Month: June 2024

Dollar edges higher, sterling slips ahead of BOE meeting

Post Content

US, China to hold high-level talks on anti-narcotics cooperation

Post Content

Bitcoin Now Accepted At South London’s Tooting Market

Established in 1930, Tooting Market in South London is an iconic indoor market and the UK’s first food market.

It has garnered accolades such as Best Small Indoor Market at the 2017 Great British Market Awards and Tooting is listed among Lonely Planet’s ‘Favorite Lesser-Known Neighborhoods In The World’s Greatest Cities.‘

And now it accepts bitcoin payments.

Bitcoin Integration

Local Bitcoin enthusiasts, led by a pseudonymous Bitcoiner known as Hashley Giles, have successfully introduced bitcoin payments at the market.

With support from Bridge 2 Bitcoin (UK-based Bitcoin circular economy builder), eight merchants — including restaurants, bars, and a vinyl record store — started accepting Bitcoin on June 18, 2024.

This event saw participation from notable Bitcoin community members and organizations such as CommerceBlock, Mercury Layer, CoinShares, Civkit, Bitcoin Core developers, Pleb Underground, and Lightning Network developers.

Some restaurants and bars at Tooting Market now accept bitcoin.

Impact and Future Prospect

This initiative could be a pivotal moment for Bitcoin adoption in the UK.

Local traders appreciate the simplicity and permissionless nature of Lightning payments, which offer a solution to banking challenges faced by cash-based businesses.

Nicholas Gregory, lead at Mercury Layer & Civkit, highlighted the potential impact.

“Local initiatives like this are key for Bitcoin,” explained Gregory. “The more traders accept Bitcoin, the more we can push the state to recognize it as a legitimate form of payment, making it easier to use from a tax efficiency perspective.”

Certain merchants at Tooting Market now accept bitcoin.

Bitcoin Beach Moment for the UK

This could be the UK’s Bitcoin Beach moment, emulating the success seen in El Zonte, El Salvador.

Bitcoin Beach transformed El Zonte into a Bitcoin adoption hub, eventually leading to Bitcoin being recognized as legal tender in El Salvador.

Tooting Market could similarly become a mecca for Bitcoin adoption in the UK, driving broader acceptance and usage of Bitcoin across the country.

Tooting Market stands at the intersection of tradition and modern innovation, exemplifying how local communities can drive the adoption of new technologies like Bitcoin.

This blend of historical charm and cutting-edge finance could set a precedent for markets in other regions.

Bitcoin Financial Platform Lava Unveils Exchange And Stable Payments

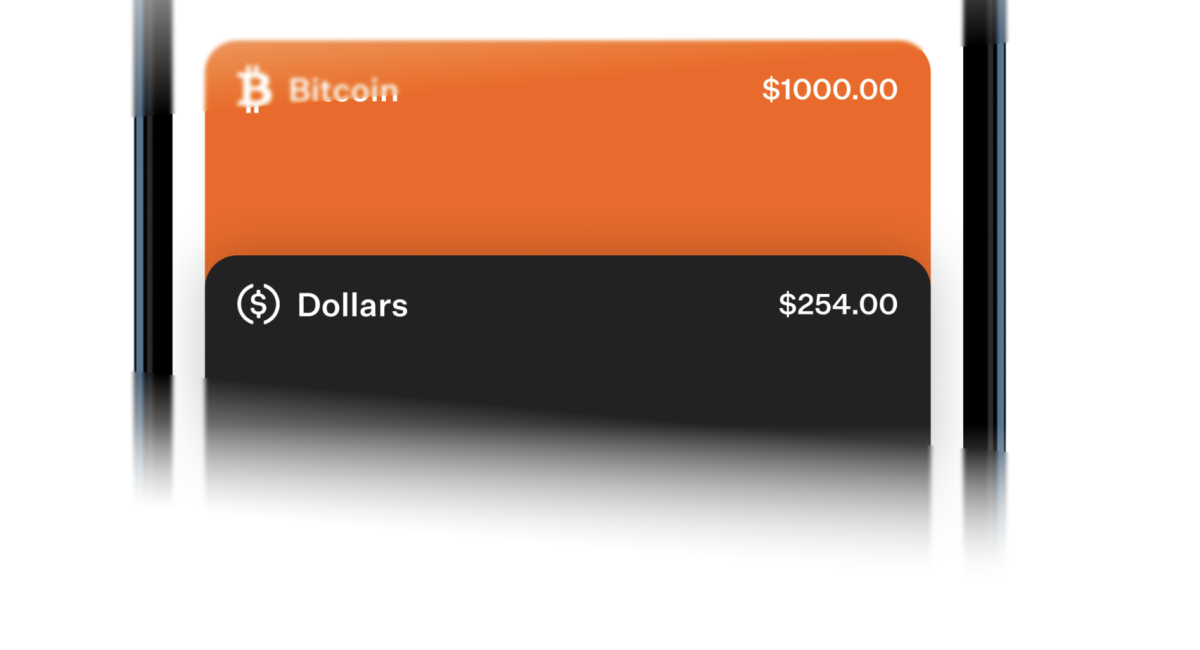

Following a year of stealth development, Lava is introducing the first two of its suite of financial products—Lava Free Pay and Lava Exchange—poised to transform how we handle digital dollars and access to Bitcoin. In a conversation with Bitcoin Magazine, Lava CEO Shezhan Maredia provided an in-depth look at what these new offerings bring to the table and how he hopes they can redefine the mobile self-custodial experience.

Lava Free Pay: Liberating Global Payments

The promise of digital dollars has always been seamless, global payments. However, Maredia argues the current user experience falls short. “Imagine if every time you wanted to send money on Venmo, you first had to buy volatile VenmoBucks, incurring fees, and then pay an additional transaction fee in those same volatile VenmoBucks.”

Lava abstracts those issues to provide Bitcoin users seamless access to stablecoins. “The traditional friction of having to deal with other chains has been completely removed. No unnecessary detail is exposed in the app.”

Lava Free Pay is a trustless broadcasting service for users that provides best-in-class stablecoin integration of any Bitcoin wallet in the marketplace. This innovation unlocks free, instant, and global payments, making digital dollars more practical and accessible for everyday use.

Maredia explains he plans to support multiple networks and eventually allow users to send payments across all of them. “Bitcoin-based alternatives may be considered once they mature.” These upgrades will integrate smoothly into Lava’s existing infrastructure, ensuring users don’t have to worry about the technical details.

Lava Exchange: Your Gateway to Self-Custody Asset Management

Navigating the world of Bitcoin and digital assets can be overwhelming, especially when it comes to finding the best exchange rates and lowest fees. Lava Exchange addresses this challenge by enabling users to buy assets directly to self-custody and withdraw money to their bank accounts with minimal fees.

“We thought long and hard about how to offer users a cheap and convenient way to onboard into Lava self-custodially,” says Maredia.

After considering every market option, his team decided to build their own exchange aggregator. Using your location and market data, Lava can connect you to the exchange that offers the best rates and lowest fees for your desired transactions. Those services are directly embedded in the Lava Vault, reducing the steps necessary for the user to acquire Bitcoin.

“We think people should continue to save Bitcoin and spend dollars and we want to give them the best tools to achieve this. I built Lava for those that live a Bitcoin-based lifestyle.”

Underneath the hood, Lava is supported by a state-of-the-art self-custody solution called the Lava Smart Key. Building on a decade of mobile Bitcoin development, Maredia believes his company offers the most secure mobile key custody system available today.

Lava plans to continue rolling out new products and is already getting ready to launch its awaited loans protocol using trustless Bitcoin smart contracts.

Users can get started by downloading the Lava Vault from the App Store on iOS or Android, or by visiting lava.xyz.

Dollar struggles for direction, euro close to 1-1/2-month low

Post Content

China police probe drug-related money laundering operation after US tip

Post Content

Donald Trump Pushes For USA to Lead in Bitcoin

Former president Donald Trump is doubling down on his pro-Bitcoin stance, arguing that the USA must lead in Bitcoin and crypto or risk falling behind. Trump has emerged as a vocal Bitcoin advocate while campaigning for the 2024 election.

Trump became the first US president to accept Bitcoin lightning payments and oppose central bank digital currencies. On the campaign trail, he has promised to keep regulators away from Bitcoin if elected.

Yesterday in Wisconsin, Trump further declared he will “end Joe Biden’s war on crypto” to secure America’s future. He added new comments that “We will ensure that the future of crypto and the future of Bitcoin will be made in America, otherwise other countries are going to have it.”

JUST IN: 🇺🇸 Donald Trump says “to further secure America’s future and create opportunity for young people, I will end Joe Biden’s war on crypto.”

“We will ensure that the future of crypto and the future of #Bitcoin will be made in America, otherwise other countries are going to… pic.twitter.com/NmmM2J3kIq

— Bitcoin Magazine (@BitcoinMagazine) June 18, 2024

This marks a shift. Trump explicitly states that he wants the USA to lead in Bitcoin; otherwise, rivals will surpass it.

Trump’s embrace of Bitcoin reflects Bitcoin’s game theory. As Bitcoin grows too popular to ban, politicians realize they must support it to court Bitcoin-friendly voters.

The USA risks falling behind in the technological and financial race if it shuns Bitcoin and crypto innovation. Trump understands the USA must lead in this critical new domain.

Whether sincerely supportive or opportunistic, Trump grasps Bitcoin’s political capital. He knows backing Bitcoin can win votes, while attacking it risks alienating a passionate base.

Other nations are pursuing pro-Bitcoin policies to attract economic growth and talent. To stay competitive, America must become a welcoming hub for Bitcoin and crypto developments.

Dollar steady, sterling gains after UK inflation data

Post Content

Sterling firms versus euro and dollar after UK inflation data

Post Content

Exclusive-South Korea FX authorities aimed to cap dollar-won at 1,385, sources say

Post Content