Month: February 2024

Dollar surges to 11-week high as Fed rate cut bets diminish

Post Content

Ryan Koopmans – An Interview Regarding “The Origin” Inscription Artwork

In the evolving landscape of contemporary art, few artists capture the essence of change and permanence as powerfully as Ryan Koopmans and Alice Wexell. Their artwork bridges the gap between the natural world and urban decay. They delve into the heart of abandoned places and transform them into digital masterpieces that question the boundaries between reality and digital artificiality. Together they explore the concept of legacy and preservation in the digital age by inscribing their work into the immutable ledger of Bitcoin. Their latest work, ‘The Origin’, is a demonstration of their innovative approach to digital art. It combines photography, digital manipulation and Bitcoin ordinal technology to create a dynamic on-chain artwork that reflects the passage of time in the ruins of an Italian building. As pioneers in this field, Koopmans and Wexell challenge us to rethink the value and permanence of art in the digital age and invite us to question our concepts of time, memory and heritage.

Steven Reiss: Many people will know you from your series ‘The Wild Within’, which you do together with Alice Wexell. Perhaps you could briefly explain how you came up with the idea of creating works of art with and through abandoned architecture.

Ryan Koopmans: The Wild Within is a series of digital artworks that bring new life into abandoned buildings from a bygone era. After 15 years of working as a documentary photographer, I felt the urge to create work that involved more of an imaginative intervention rather than purely as a ‘real world witness’.

After photographing a series of abandoned buildings in the country of Georgia, we realized that there was more conceptual work that could be done to enhance the images and truly emphasize the feelings and mood we experienced while exploring these crumbling ruins.

The result was a project that my wife Alice Wexell and I began, The Wild Within, whereby real-world physical spaces, in countries that have undergone dramatic transitions such as Georgia, Lebanon, Armenia, Italy and Poland, are photographed and then transformed into conceptual works of art.

Upon returning, we digitally introduce vegetation and modify the structure and lighting with the intention of reviving the empty spaces, essentially bringing life back into the rooms.

The results are a surreal collision between the past and future, natural and manmade, physical and digital, and the real and imaginary.

Furthermore, many of the buildings depicted in The Wild Within have been demolished in recent years or continue to deteriorate, emphasizing the theme of time passing in the cycle of growth and decay.

We chose to inscribe the artwork [Ryan refers to ‘The Origin’, SR] on a satoshi mined on March 24, 2021, a tribute to the day that the first artwork from ‘The Wild Within’ was minted on Ethereum.

SR: What is the fascination and how do you go about it? When is a scene the right one and how do you process the image?

RK: We have long been inspired to travel to remote locations and discover places that have not yet been extensively photographed.

Especially fascinating to us are buildings that were abandoned and left to deteriorate without intervention. They act as time capsules, especially rooms that have been sealed off from outside visitors for decades.

It takes a long time to research, discover, and photograph these buildings, and then to create an artwork. Thus we are very selective with what we actually release into the world. Sometimes when we are shooting a particular room, we get a feeling in our core that this will be an image that belongs in the project.

By exploring and then carefully composing images that are then turned into artworks, our interests related to architecture, nature, creative expression and the human condition are all activated.

The structures that we like to base pieces on are inherently rare as many are deteriorating or have already disappeared since we first discovered them.

Whether due to fires, demolition, looting or the natural elements, in many cases the buildings cease to exist in the form they once were as our world rapidly modernizes.

Importantly, the artwork immortalizes and preserves not only itself but also its subject matter on the blockchain, functioning as an act of artistic, interpretive architectural preservation.

SR: Why did you choose this particular location for ‘The Origin’?

RK: It was important to us to enter the world of inscriptions on Bitcoin with a concept that not only embraced the technology’s potential but also stayed true to the inherent themes of our work.

Given that the theme of time is a recurring element, we collaborated with the Inscribing Atlantis team to create a dynamic time-based artwork. This piece seamlessly transitions between day and night modes, synchronized with the Bitcoin clock.

In order to achieve this, using an interior with expansive windows connecting to the external surroundings was crucial. Situated in the forest just outside a small town in Northern Italy, this particular architectural space occupies the top floor of a tower. Accessing it posed a challenge, requiring climbing into a window and carefully navigating along precarious hanging wooden floors.

The distinctive patterns on the walls and circular forms within the space made it an ideal setting for the construction of this artwork, since it felt like a nucleus or an encapsulated hub for a grand idea.

SR: In your announcement of ‘The Origin’, you intriguingly describe both abandoned buildings and digital artifacts inscribed on Bitcoin as anthropological markings. Could you elaborate on how this concept influences your work, particularly in terms of contributing to the broader discourse on digital heritage and cultural preservation? Furthermore, how do you reconcile the juxtaposition between the physical decay of buildings and the enduring nature of Bitcoin in your artistic process?

RK: Architecture serves as anthropological markings on the landscape, albeit temporary ones. Within the structures themselves, one finds markings left by people and the passage of time, whether by inhabitants, vandals, or the forces of nature. The concept of impermanence and the eventual disappearance of these markings inspire the idea to photograph, creatively intervene, and then preserve the visuals on the blockchain.

Exploring these buildings often reveals intriguing artifacts, creating a sense of discovery that evokes the feeling of uncovering forgotten eras.

Inscriptions on ordinals, albeit more permanent, are also digital artifacts scattered throughout the network. Over time it will be interesting to go back and see the evolution of these markings, which range in quality and intention, but reflect a distinct moment in time and cultural context from which they were created.

While creating digital artwork is a form of preserving this experience and idea, inscribing it on a secure and immutable blockchain elevates it to a higher level of permanence.

Our goal is not to create historically accurate representations or documentations of architecture. Instead, we aim to preserve our interpretation of this fleeting subject matter by crafting artwork that depicts the decaying buildings in an imaginatively overgrown state.

Ultimately, our objective is for the artwork to outlive us, and utilizing this technology provides a solid medium to secure the digital legacy of the artwork.

SR: With the intention that your artwork will outlive you, how do you see the role of digital art in the future? Do you believe that digital artworks can achieve the same emotional and cultural significance as physical artworks once the physical impact is completely removed?

RK: Absolutely. Digital artwork is being created in an era where the future display methods are not fully realized yet. We are yet to know what kinds of frictionless screens or immersive perspectives will become integrated into our daily visual landscape.

In the present approaches to showcasing digital art, the appeal of printing it out or presenting it on a wall screen lies in the residual value attributed to the tangible nature of art. However, these methods are far from ideal for showing digital artworks at their highest potential, and directly ‘competes’ with traditional art in the realm of physical display which it shouldn’t have to.

As tools for creating and distributing art become more widely accessible, there will be an unprecedented surge in digital art production. In my opinion, it’s inevitable that certain digital works will attain the same status as some of the world’s most treasured physical assets.

I anticipate a continued transition towards a more digital future, particularly with the rise of younger generations who are already digitally native.

While the preference for collecting either physical or digital works may fluctuate over time, as cultural tastes often do, digital artworks are undoubtedly progressing towards achieving similar, if not greater, cultural significance, even without a physical impact.

SR: For many artists, bitcoin as an art medium is still new. What made you decide to release a work on bitcoin in the first place? And what were the particularities? Were there any difficulties or new opportunities?

RK: Being innovative and embracing new techniques is a core value of The Wild Within project. We love the crossover between traditional and timeless art, whilst integrating innovative technologies, which we’ve done in several instances. We were the inaugural collaborator with the AI artist Botto whereby we created a unique collaborative artwork in partnership with the Botto DAO. Additionally, we’ve created an immersive 3D space for another one of our pieces, allowing viewers to virtually ‘walk into’ a painting that led into an animated overgrown room.

While Ethereum has fewer file size limitations when minting than Bitcoin, the development of recursion has been a game changer for us by enabling the creation of larger artworks through multiple inscriptions.

Each blockchain presents a cost-benefit analysis, with both compromises and advantages in releasing artwork. Ordinals, functioning as digital artifacts, evokes a sense of preserving these deteriorating architectural ruins, and the artwork, on the blockchain.

Reaching new audiences is integral to being an artist, and the Bitcoin art community has been welcoming, supportive and enthusiastic.

Furthermore, having the opportunity to work with such talented developers at Inscribing Atlantis meant that an artwork could be created which was customized and true to our artistic vision.

SR: The name ‘The Origin’ suggests that there is more to come. Can you reveal anything about it yet?

The ability to create a structure of provenance that organizes one’s presence on ordinals is truly exciting. The Ancestor, Parent, and Child structure of provenance is very appealing, as it establishes the foundations for growth into the future. We have left the possibility open to add another 1 of 1 artwork under the Parent in the future, and the structure allows for the potential release of editions under their own category.

What we release next and when is still to be determined, but one thing is certain: now is an opportune time to leave one’s mark on Bitcoin. However, it should be done with respect, an understanding of the culture, and with creative intent and meaning because once your mark is made, there is no going back!

This is a guest post by Steven Reiss interviewing Ryan Koopsman. Opinions expressed are entirely their own and do not necessarily reflect those of BTC Inc or Bitcoin Magazine.

Asia FX weakens, dollar strong as traders price out early rate cuts

Post Content

Dollar jumps, traders pare rate cut bets after strong jobs report

Post Content

Instant Settlement Series: Real Time Streaming Payments

With the previous articles, we found the disconnect between paid-for work and paid-for time. We also understood that if you want to get paid you have to provide work that is valuable for others. So when the person consumes the benefit of your work, the exchange happens value for value – work for sats. But what happens if the benefit that the consumer experiences is not a momentary but a continuous process? There are a few examples of this. I will start with the one that is not that captivating but still valuable.

Streaming services, like other industries, grapple with the limitations of the fiat payment system. The burden of fees and the absence of suitable technology for streaming payments have compelled them to adopt similar mitigations as other industries. This translates to charging users on a monthly basis.

With the Lightning Network, we have the technology to stream sats for content. No longer confined to monthly subscriptions, you pay for what you consume in real time. Whether you watch sporadically or binge extensively, streaming payments allow for a more personalized and efficient payment model. This way the creator of the content and the user have a direct connection for each minute the content is broadcasted. With streaming payments now you can say goodbye to subscription payments.

Unveiling A New Era Of Fair Compensation And Accountability In Movie Production

Imagine you’ve created a movie or documentary. Traditionally, you’d charge people for a ticket, essentially asking them to pay upfront for future value, creating a slight disconnect. Now, with streaming payments using sats, consumers can pay as they watch. If your movie sucks, they might only pay for the first 30 minutes. However, you still receive value, and viewers won’t feel overcharged for something they didn’t enjoy. If your movie is great they not only stream sats the whole time but at the end, they leave a tip.

On the receiving side of the movie most people involved in it received a salary for doing their job. As we already know this is not aligning the whole structure in the same direction. Some people do not care at all how good the movie is if they have already been paid and do not receive a bonus further. Some people might care about reputation in the market but very few just want to do the best job. Again, we went through this, and as you are guessing you just do a split payment in the backend where all the people in the credits actually receive sats or even milisatoshis based on their contribution. This was something I did not expect that Bitcoin would disrupt. This way the reputation is directly linked to the payment and a lot more people will fight to have the best movie. You can be someone who contributed to a project and wants to stay anonymous for whatever reason but still receive money – Lightning instant settlement is the way to do it.

These concepts should not be new if you read through the last 3 articles. In addition, people in the Bitcoin space are familiar with the Value for Value (V4V) podcasting and that is very close to what I am describing above. While the technology for podcasting is already in place, it’s surprising how few podcasts leverage this technology to implement split payments effectively. They give that responsibility to some hosting service that decides to take a 5% split for themselves and the other 95% goes to the wallet of the show. Why not do the split the proper way? The hosting service provides value so they should get a percentage but if you are 3 people involved in the production of the podcast you should have that 95% split so it goes to those individuals. There’s no excuse, especially for Bitcoin podcasts, not to make this effort and implement split payments appropriately.

The Dynamic Future Of Pay-as-you-go In Content Consumption

In this example, the pay-as-you-go model holds true for continuous experiences, like streaming. Now, let’s revisit the movie example. If you’re a theater, you are essentially the hosting provider for the movie. The quality of the theater experience can vary; one theater might have uncomfortable chairs, while another boasts luxurious massage chairs. The theater with subpar seating might receive a 3% share of the movie’s streaming sats revenue, while the one with comfortable massage chairs might earn 5% for each sat stream paying for the movie. Furthermore, if a viewer activates the massage function of the chair, additional sats are streamed for each second that the function is on. I do not know the exact payment dynamics between theaters and movie studios but I bet there are prepayments and funds held at multiple points in the fiat payment process. With the adoption of the Lightning Network, theaters no longer have to prepay for movies to be projected on their screens. They can now observe which movies are most popular in real time and adjust their projections accordingly to optimize revenues. This benefits the consumer and optimizes profits for themselves and the creators of the movie.

Now you see the content gets its value stream for the continuous experience and everyone in the film industry will fight to give the best experience for the most amount of time. The better the experience the more sats flow their way. Due to the highly subjective nature of content, where one person might deem a movie subpar, another might label it as their favorite. This subjectivity is why I believe most content streaming will not have a predetermined price. Even movies may adopt the V4V model, similar to what Adam Curry is pioneering in podcasting. For instance, you watch a movie, and during the credits, a prominent QR code appears, allowing you to decide how much you want to send to the creators of the movie. You will listen to a song or a podcast the same way. Whether you predefine a streaming rate per minute or request payment at the end, both options are technically possible. However, the market will ultimately determine which option prevails as the better one.

Also, why not have a bidding competition for any event that has assigned seats? The person who bids the most for a ticket gets to be in the first row of the concert or a sports stadium. This way the subjectivity is left for all the viewers to decide how valuable it really is. This way it ensures a full stadium also because if there is no value in attending the event people are not going to bid for the seats or just pay 1 sat for it.

Revolutionizing Taxi Transactions For Drivers And Passengers Alike

The continuous experience or service for streaming could be anything in the physical realm. I will take a look at how instant settlement could look like in transportation services. One such transportation service is the taxi service. Even though Uber decentralized the taxi companies which is great they did nothing about decentralizing the payment process. Lightning Network fixes that and more.

With a streaming payment option for each meter of movement, taxi drivers no longer need to wait until the end destination to receive their payment. In a world of instant settlement, payment occurs as you go, eliminating the risk for the taxi driver regarding whether the passenger will pay at the end of the journey. While this might not be a groundbreaking improvement, there are several additional benefits to consider.

Why do most taxis operate with cash? Taxi drivers in most places need a POS device for the customers to be able to pay for a better user experience (UX). It may be a better UX but on the other hand, it creates problems for the drivers either way:

They have to acquire clunky devices.They must pay payment processing fees, negatively impacting their margins.Operating solely with cash exposes them to the honeypot problem, carrying a substantial amount of money, and making them vulnerable to theft.

With an app tailored for the taxi experience and integrated with the Lightning Network, these issues become irrelevant. There is no need for additional equipment, no payment processing fees for receiving money, and no exposure to visible cash, reducing the risk of being a target for theft. Now you can have a better UX with better security and better margins – an additional benefit is that it will be paid with Bitcoin. Not only that but just like the example with the movie theater chairs drivers will be incentivized to make the travel experience even better. They can offer – to watch a movie, video games like PlayStation, or massage chair. If you choose to use those extra experiences on top of the travel experience you have to increase the sats streaming their way.

An additional benefit for the travel experience of customers arises when multiple passengers in a taxi have different destinations. Traditionally, the taxi meter ticks for the entire journey, and when the first person is dropped off, determining a fair amount for their portion becomes complex. However, with the Lightning Network, it’s conceivable to streamline this process. Imagine a scenario where three passengers enter a taxi, each with distinct destinations. Each person scans a QR code upon entering, linking their streaming sats to the taxi app. The app manages split-receiving, dynamically adjusting the distribution of streaming payments based on how many people are in the taxi. As passengers are dropped off one by one, the app seamlessly adjusts the split-receiving, providing a fair and efficient payment solution for each individual’s share of the journey.

Optimizing City Transportation With Streaming Sats

The proposed model of split-receiving through QR codes and streaming sats can extend beyond taxi services to other modes of transportation, such as buses. The idea is to calculate the average cost per mile (or meter/foot) for providing the transportation service, including factors like fuel, maintenance, and driver salary, and add a margin for profit. Passengers entering the vehicle scan a QR code, and the app dynamically adjusts the streaming payments based on the number of people on board.

For buses, this model allows for real-time adjustment of streaming payments as passengers enter and exit. If there are 30 people on the bus the split is between them. At the next stop, 10 people are dropped off and 5 people get on board – now the sats stream is divided by 25 people. As the number of people on the bus changes at each stop, the streaming sats are proportionally divided among the passengers. This approach can lead to more efficient and flexible city transportation. Late-night buses will be more expensive for the passengers because of the fewer riders, while buses during peak hours may offer a more cost-effective traveling experience as payments are shared among more passengers.

This system encourages transportation optimization around events, such as concerts or sports games, where private buses or minivans wait to fill up before departing. Routes can be dynamically adjusted because you will have a system tracking how many people are in the vehicles at what time and at what location on the map. Importantly, this data remains anonymous, as no KYC information is required for the Lightning Network payments.

The Streamlined Pay-from-a-distance

Now with this streaming money feature, it can be applied differently. Let’s go back to the taxi service for a moment. The pay-from-a-distance feature that is available in the Lightning Network can significantly enhance the experience of ordering a taxi. Instead of the traditional model where drivers wait patiently and charge fixed fees when passengers enter the car, this model introduces streaming sats from the moment the passenger accepts the ride. Here’s how it works:

The passenger places an order in the app, specifying the destination. Nothing new here.Drivers see the order and can apply for it, similar to platforms like Uber.Streaming sats start the moment the passenger accepts the driver, and streaming payments commence. This fee will be less than the actual transportation but the user is still paying for the service of the car coming to him and not the other way around.The taxi arrives at the passenger’s door, and the streaming payments continue. There is a fee for waiting at the door per minute.

By shifting the waiting cost to the passenger, there’s a strong incentive for both parties to be prompt, and the system becomes more efficient. Additionally, the passenger’s responsibility to follow the car reduces operational costs related to alerting passengers via message or a call. Any inefficient time management becomes a cost for the passenger. This model aligns incentives for both drivers and passengers, creating a more seamless cost and time-effective taxi experience.

The concept of paying from a distance can be creatively applied to various scenarios, providing convenience and peace of mind. For instance, when it comes to sending your child somewhere with a taxi, traditional concerns about trusting them with money or the driver’s reliability may arise. However, with the ability to stream sats for the ride, you gain real-time visibility on your device, tracking your child’s journey and ensuring they reach the intended destination safely. This pay-from-a-distance feature extends beyond transportation and can be applied to other continuous services. For example, daycare services charge per minute, allowing you to stream payments in real-time, ensuring accurate and fair compensation for the duration your child spends there. Additionally, you can send a present to a friend, such as a massage session, and pay for it in a streaming fashion, covering the cost continuously based on the duration of the service. The flexibility of streaming payments not only offers real-time tracking and control but also opens up new possibilities for various services where charging per minute or duration is relevant. Those services can be paid on the spot or from a distance.

I know that now it looks like we are going backwards from the original point of never paying money for time. The key distinction here is that you may be paying for time past for the service but in that time you get a continuous stream of value (work done) so you are streaming value back to pay for it. In some cases the time spent is actually an accurate measure of the work done.

It’s true that developing apps with such functionalities is technically feasible, and there might be entrepreneurs and developers willing to explore these possibilities. However, a significant challenge arises when considering custodial control over users’ funds. Small startups might find it financially burdensome and complex to operate as custodians, potentially steering away from such responsibilities. This will take not only high responsibility but also a very big financial wall and expertise to obtain the licenses that comply with the ever-changing regulations. On the other hand, large tech companies with substantial resources could afford to take on the role of custodians, presenting both a business opportunity for them and a risk for the users. The move by some tech giants, like X(formerly Twitter), to obtain such licenses can be seen as a strategic measure for self-preservation over their own finances. This is also an opportunity to consolidate control over not only user data but user finances within their platforms.

The Breez SDK offers a powerful solution, empowering developers to create diverse applications without having to worry about payment intricacies. Its non-custodial nature is a key advantage, eliminating the need for licenses. The infrastructure of it is made in such a way that it is peer-to-peer so no one is holding money for someone else. The app developers focus on the experience within the app and just plug in the code. This combination of features gives startups a competitive edge and reverses the advantage held by large tech companies. While they go through the complex process of getting a license the startup can integrate the global payment network (the Lightning Network) in one day. Even if certain tech giants choose to lock users’ funds within their applications, alternative options will continue to be developed, and users will have the freedom to opt-out. Just like people are choosing Bitcoin over fiat.

Now who is ready to give all of us those experiences in their app?

This is a guest post by Ivan Makedonski. Opinions expressed are entirely their own and do not necessarily reflect those of BTC Inc or Bitcoin Magazine.

Presidential Election Puts El Salvador’s Bitcoin Future At A Crossroads

The below is an excerpt from a recent edition of Bitcoin Magazine Pro, Bitcoin Magazine’s premium markets newsletter. To be among the first to receive these insights and other on-chain bitcoin market analysis straight to your inbox, subscribe now.

On Sunday, February 4, El Salvador’s presidential election will determine whether Nayib Bukele and his revolutionary experiment with Bitcoin will have a continued presence in the nation’s future.

Since Nayib Bukele became President of El Salvador in 2019, he has enjoyed a fairly broad base of support; he was the first man since 1984 to win independently of the nation’s two major political parties. The topic that has taken his administration to a subject of worldwide discussion, however, has been his support of Bitcoin. Bukele made world history in September 2021 when he raised it to the status of legal currency, and El Salvador’s radical experiment with Bitcoin has captivated interest worldwide ever since.

Bitcoin Magazine Pro is a reader-supported publication. To receive new posts and support our work, consider becoming a free or paid subscriber.

Naturally, a large deal of this interest has been negative, especially from the financial and media establishment worldwide. The Bitcoin law went into effect mere weeks before bitcoin fell from its all-time highs, and this led to no small amount of speculation that the government would lose huge sums as a result. More pressingly, financial institutions like the IMF also repeatedly urged El Salvador to give up on its project, raising the possibility that the country might lose access to loans. However, as of 2024, not only have the government’s investments into bitcoin stockpiles gone firmly into the black, but major financial institutions have also grudgingly accepted the strength of the Salvadoran economy. The nation’s critics have been disproven from this angle, but there’s one more immediate test on the horizon: the matter of Bukele’s re-election.

In an interview on January 31, Bukele’s running mate Felix Ulloa went to great lengths to stress that a re-election will mean a firm re-commitment to Bitcoin. Although Ulloa revealed that the IMF has quietly been repeating its requests to de-list bitcoin in El Salvador, he was insistent that these pleas are falling on deaf ears. A particular source of strength, he claimed to Reuters, was the takeoff of the ETF in the United States. A major victory like this means for him that Bitcoin “enjoys the greatest credibility in the entire world.” Not only did Ulloa claim that the existing laws in support of Bitcoin “will be maintained”, but he also added that the proposed “Bitcoin City” infrastructure project continues to enjoy the government’s full support.

As far as the polls are concerned, a wide variety of international press agencies all agree that Bukele’s victory is practically guaranteed. The centerpiece of his popularity, it seems, actually has nothing to do with Bitcoin, as large numbers of citizens remain unconvinced. Instead, it seems his sweeping crackdowns on gang activity are the main reason, causing El Salvador’s murder rate to plummet from a shocking 105 murders per 100k residents in 2015 to 7.8 per 100k, the lowest in the region. In other words, his voters love him extensively, but as of yet they remain ambivalent on the Bitcoin initiative. Fickle support like this could indeed be dangerous, as future economic difficulties could turn this indifference into outright rejection. However, as far as all polling suggests, Bukele will have another term to convince his people.

Luckily, there are extensive plans in place to attempt to deepen these connections in multiple spheres of life. The usage of an international currency like bitcoin has attracted the flow of international spending, with tourism to the nation spiking in recent years. In addition to these more casual inflows of cash, the government has also encouraged more permanent immigration by allowing foreign nationals to directly purchase citizenship with bitcoin investment. These attempts to raise foreign dollars can definitely impact the nation’s citizens, but there are also efforts underway to directly create jobs in this burgeoning industry.

Since October, El Salvador has partnered with several firms to create mining infrastructure powered by geothermal energy. Bitcoin mining is a growing market worldwide, and the use of green energy easily sidesteps the most common refrain against it. These goals of creating domestic jobs and attracting foreign investment both fall under the umbrella of the aforementioned “Bitcoin City” project, a plan with the long-term goal of fostering all the multifarious jobs in software development and blockchain engineering associated with the digital asset space.

If El Salvador’s voters do decide to re-elect Bukele on February 4, he’ll have his work cut out for him to ensure that Bitcoin is an enduring presence. As of yet, many of his citizens are either earning extra revenue from international travelers interested in Bitcoin, or involved in building the new pools to mine it. Although the economy is growing, this has not been sufficient to win his people over to the full possibilities of a radical new economic future. Nevertheless, he has won their love anyway, as his government has continually enjoyed fierce public support. In other words, re-election is very likely, and the experiment will continue for the five years of his second term. The major challenge of these five years, however, will be to ensure that Bitcoin will become a fact of life for his people. Still, as daunting of a task as this may seem, he has already been working on normalizing Bitcoin in a wide variety of ways.

Just as one example of this, last year the country partnered with one of its largest distributors, enabling huge numbers of businesses to begin accepting bitcoin for the most mundane transactions. Furthermore, these normalization efforts have extended beyond El Salvador’s borders. El Salvador needs the support of its citizens, but it also wishes to encourage broader support from other nations. The Central African Republic (CAR) was directly inspired by El Salvador when it briefly became the second nation to adopt bitcoin as a legal currency. However, this effort was simply impossible to sustain in a country where around 90% of citizens do not have internet access, and it was shuttered in 2023. CAR was not the only country to be influenced by Bukele’s government, as he actually sent a team of “Bitcoin Ambassadors” to Argentina upon the election of its newest President last November. Outreach efforts like this will go a long way to ensure that El Salvador is the first country to accept bitcoin as legal tender, but won’t be the last.

Get more from Bitcoin Magazine Pro in the Substack app

Available for iOS and Android

Some of these initiatives highlight the way that El Salvador’s Bitcoin project has radically different aims from the ETF battle in the United States, even though Salvadorans like Vice President Ulloa are naturally heartened by its victory. The ETF is a financial instrument that allows ordinary Americans some extra opportunities to indirectly profit from Bitcoin’s success, while Bitcoin has a radical vision for anyone in the world to take control of their economic fortunes. Nayib Bukele has shown a real interest in fostering Bitcoin as a part of everyday life, as shown by the variety of ways he’s encouraged economic development and his attempts at international outreach. Our community needs fighters like those who pursued the ETF battle, but it’s important to remember that Bitcoin means so much more than a way to earn fiat currency. If Bukele has the chance to really embed Bitcoin in El Salvador’s society, it’ll show the world what kind of success Bitcoin can offer us all.

Donald Trump Won’t Reappoint Fed Chair Jerome Powell If Elected President

In a recent statement, former President Donald Trump made it clear that, if elected for a second term, he would not reappoint Jerome Powell as the Federal Reserve Chair. Trump has expressed his dissatisfaction with the current Fed Chair’s performance, and suggests that Powell will rate cuts in attempt to give Democrats an advantage in the 2024 elections.

Trump’s criticism comes amidst concerns over inflation and the Federal Reserve’s handling of monetary policy. The former President believes that Powell’s approach has been too “political” and not been in the best interest of the U.S. economy. The Federal Reserve plays a crucial role in shaping economic policies and managing interest rates, impacting everything from employment to inflation.

“No, I wouldn’t do that,” Trump stated when asked if he would reappoint Jerome Powell. “I think he’s going to do something to help the Democrats, if he lowers interest rates,” Trump continued. The former president then went on to mention that he has a “couple choices” of who he would replace Powell with, but declined to reveal exactly who.

The announcement adds an interesting dimension to the political and economic landscape, setting the stage for potential changes in leadership at the Federal Reserve if Trump were to secure a second term. Powell has faced challenges since being appointed for his second term as Fed Chair by current U.S. President Joe Biden, including navigating the economic fallout from the COVID-19 pandemic.

As political dynamics continue to evolve, Trump’s stance on Powell and the Federal Reserve will continue to be focal point of discussion, considering the critical role the institution plays in shaping the nation’s economic trajectory. Investors, policymakers, and the public will keenly watch how this declaration influences economic narratives and potential shifts in leadership within the Federal Reserve.

LN Markets Upgrades Bitcoin Trading With DLCs

Bitcoin is fixing money.

Thanks to Bitcoin, anyone in the world is free to transfer money over a peer-to-peer network without having to go through a financial institution. Money that cannot be censored by authorities, devalued by governments, monopolized by corporations, or stopped by borders.

However, when it comes to trading, going through a trusted third party still remains necessary. Why is that a problem? Because trusted third parties always have been, and continue to be, security holes.

Bitcoin Trading Is Broken

Individuals and financial institutions alike rely on trusted third parties such as clearinghouses and exchanges to clear their Bitcoin spot and derivatives transactions.

“Banks must be trusted to hold our money and transfer it electronically, but they lend it out in waves of credit bubbles with barely a fraction in reserve.” – Satoshi Nakamoto, 2 Nov 2009

Sound familiar? Yes, that’s exactly what happened during the 2022 contagion event where Celsius, Terra, Three Arrows Capital, BlockFi, Voyager, FTX and many more collapsed. Most of the time, end users, who trusted these third parties, lost everything.

Centralized exchanges are inherently insecure because funds can be pooled together without any oversight. Trading and custody should never, ever be mixed.

Looking at the above list of bankruptcies, one may feel helpless and declare Bitcoin trading a no go. Instead, we took a second look and wondered: does Bitcoin trading really need to take place in the books of a trusted third party? Certainly not. And Bitcoin itself provides the solution!

Bitcoin is a complex and dynamic system that has not yet found its equilibrium, and no one can predict the ultimate role it will play. Defining Bitcoin is challenging because it intersects multiple domains. Some view it as a financial asset, others as a currency, a network, or even as an ideological manifesto.

As developers of innovative trading solutions, we are particularly interested in one dimension: Bitcoin as a technical infrastructure. This technical dimension is the least visible, probably due to its relative complexity, yet we find it one of the most fascinating aspects of this Unidentified Financial Object (UFO).

And we firmly believe that Bitcoin the protocol provides the ideal building blocks for the development of sound financial services.

Building The Future Of Trading On Bitcoin

Bitcoin’s code consists of operations that, when assembled, form a script. This list of available elementary operations evolved over time, with the addition of new operations to enable more complex scripts. These evolutions are often slow, but this gradual pace helps preserve the stability and security of the protocol.

The simplest script, of course, is the peer-to-peer transfer of a unit of value. The first trading platforms were built by integrating this functionality: it became possible to transfer funds directly from a wallet to a platform for processing.

The Lightning Network is an application built from a more complex script. It allows for the risk-free and instantaneous transfer of BTC. LN Markets was the first trading platform to integrate this new protocol into its core development.

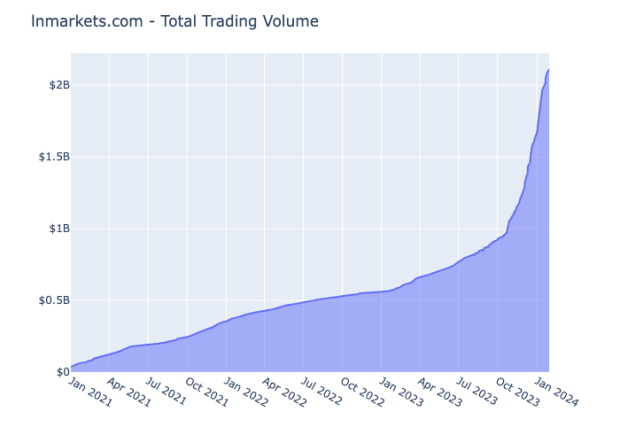

Targeting the retail market, its value proposition is an extreme simplification of the trading experience: it takes only a few seconds for a user to handle everything from account creation to collateral transfer, all done instantly from a Lightning wallet. The value proposition of instant trading brought more than $2 billion cumulative trading volume.

Building on this success, it was only natural for us to turn our attention to Discreet Log Contracts. A DLC is a native “smart contract” built on Bitcoin which enables the delivery of a payoff depending only on the publication of a price by an oracle.

Today, we think it’s time to build on the DLC protocol to enable full trustless trading and put an end to the pooling of funds by trusted third parties.

Trust Minimized Trading On Bitcoin Is Now A Reality

Over the past few months, we have been building in stealth mode a trustless OTC derivatives trading platform designed to meet the needs of crypto financial institutions: DLC Markets.

Any kind of financial instrument can be traded on DLC Markets with almost no counterparty risk: Bitcoin futures and options, products on hashrate and blockspace, and potentially any asset in the world.

Traditionally, trading for institutions has always been centralized and standardized. At some point, a clearinghouse (CCP) takes control of the funds and manages settlement. Paradoxically, despite technological advancements, Bitcoin trading is much riskier than traditional trading: no regulation, trading and custody in the same place, conflicts of interest, numerous risks, and frequent bankruptcies.

DLC Markets aims to address these issues. Drawing inspiration from traditional OTC trading, we are developing a marketplace where participants can meet and transact. Similar to an ISDA/CSA agreement, collateral is exchanged directly between peers.

To manage settlement, a smart contract (DLC) acts as a CCP. This smart contract is unique to each transaction, ensuring segregated fund management, complete transparency for transaction participants, and confidentiality from external actors.

Market participants can chat and submit bilateral requests for quotes (RFQ) to each other. Upon mutual agreement for a trade, they confirm the trades parameters and submit the initial margin to a smart contract on the Bitcoin blockchain. Throughout the life of the trade, margin calls, liquidation, and settlement may take place and unlock the corresponding outcome in the smart contract. The computation of any settlement is contingent solely on the publication of an independent oracle.

The oracle is a trusted third party to verify certain events accurately. Unlike an escrow, the oracle is not tasked with interpreting or executing the contract. No explicit approval is required from the oracle to establish or unilaterally settle the contract. The only requirement is the use of data published regularly by the oracle, which is both freely available and shareable.

While traditional DLCs can be cumbersome to implement, we introduce a novel approach with a coordinator to solve the free-option dilemma when the DLC is initiated. This approach also makes it possible to integrate margin calls, liquidation and netting in the DLC process.

Time flow chart of margin call steps and hedged period for DLC with most expected transactions format

For a technical deep dive on our solution, check our white paper.

The Future Is Now

DLC Markets represents a paradigm shift, offering a trustless and secure alternative to the centralized exchanges that have long dominated the financial sector. You can already sign up to try out our Beta!

To accelerate Bitcoin as an infrastructure, we have completed the raise of a $3 million seed round led by ego death capital, along with Lemniscap and Timechain, joining our current investors Arcario, Bitfinex and Fulgur Ventures. We’re very excited to partner with investors who share our belief that bitcoin-native companies will change the world.

Welcome to a new era of transparency, efficiency, and resilience in derivatives trading.

More info: https://lnmarkets.com/ & https://dlcmarkets.com/

This is a guest post by LN Markets. Opinions expressed are entirely their own and do not necessarily reflect those of BTC Inc or Bitcoin Magazine.

Asia FX muted, dollar nurses weekly losses ahead of nonfarm payrolls

Post Content

Valkyrie Becomes First Spot Bitcoin ETF to Diversify Coin Custody, Uses Coinbase and BitGo

Digital asset investment firm, Valkyrie, has become the first spot Bitcoin Exchange-Traded Fund (ETF) to diversify the custody of its coins, according to a recent Securities and Exchange Commission (SEC) filing. In a move to enhance security and reliability, Valkyrie is now working with leading custodian provider BitGo, already in addition to Coinbase, to safeguard their funds.

The filing, dated February 1, 2024, is an attempt by Valkyrie to strengthen the security infrastructure of its spot Bitcoin ETF by engaging multiple custody providers. The collaboration with BitGo aims to optimize for the safety of their bitcoin by diversifying the funds that were all previously held with Coinbase.

“On January 17, 2024, Valkyrie Bitcoin Fund (the “Trust”) and BitGo Trust Company, Inc. (“BitGo”), a South Dakota trust company duly organized and chartered under the South Dakota Banking Law, entered into a Custodial Services Agreement,” the filing stated. “Pursuant to the Agreement, BitGo will provide services related to custody and safekeeping of the Trust’s bitcoin holdings.”

By diversifying custody providers, the firm not only bolsters the security of its ETF assets but also sets a precedent for other Bitcoin ETF issuers seeking to protect their customers funds.

“The Trust’s existing custody arrangement with Coinbase Trust Company, LLC (“Coinbase”) is unaffected by the entry into the Agreement,” the filing continued. “The Sponsor anticipates utilizing the custodial services of both Coinbase and BitGo to custody the Trust’s bitcoin.”

Valkyrie’s decision to diversify their assets comes at a time of heightened focus on security measures within the Bitcoin industry. By working with Coinbase and BitGo, reputable entities known for their proven expertise in bitcoin custody, Valkyrie hopes to fortify the protection of its investors’ assets.

“The Sponsor expects to utilize BitGo’s services to custody a portion of the Trust’s bitcoin beginning on or about the date of this report,” the filing confirmed.