Month: June 2024

Asia FX sees some relief as dollar cools; yen firms amid intervention talk

Post Content

Chinese yuan softens, USDCNY at 7-mth high on weak fix, trade jitters

Post Content

Bitcoin drops 7.8% to below $60,000

Post Content

The Evolving Bitcoin Layer Landscape

At the most recent Bitcoin++ developer conference in Austin, TX, Bitcoin Magazine’s Alex B. sat down with Michael from Boltz and Tiero from Ark Labs to discuss the latest developments in Bitcoin’s technology ecosystem, particularly focusing on Lightning Network, Liquid, and emerging technologies like Ark.

The Journey and Challenges of Lightning

Reflecting on the journey of the Lightning Network, Michael shared insights on the challenges faced, especially in high-fee environments. “The biggest blind spot that was glaringly obvious recently was like in a high fee environment, Lightning tends to hurt a lot,” he said. He elaborated on the difficulties posed by fee spikes and the need for better preparation and solutions, such as moving operations to different chains via submarine swaps.

Tiero highlighted the underestimated challenge presented by Lightning’s infrastructure. He pointed out the need for innovative designs that use Lightning to connect various layers, including Fedimint, Liquid, and Ark, to enhance the user experience. “Lightning will always be the way to connect all these new ideas,” Tiero said.

Liquid’s contested role

Despite its relatively modest adoption compared to other technologies, both Michael and Tiero acknowledged that Liquid has proven to be a stable and reliable platform. “Liquid has been around the block. It’s known and it survived. It’s still around today,” Michael stated, pointing out the platform’s resilience and reliability over time. This stability is crucial for developers looking to build and experiment with new solutions without the risk of frequent disruptions.

Tiero from Ark Labs expanded on the advantages of sidechains like Liquid, highlighting their ability to reduce congestion on the Bitcoin main chain. “Having a side chain with clear trade-offs can alleviate pressure on the main chain,” he said, emphasizing that Liquid’s architecture offers distinct benefits, including lower transaction fees and faster processing times. This can be particularly beneficial in high-fee environments, where moving operations off the main chain can result in significant cost savings.

Michael also addressed the competitive landscape of new blockchain proposals, asserting that Liquid’s established track record offers a level of trust and predictability that newer solutions may lack. “In the grand scheme of things of the new proposals coming up, I think Liquid is here to stay for at least quite a while.”

Emerging standards & interoperability

Discussing the fragmentation within the ecosystem, Michael from Boltz outlined the critical role his company could play in providing liquidity across different chains and services. This ability to facilitate swaps between various Bitcoin layers, such as Lightning, the main chain, and Liquid, is crucial for maintaining a fluid and interconnected ecosystem. By offering these services, Boltz helps bridge the gaps between different platforms, making it easier for users to move assets seamlessly.

Michael also stressed the importance of maximizing competition among service providers to ensure users receive the best market rates. “In the end, an open spec would make sense, but we are so early in this process,” he remarked, highlighting the necessity of experimentation before moving towards standardization. This experimentation phase allows for the identification of best practices, which can then inform the development of standardized protocols.

Tiero from Ark Labs echoed Michael’s sentiments, adding that the diversity of user needs makes it challenging to establish universal standards at this stage. “Every business has its own user and sensibility to their user.” He suggested that a larger, more diverse ecosystem would justify efforts toward standardization, but until then, businesses need the flexibility to innovate and respond to their specific user bases.

Both agreed that the current priority is to allow companies to experiment and innovate freely. “We can move so much faster if we can just try out things ourselves and see where it goes,” Michael said. This approach enables rapid iteration and adaptation, fostering a more robust and resilient ecosystem in the long run.

Innovating with ARK

Tiero from Ark Labs provided an exciting glimpse into their latest project, Ark. “ARK is still in a post-idea stage.” The focus, he explained, is on creating a protocol that integrates seamlessly with existing technologies like Lightning, ensuring that it can effectively serve the needs of its users.

“We managed to show that it is doable, is working. And the thing I think the next step will really be trying to understand what are the real use cases for which demand is huge,” Tiero noted. By focusing on practical applications and real user needs, ARK aims to create a robust, user-friendly protocol that addresses the current limitations in the ecosystem.

Experimentation is a key part of ARK’s development strategy. Tiero emphasized the importance of testing in flexible environments like Liquid before finalizing detailed specifications. “Let’s just go where it’s super flexible and Liquid has introspectional code at the maximum level so you can really do recursive covenants,” he explained. This approach allows the team to explore the full potential of the protocol and make necessary adjustments based on real-world applications and feedback.

Michael noted the uncertainties surrounding ARK’s future use cases and liquidity requirements. “It’s also like unknown unknowns again. In theory, it’s interesting for service providers who have liquidity anyways,” he said, emphasizing the need for further exploration and development.

Optimism for Bitcoin’s Future

Concluding the discussion, both Tiero and Michael expressed a strong sense of optimism about the future of Bitcoin layers and covenant technology. Tiero, in particular, was bullish about the advances being made in covenant technology, viewing it as a transformative force for enhancing protocols like ARK and Lightning. “I’m super, super bullish after these two days because for the first time all the people working with Covenant in production or in general, they’re really, really very knowledgeable about the topic.” He celebrated the opportunity of having experts gather to discuss and refine these ideas in a collaborative environment conducive to groundbreaking innovation.

They also praised specific proposals, such as Rusty Russell’s restoration project, which aims to methodically enhance Bitcoin’s script capabilities. “Rusty’s model gives us actually something to talk about, a frame of reference for what these covenants mean from a computational perspective and like you can actually like I said restore Bitcoin script to its former glory in a safe and sensible manner,” said Michael.

US dollar dips from 8-week high vs yen as intervention fears intensify

Post Content

Give Me Self-Custody Or Give Me Death

It feels like this year is going by at the speed of light, doesn’t it? I can hardly believe that it’s already June. Everyone is in vacation mode and ready to relax by the pool and forget the daily grind of work and taking care of a family.

I completely understand the sentiment. Who doesn’t want to stop thinking about wallet-crushing inflation, high interest rates, credit card debt, and the sense that whatever you do you can’t advance in life? It almost feels like this whole system is rigged against you right?

Well, it is, to be honest, but that’s a story for another time. The powers that be who want you fat, happy, and stupid have largely succeeded in that mission. Now that they have succeeded in dumbing down the populace, they literally can do whatever the hell they want and get away with it with impunity.

The thing is their hubris has gotten the best of them. The Federal Reserve and its zero interest rate policy (ZIRP) royally screwed things up to the detriment of the American people and the federal government.

Before the pandemic of 2020, the government had a hard time keeping the inflation rate around its 2 percent benchmark. Certain economic factors such as improved technology, a declining birth rate, baby boomer retirement, and globalization made it where inflation was trending down over time.

The Federal Reserve, in their infinite wisdom and constantly worried about deflation, kept cutting interest rates to spur borrowing and lending in the American economy, which worked for a time until we got to 2008 and the Great Financial Crisis (GFC).

The increased borrowing and lending overheated the housing market and almost took down the global economy, but luckily we had the “mighty” government to step in a fix a problem they helped create. That being said you would think they would have learned their lesson and got their fiscal house in order.

It’s the government, of course not! They did nothing of the sort, what they did do is keep going on their spending binge through the 2020 pandemic. It didn’t matter what political party was in office, the spending kept going up and up.

Did you know that former President Trump added $8.4 trillion to the national debt while he was in office and President Biden is not faring much better with total debt looking to clock in around the $7.9-$8 trillion mark? Needless to say, the government is broke and is living on borrowed time.

Whoever “wins” the election will be the captain of a sinking ship. Medicare and Social Security are broken and completely unaffordable but politicians don’t dare tell the millions of Americans who “paid” into their entire working lives that there is no pot of money set aside for them and that it was just an elaborate tax scheme to fund the government.

You are NOT entitled to receive social security “benefits”, I hope you know that by now. If the government told you f**k you, you ain’t getting Social Security or Medicare, there isn’t a damn thing you could do about it. There are no lawsuits that you could file to compel the government to give you your money back or elect the “right” congressman to fix things. Once the government taxes your paycheck, that money is GONE forever.

You can’t trust the government to keep its end of the bargain or not to debase the currency and destroy your quality of life. With a government like this, why would you trust them with anything? Self-custody of assets is going to determine the winners and losers over the next 5-10 years.

Storm Clouds Gathering

I don’t know about you but I have this unsettling feeling that we are on the precipice of something major. It is going to be a paradigm shift for the whole world. If you look out over the horizon you can see all the pieces falling into place. Just take a look at what is going on:

The United States government is $34 trillion in debt with no end in sight.

Israel bombing the Iranian military in Syria

BRICS expansion and de-dollarization ongoing

Global birthrate under replacement levels

All across the globe there is open hostility or simmering tensions about to blow out in the open. I’m not sure if this is how the world felt pre-WW2 but it sure feels like the world is coming apart at the seams. With all this going on, how can you trust the current dollar-based system to protect your hard-earned wealth?

Nothing New Under The Sun

If you have large amounts of dollars in the bank, your wealth is at risk. The banks can confiscate or severely restrict your access to your money, especially during a bank run or some other unforeseen crisis. This is exactly what happened in 2013 during the Eurozone crisis.

During this time Cyprus’ two largest banks were in trouble and need of a bailout from the European Union. The Cypriot government was desperate and the EU knew it, so in classic mob fashion, they insisted on the bank conducting a bail-in using customer funds!!

It doesn’t get any worse than this people. According to a 2018 survey, 55 percent of households who were over the $100k threshold in deposits experienced direct financial loss, and 28 percent experienced a bail-in of deposits.

If you think it can’t happen to you, think again. I bet the Cypriots thought it couldn’t happen to them yet it did. Now is not the time to be complacent and think that everything is fine. If you are a Bitcoiner you understand the world we live in right now.

This is why self-custody of your assets, principally Bitcoin is a must if you want to survive the economic armageddon with your wealth intact.

Self Custody Is The Best Tool For Economic Freedom

Satoshi created Bitcoin and gave us the monetary policy that we need to change the trajectory of humanity from endless fiat wars and a dystopian surveillance state to a bright orange future where human potential can flourish.

In addition to creating a just and fair monetary system, Satoshi gave us the ability to self-custody our wealth without the need for a middleman such as a bank. A simple Bitcoin wallet address and your private key are all you need to secure your wealth from confiscation by a malicious third party. This is truly revolutionary, I mean this is a true 1776 moment in history that was fired back on Jan 3, 2009.

Self-custody gives you the ability to move across borders with your wealth and start over in a new place if push comes to shove. You can’t do that with gold, you can’t do that with silver, you can’t do that with your 401k or the brand new shiny Bitcoin ETFs.

Not your keys, not your coin is the mantra that should be drilled into the head of every single new person coming into Bitcoin. Trusting a custodian to hodl your Bitcoin wealth is just as risky as keeping money in the bank.

There is so much educational material and Bitcoiners willing to help people new to Bitcoin that quite frankly it is unacceptable to have anyone holding any amount of Bitcoin on an exchange. If a majority of Bitcoin holders are keeping their coins on an exchange or purchasing a Bitcoin ETF instead of the real deal, what are we even doing here? It’s self-custody or bust. This is the mission at hand. Are you ready anon?

This is a guest post by Robert Hall. Opinions expressed are entirely their own and do not necessarily reflect those of BTC Inc or Bitcoin Magazine.

South African rand falls as traders await cabinet lineup

Post Content

Bitcoin Lightning Alliance To Accelerate Adoption Using New Asset Protocol

A new collaborative effort spearheaded by Lightning infrastructure company LNFi intends to accelerate the adoption of the Lightning Network. Leveraging the progress of novel protocols such as Taproot Assets and Nostr, the LN Alliance hopes to mobilize industry partners and contribute to standards around the growing Bitcoin ecosystem. A recent community discussion highlighted the group’s ambition to promote the emergence of this new Lightning-based, interoperable, financial market.

Behind this initiative, Darius from Lightning infrastructure company LNFi explained his motivation: “Today, the entire Lightning ecosystem is rather fragmented. There are all sorts of standards, protocols out there. The LN Alliance is just there to feature everyone and create enough exposure and awareness of existing Bitcoin, Lightning and Nostr projects on top of these standards so hopefully we can advance forward as a joint community.”

Additionally, by raising awareness around existing tools and protocols, members of the group seek to reduce duplicated efforts, allowing developers to build on what already exists rather than reinventing the wheel.

LN Link is one such standard being developed and promoted by LNFi and its partners. Built as an extension of Nostr Wallet Connect (NWC), it allows Bitcoin applications to easily interface with Taproot Assets, a protocol at the center of the LN alliance’s mission

Preparing for Taproot Asset

One of the driving forces behind this union is the emergence of Lightning Labs’ Taproot Assets. Ryan Gentry from Lightning Labs shared exciting updates on the protocol, revealing that over 150,000 mints have occurred on the protocol since its launch last October. The upcoming release promises to integrate these assets with the Lightning Network, enhancing their usability.

Taproot assets take inspiration from older concepts like Omni and Counterparty’s colored coins but are upgraded for the Taproot era. They allow for advanced scripting and off-chain data commitment within UTXOs, making them highly scalable without adding blockchain bloat. This architecture enables native composability with existing Lightning infrastructure.

“You can use all of the existing LND APIs that you’re familiar with. And all of a sudden you just have an asset ID parameter to tell the software that instead of sending Bitcoin, I want to send this Taproot asset,” said Gentry.

The goal is to make asset issuance and management on Bitcoin more efficient and user-friendly, leveraging the Lightning Network’s capabilities.

Shifting the focus to the maturing Lightning Network infrastructure, Voltage CEO Graham Krizek insisted on the importance of an accessible and reliable network, particularly with the potential integration of stablecoins. “Stablecoins on Lightning is a powerful thing that applies to a lot more people around the world than the network does today.” He emphasized that making the technology user-friendly is crucial for broader adoption.

Joltz co-founder Linden Stark shared practical steps being taken to simplify user interaction with Lightning. Joltz is implementing zero-confirmation channels and submarine swaps to facilitate instant transactions between assets and layers without the need for extensive channel management. “We think zero-conf channels will be best for the majority of users.”

Praising the ability of new Taproot assets to be seamlessly integrated and used for payments, Jordi, founder at FewSats the potential for the Lightning Network to become “a network of networks.”

Banking on Lightning interoperability

Increasingly looked at as a crucial interoperability layer, Lightning has recently established itself as the connective tissue between the supporting pieces of the broader Bitcoin ecosystem.

“I think we’re going to see a big trend over the next couple of years of Lightning swap services that are interfacing, similar to how Boltz is powering Aqua wallet. Users have funds on Liquid, and don’t have a Lightning channel at all, but can pass in and receive over the Lightning Network via a Boltz swap service.,” said Ryan Gentry from Lightning Labs.

Other participants in the discussion corroborated the expectation for Lightning to become the interoperability layer connecting users and services of other supported networks. The network effects of Lightning are expected to grow as these new environments utilize it for interoperability. For instance, a swap service could manage stablecoin transfers across various platforms, simplifying the user experience.

Combining Nostr Wallet Connect and Taproot assets can improve user experiences so that users are able to transact across different asset types without worrying about the underlying complexities. “You can pay an invoice seamlessly, even if the recipient wants a different asset,” said Jordi from Fewsats. This functionality hints at an important evolution of how asset exchange might operate, reducing the reliance on centralized intermediaries.

Joltz is one company that is actively building the necessary infrastructure to support this interoperability. By developing an SDK that allows wallets to integrate with swap providers easily, Joltz aims to streamline the process of connecting various sidechains with the Lightning Network. Highlighting the efficiency gains from using Lightning as a central hub. Joltz co-founder Linden Stark remarked: “It really doesn’t make sense to integrate each sidechain individually.”

Incentivizing financial opportunities

To further the success of its initiative, LN Alliance members discussed ways to incentivize the development of this infrastructure. One of the most common ways to benefit from the Lightning Network’s economic activity is through the yield opportunities created by routing fees or channel leasing.

Jesse Shrader, founder of Amboss explained that while yields from routing payments have historically been modest, Taproot assets are expected to drive significant volume, thereby increasing the usage of scarce liquidity on the network. “We’re focused on opportunities for routing payments and leasing liquidity.” Amboss’s efforts with their Magma marketplace and Hydro liquidity management tool aim to simplify liquidity management for merchants and enhance yield returns by driving more payment volume through the network.

Noting the uneven distribution of yield from routing fees, Ryan from Lightning Labs emphasized the goal of providing equal access for all participants to earn yields by forwarding payments on the Lightning Network. “Taproot assets will introduce new services and opportunities for entrepreneurs,” Ryan noted, predicting that the increased activity from Taproot assets will benefit even those who do not directly engage with these assets.

Other speakers rallied behind the idea that the new protocol would attract many entrepreneurs to build dynamic ecosystems, particularly around stablecoins, which could eventually drive up economic activity. Supported by new markets around Taproot assets, new businesses such as swap providers or market-making activities might open new revenue streams for Lightning node operators.

The LN Alliance is yet another sign of the growth of the Lightning Network industry. After early headwinds caused by a nascent infrastructure, the introduction of Taproot Assets potentially marks the beginning of a new era of financialization using Bitcoin’s most native protocol. With increased focus on interoperability and new financial opportunities, the LN Alliance hopes to grow the economic pie and pave the way for more vibrant and efficient Bitcoin financial markets.

LNFi is a portfolio company of UTXO Management, a regulated capital allocator focused on the digital assets industry. Bitcoin Magazine is owned by BTC Inc., which operates UTXO Management. UTXO invests in a variety of Bitcoin businesses, and maintains significant holdings in digital assets.

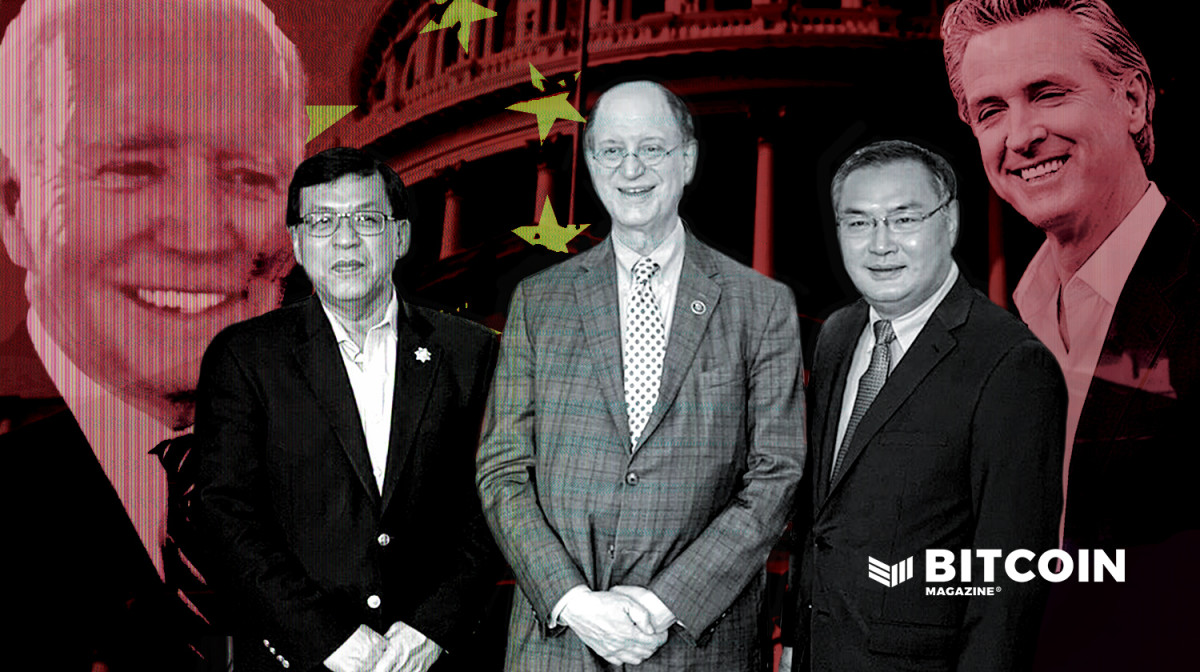

A Large Donor to Anti-Bitcoin Rep. Brad Sherman Coordinates With China’s “Magic Weapon” to Influence US Politicians, Including President Biden and Vice President Harris

In 2018, one of the largest donors to Rep. Brad Sherman’s campaign was a bank director who had spent large sums of money to build political influence among American politicians — and who led a US-registered non-for-profit that “signed a MOU of friendly cooperation” with a Chinese state entity alleged by the US State Department to “malignly” influence local and state authorities — a branch of the Chinese People’s Association for Friendship with Foreign Countries and part of the United Front Work Department (UFWD) responsible for “co-opting and neutralizing threats to the party’s rule and spreading its influence and propaganda overseas,” as alleged by the State Department. His name: Simon Pang of the Royal Business Bank.

The Chinese People’s Association for Friendship with Foreign Countries (“CPAFFC”) draws its leadership from the Chinese political elite — including former ambassadors and the children of important Party leaders. According to Ann Marie Brady, an expert on the topic, it has a main goal of 洋为中用, or “making the foreign serve China”. It is affiliated with the Ministry of Foreign Affairs of the People’s Republic of China (“MoFA”) – its last two chairs have been former ambassadors and it has “oversight and management by China’s Ministry of Foreign Affairs and staffing by foreign-affairs cadres”.

MoFA is the first-ranked executive department of the State Council that governs China, roughly an equivalent to the US State Department. Under Xi’s rule, the United Front, an effort to cultivate foreign communities and elites for Chinese state interests, has grown in scope and importance and has been described as “China’s magic weapon”. The CPAFFC is described as the “public face” of the United Front Work Department by senior figures at the Heritage Foundation and Asia Society, and it is alleged that it is the main force behind “united front work” designed to exert Chinese state objectives through the use of influence abroad. Its aim has been described as pushing “the CCP’s political agenda on the subnational level and [to] bypass official diplomatic channels by using foreign “friends of China”.

In Canada, China was alleged to be the main perpetrator of “foreign influence in elections” in the last two elections. The former opposition leader testified that this probably led to the “loss of up to nine seats” for his party. The investigation into the matter has now led to a report that alleges that Canadian lawmakers covertly worked with foreign governments, most notably China. In Europe, an aide for a Member of the European Parliament was arrested under suspicion for spying for China, and his boss was placed under investigation for alleged payments from the Chinese state. Perhaps this rising level of assertiveness is why President Biden has warned President Xi not to interfere in the upcoming presidential elections.

Simon Pang meets with President Biden, Photo Credit: https://usa-rc.com/blog/build-your-dream-20230530/Simon Pang meets with Governor Newsom of California, Photo Credit: Baidu – https://image.baidu.com/search/detail?ct=503316480Simon Pang meets with Mayor Bass of Los Angeles. Photo credit: https://k.sina.cn/article_6547448743_1864223a702001g3sm.html?from=international

Rep. Sherman has long been an anti-Bitcoin advocate who has alleged that tax laws would not be enforceable because of the lack of transparency around Bitcoin. He draws most of his support from the Securities and Investment, Finance and Real Estate sectors consequently. The Royal Business Bank is no exception to this tendency.

Rep. Brad Sherman met with Simon Pang and Chinese state officials at least once. In a June 1, 2019 Facebook post, he shared that he had met the Consul General and Deputy Consul General to discuss US-China issues with Mr. Simon Pang. By that time, Royal Business Bank had donated $16,600 to his campaign, and would donate $5,700 after.

Simon Pang meets Rep. Brad Sherman along with Chinese diplomatic officials, Photo Credit: Author screenshot

How did Simon Pang, a director at a community bank with an approximately $300 million market cap in the United States, nowhere near even the top 100 banks in the United States by size, become an institution that could sign a memorandum of understanding with a prominent branch of a Chinese United Front work department, be hailed and honored by two chairs of the public face of Chinese influence abroad, be a part of a meeting with Chinese diplomats and American politicians like Rep. Sherman, become Rep. Judy Chu’s +1 to the Obama-Xi 2015 state dinner, be highlighted by Vice President Kamala Harris as a “friend for so many years” who has stayed “involved in such an extraordinary way”, and meet President Xi Jinping one-to-one to discuss “California’s sole presence” at President Xi’s “personal project” — the CIEE Forum to boost imports to China — a 1:1 meeting often coveted but often denied to America’s most powerful corporate leaders?

Simon Pang with Rep. Judy Chu, U.S. representative for California’s 28th congressional district as her +1 for the 2015 Obama-Xi state dinner. Photo credit: Getty Images – https://www.gettyimages.ca/detail/news-photo/representative-judy-chu-a-democrat-from-california-left-and-news-photo/490149968

Perhaps it has something to do with the volume of donations Simon Pang (冯振发 in Mandarin) is correlated with, along with money from multiple entities and the influence he is able to bring to bear with his high-level relationships with the Chinese political and business elite and his ability to bridge them with high-ranking American politicians. He is president of the US-Sino Friendship Association, a small but mighty organization of three.

In total, Simon Pang and the Royal Business Bank he co-founded has made at least $1.42mn in federal contributions, along with numerous state and local donations since September 27th, 2011. During that time period, East West Bank, a large Chinese-American community bank which has about 333x the market capitalization of Royal Business Bank ($10bn vs ~$300mn) and at least 18x the number of employees on LinkedIn had made (half) the number — $745k — in political contributions as RBB. The Royal Business Bank punches way above its weight class here and much quicker (2.5% of federal contributions from East West Bank were 2k and above, while for RBB that figure was nearing 35%) – and that probably allowed its directors to book meetings and garner influence with American politicians – most notably Simon Pang.

Royal Business Bank is also in the business of expanding rapidly around the United States. For example, it purchased Gateway Bank and other banks like it from Pacific Global Bank in Chicago to First American International Bank in New York City. In its S-1 filing with the SEC, RBB also described how a core group of funders that raised $70 million de novo in the depths of the Great Financial Recession (“at that time, this was the largest amount of capital raised by any de novo institution in California”) to form the Royal Business Bank “have also assisted our management team in establishing and growing strong connections with businesses located in China and Asia, as well as at high levels of government in China and Taiwan.“

Simon Pang has since retired from Royal Business Bank, but continues to make significant donations as a “Bank Director” at Bank of the Orient and a “Bank Senior Advisor” at New Omni Bank.

Helen Hong Yu is the second member and the secretary of the US-Sino Friendship Association. She owns the Torchwood company and has donated under the Royal Business Bank as well. She sometimes donates under the name Helen Yu or Helen Hong Yu, but often uses the same addresses for those donations. Torchwood may be a reference to the Torchwood Institute — a fictional secret organization in the Doctor Who series that nominally protects the human race against aliens but in reality is trying to (secretly) restore the glory of the British Empire.

In 2015, she received $24,000 in salary for her work as the Secretary of the US-Sino Friendship Association, which spent most of the other funds raised that year for arranging a “delegation to China to promote tourism and trade” and attending the “Annual International Friendship Conference” — likely a reference to the Chinese state sponsored China International Friendship Cities Conference. In total, through her companies Torchwood Inc. and the Royal Business Bank, she has made at least $100,000 in federal contributions. She put the same address for her Torchwood contributions as she did with her Royal Business Bank contributions — 2801 Sepulveda Blvd, Unit 115, 90505-2865. This address is an upscale residential condo with three bedrooms and three bathrooms. The Torchwood corporation is now registered at 2877 Maricopa Street, Torrance, California, 90503 but was incorporated at the 2801 Sepulveda address. This is a 4 bedroom, 3 bathroom house. The Torchwood company itself is listed as a “trading company” on a statement of information.

Kevin Xu is the CEO and the owner of Mebo International and Mebo Group. He has been profiled multiple times as the owner of LA Weekly (this same article lists his mother as Lily Li), and a donor of $1 million to San Francisco in order to be able to host the APEC event. He subsequently became the chair of the APEC Host Committee in 2023, the same event that set the stage for President Xi Jinping‘s first visit to the United States since 2017. He is also listed as the CFO of the US-Sino Friendship Association in some of the initial filings for the organization. A social media profile associated with the Mebo International name posted that in July 3rd, 2017, they were waiting on regulatory agencies in the US to launch. The same page is tagged by the USC Alumni Association with Kevin Xu’s personal profile tagged as well.

Posts from the Mebo International Facebook page, Photo credit: Author screenshotPosts from the Mebo International Facebook page, Photo credit: Author screenshot

Before this post advocating for California secession, MEBO International had made about $620,000 in federal contributions, including a $100,000 donation to the Hillary Victory Fund. There were also three donations made under the “MEBO Group” name by his mother, Lily Li, between 2016 and 2017 totalling $14,000. The MEBO Group is the name of the company that “was selected by the Ministry of Health of the P.R.C. to be one of the first ten major medical technologies being promoted and popularized across the grass-roots of the country” and is based in Beijing. During that time period, there were no active California-incorporated “Mebo Group” companies called exactly that. The GLOBAL MEBO GROUP INC. (2024634) was terminated in 2002. The MEBO GLOBAL GROUP (4238235) was only incorporated in 2019. The MEBO JINDE MEDIA GROUP INC. (3943622) was active around that time, but the donations did not specify Mebo Media. Overall, both either Kevin Xu and his mother Li Li have both incorporated 14 Mebo entities in California — while its main “International” entity had the ability to make more than half a million dollars in political contributions while “waiting on regulatory authorities”.

The contributions of this small-but-mighty band of the US-Sino Friendship Association are correlated with large sums of donations from others as well. Examples of this include Yeh Shan, who will sometimes donate as a banker at Royal Business Bank or sometimes under multiple telecommunications-related companies such as MY WIRELESS. In one instance, Yeh Shan donated to the Kaine for Virginia fund as “Sales” for MY WIRELESS at the exact same address as they used for a donation to Sherman for Congress under the “Banker” title at Royal Business Bank. This address, 81 Royal Saint George Rd, Newport Beach, CA 92660, appears to be a private residence, a 6,600 square foot mansion estimated by Zillow to be worth about $7 million.

It is unclear exactly what roles figures like Yeh Shan and Helen Hong Yu exactly hold at Royal Business Bank, given that they put their role in FEC disclosures as “BANKER” and “BANK OFFICER” and seem to also own and direct multiple companies at the same time. A public LinkedIn search found no record of a Helen Hong Yu or Yeh Shan working at Royal Business Bank in current or past roles.

Neither was this level of spending confined to federal political contributions either — with the LA Mayor’s Fund listing Simon Pang as a contributor in their 2023 Annual Report. A quick scan of public state and local political contributions databases shows Simon Pang, Helen Hong Yu and Kevin Xu popping up multiple times. For example, contributions in the hundreds of thousands have been marked in the California contributions database. While their names are sometimes conflated, with others (especially Helen Yu, with a lawyer that works at Yu Leseberg having made $13,100 in contributions), their donations stand out through their employers – the same ones they use for federal contributions, most notably Royal Business Bank.

Screenshots of the California contributions database, photo credit: Author screenshotScreenshots of the California contributions database, photo credit: Author screenshotScreenshots of the California contributions database, photo credit: Author screenshot

Kevin Xu has his own website listing his philanthropic initiatives, including support for the Obama Foundation, the Clinton Foundation, the Bay Area Council, Harvard Medical School and the Rhodes Trust. He also serves on multiple roles in media organizations, and has donated to universities such as Harvard Medical School.

Kevin Xu with President Clinton, Photo credit: https://kevinxu.wiki/

In Ann Marie Brady’s report, two prime objectives of President Xi’s CPAFFC are to “Appoint foreigners with access to political power to high profile roles in Chinese companies or Chinese-funded entities in the host country. Use sister city relations to expand China’s economic agenda separate to a given nation’s foreign policy. The CCP front organization, the Chinese People’s Association for Friendship with Foreign Countries, is in charge of this activity.”

As an illustrative example of both, Simon Pang has coordinated large tours of Chinese cities for American politicians with the CPAFFC, such as this tour of Chongqing with 17 California politicians including El Segundo Mayor Drew Boyles and Sydney Kamlager-Dove, the current House representative of California’s 37th Congressional District. He also hosted Rep. Jimmy Gomez and at least six California politicians in Jiangsu. In this vein of introducing US mayors to Chinese interests, Simon helped arrange a meeting between the Chinese Faraday billionaire founder and North Las Vegas mayor John Lee.

Simon Pang coordinating a tour of Chongqing’s Stilwell Museum with California lawmakers. General Stilwell was the Allied Chief of Staff in the China Theater during WW2. Photo credit: https://zfwb.cq.gov.cn/zwxx_162/wsyw/201912/t20191224_2695441.html

As the mayor himself put it in an op-ed: “One very important guest at the event was my good friend Simon Pang. When we were scouring the world looking for a business to come to North Las Vegas, Simon told me about Faraday. Nobody in Nevada had heard of Faraday until Simon introduced me to them, and our city and state are forever indebted to him.” Simon Pang had made at least $5,000 in contributions to Mayor Lee as well. As US intelligence warns on foreign influence from China: “Financial incentives may be used to hook U.S. state and local leaders, given their focus on local economic issues.” and that China “understands U.S. state and local leaders enjoy a degree of independence from Washington and may seek to use them as proxies to advocate for national U.S. policies Beijing desires.”

A delegation of California lawmakers meets Simon Pang and Kevin Xu at Mebo Group’s office in China. Photo credit: https://www.mebo.com/detail/index/sign/ad8b4d9db5824808d12850cc063776d1.html

He also cultivated a relationship with John Chiang, the former state treasurer of California and a gubernetorial candidate. Simon Pang’s organization helped coordinate a trip with the CPAFFC for John Chiang, who served on a board with Simon in Chijet Motor Company Inc. – perhaps an example of appointing “foreigners with access to political power to high profile roles.”. Chijet “is partnered with FAW Group (“FAW”), one of the ‘Big Four’ auto manufacturers in China”.

Simon Pang in a group shot with John Chiang, 33rd Treasurer of California, and Rep. Ted Lieu, US House of Representatives Member for California’s 36th congressional district and Vice Chair of the House Democratic Caucus, Photo Credit: US News Express

These two examples are a small preview of the work that have led to Simon being hailed by previous CPAFFC chair Li Xiaolin, the daughter of one of the most powerful men in China during the 1980s, for his work and designated an “honorary overseas director” by her successor, Lin Songtian, who was once China’s “brash” ambassador to South Africa.

Archived Google result detailing CPAFFC President Li Xiaolin praising Simon Pang, Photo credit: Author screenshot

Simon Pang was also honored by then-Vice Minister of Foreign Affairs for the People’s Republic of China Zheng Zeguang, considered to be a leading expert on US-China relations and once a leading contender to be China’s ambassador to the United States after multiple postings in the United States. Instead, Zheng Zeguang was appointed the ambassador to the United Kingdom, where he was recently summoned to deal with foreign espionage charges on British soil from Hong Kong intelligence services.

“On July 30, 2018, Vice Foreign Minister Zheng Zeguang, on behalf of the Ministry of Foreign Affairs, accepted a RMB 600,000 poverty alleviation donation from Feng Zhenfa, President of the “US-China Friendship Association”, on behalf of the association to the Ministry of Foreign Affairs’ Poverty Alleviation Office, and presented him with a “Certificate of Honor” and a letter of thanks.” Photo and caption credit to: https://news.sina.cn/2018-08-03/detail-ihhehtqh4932666.d.html

What was the ultimate goal of this largess and influence-building in coordination with Chinese state organs and applauded by senior figures in China’s foreign policy apparatus? It’s possible that this was an organic effort on everybody’s part to cultivate good business and political ties — albeit a relatively expensive one — the sort of traditional “relationship-making” that might be seen in certain banks.

Simon Pang presented a certificate of being an “honorary overseas director” by then-CPAFFC chair Lin Songtian. Photo credit: https://mp.weixin.qq.com/s?__biz=MzIwNTQ0OTYwNg==&mid=2247552559&idx=2&sn=61e11e9f25d804478fcf4eab5c7139ac

Yet this pattern seems to have hit on a vulnerability inherent in the US electoral system and financial system: first, harnessing state and local benefits among somebody who seems incredibly well-connected with Chinese billionaires and who makes good contributions too, then moving to an amount of contributions in federal elections that would be enough to get meetings with the right people. Members of Congress could notice you being one of their largest donors at the approximately $10k mark and take meetings and trips with you to China. All of this proceeded with the regular banking system and a donor institution that was a bank itself, and this activity doesn’t appear to have drawn any notable public scrutiny through more than a decade even though the bank was a publicly traded company.

Simon Pang signing a MOU on behalf of the US-Sino Friendship Association, Photo credit: https://zfwb.cq.gov.cn/zwxx_162/wsyw/201912/t20191224_2695441.html

Simon Pang is from Singapore and has 38 years+ of banking experience — and it is assumably good business to be immensely politically connected in banking. He previously worked as the SVP of United Commercial Bank, which failed after fraud convictions of senior leaders, the hardship of the 2008 Recession, and a failed takeover bid by Minsheng Bank, China’s first private-owned bank.

Perhaps this was indeed a private, unsupervised but coordinated attempt to curry favor and support China and American authorities in order to build his banking practice and protect himself from the experience of United Commercial Bank. No matter the intent, however, significant funds were being spent towards contributions with someone who coordinated closely with an “organization tasked with co-opting sub-national governments” as alleged by the US government – and some of those funds went to Rep. Sherman.

Simon Pang at a Chinese political gathering, Image credit: Baidu – https://image.baidu.com/search/detail?ct=503316480

It appears that Rep. Brad Sherman was somebody that was in the sights of this network of influence as it looked to expand beyond local and state politics to federal and presidential. In 2018, his third largest donor was Allied Wallet, who were indicted but not ultimately found guilty of using straw donors. His second largest donor in the 2018 electoral cycle was Royal Business Bank.

Simon Pang donating PPE in the United States with the CPAFFC and Consulate General of China. Photo credit: JoinLASD, X – https://encrypted-tbn0.gstatic.com/images?q=tbn:ANd9GcQrPNflEuTQVYFmMl6P9r3ALmjMlUEG9tV7Oc3Cn_iDTRri-hNp,Author screenshot

Commenting on his guided tour to Chongqing, Simon Pang said that politicians were able to see “a different version of China”. One might ask if Rep. Sherman was presented that version – along with the many other local, state, and federal politicians from mayors to Presidents Simon Pang has donated to – such as $10,000 to President Trump’s victory fund, and significant personal contributions to Speaker Nancy Pelosi (at least $39,400) and Secretary Hillary Clinton in her presidential campaign (at least $14,700). While he has donated to Republicans, the majority of his donations favor Democratic legislators or state parties. It might be asked for President Biden’s cabinet as well – with Simon posing with US Trade Representative Katherine Tai, “the principal trade advisor, negotiator, and spokesperson on U.S. trade policy.”

Simon Pang in a meeting with USTR Katherine Tai, the member of President Biden’s cabinet responsible for US trade policy. Photo credit: http://www.chinesenewsusa.com/news/show-35395.html

In 2021, Simon Pang was appointed to the President’s Advisory Commission on Asian Americans, Native Hawaiians, and Pacific Islanders by President Biden. As of today, Simon Pang had personally donated at least $132,500 to fundraising efforts for President Biden, and at least $2,800 in federal contributions and just under $335,000 in California state contributions, spread to many of her political allies, for his “friend for so many years”, Vice President Harris.

Simon Pang meeting with President Obama, Photo credit: https://www.sohu.com/a/359650771_120325604Simon Pang meeting with former House Speaker Newt Gingrich, Photo credit: Baidu – https://image.baidu.com/search/detail?ct=503316480

Simon Pang with President Biden. Photo credit: @Jerry_C_Lynn, X

Simon Pang with former Hong Kong Chief Executive Carrie Lam after her meeting with President Xi Jinping, Photo credit: @Jerry_C_Lynn, X

Simon Pang sitting next to 77th United States Treasury Secretary Steven Mnuchin, Photo credit: @Jerry_C_Lynn, X

This is a guest post by Roger Huang. Opinions expressed are entirely their own and do not necessarily reflect those of BTC Inc or Bitcoin Magazine.

Mt. Gox to Start Bitcoin Repayments in July

Defunct Bitcoin exchange Mt. Gox said it would begin distributing assets stolen from clients in a 2014 hack starting in July, after years of postponed deadlines.

JUST IN: Bankrupt Mt. Gox will begin $9 billion #Bitcoin repayments in July 👀 pic.twitter.com/Rph2AupnTY

— Bitcoin Magazine (@BitcoinMagazine) June 24, 2024

“The Rehabilitation Trustee has been preparing to make repayments in Bitcoin and Bitcoin Cash under the Rehabilitation Plan,” trustee Nobuaki Kobayashi said in a statement posted on the Mt. Gox website today.

“The repayments will be made from the beginning of July 2024,” Kobayashi added, noting due diligence and safety steps are still required.

Mt. Gox was once the world’s largest Bitcoin exchange, handling over 70% of all Bitcoin transactions in its early years. In 2014, hackers stole around 740,000 bitcoin, worth $15 billion today, in one of many attacks on the exchange from 2010-2013.

After declaring bankruptcy in 2014, Mt. Gox has faced numerous delays in repaying victims. Last year, the Tokyo court set an October 2024 deadline for the exchange’s civil rehabilitation plan.

In May, Mt. Gox moved over 140,000 BTC, worth around $9 billion, from cold wallets for the first time in five years. The transactions were likely preparations for repayments.

The upcoming payouts will be made in Bitcoin and Bitcoin cash through exchanges that Mt. Gox has partnered with. The order will depend on the progress of required due diligence with each platform.

Victims have waited over ten years to recover funds lost when Mt. Gox collapsed. For many, this July start date finally offers hope they will recoup stolen savings.

The reimbursements are expected to distribute 142,000 bitcoin, 143,000 bitcoin cash, and 69 billion Japanese yen owed to around 127,000 creditors.

While long anticipated, some worry the large payouts could momentarily weigh on Bitcoin’s price if victims sell part of their returned funds.

Nonetheless, affected users are eager to move on after Mt. Gox’s hack and failure became symbolic of Bitcoin’s early days. The repayments represent an ending chapter in Bitcoin’s history.