Month: February 2024

Chinese banks’ dollar purchases via swaps from clients hit record high in Jan

Post Content

Exclusive-India cenbank lifting curbs on forex non-deliverable forward arbitrage by banks, sources say

Post Content

Dollar steadies ahead of PCE data; euro drifts higher

Post Content

Asia FX weakens, dollar rises with more rate, inflation cues on tap

Post Content

South African rand extends losses in budget aftermath

Post Content

Dollar index on track for first weekly fall this year

Post Content

Canadian dollar weakens vs. USD as spreads, Bank of Canada bets prove a headwind

Post Content

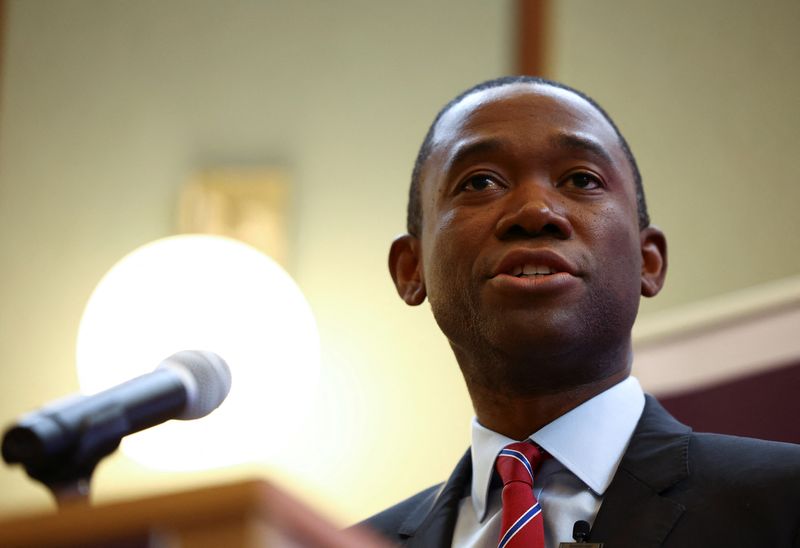

China’s woes won’t slow US economy, but excess capacity a concern, says Treasury’s Adeyemo

Post Content

Read Adam Back’s Complete Emails with Bitcoin Creator Satoshi Nakamoto

The full email correspondence between Hashcash inventor Adam Back and Bitcoin creator Satoshi Nakamoto is now public after being entered into the official court records in the U.K. this week.

Detailed in the five emails below is the complete conversation between Nakamoto and Back, who was cited in the seminal Bitcoin white paper. In the emails, the two cryptography heavyweights can be seen for the first time discussing the work.

Though Back has previously spoken publicly about the emails, hinting at the details of the conversation, and in particular how he neglected to read the white paper at first, the emails represent the first time that the full text has been made available.

Adam Back, a renowned figure in the cryptocurrency world, and the chief executive of Blockstream, has long been speculated to have been involved in the creation of Bitcoin, though these emails will likely weaken such suspicions.

As detailed, the correspondence between the two was polite and professional, with Back pointing Satoshi to a few related papers, and Satoshi seeking to make clear the unique contributions he added to Back’s prior work.

Invented in the 1990s by Back, Hashcash was a method for slowing email spam, one that prompted a computer’s processor to prove it had conducted calculations before delivering the message. The system is the blueprint for Bitcoin’s mining system, in which a distributed network of computers compete to solve cryptographic puzzles, and in exchange for the work, release new bitcoins into the economy.

Elsewhere, it’s now clear Satoshi tried to keep in touch with Back, emailing him in January 2009 on release of the Bitcoin software.

Since their publication this week, the release of these emails has reignited interest surrounding the true identity of Satoshi Nakamoto, as it coincides with other new emails presented by Satoshi’s early collaborators.

While an interesting relic of history, however, these emails do little to shed light on Bitcoin’s essential mysteries.

EMAIL #1: Satoshi reaches out to Adam back

EMAIL #2: Adam points to Satoshi to Wei Dei’s work

EMAIL #3: Satoshi notes his unique contributions to Bitcoin

EMAIL #4: Adam still hasn’t read the white paper

EMAIL #5: Satoshi informs Adam of Bitcoin’s release

$30 billion RIA Platform Carson Group Approves To Offer Spot Bitcoin ETFs To Clients

Carson Group, a significant $30 billion registered investment adviser (RIA) platform, has recently announced its approval to offer four spot Bitcoin exchange-traded funds (ETFs) to its clients, according to a Bloomberg report. Out of the recent batch of US-listed spot Bitcoin ETFs, Carson Group has greenlit BlackRock’s iShares Bitcoin Trust, Fidelity Wise Origin Bitcoin Fund, Bitwise Bitcoin ETF, and the Franklin Bitcoin ETF.

JUST IN – $30 billion RIA platform Carson Group has approved to offer these four spot #Bitcoin ETFs to their clients:

– BlackRock

– Franklin

– Bitwise

– Fidelity

— Bitcoin Magazine (@BitcoinMagazine) February 23, 2024

Grant Engelbart, Carson Group’s vice president and investment strategist, highlighted the criteria for selection, emphasizing the “significant asset growth” and trading volume of BlackRock and Fidelity’s ETFs. “We feel it is important to offer these products as a result from two of the largest asset managers in the industry,” stated Engelbart.

Additionally, Carson Group has prioritized the cost-effectiveness of offerings, acknowledging the appeal of the $1.2 billion Bitwise Bitcoin ETF and the $100 million Franklin Bitcoin ETF, which boast relatively low fees.

“Bitwise and Franklin Templeton have committed to being the lowest-cost providers in the space, and have also seen large inflows and trading volumes,” Engelbart continued. “Both firms also have established in-house digital asset research teams and expertise that we feel are beneficial to the continuing growth and management of the products, as well as advisor research and education.”

Access to platforms catering to financial advisors and their retail clients is pivotal for spot Bitcoin ETF issuers aiming to tap into new markets. Approval by platforms like Carson Group can serve as a catalyst for fund growth, given the vast wealth managed by financial advisors. As Carson Group moves forward with offering these Bitcoin ETFs to its clients, it positions itself as a forward-thinking player in the financial advisory space, unlike $7 trillion investment manager Vanguard, who blocked its clients from being able to purchase the SEC approved ETFs.