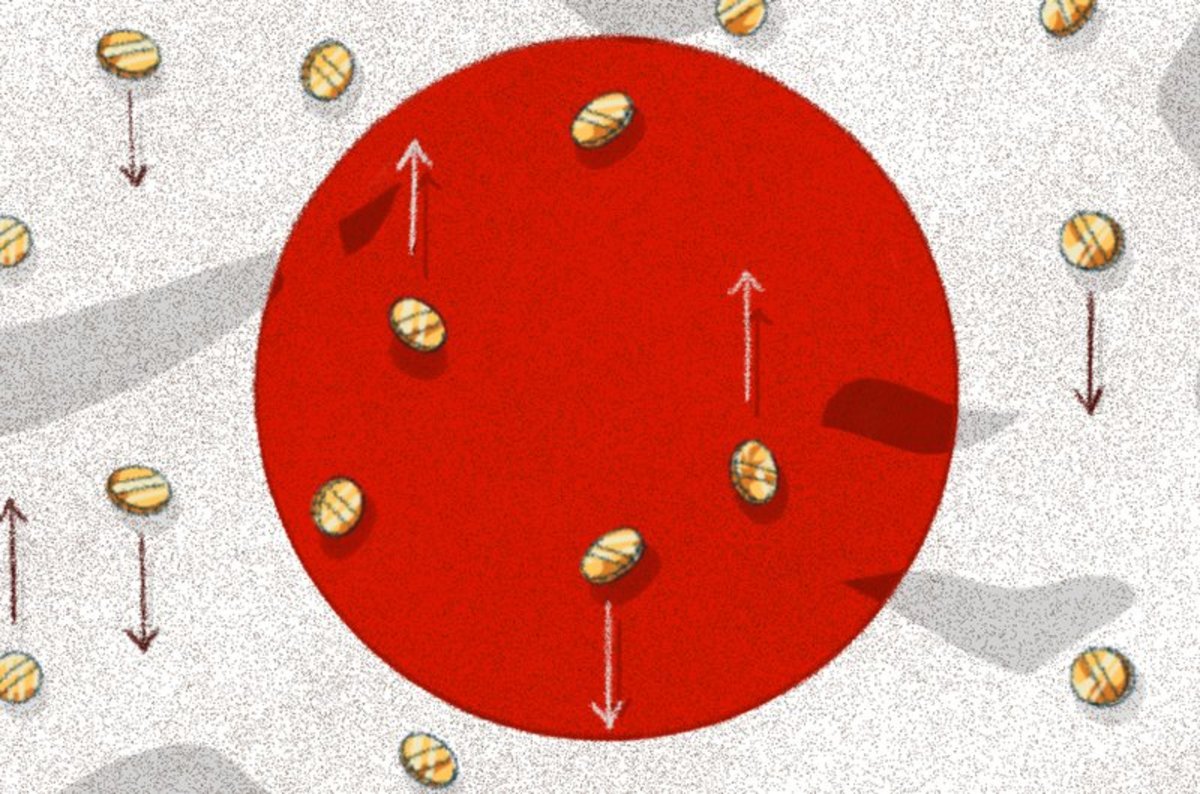

Stablecoins Are Coming To Bitcoin’s Lightning Network

The world of finance assets and alternative currencies has officially arrived to Bitcoin. If it wasn’t clear already following the slew of new protocols birthed by the Ordinals’ movement, the release of Lightning Labs’ Lightning-native Taproot Assets protocol feels like a consecration to the phenomenon.

More than two years after the protocol was originally announced, users and developers can now open channels denominated in a unit of account of their choice and leverage the existing Lightning Network infrastructure. Though Taproot Assets was leapfrogged in its effort to bring assets to Bitcoin by more naive protocols such as BRC-20 or Runes, patience has been rewarded as advocates of the protocol contend it is superior in all aspects, from scalability to security.

With billions, if not trillions, of stablecoin opportunities abound, Taproot Assets is positioned as a strong contender to bridge the current gap between the dollar economy and Bitcoin.

To get a better sense of how their protocol stands up to existing solutions, I had a conversation with some members of the Lightning Labs team as they prepared to onboard the world of finance onto Bitcoin rails. We explored Lightning’s advantage as an interoperability layer and why Taproots Assets could unlock the next phase of innovation

Bridging Economies Using Lightning Interoperability

Last decade’s proliferation of stablecoin networks has fragmented the global on-chain economy and kept it at arm’s length from Bitcoin’s own. Anyone with modest experience using those networks can attest to the headaches created by different token standards and their incompatibility.

In today’s blockchain inflation environment, issuers must keep up with endless integrations to support the infrastructure and liquidity required for those chains to thrive. Users, unable to send payments across ecosystems, are often left to navigate the complexity and risk of cross-chain bridges. The team at Lightning Labs is convinced of Lightning Network’s opportunity to shine as a connective tissue for those economies.

“While stablecoins do tend to have a network effect, including the dominance of USDT, the design of Taproot Assets also makes it easier to do cross-asset transfers, for example sending a USD stablecoin and receiving in BTC or sending between two different stablecoins,” says CEO Elizabeth Stark.

What happens when Taproot Assets are on the Lightning Network?

⚡️ Instant Settled Foreign Exchange!

Alice can send USD to Bob instantly in EUR.

#LightningNetwork #TaprootAssets #StableCoin #Lnfi pic.twitter.com/YOm6PJDwNs

— luke (@Web3Luke) July 20, 2024

Thanks to Taproot Assets’ end-to-end design principle, swap providers called edge nodes facilitate transfers and exchanges between assets with no additional effort and at low costs to end users. Payees can submit invoices denominated in any currency and leave the payment asset at the payers’ discretion. The Request for Quote (RFQ) service included in this latest release opens up entirely new opportunities for liquidity providers, exchanges & brokerages to manage their stablecoin inventory and hedge against different market conditions. Using the protocol, applications can seamlessly negotiate the best exchange rates for end users based on offers from an open and global liquidity market. Underneath this activity, sats are used as the routing fuel allowing any Lightning node on the network to relay those transactions to other peers without concern for the ultimate settlement currency, a process the Lightning Labs team has referred to as “bitcoinizing the dollar.”

As the industry envisions continued growth in the number of issuers and assets, proponents of the protocol believe the importance of this interoperability cannot be overstated. A payment experience previously fragmented into individual networks has the opportunity to be unified under the same Lightning umbrella. In the process, the network stands to benefit from the additional demand for liquidity which is likely to reflect in the cost and reliability of regular Bitcoin transactions. Regular Lightning node operators should also enjoy an uptick in routing fees as the adoption of Taproot Assets ramps up.

Asked about the evolution of the protocol since its inception, Stark stressed the ability to leverage Bitcoin’s existing network effect as central to the original vision.

“We envisioned two major narratives, the rise of Layer 2s and stablecoins becoming a globally significant asset – and both have come to fruition. As we’ve seen an explosion of creativity in the developer community, the need for a global, scalable, interoperable protocol for transferring bitcoin and assets on bitcoin has only increased in importance.”

The arrival of new scaling proposals is top of mind when discussing the potential of their asset protocol with the Lightning Labs team. I’ve previously covered the challenges created by those unique designs and there are increasing reasons to believe that a standardized framework for assets brings some cohesion to the picture. Further supporting the thesis that an interoperable layer is needed to connect those projects, a participant in a recent hackathon organized by layer two project Botanix Labs proposed to use Lightning as a trustless bridge between EVM chains and Bitcoin.

Lightning Labs’ Head of Business Development Ryan Gentry previously highlighted the opportunity created by those novel layer technologies, claiming that “DeFi will require the stablecoins issued on Taproot Assets in order to thrive, so the timing for these new projects couldn’t be better. Lightning will be the interoperable glue that will connect them all!”

In our chat, Lightning Labs CTO Olaoluwa Osuntokun echoed his colleague’s sentiments:

“Bringing stablecoins to Bitcoin helps to supercharge what can be built on the higher layers. Further, being able to properly represent some other chain or asset within Bitcoin makes interoperability using constructs like bridges easier.”

Fueling The Bitcoin Development Ecosystem

When questioned about the importance of this release, the team is quick to point out how essential the developer community at large has been in this journey. Indeed, the prospect of expanding the range of use cases and assets available within the Bitcoin ecosystem has propelled a collection of new initiatives to rally around the Taproot Assets protocol. No longer pigeonholed by the store of value narrative, the integration of different asset classes into the ecosystem is creating a noticeable buzz in developers’ ranks. Lightning Labs is excited to ride the momentum generated by this new trend of builders on Bitcoin and believes they are exceptionally positioned to do so.

“We’ve been blown away by the developer response already–we have people staying up late at night to join our community calls, new teams popping up in various places around the world, and lots of devs testing and providing valuable feedback,” shares Gentry.

To facilitate developer adoption, Taproot Assets was carefully engineered to be compatible with Lightning Labs’ industry-leading Lightning node implementation. Supporters argue this distribution into an established software stack will be key to bootstrap the protocol’s network effect. Today’s release comes with a significant suite of features that harnesses the power of Bitcoin’s Taproot upgrade, allowing developers to pick up known and existing concepts such as PSBTs or multi-signature and apply them to different assets.

Although the emergence of alternative asset protocols on Bitcoin has generated controversy this year, Taproot Assets was specifically designed with scalability and efficiency in mind. Rather than needlessly consume scarce Bitcoin block space, the protocol allows for the issuance of multiple assets within a single UTXO and keeps most of the relevant data off-chain for clients to independently validate.

Now that the payment channel implementation is available on mainnet, the expectation is for developers to start testing their integrations within a real-world environment though the team advises caution given the alpha status of the release.

Having faced growing pain since its introduction nearly a decade ago, the Lightning Network has hit significant strides recently, reaching an all-time high in USD-denominated liquidity. Advances to the protocol such as splicing and the progress around Lightning Service Providers (LSPs) have bolstered the protocol’s reliability and improved the user experience considerably. Lightning Labs believes Taproot Assets is likely to help address outstanding challenges such as inbound liquidity by expanding the developer mind share and incentivizing a new cohort of products and businesses to come up with innovative solutions.

“The growing momentum around building on Bitcoin is undeniable. With bitcoin-native assets on Lightning, developer momentum will only accelerate, bringing new users and use cases along with it. We are witnessing global bitcoinization in real-time.”

Anyone interested is encouraged to start contributing to the growing community of developers building on Taproot Assets by reading the getting started guide available here.

Wells Fargo sees slower US dollar decline through 2025

Post Content

Japanese Public Company Metaplanet Partners with Hoseki to Launch Bitcoin Proof of Reserves

Metaplanet Inc., a Japanese public company listed on the Tokyo Stock Exchange, has announced a partnership with Hoseki, a global leader in Bitcoin verification solutions, to launch a Bitcoin proof of reserves system. This collaboration aims to enhance transparency and trust in Metaplanet’s Bitcoin holdings through Hoseki Verified, a Bitcoin verification product.

“Companies like Metaplanet will define the future of the Bitcoin industry,” said Sam Abbassi, Founder and CEO of Hoseki. “We are thrilled to support them in utilizing this core feature of the Bitcoin monetary network – its radical audit-ability and transparency.“

Hoseki Verified offers a public dashboard providing real-time visibility into Bitcoin holdings, showcasing verified assets with custodians such as Coinbase, BitGo, and Gemini. This initiative ensures that investors and stakeholders can verify the integrity of Metaplanet’s Bitcoin holdings in real-time.

“As Bitcoin adoption proliferates globally, the importance of transparency cannot be overstated,” said Dylan LeClair, Director of Bitcoin Strategy at Metaplanet. “Our partnership with Hoseki aligns with Bitcoin’s ‘Don’t Trust, Verify’ ethos and pioneers transparency in a world where money exists on a transparent, auditable global ledger. This marks the beginning of a series of initiatives Metaplanet will undertake to uphold and advance these principles.”

Earlier this year, Metaplanet adopted the MicroStrategy Bitcoin corporate playbook by purchasing Bitcoin and holding it as the company’s primary treasury reserve asset. Since the initial purchase, the company has continuously bought more and more Bitcoin. Just yesterday, the company bought an additional ¥200 million worth of BTC.

JUST IN: 🇯🇵 Japanese public company Metaplanet buys another ¥200 million worth of #Bitcoin pic.twitter.com/jMuBtYaNqI

— Bitcoin Magazine (@BitcoinMagazine) July 22, 2024

Disclaimer: Bitcoin Magazine is wholly owned by BTC Inc., which also operates UTXO Management, a regulated capital allocator focused on the digital assets industry and invested in Metaplanet. UTXO invests in a variety of Bitcoin businesses, and maintains significant holdings in digital assets.

As D.C. Adopts Sound Money Principles, States Must Continue to Lead

Conservatives vowed to bring sound money policy to Washington in 2025, but the battle for your financial freedom is closer to home than you would expect. States pioneered this effort, and should capitalize on this national momentum to defend American financial liberties locally.

This month, the Republican National Committee released a draft proposal for changes to the party platform that would assert the party’s stance against a central bank digital currency — also known as a CBDC or digital dollar — and in support of the right to mine, own, and privately transact in digital assets like Bitcoin.

Sound monetary policy has been a growing focus of the 2024 election as Republican candidates like Former President Trump and Vivek Ramaswami publicly supported digital assets — specifically Bitcoin — while denouncing the implementation of a CBDC. Even the independent presidential candidate Robert F. Kennedy Jr. holds a similar stance on these issues.

As fresh as these issues may seem at the national level, states have been in discussions over sound money for some time. The Idaho Republican party was the first to add pro-digital asset, anti-CBDC language to a major state party platform. The Gem State also considered two bills during the 2024 legislative session that would have fulfilled that pillar of the platform, but ultimately failed by close votes in the House and Senate.

Though Idaho still faces roadblocks, other states have successfully enacted sound money policy in recent years. Florida passed legislation to ban CBDCs. North Carolina and Arizona considered similar legislation that ultimately failed. Meanwhile, Wyoming, Montana, Arkansas, Oklahoma, and Louisiana passed legislation to defend fundamental rights on digital assets.

These policies come as states attempt to stem the threats to Americans’ liberties posed by private banks and the federal bureaucracy.

Financial institutions are the new scene of the Left’s cultural warfare. Many banks are ending their business with certain religious organizations, firearms manufacturers, or non-green industries. This can be crippling in a modern, mostly digital economy and threatens agriculture, mining, and energy — some of the leading industries in Idaho’s economy.

Privacy is also a chief concern for many Americans. The federal government weaponizes its power over the banking system to search citizens’ transaction histories without a warrant despite this infringing on the Fourth Amendment of the U.S. Constitution.

Worse yet, bureaucracies in Washington, D.C. — being dissatisfied with their existing degree of outsized control — want to monitor and control every American’s financial transactions through a CBDC. This new, digital dollar, could offer unparalleled control through programmable issuance, use, and taxation.

It’s worrisome that bureaucrats want even more control over a financial system they already proved they cannot manage well. The hidden tax of inflation is devastating the savings of all Americans who use the dollar as a store of value. Yet, the government continues to borrow and print to sustain its ever-increasing size.

States that have proposed and passed legislation to protect the financial liberties of their constituents recognize these problems and are acting accordingly. They are providing a way for the market to escape from a financial system that is no longer private, stable, and free.

Even if sound money policy advances at the federal level, this would not relieve the need for states to act. States that do not yet have these protections must continue to advance these policies locally.

States should take advantage of the national momentum for sound money policy and work to defend the financial sovereignty of their constituents. Idaho is a prime candidate for these policies. After all, both of the Gem State’s neighbors to the east already enacted some of these policies.

Idaho should catch up to her peers by executing its own sound money policy agenda. This starts with acknowledging a CBDC is not money and banning the state’s cooperation with the Federal Reserve’s implementation of the system. It must also defend the right to mine, own, and transact in digital assets. This will allow Idahoans to defend their financial liberties by opting out of a system poised to control and regulate their finances.

Of course, Idaho is not the only state that could benefit from these policies. Now is the time for state legislatures to leverage this national momentum and consider how they can protect the finances of their constituents. Otherwise, they may find that the nation has left them behind on an issue where states are leading.

This is a guest post by Niklas Kleinworth. Opinions expressed are entirely their own and do not necessarily reflect those of BTC Inc or Bitcoin Magazine.