Month: April 2024

Dollar dips, yen steady after inching near 152 level

Post Content

Largest US Crypto Exchange Coinbase To Integrate The Bitcoin Lightning Network

Lightspark, led by CEO David Marcus, former President of PayPal, has been selected by Coinbase, the largest US cryptocurrency exchange, to integrate the Bitcoin Lightning Network onto its platform. This integration is set to enable Coinbase customers to conduct instant and cost-effective bitcoin transactions.

Thrilled to announce that @Coinbase has selected @Lightspark to enable the #Bitcoin Lightning Network across its platform and services. Yet another significant milestone for Lightning! ⚡to many millions of new people and 100+ countries coming soon! https://t.co/Dj5JDqdmOl

— David Marcus (@davidmarcus) April 3, 2024

“Coinbase is committed to making the global financial system faster and more efficient,” said Shan Aggarwal, VP of Corporate & Business Development. “We’re excited to partner with Lightspark to eliminate payment barriers and enable faster and cheaper Bitcoin transactions through support for the Bitcoin Lightning Network.”

Lightspark has dedicated nearly two years to developing its platform as a premier entry point to the Lightning Network, catering to the needs of institutional clients seeking reliable and efficient solutions for Bitcoin transactions. The integration with Coinbase includes Lightspark’s sophisticated tools and services, such as SDKs, APIs, and developer tools, which simplify the process of implementing and managing Lightning nodes.

One key aspect of the integration is Lightspark’s remote-key signing implementation, where Coinbase holds the Lightning signing keys while Lightspark hosts the Lightning node. This setup aims to ensure scalability, reliability, and optimization of node infrastructure, allowing Coinbase to focus on delivering exceptional user experiences without the complexities of managing a large-scale Lightning implementation.

“It was a pleasure to get to know David and the entire team at Lightspark,” said Coinbase Protocol Specialist, Viktor Bunin. “They’ve built great tech, are great to work with, and we’re excited to partner with them to launch Lightning support soon™.”

Todays official announcement comes almost a full year after Coinbase CEO Brian Armstrong committed to integrating the Lightning Network onto the exchange. The integration is now coming at a crucial time, considering the increasing demand for efficient Bitcoin transactions amid rising Bitcoin prices and transaction fees. Coinbase facilitates a major $154 billion in quarterly volume traded across its platform, and will now give its customers access to cheap and efficient Bitcoin transactions to help further improve scalability.

As Halving Approaches, Miners Turn Record Profits into New Strategies

The below is an excerpt from a recent edition of Bitcoin Magazine Pro, Bitcoin Magazine’s premium markets newsletter. To be among the first to receive these insights and other on-chain bitcoin market analysis straight to your inbox, subscribe now.

With Bitcoin’s next halving set to take place this month, miners are using record profits to adapt their business models for chaotic opportunities.

The halving is almost upon us. As the whole world of Bitcoin waits with bated breath for mining rewards to be cut in half, the potential for new revenue streams has left us wondering how the space will react to new market conditions. Halvings in the past have generally been associated with prosperity for Bitcoin, but they’ve also been known to shake up previously-held assumptions in a big way. We’re already seeing a few examples of these market changes; just to name one, the larger miners have been modernizing their equipment to ensure maximally efficient hardware. This has led to a fire sale of outdated equipment from these companies, with many thousands of mining rigs finding their way to aspiring miners in Africa and Latin America. The cheap hydroelectricity from Ethiopia has already been attracting international capital to become a new mining hub, and a large portion of these rigs are going there for pennies on the dollar.

In other words, miners are expecting to see less output in the immediate future, but this has nevertheless incentivized the creation of new mining companies worldwide and net growth for the industry. This is just one illustration of the sorts of unexpected opportunities that will take the digital asset space by storm, and it’s up to Bitcoiners to seize on them. For miners as a whole, opportunities are certainly plentiful. March 2024 saw the highest ever monthly revenues for the collective mining industry, just topping $2 billion. This is particularly noteworthy because less than half of this revenue has come from transaction fees, a far cry from the situation in December where transaction fees outpaced mining rewards.

In December, the price of Bitcoin was far lower, and the blockchain was plagued with congestion. Not only did this congestion suppress the demand for buying Bitcoin, but it also raised the demand for miners to process the blockchain. Simply resolving transactions on already-mined Bitcoin made up a larger share of profits than mining and selling new ones, and this enterprise became a lifeline for many smaller firms. Now, however, it seems like the money is flowing all around. Bitcoin ETFs are gobbling up Bitcoin at extreme rates—more than 6x the actual output of miners. The bonanza has even brought venture capital interest squarely back into focus, further increasing the frenzy. In the first three months of 2024, major exchanges collectively saw their reserves of Bitcoin drop by nearly $10 billion, revealing the immense demand for newly-mined coins. With market conditions like this, it’s no wonder that miner profits have hit an all-time record.

However, although this period of intense sales has certainly created an opportunity for the miners, there are also perils associated with the halving. These companies are in a mad dash to secure as much revenue as possible pre-halving, and the race is so desperate for one simple reason: trendlines may give encouraging data, but there’s no actual guarantee that Bitcoin’s price will climb accordingly after its supply is cut down. Halving hype and the runaway success of ETFs have brought Bitcoin’s price to its highest levels, but this record has been followed by volatility. Bitcoin has hovered around its great benchmark ever since passing it without continuing to rally in a bombastic spike. If Bitcoin’s price continues to behave in unexpected ways, it will eventually wreak havoc on smaller firms and promote industry consolidation.

Additionally, a particularly interesting development has emerged in the secondary Bitcoin markets. Since the rapacious demand of ETF issuers and other financial institutions has completely outpaced supply, some long-term holders (LTHs) have been awakening to fears of a generalized liquidity crisis. Whales previously content to hold Bitcoin for years at a time have changed their behavior, evidently deciding that now is the time to finally realize massive profits. March 2024 has seen long-term holders begin selling their assets at unprecedented rates, raking in a disproportionate amount of profit in relation to other Bitcoin sellers. Obviously, a resource like this cannot last forever, but it’s an important reminder to some of the miners: just because you’re having trouble making ends meet post-halving, it doesn’t mean the industry is. Adapt, or the space will find new ways to leave you behind.

Nevertheless, miners big and small have not taken on the challenge of the halving lying down. These runaway profits have enabled businesses to invest in a wide variety of preparation strategies, sometimes even dramatically shaking up their business models. For example, the American firm Arkon Energy has previously operated more as an infrastructure company, viewing itself as a provider for a client base of independent miners. As it announced a major purchase of state-of-the-art mining equipment on April 2nd, it joined an industry-wide trend of preparing for the halving with maximally efficient machines. Rather than offering this equipment to its previous clientele, however, Arkon has stated its intention to pivot and simply mine Bitcoin themselves. This simple shift represents a dramatic change in their overall business model, and they plan to follow through by “aiming to make Arkon one of the most efficient miners in the world”.

Leading miner Hut 8, on the other hand, has initiated a business model pivot of its own, but in a slightly different direction. A Q1 earnings call in late March saw CEO Asher Genoot acknowledge that 70% of the company’s revenue came from asset mining, but that plans were expected to change somewhat as the halving approaches. Hut 8 is still focusing on upgrading its hardware and exploiting energy resources at new sites, like many other mining companies, but it’s also investing in a new direction. This new direction is not in a different asset, as its mining operations are focused on Bitcoin, but rather in developing high-performance computing and AI operations. Genoot claimed that these new operations were “sub-scale today… But we are excited about that business because we see it as a foundation to be able to grow.” He added that “You’ll see us continuing to be creative in how we maximize the value of every machine,” stressing the need to maintain an eager and disciplined attitude toward the existing mining operations.

These are just a couple of the different new strategies that miners are taking to anticipate the halving. Companies have been preparing for months now, and there is still time to make additional new plans. At the time of writing, the halving is in less than three weeks, and the countdown to this event reveals the optimistic and celebratory attitude of Bitcoiners everywhere. No matter what happens when the long-awaited day finally gets here, a few constants seem very reliable. There will be an immense demand for the world’s leading digital asset, and the Bitcoin community will have the same innovative spirit as always. Whether Bitcoin jumps right away or behaves unpredictably, it’s certain that someone will wind up a big winner. For us Bitcoiners, that means there’s plenty to look forward to.

Genesis Digital Assets Leverages Renewables to Increase Bitcoin Mining Capacity at New Texas Facility

Today, one of the largest bitcoin mining companies in the world in terms of hash rate, Genesis Digital Assets (GDA), announced that it will gain access to 36 MW of power from the Tarbush data center in West Texas, adding 1 EH/s to its total hash rate capacity.

GDA, which was founded in 2013 and operates 19 mining facilities across North America, Europe and Central Asia, has entered into a strategic hosting arrangement with Lonestar Dream, developer of immersion cooling systems for bitcoin mining devices, to run the Tarbush operation.

“This hosting agreement is an important milestone for us as we continue expansion in the West Texas region,” said Andrey Kim, CEO of GDA in a press release shared with Bitcoin Magazine.

This is the 6th new site in Texas into which GDA has expanded in recent years. The state’s abundance of renewable energy and its flexible power grid have prompted the company to continue expanding in Texas.

Tarbush is located within the ERCOT West Hub, which is well-suited for wind and solar energy production. As of Q1 2023, ERCOT, which stands for the Electric Reliability Council of Texas, was the top region for renewable energy generation output across the US, according to S&P Global. And PBS recently acknowledged that Texas, a state once well known for its oil production, is quickly becoming a leader in renewable energy.

According to ERCOT, renewable resources like wind and solar normally meet approximately 40% of the energy demand in Texas. During some periods, though, they can meet as much as 75% of the demand.

Wind, solar, and a tiny bit of hydro met 75% of power demand in ERCOT today a little after 2:00, a new record. Add in nuclear and the Texas grid was more than 80% emissions-free for most of the afternoon. And again, prices were $0. Clean power is low cost power. #txlege #txenergy pic.twitter.com/rtbPBWnZMA

— Doug Lewin (@douglewinenergy) March 29, 2024

“We believe that our commitment to renewable energy and utilization of some of the most advanced technology in the bitcoin mining industry empowers us to engage in efficient and reliable bitcoin mining operations,” Kim added.

For more information on GDA, visit the company’s website.

$111 Billion: Bitcoin ETFs See Record Volumes in March

Spot bitcoin exchange-traded funds (ETFs) saw their trading volume surge to a record $111 billion in March, nearly triple the $42 billion traded in February.

Approved earlier this year by the SEC, US spot bitcoin ETFs have rapidly gained traction among investors. Their volumes last month exceeded even the most optimistic expectations.

NEW: #Bitcoin ETFs saw a record volume of $111 BILLION in March.

That’s TRIPLE the inflows from February 🤯 pic.twitter.com/Ol1PaS8vC9

— Bitcoin Magazine (@BitcoinMagazine) April 3, 2024

According to Bloomberg ETF analyst Eric Balchunas, March trading volume was around triple that of February and January. The massive rise indicates spot bitcoin ETFs are meeting strong demand from institutional and retail investors.

He stated, “I can’t imagine April will be bigger, but who knows.”

BlackRock’s Bitcoin ETF (IBIT) led the pack, capturing 50% of the total volume. Grayscale’s GBTC took second place with 20%, while Fidelity’s FBTC followed at 17%.

Balchunas declared IBIT the “$GLD of bitcoin,” referring to the mammoth SPDR Gold ETF. He said its March victory makes IBIT the undisputed leader among bitcoin ETFs.

The surge in trading activity aligns with Bitcoin’s climb to new all-time highs in March. However, it also suggests spot ETFs are altering market dynamics and driving new demand.

Critics initially argued bitcoin markets would shrug off the new products. Yet flows into funds like IBIT and FBTC have been overwhelmingly positive.

Demand is vastly outpacing bitcoin mined. ETFs bought around 66,000 BTC in March, while miners only produced 28,500. This supply-demand imbalance seems poised to grow as more investors get exposure through ETFs and newly mined coins get cut in half in two weeks during the bitcoin halving event.

With strong inflows, assets under management, and trading activity, these new regulated instruments have firmly established themselves within Bitcoin markets. If March was any indication, their rise is only just beginning.

Dollar edges lower, but still at elevated levels ahead of Fed speeches

Post Content

Exclusive-India cenbank’s stance on underlying exposure for FX derivatives unchanged, sources say

Post Content

Asia FX muted, dollar falls from 4-½-mth peak as rate uncertainty persists

Post Content

Dollar dips while jawboning supports yen

Post Content

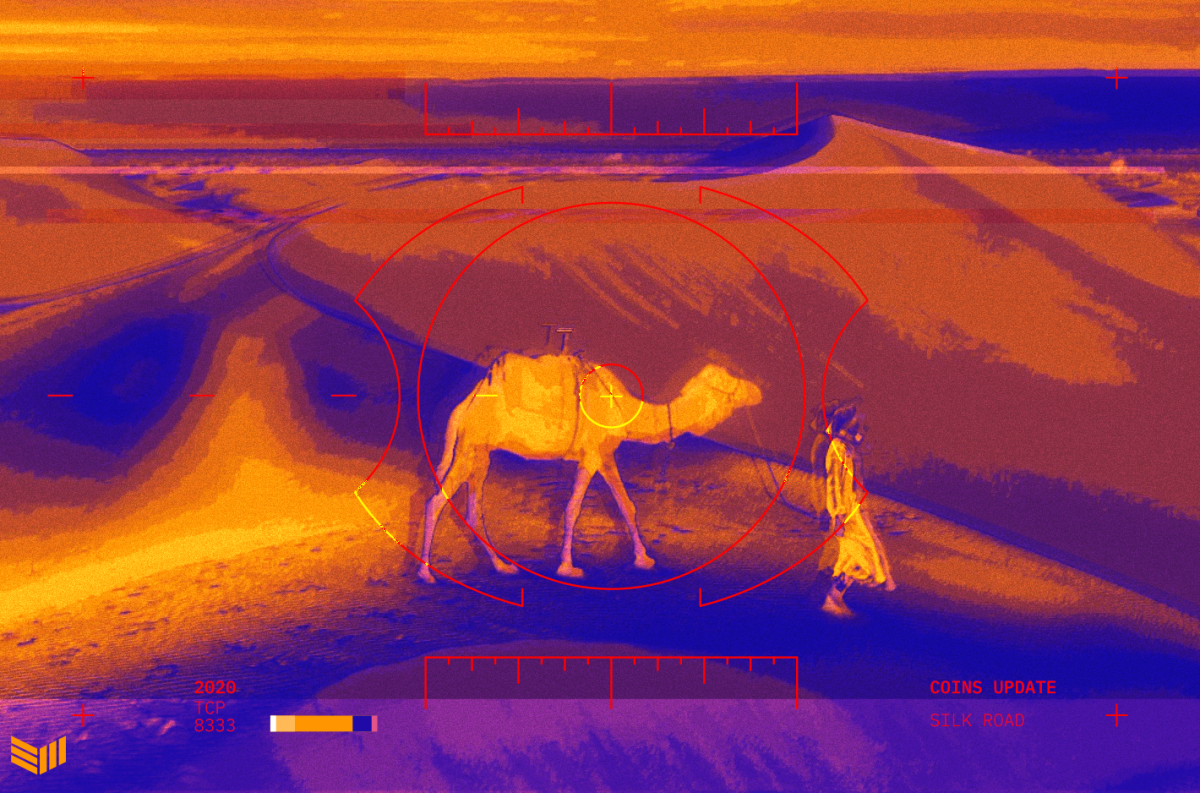

US Government Preparing to Sell 30,000 Silk Road Bitcoin, On-Chain Data Shows

Today, the US government sent a transaction that appears to indicate it may be on the verge of liquidating the remaining Bitcoin it confiscated from the online marketplace Silk Road.

According to on-chain data, a 0.001 BTC test transaction, part of a larger stash of approximately 30,174 BTC worth $2 billion linked to the infamous Silk Road marketplace, were moved by the US government.

Coinbase, the largest cryptocurrency exchanges in the United States, received the transaction from these Silk Road-related funds. Arkham Intelligence first identified the origins of where the BTC was coming from, and the coins destination of Coinbase. It appears the purpose of this transaction is to sell the coins, as it has previously done in the past.

Last March, the U.S. government sold off 10,000 bitcoin related to Silk Road, selling just over 9,861 BTC worth $216 million, according to a court filing.

As in this case, this event was proceeded by 3 on-chain transactions, which were sent a few weeks prior to the sale’s disclosure in a court filing.

The U.S. Marshals Service is one of the largest Bitcoin sellers to date. According to data from researcher Jameson Lopp, the US Marshals have helped the US government sell 195,000 BTC.

Despite attempts by U.S. lawmakers to have the agency hold these funds as a strategic asset, it has continued to sell the funds in line with its mandate, the role of the U.S. Marshalls Service being to sell off assets confiscated in criminal investigations.