Month: February 2024

Dollar falls, traders price for rate cut by May

Post Content

I Moved to El Salvador; Ask Me Anything

Last year, I planned a hike through El Boquerón, a national park atop the San Salvador Volcano that features a scenic crater, as well as a tiny crater within that crater called Boqueroncito (”Little Boquerón”), which I find adorable. In true millennial fashion, I consulted a handful of travel blogs to make sure I was well-prepared for the trip.

A blog entry by a couple of tourists caught my attention. Be careful to avoid the advanced hike route, it read, as you might run into aggressive stray dogs.

Now, getting bitten by a dog and then spending hours seeing my life flash before my eyes as I rushed to the nearest hospital wasn’t really appealing to me. Suddenly unsure of my plans, I called my Salvadoran friend Sara to tell her about my concerns.

She straight-up laughed.

“I am so happy,” she exclaimed, “that your biggest concern here are stray dogs, and no longer the gangs.”

In the end, my stray dog worry was unfounded—you know that’s not the point of this anecdote, but lest there be any confusion, I had the best time, and nobody bit me.

The world feels like a weird place lately, and I’ve wondered more than once whether past generations have felt the same. When the gaps between crises close and each of them leaves a scar deeper than the last, and when we see before our very eyes how things change, gradually, then suddenly, it leaves me no other conclusion except that we are living through the end of an era, if not the end of an empire; I know that sounds dramatic, but one way or another, it is definitely a time our children will look back upon, shaking their heads going, “how could they not see it coming!”

As bitcoiners, we pride ourselves in “seeing it coming.” (For the record, I don’t think we do, but that’s a different conversation.) We are witnessing the bloody decay of entire countries’ financial backbones. State-level corruption is socially acceptable. “So, our government is hella shady, whaddaya do?”

Move, that’s what ya do. At least that’s what I did. Then again, most of the time that means jumping out of the frying pan into the fire. I’ve spent the last ten years traveling the world, and in just about any country I have visited or lived in, I could see shades of the same pattern forming. The general mood is shifting; people are struggling to plan, let alone build their futures and, as a result of this and other influences, delving into destructive high-time preference distractions.

Bitcoiners seek to escape this vicious cycle. For you and me, Bitcoin is a lifeboat. A lifeboat is great. It protects you from the tide and keeps your head afloat. But who wants to live on a lifeboat? A boat needs a harbor to dock.

Enter the smallest country in America. El Salvador was never on my radar. By that I mean, it was so very far outside my radar that the first time I even heard about it was when Nayib Bukele announced he was making Bitcoin legal tender.

I had the privilege of meeting the president a few months after the Bitcoin Law became official, at the very affordable cost of one of my first plushie prototypes. At the time, he was on a state visit to Turkey; when my business partner Danny and I went to meet him, he showed up flanked by his security detail and what I assumed were at least 50 members of staff. What immediately caught my eye was the youthful energy in that colorful mix. Unbeknownst to me, it was a teaser of the spirit that had gripped the country. This kind of optimism was all but alien to me. Where I’m from, governments are sluggish, bloated, boomer-operated calcified machines (I could’ve added more adjectives, but you get my gist).

The experience made me decide to go and check out the country myself. It took me a year and a half to make the trip, but I made up for it—by staying.

El Salvador is one hell of a place. At first, I thought it was just me, that perhaps my personal bias skewed my experience from the moment I set foot here. But so far, every single person I’ve spoken with confirmed my own impression: something is different about this country, and it took coming here to really grasp it.

Let me attempt an explanation anyway and tell you why I moved myself and my company to Bitcoin Country—spoiler alert: it wasn’t for the Bitcoin Law.

Enter El Salvador

“People really drive like madmen here,” Sara moaned as we set out for our roadtrip during my first week in El Salvador.

“I’ve seen worse,” I said. Not about to drop names, but compared to some other places I’ve seen, the traffic in El Salvador isn’t half-bad.

We drove along the famous Ruta de las Flores, a scenic road winding its way through tropical hillscapes, connecting numerous lively townships and sleepy villages. Our destination was the famed village of Ataco, not too far from the border to Guatemala, where Sara had looked up a little restaurant serving traditional Sopa de Gallina, or hen soup. On a small veranda off to the back of the place sat a weathered rocking chair that smelt of leaves and rain. As I walked up to the edge of the porch and peaked beyond at the sprawling forest below, a dizzy sensation gripped me and pulled my feet back a couple of steps.

We ate hen soup, thick corn tortillas, cheese, and chorizo, all with a view that would’ve made you believe somebody had thrown a real-life Instagram filter onto the landscape. When I was little, I would see sceneries like these printed on the centerfold of travel magazines, or postered on the inside of the local supermarket window. Gazing upon the lush tree-covered hills, it felt as if I had stepped right into one of those adverts.

As we strolled through the buzzing little market that was happening in town, I spent half an eternity at a stall selling colorful handmade capiruchos, a popular toy in the form of a little wooden cup, tethered to a stick by a string. Three or four locals demonstrated the game (the goal is to flip the cup up into the air and catch it with the end of the stick). They say those who make a skill look easy show true mastery. Alas, I failed spectacularly and instead resorted to watching the experts while capturing the scene. When I pulled out my phone, I caught Sara smiling from beside me.

“You know, before the new government, this would’ve made you a target,” she said, leisurely pointing at my bright-red flip cover.

“Walking with my phone in my hand?”

“Yep. Also, wearing branded clothes, like those.” Her gaze fell onto my worn Nike sneakers, and I felt a sinking feeling in my stomach. I had spent a considerable amount of time living in places where you’d generally be advised to always keep a hand on your bag, just in case. But recalling the stories I had heard from Salvadorans about the state of things “before the new government,” I began to slowly realize just how different life had been here just a couple of years prior.

“Things are a lot better with the new government,” Sara told me. “Sure, not everything is perfect. But we understand there are things that can’t be fixed in five years’ time.”

“Like what?”

“The healthcare system,” she replied instantly, “as well as job opportunities for young graduates. Also, real estate prices.”

“We’re happy that people are coming to El Salvador to invest, and that the diaspora is returning. But housing prices have gone through the roof.”

If you bought property in El Salvador two or three years ago, hats off to you. Prices have gone parabolic (sorry Bitcoin). This is also reflected in rent prices, so if you’re looking to relocate anytime soon, be prepared. These are growing pains, and so wherever you go, you’ll see houses, condos, and also malls and recreational facilities being built.

Meanwhile, you’ll be hard-pressed to find anyone who has something negative to say about the current administration. In fact, it happens on the regular that people will start proudly talking about “the new government” without so much as a prompt, out of an inherent urge to remind you of this timestamp in their most recent history. It’s rather unusual not to hate your government these days, and so I wouldn’t blame you if your initial reaction here was to raise an eyebrow or two. Yet if I’ve learnt one thing since coming here, it is that the divide between headlines about El Salvador and the reality within El Salvador borders on sheer absurdity. A good proportion of the coverage you see makes for beautifully ornate works of fiction.

El Presidente

So, who is this “new government,” and is it in the room with us right now? In 2019, Nayib Bukele won the presidential elections with 53% of the vote, shattering decades of de-facto bipartisanship. Five years later, his approval rate stands at over 90%. I know that seems hard to believe, given all the headlines about the draconian iron fist of the “millennial dictator.”

While in our circles, we know him for playing out nation state-level game theory in the grand Bitcoin adoption scheme, throughout Latin America, much of his popularity stems from how he essentially turned his country upside down—or downside up—by stamping out long years of gang tyranny and bringing security to the streets, homes, and businesses of El Salvador. He did so at an unprecedented speed, all while letting his people and the rest of the world take part in the process every step of the way, broadcasting his campaigns and policies to Twitter, TikTok, Facebook, and Instagram.

But, but, presidents aren’t supposed to be familiar with the internet! They’re meant to be boomers whose interns generate a Tweet for them every two days via a poorly authored ChatGPT prompt.

In a complete departure from what we know of our politicians, Nayib shows up in unicolor sweaters, jeans, and sneakers. He likes Marvel and Star Wars, quotes Napoleon and Alexander the Great, routinely sub-Tweets the powers that be, and when I met him, the first thing I thought was, “he’s way too human to be a politician.”

Which, if modern politics is any indicator, would be an oxymoron. You can be human, or you can be a politician. God forbid you try to be both. Strategically placed narratives have sold us the idea that politicians who haven’t lost touch with reality pose a bigger threat than the puppet string-attached suits that dominate today’s world stage.

But it isn’t just the fact that he knows how to use a smartphone which sets the president of El Salvador apart from many of his fellow heads of state. What tends to throw people off is, simply put, that he utilizes common sense, “which is not that common,” as he would say. What helped him to the presidency was his focus on the silent majority of non-voters and those who felt represented by neither ARENA nor the FMLN, the two behemoth parties that had dominated Salvadoran politics since the end of the civil war. The parties had aged, as had their politics, and instead of votes, they had been collecting corruption charges.

Bukele sought change, with an urgency at that. He focused on slashing crime and corruption and began promoting a revitalized national identity, a sense of pride among the people for being from El Salvador, no longer the land of war and gangs, but now the land of surf, volcanos, and financial freedom.

It is challenging enough to turn your nation around and relieve it from its tragic title of “most dangerous country in the world.” But as if that wasn’t enough, faint cries sound from shaky ivory towers, an ocean away. It’s a sound bitcoiners are very familiar with—the roar of “leading” legacy media writing their fingers to the bone in their pursuit to outdo each other in the latest sensational narrative fabrication. With the skeletal digits of an aging colonizer, so-called superpowers descend upon the small Latin American nation, chanting their favorite buzzword “democratic backsliding” while pulling the curtain over the dumpster fire in their very own backyard. This condescending attitude makes a mockery of every single party involved and achieves absolutely nothing even remotely of value. I am really very sick of it.

El Salvador’s approach to eradicating crime and corruption is extreme. But you don’t fight forest fires with a watering can. The citizens are overwhelmingly in favor of their administration’s policies, and the reason becomes clear when you listen to personal accounts of those who have lived in pre-Bukele El Salvador. Most Salvadorans have very personal experiences in the way organized crime affected them in the past. There are countless stories that will radically put many accusations into perspective—but they are stories so horrible I cannot for the life of me type them out in this article.

We can barge in with our Western magnifying glass and attack El Salvador’s measures all we want—as of today, I have not seen any viable suggestions as to how Bukele could’ve better protected the honest people from the murderers.

One would think El Salvador is long used to nosy neighbors, as the country has a long history with foreign meddling in its internal affairs, be it from nation states or inter-governmental organizations like the IMF or the UN. At the 2022 United States General Assembly, or UNGA for short, Bukele called this out. Nobody watches those speeches, so I transcribed a section of it for you, because it is worth reading:

“I come from a people that is only the master of the smallest country on the American continent. And even this little dominion over this small parcel of land, barely visible on the map, is not respected by countries that have a great deal more territory than us, much more money, much more power, and that think—correctly—that they are the masters of their country, but that think incorrectly that they are also the masters of ours. […] While on paper we are free and sovereign and independent, we will not really be so until the powerful understand that we want to be their friends, that we admire them, that we respect them, that our doors are wide open to trade, for them to visit us, to build the best possible relations. But what they can’t do is come to our house to give orders. Not only because it’s our house, but because it makes no sense to undo what we’re doing, what we’re achieving.“

Earlier this month, Bukele reiterated his stance: no more foreign intrusion in national matters. This has further boosted his popularity, even with the notorious meddler that is the United States. Bukele’s rising reputation among U.S. citizens is striking, and even the U.S. government has long realized it can’t afford to burn bridges with the most popular president in Latin America, and possibly beyond. You can tell very clearly whose side I’m on. I never much enjoyed talking about politics, for two reasons: firstly, politics divides people, ironically. Secondly, I never felt represented by the public servants who so often tended to serve themselves first. In El Salvador, I see a reversal of both trends. Is everything rainbows and butterflies? Of course not. It’s still politics. At the end of the day, you pick the lesser evil, which for me happens to be under a “millennial dictatorship.”

About Bitcoin

So I’m two thirds into this article and only now starting to talk about Bitcoin. That’s intentional. Out of all things intriguing about El Salvador, Bitcoin is not at the top of my list. Bitcoin is not the be-all and end-all of El Salvador’s charm. It fits right into the picture of a country that likes to swim against the current. It’s a perfect indicator of low-time preference leadership. But it is not what “makes” El Salvador.

Here, everybody knows about Bitcoin. Depending on where you go, you’ll be able to pay with bitcoin, and I’ve met several people who live their lives entirely on sats. Down in El Zonte, the Bitcoin Beach initiative has created a little Bitcoin haven. The municipality of Berlin has its own growing Bitcoin circular economy. In the mountainous forests, coffee farmers get paid via Lightning. In the capital, while less present, you will still be able to pay with bitcoin here and there. You can see a clear trend, but the reality is that the majority of the Salvadoran population uses the dollar for payments, not bitcoin. Does that mean the “Bitcoin experiment” (thanks for the term, legacy media) has failed? Of course not.

When I first read that accepting bitcoin would be made compulsory, it left me with a funny feeling. This is not the way. Live and let live. Offer the choice, don’t force the solution. If this was how it would be done, I feared it wouldn’t be sustainable, especially in light of the ensuing bear market that, perfectly timed by the Universe (or certain over-leveraged industry companies), kicked off shortly after the Bitcoin Law went into effect.

Fast-forward to today, I can’t use bitcoin as much as I would like. I would’ve loved to pay for my hotel stay in bitcoin, but the hotel couldn’t find its POS device. I’d love to pay my rent in bitcoin, but my landlord thought otherwise. I’d love to pay the customs office—well, I’m not sure I would love to pay them, but if I have to, I would like to do it in bitcoin. That didn’t happen either.

Sure, I’d like more options to pay in bitcoin. But I’m way happier to see that the “mandatory” part of the law is not being enforced. Bitcoin is an option here, an offer for the population to make use of—or not. Surely price action contributes its fair share to the general interest of the population, much like in the rest of the world. The difference between El Salvador and many other countries is that once said interest returns, which it will, the infrastructure will be there to welcome it. Merchants will have their payment terminals, individuals will have their wallets, the school system will have Bitcoin education, and the country will once again step into the limelight as the one who kicked off nation-state adoption; a title that can’t be taken away. There’s even an actual Bitcoin Office here, run by Stacy Herbert and Max Keiser, who were among the first bitcoiners to relocate and have since been championing various programs to further establish Bitcoin in the country.

To help move things along, there are various other private initiatives run by a fast-growing community, and by now, many bitcoiners have found a new home here. To them, Bitcoin is the gateway drug to a country that ticks many more boxes than just the orange one, especially when the state of the world out there has them scratching their heads.

For bitcoiners, the Bitcoin Law brought a harbor for our lifeboats. For El Salvador, it brought investment, tourism, and attention. Of course, lots of that attention was negative for the longest time and often still continues to be, but El Salvador’s show of low-time preference is due to pay off big time, in due time.

First movers have it the hardest, but they reap the biggest rewards. The same goes for the personal decision to exit the status quo and opt into an alternative to Big Brother.

Wen El Salvador?

A fifty-minute drive from San Salvador, the air is sticky with humidity, and buzzing traffic noise is swapped out for the humming of powerful waves washing up on the pebbly beaches of El Zonte. It’s the birthplace of Bitcoin Beach, the grassroots movement that inspired the nation.

Every month, Bitcoin Beach organizes a meetup at Palo Verde, a cozy boutique hotel by the beach. Anyone can join, and every time I’ve attended, the place was packed. During the event, Roman Martinez, one of the brains behind Bitcoin Beach, invites locals and expats onto a small stage nestled in between the pool and the restaurant where they talk about their projects, from grass-fed beef subscriptions and real estate companies to educational ventures and plushies (that’s me). Sometimes, an excited guest will grab the mic and report on their personal experience living in El Salvador. Other times, a spontaneous panel will form, and attendees will discuss new potential startups to pursue in Bitcoin Country. There is an energy second to none. Again, you have to see it to believe it.

Moving countries is a huge endeavor, and the real challenge starts after you have completed the literal relocating part. A different culture, a different language, a different climate, a different environment, a different lifestyle, a different community, and so on and so forth. Numerous factors play into whether your move to a new country will fulfill you, first and foremost your own willingness to step way outside of your comfort zone. What you get in return here in El Salvador is a country with breathtaking sceneries, stunning nature, mountains, beaches, and lakes, and beautiful weather all-year round. You get a country that doesn’t give you the side-eye for being a bitcoiner (which is hard to come by). But most of all, you get a country whose people radiate optimism, and who look towards their future with joy and ambition, an attitude that is 100% infectious. You get a country in upswing, and you can see, hear, and feel it. You’ll likely think this sounds cheesy; so even though I just served you a spirited 3,500-word pitch for El Salvador—don’t trust, verify. It can’t hurt to take a look.

Just don’t wait a year and a half like I did. On that one, you can trust me.

This is a guest post by Lina Seiche. Opinions expressed are entirely their own and do not necessarily reflect those of BTC Inc or Bitcoin Magazine.

To Dust You Shall Return

Consider a doomsday scenario. You spend the past couple years diligently dollar cost averaging and withdrawing to your wallet. You have a ton of small UTXO1‘s and bitcoin transaction fees rise so much that your bitcoin turns into dust2. You’re now unable to spend your bitcoin. For some bitcoin users, this is not a doomsday scenario, this is a reality that they experienced over the past 6 months.

During 2023 we saw very big fluctuations in bitcoin transaction fees as Ordinals3 brought a flood of new bitcoin users and with that significant increase in blockspace demand. Despite the positive press from the Bitcoin Spot ETF approval, users have faced serious challenges from high transaction fees, especially for users who have small UTXO’s. In some cases, UTXO’s were unspendable, also known as turned into dust. This transaction fee pain led many people to ask the question, how can I know if my UTXO’s are at risk? For this article, we will explore the point at which dust is created and try to help lay out a minimum plan to mitigate this risk.

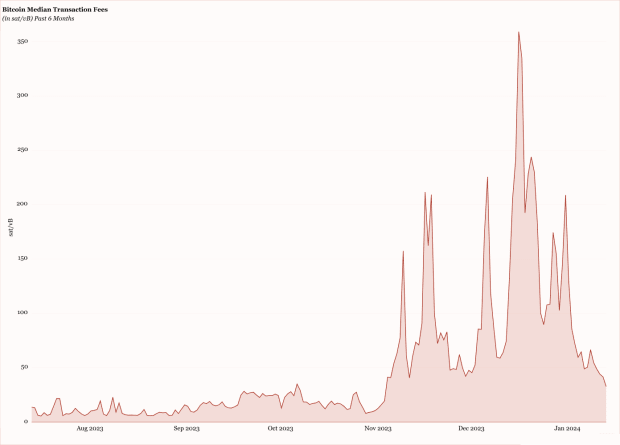

Bitcoin Median Transaction Fees In sat/vB Past 6 Months

Source: Dune as of January 12, 2024

Over the past 6 months we have seen wild swings in median bitcoin transaction fees. We saw mempools clear with 0 sat/vB and soar higher than 350 sat/vB. While that might not mean much to you at face value, it can mean big challenges for users who are sending multiple small value SegWit UTXO’s in single transactions. In fact, some users saw their UTXO’s turn into dust. This obviously caused panic, and for some this caused an expensive lesson in UTXO management. This is not an article that explains UTXO management strategy, this article attempts to tell you that you absolutely want big UTXO’s. If bitcoin does what we think it is going to do, then multiple UTXO transactions as small as 0.001 BTC could be unspendable under high fee environments, and you can kiss your dust goodbye.

Before we jump into the data, we need to define what we want to look at. For us we are trying to understand if a UTXO is spendable or it is dust (non spendable). For this we will need the following:

Sum of UTXO’s being sentTotal Weight Units4Transaction fee sats/vB

With this information we can make a formula that shows how much value is transferred in a bitcoin transaction after you remove the transaction fees.

Transferred Value = BTC Sent – ( ( ( Total Weight Units / 4 ) * Transaction Fee in sats/vB ) * 0.00000001 )

If the transferred value is a negative number, this means you have dust, the UTXO sum costs more to send than it is worth. Because calculating bitcoin transaction weight units is a bit complex, we will use a realistic scenario for use in building our table, assumptions, and recommendations.

For this example we are using5 basic SegWit (P2WPKH) financial transactions with the following weight units:

Single-input, single output, single signature, single pubkey, SegWit transaction (P2WPKH script)total weight units would be approximately 440 weight units.5 inputs, single output, single signature, single pubkey SegWit transaction (P2WPKH script) total weight units would be approximately 1,528 weight units.

Using our formula above and the SegWit transaction with (5) inputs weighing 1,528 weight units, we built the following dust table.

Dust Table

Dust Table calculated at 1,528 weight units per the5 SegWit inputs example above.

The Dust Table reveals some telling information. Dust is real, and the threshold is lower than I imagined. As transaction fees continue to rise, larger valued UTXO’s become more at risk. During the peak transaction fee times over the past month, our example transaction would be dust even for .001 BTC. That’s a little less than $50 at current market conditions. This feels incredible. 100,000 sats suddenly turned into dust. Gone. Unusable. This is terrifying.

While this example scenario does not affect all users, the lesson is very clear, make big UTXO’s! For long term storage you must not keep UTXO’s smaller than 0.01 BTC. We saw 300+ sat/vB fees last year and that will increasingly become the norm. In that fee market, multi UTXO transactions smaller than .001 are dust. Don’t be that guy.

Dust may be an afterthought for you today, we are blessed with returns to sub 50 sat/vB fees, but dust could become a costly problem for you in the future if not managed today. By understanding the relationship between UTXO weight units and transaction fees, we gain valuable insights into the lower bound sizes for UTXOs.

Dust Extremes

Modeling out the dust threshold for UTXOs is an interesting experiment because it shows you how crazy things have to get and at what point BTC becomes dust. For the table below, we are using the same data as outlined above, that is a 5 input SegWit transaction with 1,528 weight units.

This table illustrates the fee rate at which a BTC amount being sent in a 1,528 weight unit transaction will turn into dust.

Signing A UTXO

Another key finding in all this research is the cost of signing a single standard (P2PKH) UTXO. This is an extreme on the small side because it is one of the smallest transactions you can make. For this example we want to use the standard script (non-segwit) because it is the heaviest of the script types. Here are the specifics:

Standard (P2PKH) Script Type1 input1 Pubkey0 Outputs632 weight units

Signing Economics

Economics of signing a single standard UTXO with one signature, one pubkey, and 0 outputs weighing 632 weight units.

With this information you can understand the minimum cost of making Bitcoin transactions.

Key Takeaways

Dust threshold is lower than you think, especially in high transaction fee marketsWhen withdrawing BTC from exchanges consider waiting until your balance is ≥ 0.01 before sending to your storage.If you have many small(

You don’t have a crystal ball, and there are only so many things in your control. BTC price, blockspace demand, hashprice, hashrate, and bitcoin in general are out of your control. You have control over your keys, and the best thing you can do is be prepared for the inevitable high fee market. It will happen or Bitcoin will fail, I don’t make the rules. Do not let your precious bitcoin turn into dust. Remember this, if you do nothing then to dust you shall return.

By the sweat of your face you shall eat bread, till you return to the ground, for out of it you were taken; for you are dust and to dust you shall return.

-Genesis 3:19

FOOTNOTES

UTXO (Unspent Transaction Output): [n.]

A component of a Bitcoin transaction that represents an amount of digital currency not yet spent and available for future transactions.

The output of a blockchain transaction that can be used as an input in a new transaction, signifying the amount of cryptocurrency remaining after the transaction is executed. ↩︎In the Bitcoin protocol, dust refers to small amounts of currency that are lower than the fee required to spend them in a transaction. Although “economically irrational”, dust is commonly used for achieving unconventional side effects, rather than exchanging value. ↩︎Ordinals Inscriptions as a phenomenon are now a little over a year old and have caused big waves in Bitcoin. They are melting some peoples brains but will eventually be priced out. ↩︎Weight Units (n.) [Bitcoin]

A unit of measurement used in the Bitcoin network, specifically introduced with the Segregated Witness (SegWit) protocol, to calculate the size of transactions and blocks.

A composite measure that considers both the non-witness data (like transaction inputs and outputs) and the witness data (such as signatures) of a transaction. In this system, non-witness data is weighted more heavily than witness data.

The standard by which the block size limit is enforced in the SegWit protocol, with a maximum cap of 4,000,000 weight units per block, allowing for an efficient and flexible allocation of block space. ↩︎Using Lopp’s open source transaction calculator. LINK ↩︎

Dollar rises after Powell’s comments; euro slips ahead of eurozone CPI

Post Content

Asia FX falls, dollar near 7-week high as Fed says no hurry to cut rates

Post Content