Month: July 2024

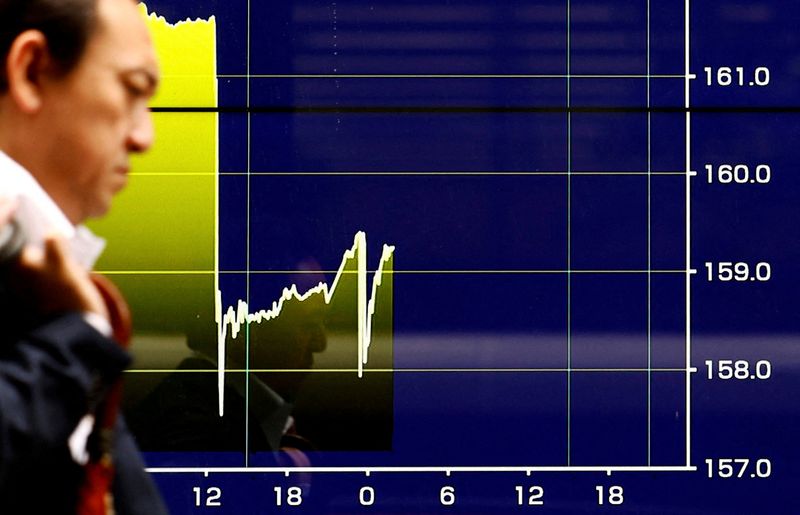

Yen gains on reports of possible BOJ hike to 0.25%

Post Content

Russia Legalizes Bitcoin And Crypto for International Trade To Bypass Sanctions

In a significant legislative move, Russian lawmakers have passed a bill permitting businesses to use Bitcoin and other cryptocurrencies in international trade, according to a report by Retuers. This development is part of Russia’s strategy to circumvent Western sanctions imposed following the invasion of Ukraine. The new law, expected to take effect in September, aims to address delays in international payments, particularly with key trading partners like China, India, and the UAE.

JUST IN: 🇷🇺 Russian law makers passes bill allowing businesses to use #Bitcoin and cryptocurrencies in international trade — Reuters pic.twitter.com/yFExWcIG9k

— Bitcoin Magazine (@BitcoinMagazine) July 30, 2024

Central bank Governor Elvira Nabiullina, a proponent of the law, announced that the first cryptocurrency transactions will occur before the year’s end. The central bank will establish an “experimental” infrastructure for these payments, with further details pending.

“The risks of secondary sanctions have grown,” Nabiullina stated. “They make payments for imports difficult, and that concerns a wide range of goods.”

The legislation also includes regulations on cryptocurrency mining and the circulation of other digital assets but maintains the ban on cryptocurrency payments within Russia. The central bank highlighted that payment delays have caused an 8% drop in Russian imports in the second quarter of 2024.

Despite efforts to shift to trading partners’ currencies and develop an alternative BRICS payment system, many transactions still rely on dollars and euros via the SWIFT system, risking secondary sanctions. Nabiullina emphasized that these sanctions have complicated import payments, extending supply chains and increasing costs.

This decision by Russian lawmakers aims to mitigate the economic challenges posed by sanctions and ensure smoother international trade operations. Anatoly Aksakov, the head of the Duma lower house of parliament, reportedly told lawmakers, “We are taking a historic decision in the financial sphere” by passing this legislation.

Japan’s new currency diplomat keeps intervention on table to stabilise yen

Post Content

Senator Cynthia Lummis Announces Bill for US To Buy 1 Million Bitcoin

Senator Cynthia Lummis (R-WY) has announced plans to introduce legislation directing the U.S. government to accumulate 1 million Bitcoin, which would be worth over $68 billion at current prices.

Speaking at the Bitcoin 2024 conference in Nashville, Lummis said the bill would have the U.S. Treasury purchase Bitcoin over a 5-year period as a strategic reserve asset to fortify the dollar. She likened it to the government’s strategic petroleum reserve.

“We know from modelling the numbers and past experience with Bitcoin that it is capable of being an absolute game changer for the mess the United States has gotten itself into with its debt and its deficits,” says Lummis.

The senator said the government would self-custody the Bitcoin across various geographic locations. The assets could only be used to pay down the national debt and would need to be held for at least 20 years.

Lummis has been one of the leading Bitcoin advocates in Congress. She believes acquiring Bitcoin will help stabilize the dollar’s value and counter inflation. The national debt recently surpassed $35 trillion.

Her proposal follows former President Donald Trump’s endorsing the idea of a U.S. Bitcoin reserve at the Nashville conference. Trump said he would never sell any of the government’s 210,000 bitcoin holdings.

Independent presidential candidate Robert F. Kennedy Jr. also called for purchasing 500 bitcoins daily until accumulating a 4 million Bitcoin reserve.

While Lummis admits her legislation is unlikely to pass before the 2024 elections, she believes the growing political interest in Bitcoin reserves reflects a paradigm shift. Bitcoin has become a major campaign issue, with both parties courting the burgeoning industry.

Lummis bill represents the most aggressive government adoption of Bitcoin proposed yet. Though its prospects remain uncertain, the move would legitimize Bitcoin as an economic asset.

Lummis said she is “optimistic” that other Bitcoin-focused bills could still pass this year as Bitcoin moves closer to the political mainstream.

Macquarie bullish on USD into 2025 should Trump win

Post Content

Hedge funds make massive retreat from short yen positions, UBS says

Post Content

Dollar’s reign to live on even as global monetary landscape evolves

Post Content

Dollar steady ahead of start of Fed meeting; traders remain wary

Post Content

Surging yen upends popular global FX carry trades

Post Content

Asia FX muted with yen steady ahead of BOJ; dollar gains before Fed

Post Content